PC market growth stifled by supply chain barriers

COVID-19 caused PC sales to spike while simultaneously disrupting supply chains

Global PC shipments reached 86.7 million units in the third quarter of 2021, representing a 3.9% year-over-year increase, according to IDC's Worldwide Quarterly Personal Computing Device Tracker.

For the sixth quarter in a row, the pandemic drove up PC sales while also causing component shortages and other supply chain disruptions.

"The PC industry continues to be hampered by supply and logistical challenges and unfortunately these issues have not seen much improvement in recent months," said Jitesh Ubrani, research manager for IDC's mobile and consumer device trackers.

"Given the current circumstances, we are seeing some vendors reprioritize shipments amongst various markets, allowing emerging markets to maintain growth momentum while some mature markets begin to slow."

Lenovo, HP, and Dell dominated Q3 PC sales with a market share of 22.8%, 20.3%, and 17.5% respectively. Apple sold 7,645 units, representing an 8.8% market share, while Asus and Acer shipped 6,028 and 5,982 units, respectively, each accounting for approximately 7.0% of the market.

Desktops, notebooks, workstations, detachable tablets, and slate tablets are among the devices sold. Though demand for PCs has risen, the US PC market remains stymied by insufficient inventory and broken supply chains.

RELATED RESOURCE

Managing security and risk across the IT supply chain: A practical approach

Best practices for IT supply chain security

"Bottlenecked supply chains and ongoing logistic challenges led the US PC market into its first quarter of annual shipment decline since the beginning of the pandemic," said Neha Mahajan, senior research analyst of devices and displays at IDC.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"After a year of accelerated buying driven by the shift to remote work and learning, there’s also been a comparative slowdown in PC spending and that has caused some softening of the U.S. PC market today. Yet, supply clearly remains behind demand in key segments with inventory still below normal levels."

-

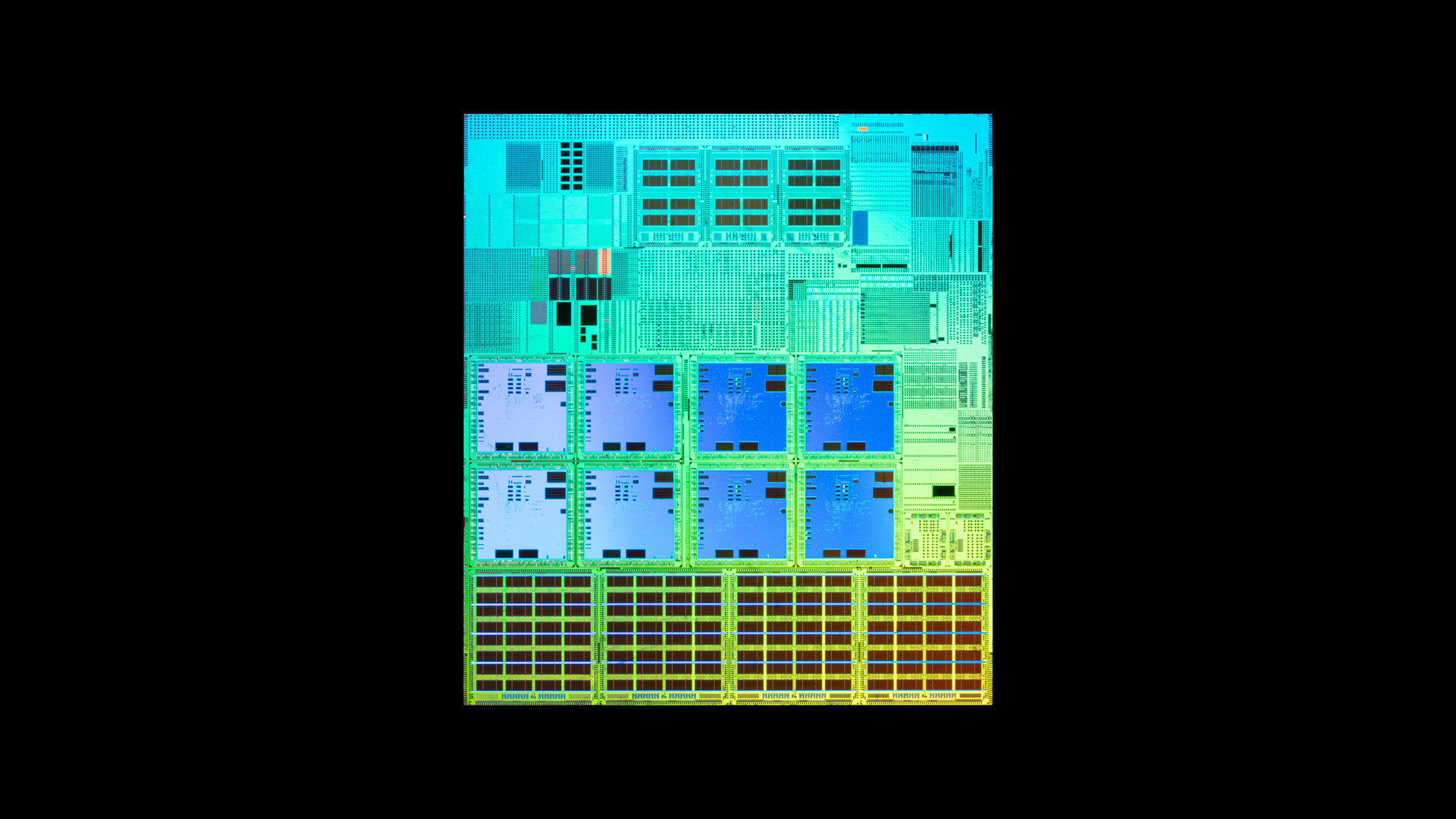

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses