US Treasury calls for tougher IRS rules on cryptocurrencies

Businesses may be required to declare transactions over $10,000, as they do with cash, to combat money laundering and tax evasion

The US Treasury is considering fresh measures to clamp down on the anonymity of cryptocurrencies by requiring businesses to treat virtual transactions as they do fiat currencies like the US dollar.

As part of the broader tax and spend proposals, businesses dealing with cryptocurrency transactions valued at more than $10,000 will need to report these to the Internal Revenue Service (IRS), as they currently do with cash payments.

The new reporting regime will cover cryptocurrencies, crypto asset exchange accounts, and payments service accounts that accept cryptocurrencies. This is in order to fight the risks of digital tokens being used to hide illicit activity such as money laundering and tax evasion.

“Still another significant concern is virtual currencies, which have grown to $2 trillion in market capitalization,” the policy proposal said. “Cryptocurrency already poses a significant detection problem by facilitating illegal activity broadly including tax evasion.

“This is why the President’s proposal includes additional resources for the IRS to address the growth of cryptoassets. Despite constituting a relatively small portion of business income today, cryptocurrency transactions are likely to rise in importance in the next decade, especially in the presence of a broad-based financial account reporting regime.”

Legally treating cryptocurrencies as cash would likely reduce the appeal of using cryptocurrencies such as Bitcoin for large business transactions, given the additional regulatory hurdles presented. It also removes one of the major appeals of exchanging cryptocurrencies; that transactions are anonymous.

The Federal Reserve’s chair Jerome Powell has highlighted the risks of cryptocurrencies as the technology gathers steam, and has even hinted at creating a central bank digital currency (CBDC).

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The US announcement comes shortly after China revealed what is effectively a crackdown on cryptocurrencies, which sent the value of various digital currencies, as well as exchange markets, tumbling by roughly 30%. Earlier this week, China banned banks and payment firms from providing cryptocurrency-related services and warned investors against speculative trading.

China and the US join an expanding list of nations considering changes to regulation in light of the growing popularity of cryptocurrencies. These range from Turkey, in which all cryptocurrencies have been banned, to the UK, where crypto derivative products have been prohibited from being sold to consumers.

RELATED RESOURCE

IT Pro 20/20: Understanding our complicated relationship with AI

The 16th issue of IT Pro 20/20 looks at the very human problems associated with artificial intelligence

The UK has also suggested that it may launch a CBDC in the near future, with experts from the Treasury and the Bank of England joining a special task force dedicated to exploring how viable such a digital currency would be.

These virtual coins are fundamentally different from cryptocurrencies, such as Bitcoin or Ether, as they’re managed by a central authority, as opposed to being decentralised assets managed through a distributed ledger.

Although the Financial Conduct Authority (FCA) took action against crypto assets last year, there are no suggestions as of yet the government is looking to make further regulatory changes in light of the widening use of cryptocurrencies in general. Cryptocurrencies are not considered legal tender in the UK, but exchange platforms are legal albeit need to be registered with the FCA.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

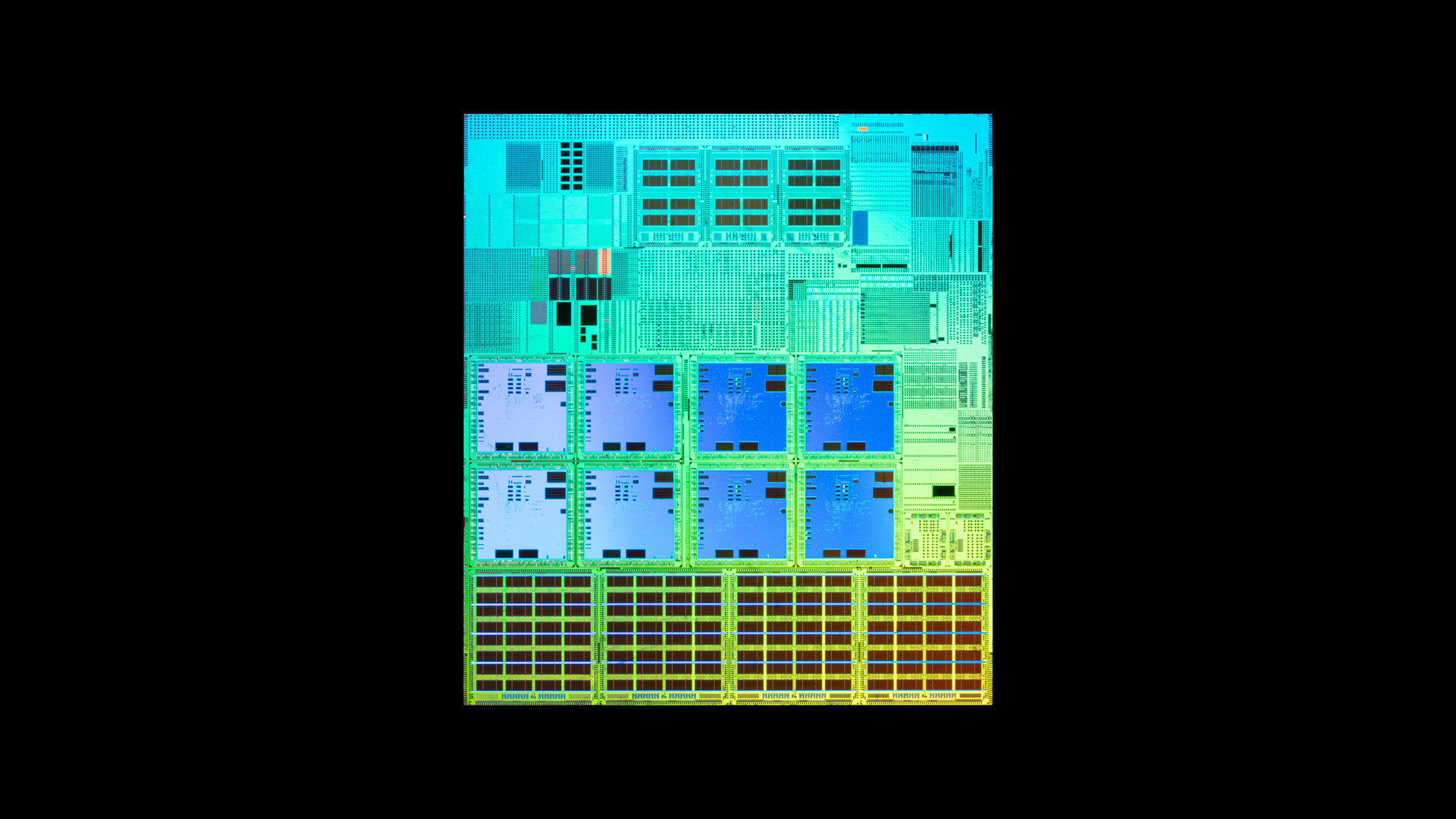

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses