HPE leads the way in high performance computing revenue

HPC records 4% growth in third quarter of 2016, says research firm

Global revenues for the high performance computing (HPC) server market grew 3.9% year-on-year in the third quarter of 2016, hitting $2.8 billion, according to analyst firm IDC.

Revenue for HPC servers across the first three quarters of the year, which is the most recent data available, was up by a similar amount (3.4%), resulting in a global figure of $8.1 billion.

Hewlett Packard Enterprise (HPE) fared particularly well, with a 35.8% share of overall HPC server revenue. The company has been working to boost its general HPC presence over the course of the past 12 months, unveiling several new workload-optimised compute platforms optimised for HPC in April at its annual Discover conference in Las Vegas and acquiring SGI in the summer.

Dell was the second largest player, with 18.5% of total revenue. This figure could change in 2017, however, as the merger of Dell and EMC to create Dell Technologies only completed in September 2016. The company also released a swathe of new HPC systems and software at the end of 2016, and is due to release a new HPC system for life sciences this month.

Strong growth was seen in the higher end of the HPC server segment in particular, according to IDC, with revenues from supercomputer systems priced $500,000 and over growing 22.3% year-on-year, from $805.7 million in Q3 2015 to $985.3 million in Q3 2016.

Divisional systems priced from $250,000 to $499,000 also did well, with revenue growing from $464.5 million in Q3 2015 to $568.4 million in Q3 2016 - an increase of 22.4%.

There is some turbulence in the overall market, though, with revenues generated by the lower end of the market in decline.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

IDC found that revenue from systems priced between $100,000 and $249,000 experienced the biggest drop, falling 14.4% year-on-year in Q3 2016, from $976.4 million to $836.2 million. Revenues from Workgroup HPC systems priced below $100,000 declined 8.7% year-on-year, meanwhile, dropping from $433 million to $395.5 million.

IDC doesn't see this as an indicator of a future downward trend in the overall HPC server market, however. "The workgroup segment, and especially the departmental segment, substantially ramped up purchases of HPC servers in the period 2012-2015, in tune with the global economic recovery," said Kevin Monroe, IDC senior research analyst for technical computing.

"In the first three quarters of 2016, more of these buyers were in a position to wait a while before buying another system. IDC expects this dip to be temporary," he added.

Jane McCallion is Managing Editor of ITPro and ChannelPro, specializing in data centers, enterprise IT infrastructure, and cybersecurity. Before becoming Managing Editor, she held the role of Deputy Editor and, prior to that, Features Editor, managing a pool of freelance and internal writers, while continuing to specialize in enterprise IT infrastructure, and business strategy.

Prior to joining ITPro, Jane was a freelance business journalist writing as both Jane McCallion and Jane Bordenave for titles such as European CEO, World Finance, and Business Excellence Magazine.

-

Google claims its AI chips are ‘faster, greener’ than Nvidia’s

Google claims its AI chips are ‘faster, greener’ than Nvidia’sNews Google's TPU has already been used to train AI and run data centres, but hasn't lined up against Nvidia's H100

-

£30 million IBM-linked supercomputer centre coming to North West England

£30 million IBM-linked supercomputer centre coming to North West EnglandNews Once operational, the Hartree supercomputer will be available to businesses “of all sizes”

-

How quantum computing can fight climate change

How quantum computing can fight climate changeIn-depth Quantum computers could help unpick the challenges of climate change and offer solutions with real impact – but we can’t wait for their arrival

-

“Botched government procurement” leads to £24 million Atos settlement

“Botched government procurement” leads to £24 million Atos settlementNews Labour has accused the Conservative government of using taxpayers’ money to pay for their own mistakes

-

Dell unveils four new PowerEdge servers with AMD EPYC processors

Dell unveils four new PowerEdge servers with AMD EPYC processorsNews The company claimed that customers can expect a 121% performance improvement

-

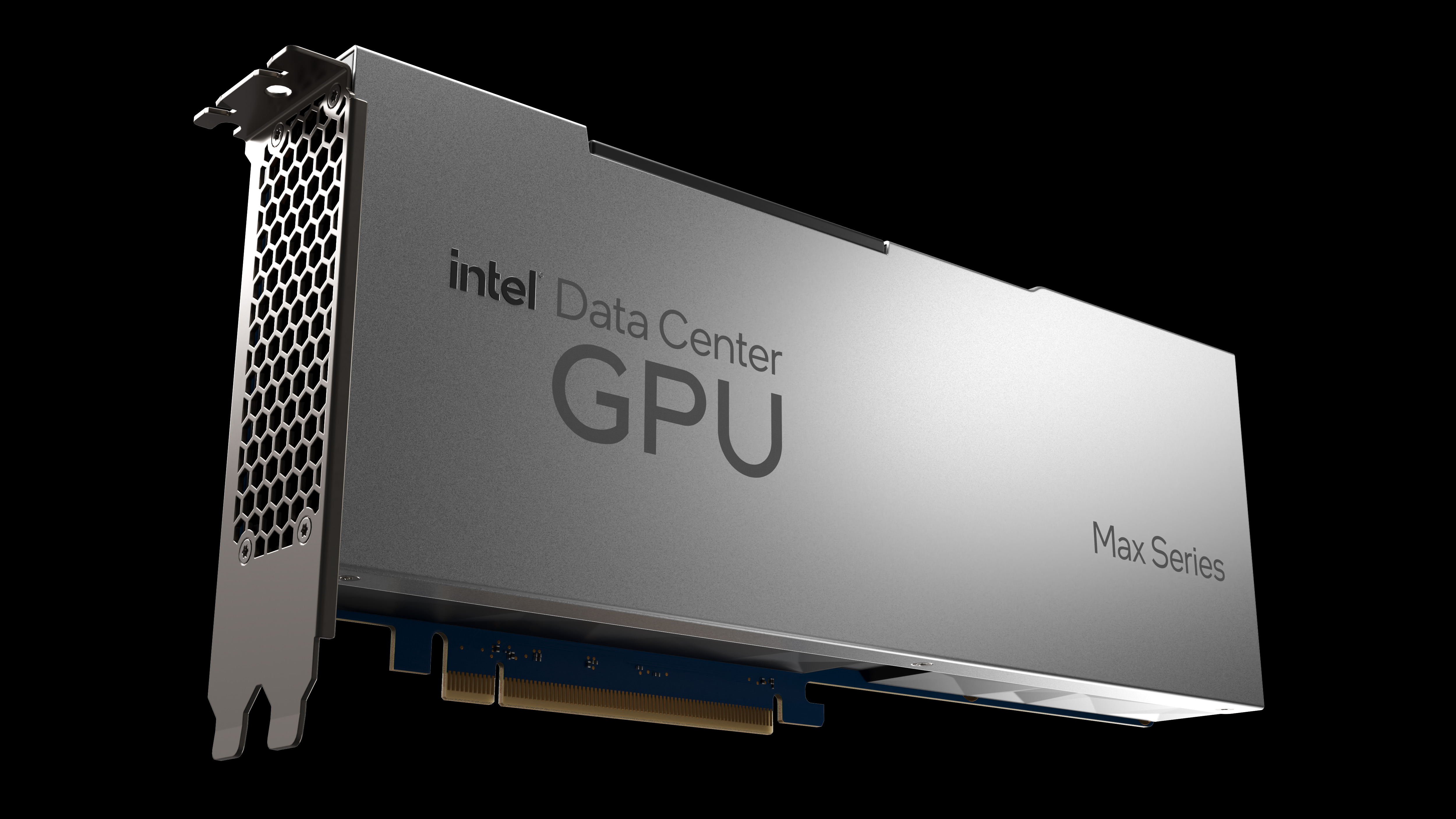

Intel unveils Max Series chip family designed for high performance computing

Intel unveils Max Series chip family designed for high performance computingNews The chip company claims its new CPU offers 4.8x better performance on HPC workloads

-

Lenovo unveils Infrastructure Solutions V3 portfolio for 30th anniversary

Lenovo unveils Infrastructure Solutions V3 portfolio for 30th anniversaryNews Chinese computing giant launches more than 50 new products for ThinkSystem server portfolio

-

Microchip scoops NASA's $50m contract for high-performance spaceflight computing processor

Microchip scoops NASA's $50m contract for high-performance spaceflight computing processorNews The new processor will cater to both space missions and Earth-based applications