Google settles tax payment in Ireland

Company makes settlement for back tax and interest payments

Google has reportedly agreed to pay €345.2 million ($387.1m) in back taxes and interest to the Irish government.

The payment, discovered by the Irish Times in Google Ireland's accounts filings, included €218 million in back taxes to the Irish government and €127.2 million in interest. The payments are a tax settlement between Google and the Irish government that forms part of a total 2020 corporate tax bill of €622 million.

Google Ireland made €48.4 billion in revenues during 2020, representing a year-on-year increase of €2.7 billion from €45.7 billion. It also made €2.85 billion in pre-tax profits that year, up 46% from €1.94 billion during the prior year.

In April, the paper reported that Google had used an accounting technique called the 'double Irish' to siphon money from its Irish operation. Google's Irish operation licensed intellectual property from its tax-registered entity in Bermuda, paying royalties in return. This allowed the company to use Bermuda (which has a zero percent tax rate) as a tax haven. The Irish government viewed the company as tax-resident in Bermuda, while the US considers it to be tax-resident in Ireland.

That arrangement, abolished in 2015, was finally phased out for existing users in 2020. Google restructured its tax operation that year, moving its intellectual property holdings back to the US.

In October, Ireland said it would join an international agreement that would set a minimum 15% tax rate on multinational companies, up from its previous 12.5%. It's part of an OECD initiative that calls for companies to pay taxes in countries where their products and services are sold.

Last year, an EU court ruled that Apple didn't have to pay €13 billion in back taxes after a long legal battle.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Big tech companies have come under fire in the past for using tax loopholes around the world that enable them to escape payments.

Danny Bradbury has been a print journalist specialising in technology since 1989 and a freelance writer since 1994. He has written for national publications on both sides of the Atlantic and has won awards for his investigative cybersecurity journalism work and his arts and culture writing.

Danny writes about many different technology issues for audiences ranging from consumers through to software developers and CIOs. He also ghostwrites articles for many C-suite business executives in the technology sector and has worked as a presenter for multiple webinars and podcasts.

-

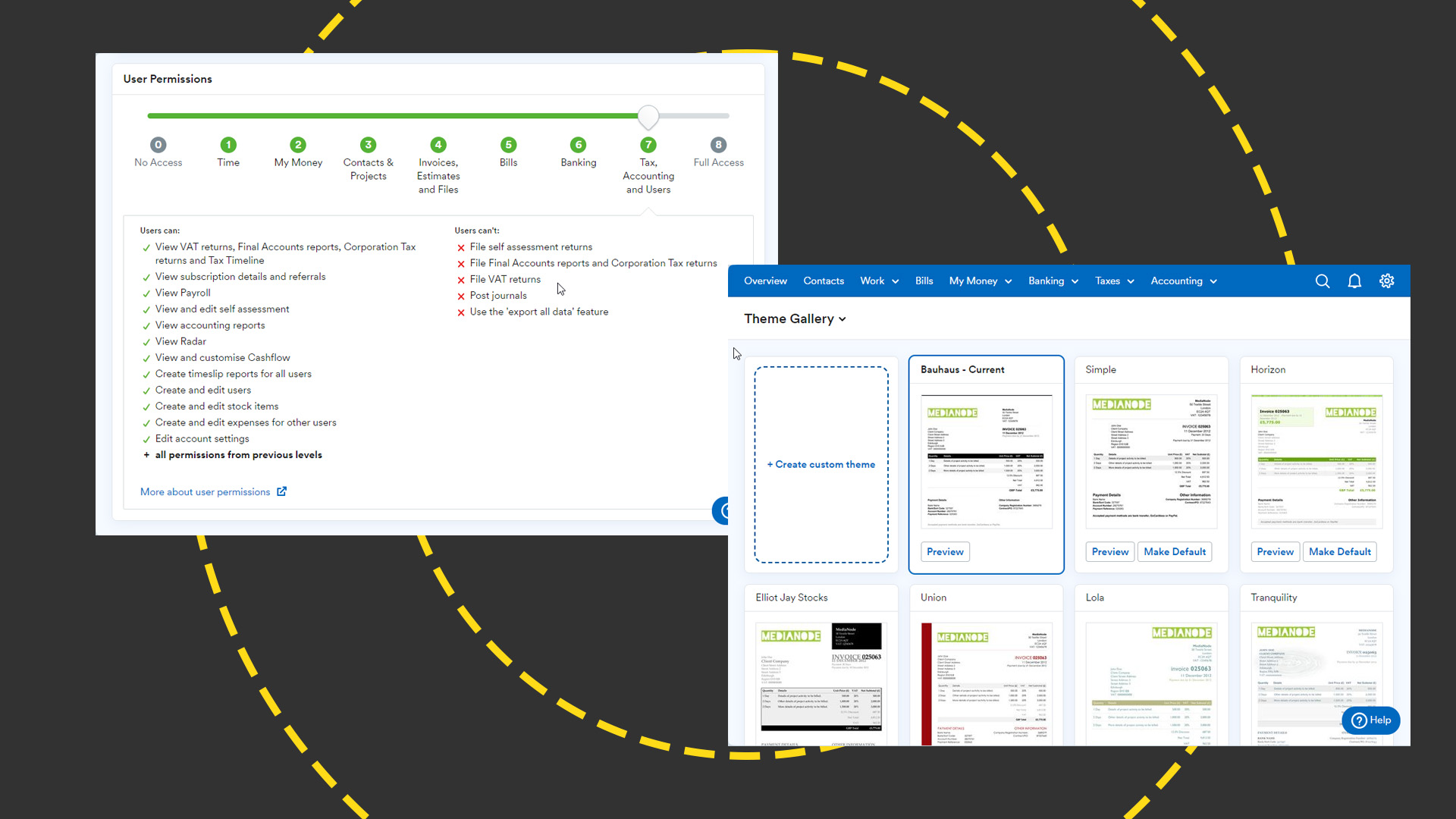

FreeAgent review: Fully featured yet easy-to-use cloud accounting platform

FreeAgent review: Fully featured yet easy-to-use cloud accounting platformReviews A keenly-priced timesaver that will shine if your business lacks an accounts department

-

Why it might be time to switch your organization’s accounting software

Why it might be time to switch your organization’s accounting softwareIn-depth Every business needs to keep track of its finance, but there are challenges involved in maintaining and switching accounting software

-

Intuit to pay $141 million settlement over misleading TurboTax ads

Intuit to pay $141 million settlement over misleading TurboTax adsNews The company's elusive ad campaign discouraged eligible taxpayers from signing up for IRS Free File Program

-

UK fintech investment reaches record levels

UK fintech investment reaches record levelsNews Out of the 112 tech unicorns in the UK, 40 are part of the fintech sector

-

US may intervene in Apple's €13 billion EU tax appeal

US may intervene in Apple's €13 billion EU tax appealNews Report - Trump administration wants to involve itself with Apple's Irish tax case

-

Google's tax bill was £36m last year

Google's tax bill was £36m last yearNews The company said it has paid what is due, even though there's a £5 billion discrepancy in sales vs. turnover

-

Apple tax case: Tim Cook calls state aid ruling “maddening”

Apple tax case: Tim Cook calls state aid ruling “maddening”News "We haven't done anything wrong," claims Apple CEO

-

Oracle employee claims company wasn't accounting properly

Oracle employee claims company wasn't accounting properlyNews The whistleblower has now been sacked after saying it falsified cloud figures and faces legal action