IT spending to hit $2.4 trillion in 2017

IDC forecasts IT revenue to be 3.5% higher than that of 2016

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Worldwide spending on IT products and services is predicted to reach almost $2.4 trillion in 2017, the majority of which is coming from "very large businesses".

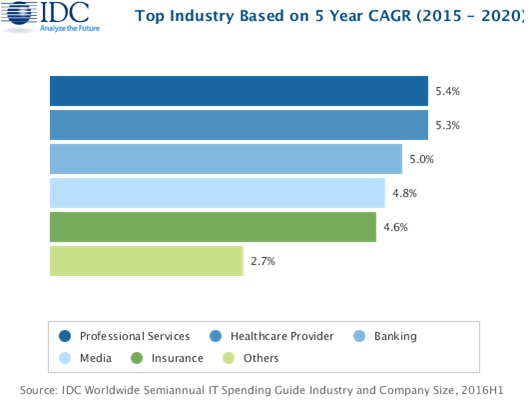

The latest forecast has come courtesy of IDC, which suggests this year's global spending will grow 3.5% over 2016 figures and exceed $2.65 trillion by 2020. The surge represents a compound annual growth rate (CAGR) of 3.3% over the 2015-2020 period.

Almost 30% of this spend will come from financial services such as insurance and investment, and manufacturing as companies push forward with digital transformation efforts.

Professional services and healthcare are also predicted to be some of the largest buyers of IT products by 2018, and are likely to overtake manufacturing in terms of overall spend, according to the research.

"Consumer spending on mobile devices and PCs continues to drag on the overall IT industry, but enterprise and public sector spending has shown signs of improvement," said Stephen Minton, VP of Customer Insights and Analysis at IDC. "Strong pockets of growth have emerged, such as investments by financial services firms and utilities in data analytics software, or IT services spending by telcos and banks."

Over 45% of this spending is to come from large businesses of more than 1,000 employees, while smaller office based businesses are set to contribute a further 25%.

By region, the US will generate more than 40% of all IT revenues by the end of the five-year period, spending $920 billion this year and hit the $1 trillion mark by 2020. Latin America and the Asia/Pacific countries are forecast to be the fastest growing regions, exceeding 5% CAGR.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Software is also predicted to outpace hardware spending by 2018, as more companies move towards the cloud through digital transformations and abandon traditional legacy systems.

"Changing SMB attitudes regarding the importance of technology investment cut across company size and region categories," said Raymond Boggs, program VP at SMB Research. "Small and midsize firms in developing geographies are just as interested in leveraging technology as those in developed regions. This sets the stage for spending growth everywhere, especially in midsize firms."

Some technology markets are set to grow this year as a result, including the struggling tablet industry. Despite its relatively poor performance recently, a recent double-digit surge in commercial spending has led to a return to growth for tablet devices. Notebooks and Chromebooks are also expected to find their largest buyers among the education sector.

Picture: Bigstock

Dale Walker is a contributor specializing in cybersecurity, data protection, and IT regulations. He was the former managing editor at ITPro, as well as its sibling sites CloudPro and ChannelPro. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.

-

How the rise of the AI ‘agent boss’ is reshaping accountability in IT

How the rise of the AI ‘agent boss’ is reshaping accountability in ITIn-depth As IT companies deploy more autonomous AI tools and agents, the task of managing them is becoming more concentrated and throwing role responsibilities into doubt

-

Hackers are pouncing on enterprise weak spots as AI expands attack surfaces

Hackers are pouncing on enterprise weak spots as AI expands attack surfacesNews Potent new malware strains, faster attack times, and the rise of shadow AI are causing havoc