Royal Bank of Scotland’s Worldpay hit by ATM scam

Hackers break into US payment processing systems and target cash machines around the world - could this happen over here?

The Royal Bank of Scotland Group's RBS Worldpay has fallen victim to a hack reported to have netted $9 million (6.1 million) in a worldwide automated teller machine (ATM) scam.

RBS Worldpay said it was hacked just before Christmas of last year. US reports, citing the FBI, suggested that before the payment processor found out, millions of dollars were taken from ATMs around the world using cloned cards.

Thousands of businesses around the world use RBS Worldpay, which allows them to take payments over the internet, phone, fax and mail.

RBS Worldpay is used in the UK, but fortunately British customers were not affected. The US business of RBS Worldpay operates on a platform independent of other Royal Bank of Scotland acquiring businesses.

The FBI told Fox 5 in the US that ATMs from 49 cities were hit, which included Atlanta, New York, Montreal, Moscow and Hong Kong. At the time, RBS Worldpay admitted that the information of 1.5 million cardholders and other individuals could have been affected.

This is the latest card payment breach to hit millions of customers. Last month, around 100 million transactions could have been exposed thanks to malware found on Heartland Payment System's computer network.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

-

Building a secure payments strategy

Building a secure payments strategySponsored Podcast Facilitating a smooth payments experience for iGaming can go hand-in-hand with building a more secure platform

-

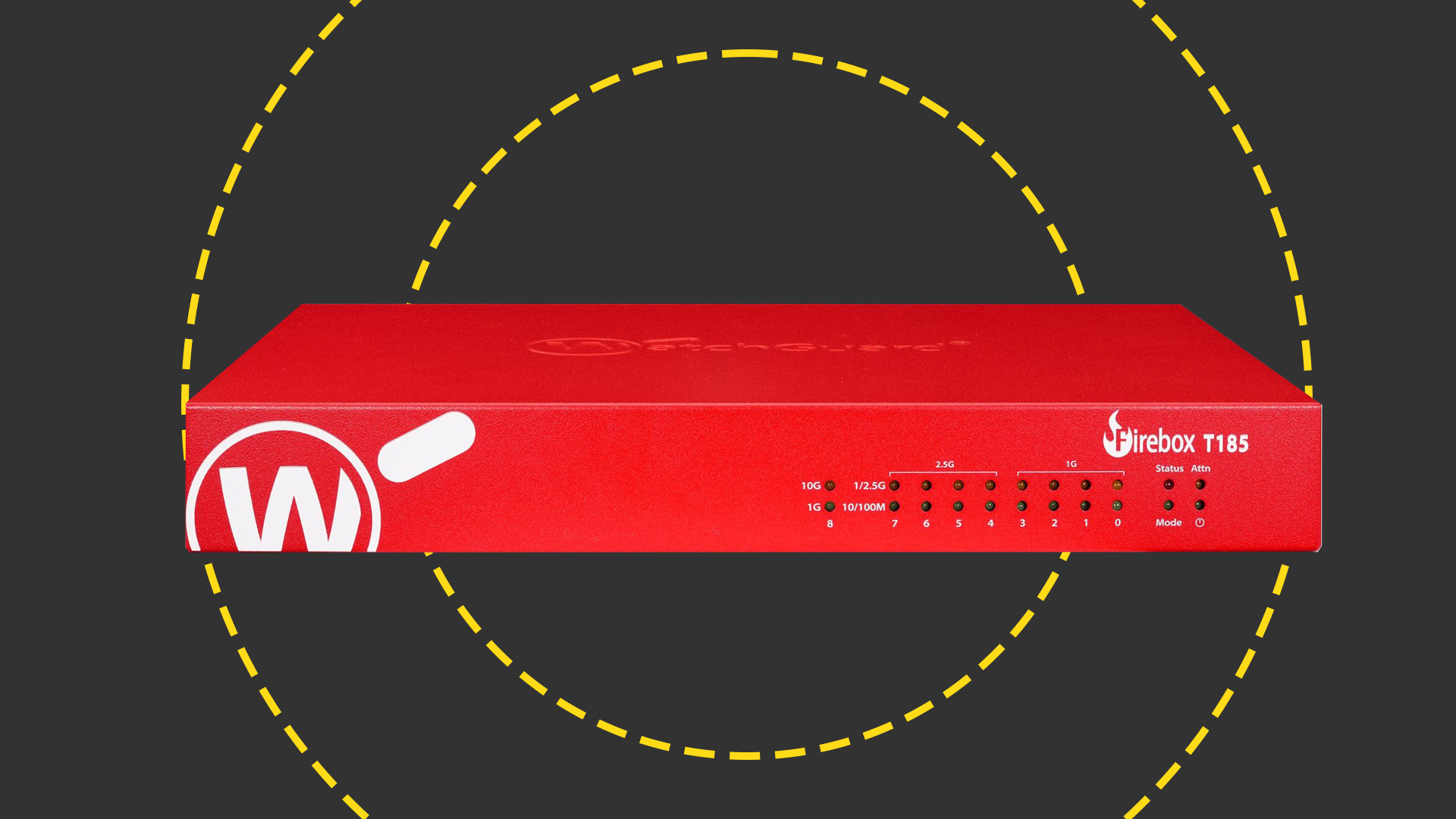

WatchGuard Firebox T185 review

WatchGuard Firebox T185 reviewReviews The Firebox T185 offers a superb range of security measures, smart cloud management, and good performance at a competitive price point