Intuit to pay $141 million settlement over misleading TurboTax ads

The company's elusive ad campaign discouraged eligible taxpayers from signing up for IRS Free File Program

Intuit has agreed to pay $141 million in restitution after an investigation conducted by the Office of the Attorney General (OAG) revealed the TurboTax owner engaged in phony digital tactics to lure low-income Americans away from federally-funded free tax preparation services.

The multistate investigation, prompted by ProPublica’s conclusive report, also unearthed Intuit’s counterfeit “free, free, free” ad campaign to boost sales of TurboTax’s Free Edition.

RELATED RESOURCE

Activation playbook: Deliver data that powers impactful, game-changing campaigns

Bringing together data and technology to drive better business outcomes

While TurboTax "freemium" products were free for approximately one-third of US taxpayers, IRS Free File products were free for 70 percent.

In its elaborate scheme to deceive taxpayers, Intuit also barred its IRS Free File landing page from search engine results in a bid to covertly deny the free filing option to eligible taxpayers during the 2019 tax filing season.

Under the terms of a settlement signed by the attorneys general of all 50 states and the District of Columbia, Intuit will dismiss TurboTax’s ad campaign and pay restitution to nearly 4.4 million taxpayers who were coaxed into using the company’s ‘paid’ TurboTax Free Edition for tax years 2016 through 2018, limiting their participation in the free IRS Free File Program offered through TurboTax.

Per reports, affected consumers will receive a direct payment of approximately $30 for each year that they were defrauded. In total, the state of New York will receive over $5.4 million for nearly 176,000 New Yorkers who were tricked into paying for free tax services.

“Intuit cheated millions of low-income Americans out of free tax filing services they were entitled to,” commented Attorney General James.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“For years, Intuit misled the most vulnerable among us to make a profit. Today, every state in the nation is holding Intuit accountable for scamming millions of taxpayers, and we’re putting millions of dollars back into the pockets of impacted Americans. This agreement should serve as a reminder to companies large and small that engaging in these deceptive marketing ploys is illegal. New Yorkers can count on my office to protect their wallets from white-collar scammers.”

-

The modern workplace: Standardizing collaboration for the enterprise IT leader

The modern workplace: Standardizing collaboration for the enterprise IT leaderHow Barco ClickShare Hub is redefining the meeting room

-

Interim CISA chief uploaded sensitive documents to a public version of ChatGPT

Interim CISA chief uploaded sensitive documents to a public version of ChatGPTNews The incident at CISA raises yet more concerns about the rise of ‘shadow AI’ and data protection risks

-

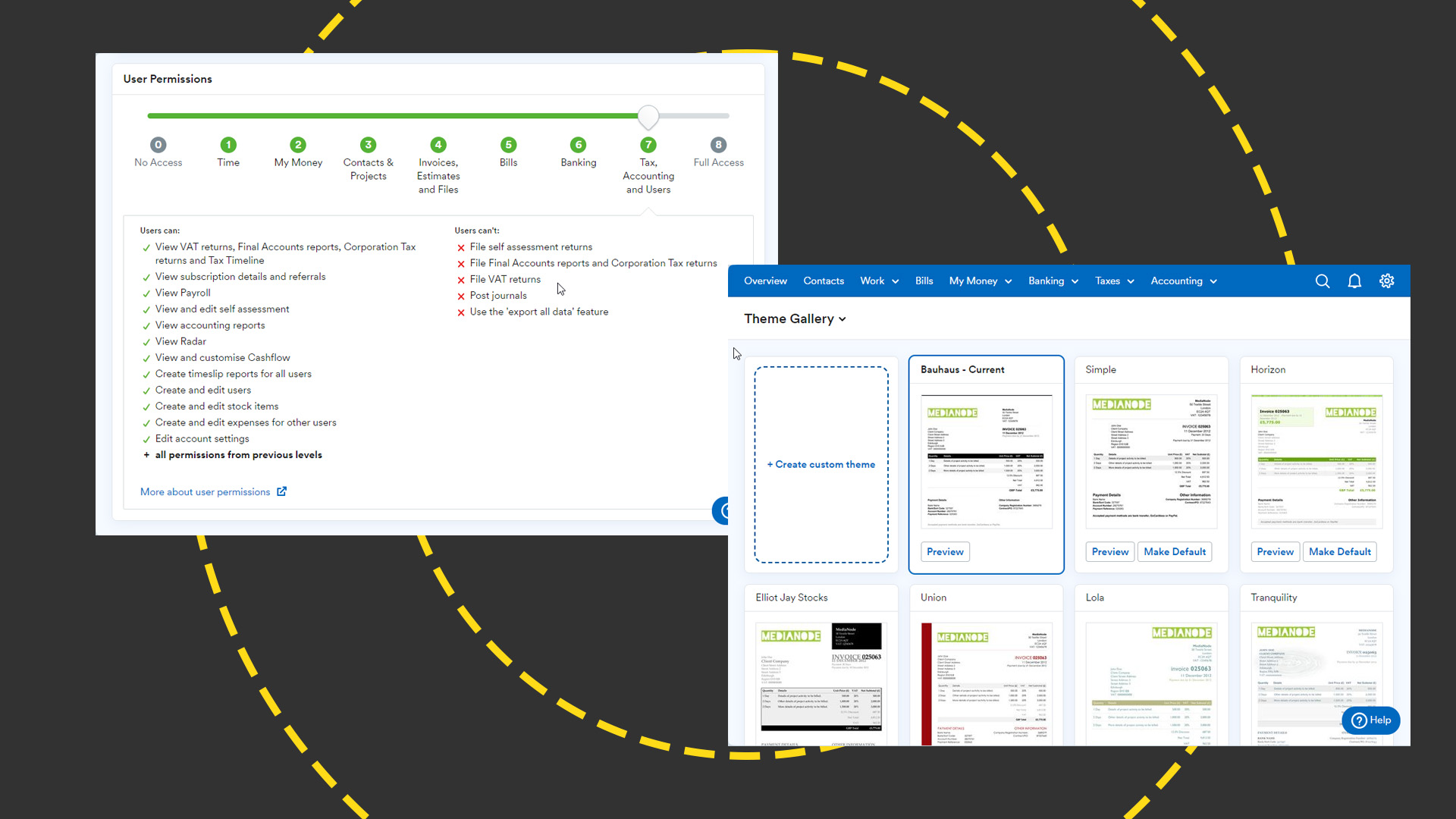

FreeAgent review: Fully featured yet easy-to-use cloud accounting platform

FreeAgent review: Fully featured yet easy-to-use cloud accounting platformReviews A keenly-priced timesaver that will shine if your business lacks an accounts department

-

Why it might be time to switch your organization’s accounting software

Why it might be time to switch your organization’s accounting softwareIn-depth Every business needs to keep track of its finance, but there are challenges involved in maintaining and switching accounting software

-

Google settles tax payment in Ireland

Google settles tax payment in IrelandNews Company makes settlement for back tax and interest payments

-

UK fintech investment reaches record levels

UK fintech investment reaches record levelsNews Out of the 112 tech unicorns in the UK, 40 are part of the fintech sector

-

Oracle employee claims company wasn't accounting properly

Oracle employee claims company wasn't accounting properlyNews The whistleblower has now been sacked after saying it falsified cloud figures and faces legal action

-

Sage One Accounts Extra review

Sage One Accounts Extra reviewReviews One of the best small business accounting services around, despite limited VAT MOSS support

-

Xero Premium review

Xero Premium reviewReviews Powerful small business accounting in the cloud

-

Crunch accounting review

Crunch accounting reviewReviews Simple software with support from accountants