RIM selling more phones, but competition remains tough

Despite posting record BlackBerry sales and increased revenues, results fall short of Wall Street expectations.

Research In Motion (RIM) shipped a record number of devices in its fiscal first quarter, but analysts remain concerned about its long-term ability to compete against its smartphone rivals.

The Canadian firm sold 11.2 million BlackBerrys in the three months ending in May, up 43 per cent on the same period last year, and reported share earnings of $1.36 narrowly ahead of the $1.34 expected.

However, revenues failed to meet expectations, with the reported $4.24 billion down on the forecast average of $4.355 billion though it was significantly stronger than last year's figure of $3.42 billion.

And while RIM added another 4.9 million subscribers during the quarter, the average selling price of the BlackBerry fell from $311 to $299 as RIM fought to compete in an increasingly competitive market.

During the company's earnings call yesterday, co-chief executive Jim Balsillie sought to allay those fears by pointing to two new handsets set to appear in North American markets by the end of the current quarter or just into the next, saying these could bolster its market position even if both revenues and average selling price were affected negatively.

Balsillie described the new devices as being a "quantum leap" ahead of anything else currently on the smartphone market, commenting that he "couldn't feel better" about the company's prospects.

The RIM executive singled out the company's performance in the UK as particularly impressive, saying O2 deserved special praise for how it had helped promote the BlackBerry brand.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The BlackBerry App World, meanwhile, is now generating more than a million downloads a day, according to Balsillie, and revealed the next major update would offer carrier and credit card billing.

However, BlackBerry's long-established stranglehold on the business phone market faces growing competition from the likes of HTC and Apple's newly launched iPhone 4.

Over the last quarter, Research in Motion's shares have broadly fallen in line with the tech-heavy NASDAQ index, losing 20 per cent of their value. Apple's shares, on the other hand, continue to outperform the market.

-

Blackberry revenue falls by 4% as cyber security division takes hit

Blackberry revenue falls by 4% as cyber security division takes hitNews Despite this, the company’s Internet of Things (IoT) division increased its revenue by 28% as it attracted new customers from the automotive sector

-

BlackBerry revival is officially dead as OnwardMobility shuts down

BlackBerry revival is officially dead as OnwardMobility shuts downNews The Texas-based startup is mysteriously shutting down and taking its ultra-secure 5G BlackBerry with it

-

BlackBerry and AWS are developing a standardized vehicle data platform

BlackBerry and AWS are developing a standardized vehicle data platformNews Platform will give automakers a standardized way to process data from vehicle sensors in the cloud

-

BlackBerry thwarts mobile phishing attacks with new AI tools

BlackBerry thwarts mobile phishing attacks with new AI toolsNews The company's Protect Mobile platform alerts users to potential malware before a link is clicked

-

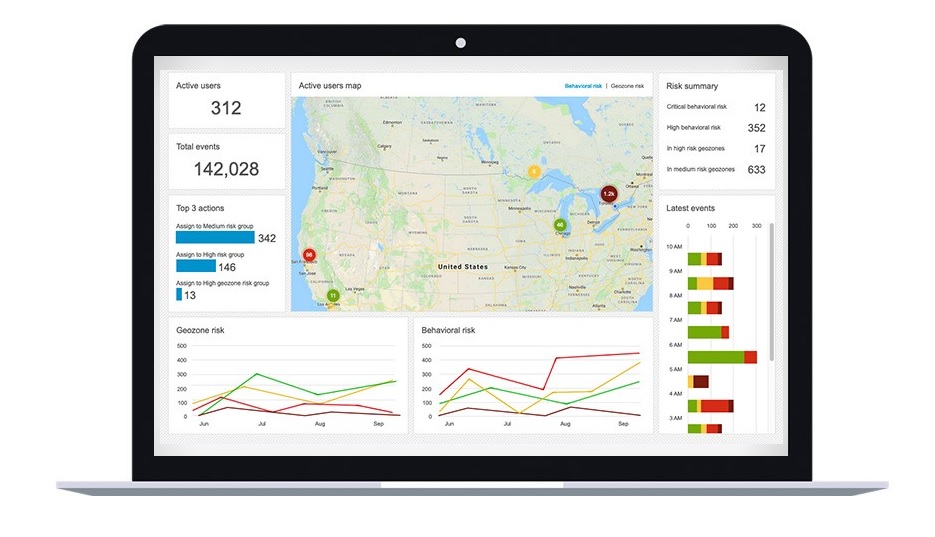

BlackBerry Persona Desktop delivers zero-trust security at the endpoint

BlackBerry Persona Desktop delivers zero-trust security at the endpointNews New security solution learns user behavior and can take action if there’s an abnormality

-

A 5G BlackBerry phone with physical keyboard is coming in 2021

A 5G BlackBerry phone with physical keyboard is coming in 2021News The business phone to be resurrected with OnwardMobility and FIH Mobile planning a security-savvy enterprise handset

-

The business smartphone is dead

The business smartphone is deadIn-depth BlackBerry’s demise signals the end of the business-first handset

-

BlackBerry Key2 review: The best physical keyboard no one asked for

BlackBerry Key2 review: The best physical keyboard no one asked forReviews Despite the improvements, the flaws of BlackBerry’s Key range are still front and centre