What is blockchain?

The tech that underpins the biggest cryptocurrency in the world is branching out

For the past few years, blockchain has remained one of the biggest buzz words in the tech industry.

It's not all hype, though, as blockchain is a seriously disruptive technology. It is a form of distributed ledger technology, made famous because it is the system on which Bitcoin and other cryptocurrencies are built upon. But, as we are slowly beginning to find out, there is more to blockchain than just digital money.

There are a number of different use cases being explored. HSBC, for example, is using it as a digitised record of transactions. This was launched in 2019, as a 'custody blockchain' platform that enables investors to access records of private assets instead of requesting a search of paper-based documents. HSBC said it aimed to move $20 billion (£15 billion) worth of assets this way by March 2020.

Similarly, IBM used blockchain as part of a system that can track the origin and ownership of jewellery. This was dubbed 'TrustChain' which is a robust system of record that the jewellery industry could use, running from precious metal suppliers through to jewellers.

The basic premise of blockchain is that it is a secure method of data storage, as data resides in a limited number of 'blocks' that make up a chain. The data sent or received over the chain can be seen by any person, whenever they like, and all changes are confirmed and uploaded at the same time. The blocks form a chain, which each new one including a cryptographic hash of the previous one and the time it was saved.

New use cases

No-one really knows who invented blockchain. Its initial research paper was published under the name 'Satoshi Nakamoto', the same person attributed to the creation of Bitcoin but it's likely that the name on the paper was a pseudonym for a group of people who all had a hand in the technology's development.

Blockchain solved the problem of 'double spending', recording what transactions had taken place on the network and preventing users from using the same digital token more than once. It also presented the opportunity for the currency to be decentralised, so governments and other authorities were not required to regulate or oversee it, making it a completely free, global currency.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

However, the idea of having a distributed ledger that is not owned by anyone clearly has benefits. For one, it's super-secure because no one owns the original file and it can be updated without the threat of a hack.

It also means even the most sensitive information such as that related to personal identities, medical information and insurance records can be stored in a place that can be made accessible by all parties in a way that's trusted.

Now that the technology has been in the public domain for a good few years, companies are finding innovative ways of deploying it. There are, for example, a slew of cannabis startups using blockchain to get a head start in an emerging industry. Most recently, startup TruTrace Technologies partnered with auditing firm Deloitte to track cannabis using blockchain technology, according to Proactive Investors.

The system tracks the drug from seed to sale in order for customers and retailers to know the history of the product as it passes through the supply and consumption chain.

The rise of blocks

Blockchain relies on blocks of data connected in a chain, as its autonym name suggests. The chain is cryptographically secured and distributed among those that want to change or tweak parts using a network. As the chain evolves, new blocks are added and the person or node that adds that block is solely responsible for authorising it and ensuring it's correct.

What's unique about blockchain technologies is that none of the blocks can be changed or removed after being added - a reason to ensure it's definitely correct or accurate before adding to the chain.

The way blockchains are created makes them perfect for highly regulated industries that need to have a paper trail of changes. Because it's tamper-proof, the financial sector is one of the industries taking the technology seriously and it was created for Bitcoin for exactly this reason.

Bitcoin miners add the blocks, acting as nodes in a huge peer-to-peer (P2P) network. Everyone works together to validate transactions, without changing anything in the chain. Because every block is linked together in a chain, nothing can be changed without breaking the chain and to change anything, it would need every person who's ever added a block to change their additions - an impossible task when so many people are using a single network.

Not all blockchains are built the same, and the time it takes to process blocks of transactions can vary. Given the nature of buying and selling, cryptocurrency blockchains tend to be the quickest examples. The Ethereum blockchain, which supports the Ether cryptocurrency as well as countless other industry projects, is able to process transactions in around 15 seconds, whereas Bitcoin's network generally takes around 15 minutes.

More affordable and efficient

Blockchain networks can operate through multiple computers across the world, sometimes thousands, in an open P2P configuration. There is no centralised database or server, and because of this users, or nodes, can organise and audit information quicker and more effectively. But the time taken to verify information does scale with the size of the network.

There are benefits to the nature of blockchain networks, with implications for privacy and security. For instance, the fact the data is not stored in any one location means it is difficult, if not impossible, to hack these networks and steal any data, or shut them down. They are also able to withstand the risk of outages, as all nodes would have to be individually taken down for the blockchain to be knocked offline.

Cooperation and collaboration are normally at the heart of most blockchain networks too, with the various users operating under a shared goal. For example, users in the financial services sector would be working to building a safer and more secure method for storing and processing transaction information. While a physical file room may have once been a fixture of such operations, a blockchain network can enable one to transmit data far quicker, and more accurately.

The scope for blockchain to reduce the risks of fraud, and allow for more affordable financial processes, is greater too - with many systems such as these, albeit in their infancy, already producing some results. Santander, for example, earlier this year rolled out a blockchain technology based on Ripple that could accelerate payments across borders.

Public vs private

Much like the field of cloud computing, the function and implementation of blockchain can vary significantly depending on whether it's designed to be public or private. The primary distinction between these types comes down to who can access a system.

Public

Public blockchains operate a shared network that allows anyone to maintain the ledger and participate in the execution of blockchain protocol - in other words, authorise the creation of blocks. It's essential for services such as Bitcoin, which operates the largest public blockchain, as it needs to encourage as many users as possible to its ledger to ensure the currency grows.

Public blockchains are considered entirely decentralised, but in order to maintain trust, they typically employ economic incentives, such as cryptocurrencies, and cryptographic verification. This verification process requires every user, or 'node', to solve increasingly complex and resource intensive problems known as a 'proof of work', in order to stay in sync.

This means public blockchains often require immense computational power to maintain the ledger, which only worsens as more nodes are added, and predicting how much that will increase is difficult. Given the number of voices in the community, it's also incredibly difficult to reach a consensus on any technical changes to a public blockchain - as demonstrated by Bitcoin's two recent hard forks.

Private

Private blockchains are arguably the antithesis of what the technology was originally designed for. Instead of a decentralised, open ledger, a private blockchain is entirely centralised, maintained by nodes belonging to a single organisation or entity.

It's a novel design tweak that has allowed the technology to flourish within those organisations looking for the same streamlined transactions afforded by public blockchains, only with highly restricted access. As there are fewer participants on the network, transactions are normally cheaper and verified far quicker on private chains, and fixes to faults or network upgrades can be implemented almost immediately.

In order to share the data stored on a private chain, they often operate using a permission-based system, in which node participants are able to grant read access to external parties, such as auditors or regulators looking to check the inner workings of a company.

Unfortunately, as there are fewer nodes maintaining the blockchain, it can't offer the same high levels of security afforded by decentralised chains.

Consortium

'Consortium' is best described as the 'hybrid cloud' of blockchain. It provides the robust controls and 'high trust' transactions of private blockchains, only without being confined to the oversight of a single entity.

It sits somewhere in the middle. Although they provide the same limited access and high efficiency afforded by private blockchains, dedicated nodes are set aside to be controlled by external companies or agents, instead of having only read access under a private blockchain.

The easiest way to understand how it differs is to think of consortium blockchains as the equivalent of a council group - with each member having responsibility for maintaining the blockchain, and each having permissions to give read access.

Given its collaborative design, it's a perfect solution for supporting the work of government committees or industry action groups where a number of companies may come together to tackle an issue - whether that be industries working to combat climate change or maintaining a shared ledger to support the work of the United Nations.

Blockchain vs Distributed Ledger Technology

The term blockchain is often deployed to refer to a host of similar yet different technologies and is often falsely used to refer to any decentralised distributed database. Blockchain is, in reality, only one form of the emerging distributed ledger technology (DLT).

DLT is a form of technology comparable to a database but distributed across multiple physical sites and locations, regardless of how near or far from one another. The purpose of such a phenomenon is to avoid having to rely on a centralised storage system or the need for a middle-man, like a network, to authorise and record changes to the records. When changes are requested, the lack of a centralised system means approval is demanded from all notes across a DLT network.

This concept is being adopted by businesses and organisations at a fast pace, and across various industries. This is not just an innovation developed and taken up by tech companies, but sectors like manufacturing and finance.

There are a number of formats in which DLT arises, but the central idea of a diversity of control is at the heart of all of these. One form of distributed ledger, for example, allows data to be stored on separate nodes, such as banking records beginning with each letter of the alphabet dispersed among different locations Rather than replicated to each area, like in a database as we've always known, the data is spread across parts of a network.

Blockchain simply refers to one iteration of this form of technology, more specifically, a data structure that takes the shape of entries stored in blocks. This form of structuring data offers an element of synchronisation between parts of a network - and it's essential for supporting innovations like Bitcoin.

Despite its success as the building block of currencies like Bitcoin, the system doesn't necessarily need to have miners and tokens to qualify as a blockchain - the term simply refers to the structure of arranging data into blocks. Blockchains, as a result, are decentralised ledgers where data is replicated rather than distributed.

Unfortunately, the frequency at which blockchain and distributed ledger are used interchangeably has created confusion over the technology as a whole, leading many to dismiss blockchain as simply a tool for Bitcoin.

Dale Walker is a contributor specializing in cybersecurity, data protection, and IT regulations. He was the former managing editor at ITPro, as well as its sibling sites CloudPro and ChannelPro. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.

-

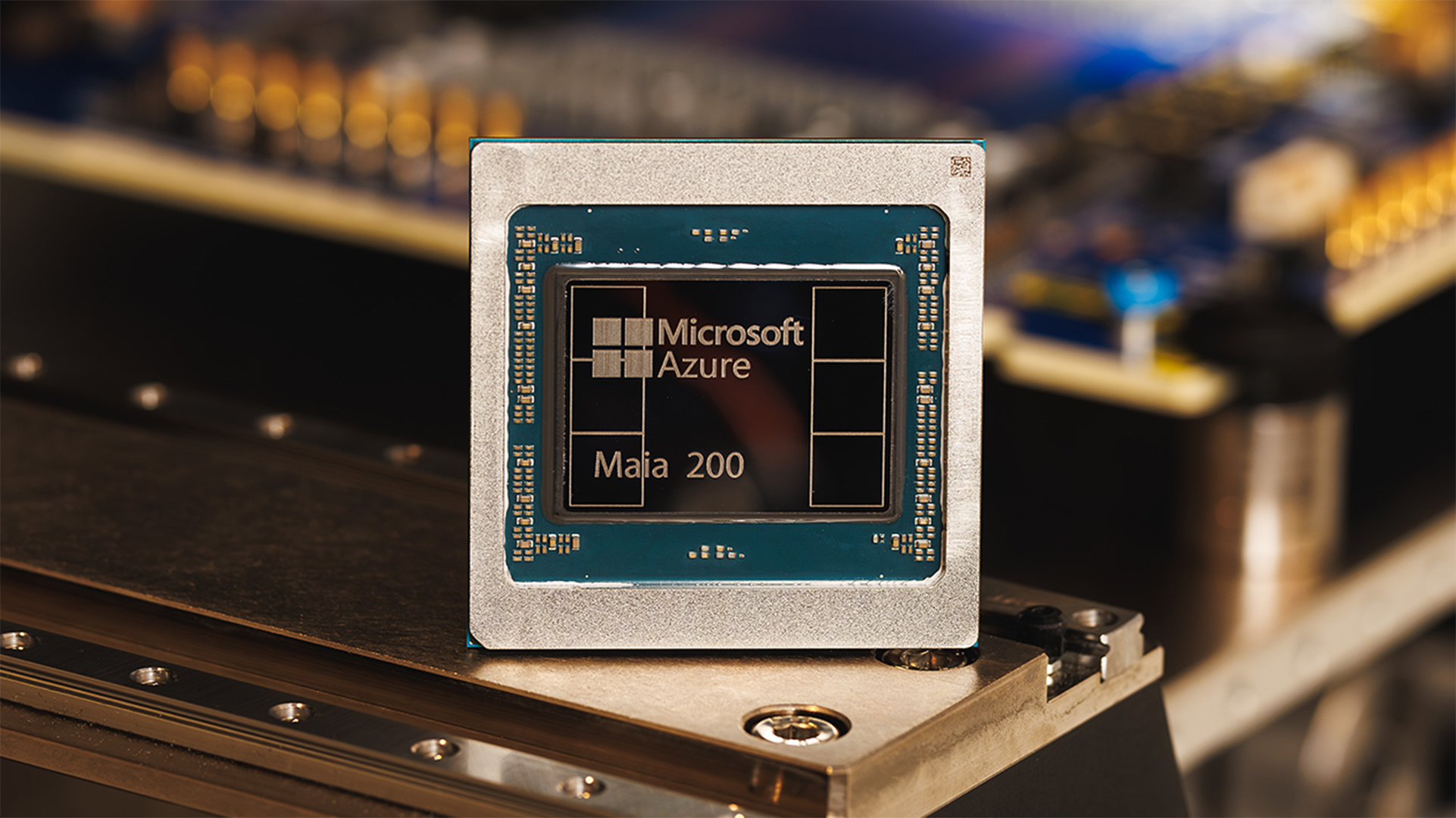

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Infosys expands Swiss footprint with new Zurich office

Infosys expands Swiss footprint with new Zurich officeNews The firm has relocated its Swiss headquarters to support partners delivering AI-led digital transformation

-

IMF urges El Salvador to remove Bitcoin as legal tender

IMF urges El Salvador to remove Bitcoin as legal tenderNews The country sought a $1.3 billion loan from the IMF last year, although this has been reportedly hindered by the fund’s Bitcoin concerns

-

Cryptocurrency: Should you invest?

Cryptocurrency: Should you invest?In-depth Cryptocurrencies aren’t going away – but big questions remain over their longevity, the amount of energy they consume and the morals of investing

-

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plans

IT Pro News in Review: Record profits in tech, hackers turn to new languages for malware, Amazon's Bitcoin plansVideo Catch up on the most important news of the week in just two minutes

-

El Salvador offers its citizens free Bitcoin

El Salvador offers its citizens free BitcoinNews Bukele doubles down on crypto commitment with a giveaway

-

Square and Blockstream to build a solar Bitcoin mining facility

Square and Blockstream to build a solar Bitcoin mining facilityNews Solar mining plant will aim to temper concerns of power consumption from Bitcoin mining

-

What are altcoins and how do they work?

What are altcoins and how do they work?In-depth The alternatives to Bitcoin explained

-

Steve Wozniak sues YouTube over Bitcoin scam videos

Steve Wozniak sues YouTube over Bitcoin scam videosNews Lawsuit claims YouTube is aware of the Bitcoin giveaway scams but hasn’t taken videos down

-

Bitcoin scam exposes the personal details of 250,000 people

Bitcoin scam exposes the personal details of 250,000 peopleNews The UK and Australia represent approximately 93% of users hit by the crypto-scam