Santander rolls out blockchain-powered foreign exchange app

One Pay FX will use Ripple's blockchain technology to accelerate payments across borders

Santander has rolled out a blockchain-powered app to simplify and speed up foreign currency transfers between customers across borders.

The app, named 'One Pay FX', will allow Santander customers in the UK, Spain, Brazil and Poland to transfer funds on the same day or the next, while showing the exact amount that will be received in the destination currency prior to the transfer.

Based on distributed ledger technology provided courtesy of Ripple, dubbed xCurrent, users will initially be able to transfer between 10 and 10,000, in EUR to 21 countries and USD to the US, with more currencies and destinations to be rolled out in the near future.

The banking giant also plans to introduce the service for small business to use in additional countries in the coming months, alongside an array of new features.

Ana Botn, Banco Santander's executive chairman, said the app provides a fast, simple and secure way to transfer money internationally - offering a greater deal of transparency and trust in the service.

"From today, customers in the UK can use One Pay to transfer money across Europe and to the US. In Spain, customers can transfer to the UK and US, while customers in Brazil and Poland can transfer to the UK," she said.

"Transfers to Europe can be made on the same day and we are aiming to deliver instant transfers across several markets by the summer."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

She added: "Blockchain technology offers tremendous opportunities to improve the services we offer our customers, and the launch of Santander One Pay FX is the first of many potential applications."

Ripple's xCurrent, the software system powering One Pay FX, has already been adopted by a host of financial institutions across the world, for instance, by Thai-based Siam Commercial Bank (SCB), and Akbank Direct Banking in Turkey.

Santander's relationship with ripple stretches back to a $4 million investment made by Santander's investment arm, Santander InnoVentures, into Ripple as part of a $32 million funding round in 2015. The development of One Pay FX, first touted the following year, was earmarked for an initial late-2016 rollout, and, according to reports at the time, had previously been made available to Santander staff in the UK.

Similarly, Barclays grew a partnership with tech company Safello in 2015 to explore how blockchain could be used to transform day-to-day banking practices, although Santander's new app represents the first time a blockchain-based international payments service has been rolled out in multiple countries simultaneously.

Despite a growing enthusiasm for blockchain technology and its wide-reaching applications, sceptics such as KPMG's head of tech growth Patrick Imbach, remain unconvinced it will reach its full commercial potential so soon - with Imbach citing 2019 as the earliest point blockchain will start to produce material results.

Speaking to IT Pro in February Imbach said it is generally only once the hype dies down that new technologies, such as blockchain, start generating commercially viable results.

"We're still a little bit early in that process, I wouldn't expect any exciting commercial opportunities to arise in large numbers any time soon - in the UK, particularly," he said.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

Hackers are using LLMs to generate malicious JavaScript in real time

Hackers are using LLMs to generate malicious JavaScript in real timeNews Defenders advised to use runtime behavioral analysis to detect and block malicious activity at the point of execution, directly within the browser

-

Developers in India are "catching up fast" on AI-generated coding

Developers in India are "catching up fast" on AI-generated codingNews Developers in the United States are leading the world in AI coding practices, at least for now

-

World-record performance for AI and ML

World-record performance for AI and MLwhitepaper Drawing benchmark strength from Dell servers to real-world performance for training and inferencing on AI and ML models

-

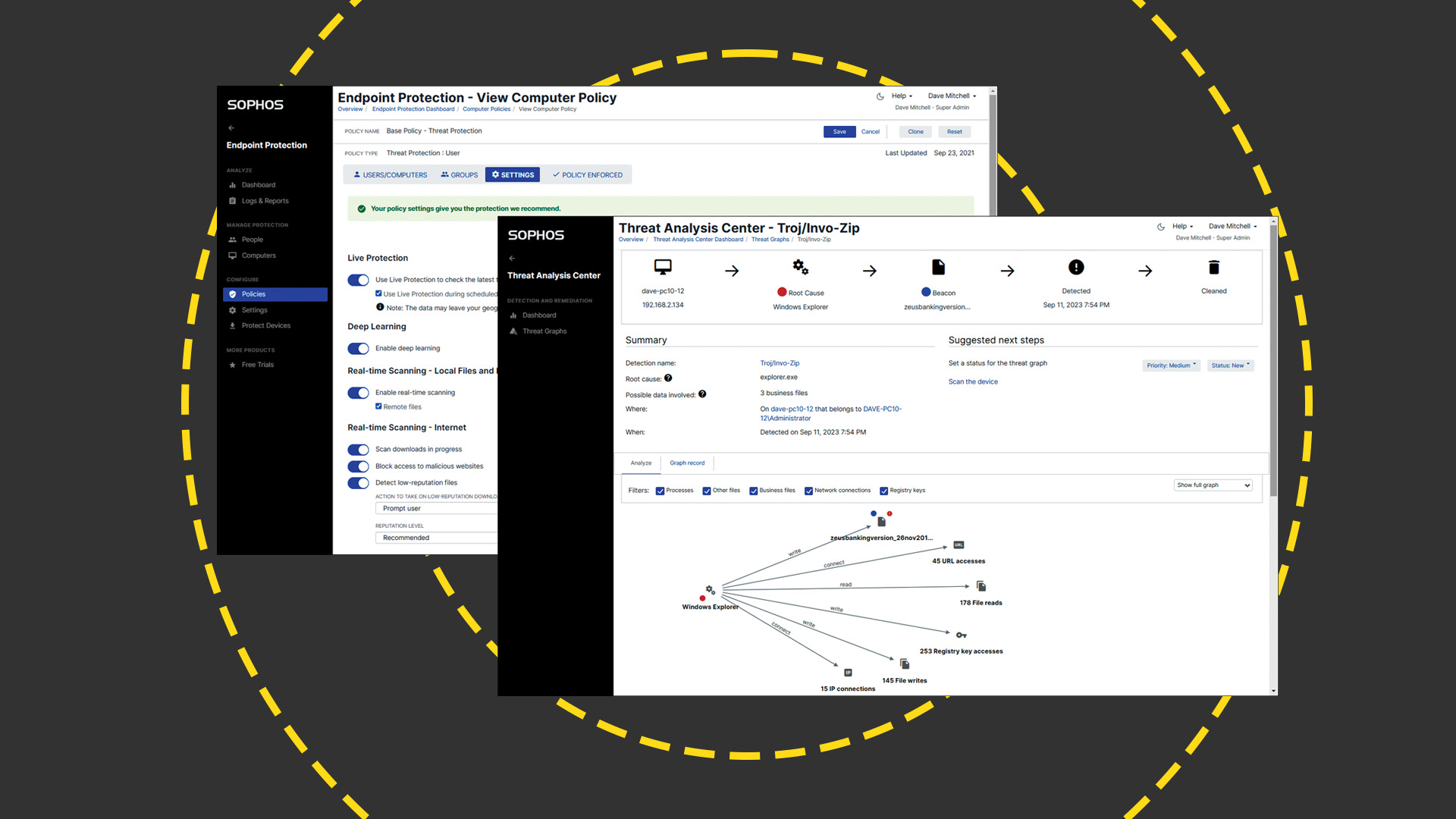

Sophos Intercept X Advanced review: A huge range of endpoint protection measures for the price

Sophos Intercept X Advanced review: A huge range of endpoint protection measures for the priceReviews A superb range of security measures and a well-designed cloud portal make endpoint protection a breeze

-

Facebook tried to buy NSO Group's Pegasus spyware to monitor iOS users

Facebook tried to buy NSO Group's Pegasus spyware to monitor iOS usersNews Social network wanted to integrate surveillance tech into its Onavo Protect app