RBS, Natwest and Ulster Bank rocked by Friday morning outage

Glitch may have arisen from ongoing technology changes, CEO speculates

Online and mobile banking was knocked offline for Royal Bank of Scotland (RBS) Group customers this morning, affecting account holders with RBS, Natwest and Ulster Bank.

RBS blamed a "technical issue" for rendering their online services unavailable to customers for approximately four hours before systems were fully restored just after 10am.

"We are aware that customers are currently experiencing issue logging into their online and mobile banking accounts," a spokesperson told IT Pro this morning.

"We would like to apologise for the inconvenience. We are aware of the problem and are working to fix the issue. Customers can still use ATMs and telephone banking."

Speaking on LBC an hour before the outage was resolved, the bank's CEO Ross McEwen confirmed he didn't know what had gone wrong and apologised to customers for any inconvenience caused.

"At this stage I've been talking to the team that are working through what's gone wrong here," he told presenter Nick Ferrari.

"As you may be aware we've made a lot of changes to our technology on an ongoing basis, it may be related to that. But we just don't know at this point. The team are working very hard to get it back up for customers."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

He also said the bank's digital health was much stronger than in the recent past, with the number of incidents recorded dropping from 300 in 2014, to 20 last year.

The in-part publicly-owned bank has sustained a string of IT troubles in recent years with several high profile incidents leading the Financial Conduct Authority (FCA) to fine the bank tens of millions of pounds in 2014.

Moreover, Natwest was forced into changing its website's security configuration last year after a heated exchange with security experts who warned the bank's website wasn't served over an encrypted connection.

But outages such as Friday's have become common across the whole industry, with several banking giants suffering similar woes with their own IT systems, and for a myriad of reasons. RBS Group's hours-long outage, for example, is the second of its kind in as many days, after Barclays fell victim to a similar online banking outage yesterday afternoon.

As with RBS, Barclays was unable to explain what exactly went wrong with its systems, with a spokesperson telling IT at the time that the bank is "currently experiencing some technical problems".

But their troubles pale in comparison to TSB's ongoing IT nightmare following a botched migration earlier this year. The failures cost the bank nearly 200 million, according to its half-year financial results for 2018, and led to its CEO Paul Pester announcing that he would step down as a result.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

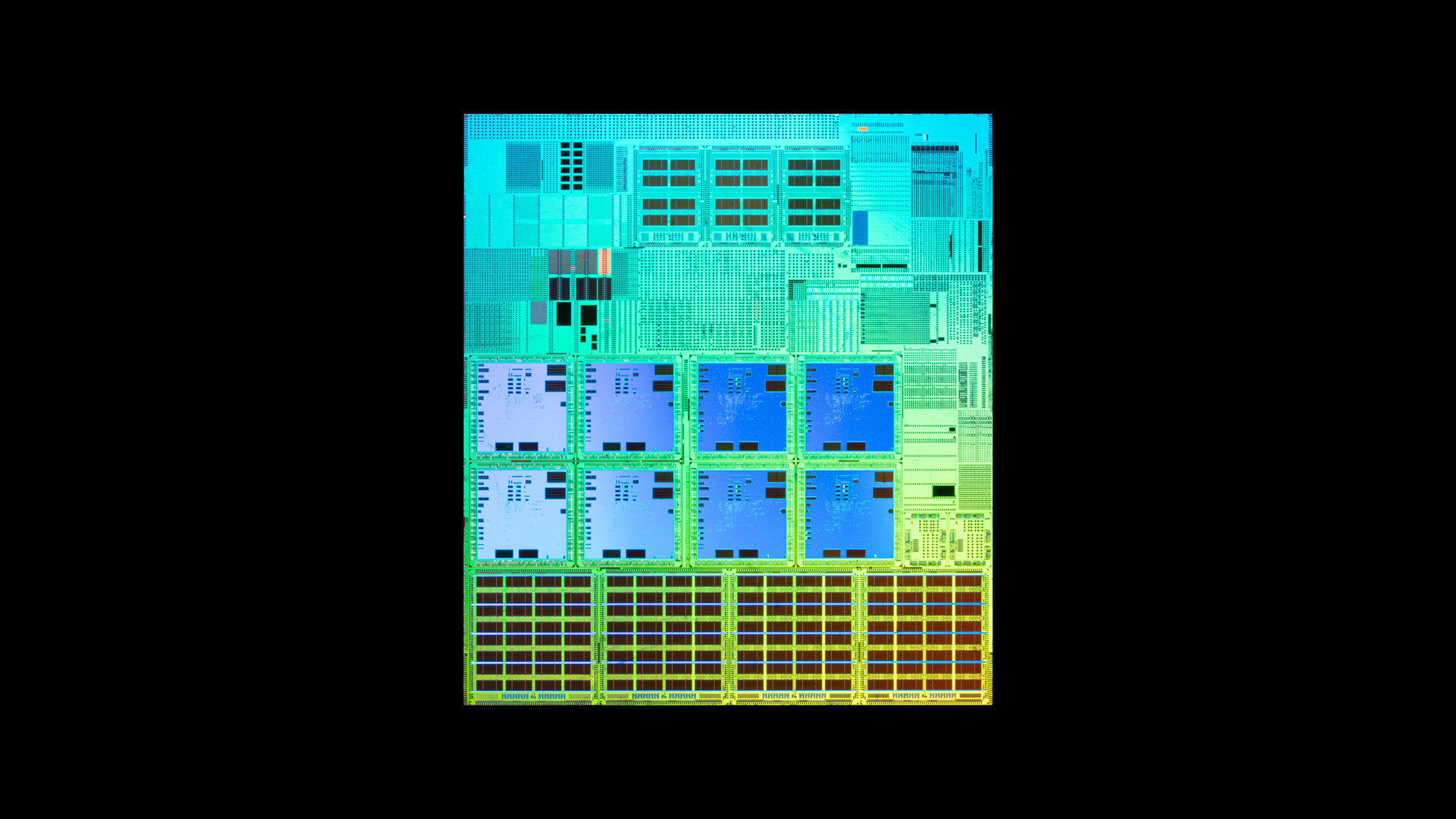

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Global IT spending set to hit a 30-year high by end of 2025

Global IT spending set to hit a 30-year high by end of 2025News Spending on hardware, software and IT services is growing faster than it has since 1996

-

AI tools are a game changer for enterprise productivity, but reliability issues are causing major headaches – ‘everyone’s using AI, but very few know how to keep it from falling over’

AI tools are a game changer for enterprise productivity, but reliability issues are causing major headaches – ‘everyone’s using AI, but very few know how to keep it from falling over’News Enterprises are flocking to AI tools, but very few lack the appropriate infrastructure to drive adoption at scale

-

Pegasystems teams up with AWS to supercharge IT modernization

Pegasystems teams up with AWS to supercharge IT modernizationNews The duo aim to create deeper ties between the Blueprint, Bedrock, and Transform services

-

Better together

Better togetherWhitepaper Achieve more with Windows 11 and Surface

-

Transforming the enterprise

Transforming the enterpriseWhitepaper With Intel and CDW

-

The top trends in money remittance

The top trends in money remittanceWhitepaper Tackling the key issues shaping the money remittance industry

-

How Kantar revamped its IT infrastructure after being sold off

How Kantar revamped its IT infrastructure after being sold offCase Study Being acquired by a private equity firm meant Kantar couldn’t rely on its parent company’s infrastructure, and was forced to confront its technical shortcomings

-

Deutsche Bank wraps up Postbank IT integration after bug-laden migrations

Deutsche Bank wraps up Postbank IT integration after bug-laden migrationsNews The IT merger is expected to generate annual savings of €300 million by 2025