Why digital wallets could be your secret weapon in Southeast Asia

Digital wallets represent a step change in supporting the unbanked across the region

Southeast Asia is fast becoming a key growth market in the forex space, offering financial services providers the chance to capitalize on a rapidly-evolving landscape ripe with opportunity.

Forex development in Southeast Asia was the topic of a recent white paper from Paysafe, which revealed that retail forex trading has been “increasing in recent years” amidst an accelerating period of digitization across a host of economies in the region.

Singapore, for example, has firmly established itself as a “major player” in international forex, according to the white paper. It’s the third-largest forex hub globally, ranked after New York and London, with nearly $1 trillion of forex trades passing through the city state every single day.

Several of the world’s largest financial institutions, including Barclays, Citigroup, HSBC, and JP Morgan, also house their regional forex trading teams in Singapore.

Other countries in the Association of Southeast Asian Nations (ASEAN), such as Indonesia, Malaysia, and Vietnam, boast large populations and growing economies.

Indonesia, for example, has the fourth-largest population in the world at 276 million and its economy could become the fourth-largest in the world by 2045.

Similarly, between 2002 and 2021, GDP per capita in Vietnam has increased 3.6 times, and the country is currently on-track to become a “high-income” economy by 2045.

With a swelling population in the region and impressive economic growth across a host of ASEAN countries, forex brokers have a prime opportunity to capitalize on an as yet largely untapped market.

Similarly, the region as a whole has an opportunity to position itself as a “crossroads” for Asian, Middle Eastern, and European financial trade routes, according to Paysafe.

Serving the unbanked

A significant portion of Southeast Asia is unbanked, meaning a large percentage of the population has no direct access to financial services. While this may appear to be a challenge for financial services institutions breaking into the region, there is an opportunity for providers to support a traditionally underserved portion of the global population.

RELATED RESOURCE

A review of the current forex market in SEA, the top market challenges, and the payment methods that can help brokers overcome them

Paysafe believes that financial services organizations can play a vital role to “break through financial exclusion” in Southeast Asia and, long-term, consolidate their position as a leading provider in the space by capitalizing on the current wave of early-stage growth.

However, while opportunities abound for brokers in the region, the industry does still face sizable hurdles – not least of all in terms of technology uptake among the population and access to payments methods.

There are promising signs on the horizon, according to recent studies. Research from Kearney, for example, found that the digital economy in SEA is growing at a rate of 17% annually.

In addition, by 2030 the e-payments industry is expected to reach an estimated value of between $600 billion and $1 trillion.

Alternative research from the World Economic Forum also shows that smartphone adoption in the region is surging, with smartphone usage in Singapore standing at 87%.

Malaysia and Thailand are also experiencing a rapid increase in smartphone adoption, statistics show.

While technology uptake among the population is promising, bridging the gap between this rate of adoption and appropriate payment methods is a key hurdle for providers.

Payment methods represent a far more complex and challenging prospect for forex brokers seeking to serve the population across Southeast Asia.

Sizeable unbanked populations in countries such as Myanmar and Cambodia means that payments into forex platforms pose a significant challenge.

A prevailing cultural trend of cash-based payments across the region also presents challenges and could inhibit uptake in the long-term.

Michael Schaper, adjunct professor at the John Curtin Institute of Public Policy at Curtin University in Western Australia, suggested that many individuals in SEA are still reliant on cash for everyday transactions, even in areas where digital transactions are growing as well.

Consequently, Paysafe’s white paper says, “forex brokers will require some form of bank transfer to their platform in order to begin trading”.

Digital wallets could be the key

Paysafe believes that digital wallets could be a “secret weapon” for forex brokers to ensure uptake among consumers for a number of reasons.

Digital wallets such as Skrill or Netseller, the firm said, offer “much better rates, and in many cases, are easier to use” than relying on bank accounts to deposit to a forex broker account.

Security is also a focal point within this discussion. Hesitancy among the population and concerns over security can be addressed by digital wallets.

“Using digital wallets also adds an element of security, as it allows individuals to make payments without sharing bank details,” the paper reads. “With mistrust in forex brokers rife in many SEA countries, this is an attractive perk.”

The simplicity of using digital wallets also offers advantages when one considers long-standing financial literacy challenges that are rife across the region.

By making forex transactions simple and easy to understand they can bridge the gap of financial inclusion.

Lingering macroeconomic concerns

Macroeconomic factors could play a key role moving forward for organizations entering the Southeast Asia forex market, Paysafe also believes.

The US Federal Reserve is “very likely” to continue raising interest rates, which could pose immediate challenges, Paysafe warns. Similarly, the continued dominance of the US dollar means that the region is, at times, beholden to economic conditions in the West.

“Another economic crash like the 2007 financial crisis could flatten the growing forex market in SEA,” Paysafe’s paper warns

Regulatory conditions are also an acute concern for organizations entering the space, or seeking to in the future. Sub-standard or non-existant regulatory safeguards in the region have resulted in consumers “losing a catastrophic amount of money trading”, according to Paysafe.

“Further regulation is needed in the region for forex to lose its reputation in some parts as predatory and dangerous,” the white paper states.

Despite significant hurdles, there is ample opportunity for organizations to capitalize on this developing marketplace, and those that act swiftly in Southeast Asia can establish themselves as leading brokers in the region as the industry matures.

To find out more about forex prospects in South East Asia, click here.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

ITPro is a global business technology website providing the latest news, analysis, and business insight for IT decision-makers. Whether it's cyber security, cloud computing, IT infrastructure, or business strategy, we aim to equip leaders with the data they need to make informed IT investments.

For regular updates delivered to your inbox and social feeds, be sure to sign up to our daily newsletter and follow on us LinkedIn and Twitter.

-

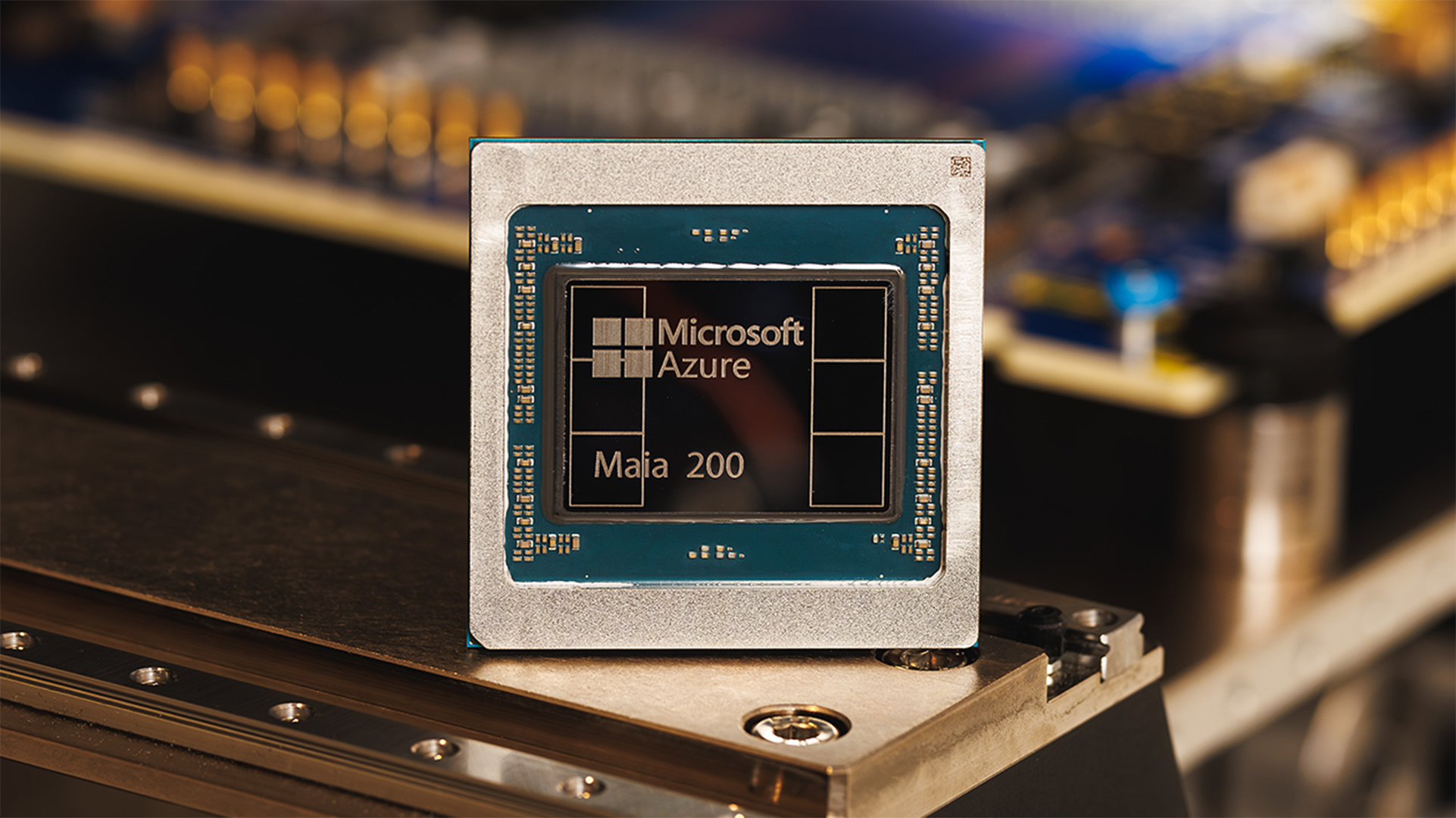

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Infosys expands Swiss footprint with new Zurich office

Infosys expands Swiss footprint with new Zurich officeNews The firm has relocated its Swiss headquarters to support partners delivering AI-led digital transformation

-

Nationwide forges closer ties with AWS in cloud transformation push

Nationwide forges closer ties with AWS in cloud transformation pushNews The building society is “consolidating and modernizing” cloud infrastructure and focusing heavily on internal skills development

-

Finance and security leaders are odds over cyber priorities, and it’s harming enterprises

Finance and security leaders are odds over cyber priorities, and it’s harming enterprisesNews Poor relations between the departments can be solved by CISOs talking in a language CFOs understand

-

How AI is reshaping the role of spreadsheets in accounting

How AI is reshaping the role of spreadsheets in accountingIndustry insights Modernizing spreadsheets can enable secure and AI-ready accounting and finance functions

-

Implementation and atychiphobia: helping SMEs overcome fear

Implementation and atychiphobia: helping SMEs overcome fearIndustry Insights Fear of failure stalls SME system upgrades, but resellers can calm concerns and build confidence

-

HSBC says get back to the office or risk bonuses – and history shows it’s a tactic that might backfire

HSBC says get back to the office or risk bonuses – and history shows it’s a tactic that might backfireNews HSBC is the latest in a string of financial services firms hoping to tempt workers back to the office.

-

Unlock the potential of LATAM’s booming crypto market

Unlock the potential of LATAM’s booming crypto marketwhitepaper Strategic pathways for crypto companies looking to expand into Latin America

-

The customer knows best: How to ensure you’re delivering an effective digital payments experience

The customer knows best: How to ensure you’re delivering an effective digital payments experienceSponsored Tap into shifting customer trends with account information services that will give your business a competitive edge

-

How AI is accelerating digital transformation in the banking industry

How AI is accelerating digital transformation in the banking industrySupported Content Gen AI, fraud detection, and chatbots are all transforming the financial industry, but the cloud is the foundation for it all