'It’s a strikingly unequal partnership': How the US comes out on top in the Tech Prosperity Deal despite some significant benefits to UK businesses

What does the future hold for US and UK businesses after the two nations agree on a landmark technology deal?

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

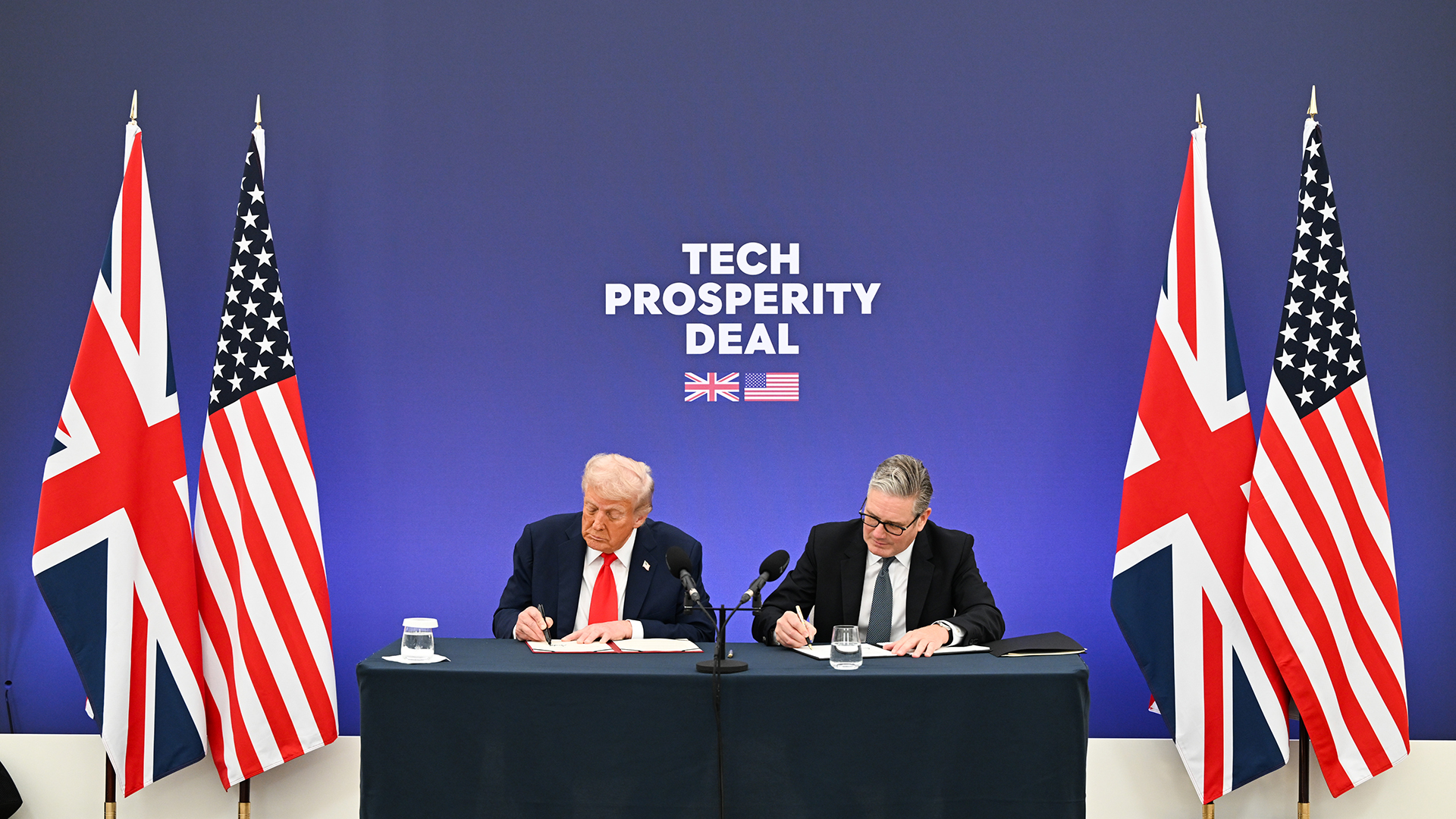

In September, the UK welcomed the US president Donald Trump with open arms ahead of the signature of the landmark US-UK Technology Prosperity Deal. This $42 billion agreement, the UK government believes, will strengthen the strategic relationship between the two countries in a variety of key areas – including quantum computing, nuclear energy and, most eye-catching of all, AI.

There's no doubting the US as an unmatchable force when it comes to tech innovation, with its biggest companies ploughing headfirst into a turbocharged AI summer. This agreement represents a chance for the UK to carve out a slice of that action, with the memorandum of understanding (MOU) laying out a framework for co-operation. In short, UK organizations should, over time, be given access to critical technology and research, while US companies will get the chance to invest billions of dollars into new initiatives – and reap the eventual rewards.

The reaction to the broad and far-reaching agreement has been overwhelmingly positive, for the most part. It is, however, not a treaty but a non-binding MOU, with plenty of details still to be ironed out. Over time, what will it mean for the long-term prospects of technology sectors in the two nations and their respective businesses?

The prospects on both sides of the Atlantic

Although much of the UK press lauded the agreement, it overwhelmingly favors the US, says John Bates, CEO at SER Group and a former Cambridge University computer science and deep learning academic. In reality, he says, "this deal may not be the win it's being sold as" because hyperscalers get to expand their presence on UK soil while strengthening their footprint.

"We’re expected to applaud America’s generosity on chips, AI models, and data centers, yet the UK risks becoming little more than an outsourcing hub for hyperscalers and Nvidia rather than a genuine AI power in its own right," Bates tells ITPro. "True innovation remains concentrated in the US, while the UK still struggles to define its own AI ambitions. Instead of relying on access to American technology, Britain should be doubling down on backing local innovators and developing homegrown AI capabilities."

That isn't to say there are no benefits at all for UK businesses. Bates suggests the UK remains more attractive than the EU as a global hub for AI innovation, for example. There's also a real upside for businesses seeking to tap into emerging technologies much faster than they could have done previously, explains Adnan Masood, chief AI architect at UST and an AI researcher.

"This shrinks a decade of infrastructure build-out into a couple of years – if power and permitting cooperate," he says, but echoes Bates' views that it's a lop-sided deal. "Let’s be honest, the CapEx is overwhelmingly American. That concentrates leverage with US vendors and raises long-term sovereignty and switching cost questions for UK buyers."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Much of this comes from the fact the US heavily outspends the UK in terms of AI investment. Last year, US private investments hit $109.1 billion, which was nearly 24 times higher than the UK's $4.5 billion, according to Stanford University research.

Given the head start, it's no doubt that perhaps the path of least resistance for UK firms is a deal that would allow them to tap into the technological progress that counterparts across the pond have already forged ahead with. It’s an alternative to spending the necessary time and money – which could take a great many number of years – to reach anywhere close to the proficiency that US firms already boast with the tech that's needed.

Charting a long-term, albeit turbulent, path for AI growth

Bates is not necessarily an advocate for this agreement, suggesting it diminishes the UK as a true factor in the global equation. "For a nation that pioneered computing, it’s a strikingly unequal partnership," he says. "I’m pro-US, but this investment doesn’t make the UK a true player. And the environmental cost of these AI factories – from potential near-permanent data center hosepipe bans to local infrastructure strain – feels a high price to pay for becoming a kind of AI Airstrip One for America."

Other downsides to consider, Masood explains, include the fact that it opens up UK businesses to US vendor lock-in and potentially stifles the prospects for a true UK rival to emerge. "The model assumes a US tech stack for chips, cloud, and tooling. That’s efficient – but it’s also a lock-in risk for the UK and reduces bargaining power for local suppliers. The UK gets capacity; the U.S. gets the standard."

There are also very genuine concerns over the technology, whether a growing bubble around the AI industry could pop, creating massive ripples in its wake. The Bank of England, for example, warned in October that there is a growing risk of the bubble bursting, with a "sudden correction" resulting in a drying up of funds. Even Sundar Pichai, CEO at Alphabet and a huge proponent for adoption of AI such as Google’s Gemini, has warned that “irrationality” in AI hype could harm the markets over the long term.

Over time, says Jim Piazza, VP of AI and machine learning at Ensono, the agreement should pave the way for a much healthier environment in the UK where businesses can pursue the integration of various advanced US technologies.

"With shared standards in place, it’s easier for vendors to demonstrate compliance and for buyers to evaluate offerings," he says. "That kind of clarity creates more confidence, especially at the enterprise level. If you can document and pass these new standards, you’ll have stronger access to funding, markets, and customers. That’s true on both sides of the pond.

"Longer term, I see this as a standardization flywheel that should mature over time. As vendors begin to pass these shared tests and document their results, they’ll unlock access to enterprise buyers and funding. Over time, that creates momentum and the more standardized and validated the ecosystem becomes, the faster adoption can happen. Once we get the teeth in place, we’ll see more clarity post."

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

How the rise of the AI ‘agent boss’ is reshaping accountability in IT

How the rise of the AI ‘agent boss’ is reshaping accountability in ITIn-depth As IT companies deploy more autonomous AI tools and agents, the task of managing them is becoming more concentrated and throwing role responsibilities into doubt

-

Hackers are pouncing on enterprise weak spots as AI expands attack surfaces

Hackers are pouncing on enterprise weak spots as AI expands attack surfacesNews Potent new malware strains, faster attack times, and the rise of shadow AI are causing havoc