ARM, AMD and Apple: Does the iPhone maker want its chips?

Apple has been linked with acquisitions of both AMD and ARM in the past week or two. Simon Brew asks what it’s up to...

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

One of the many successful decisions that Apple has made in recent years was the one to switch its Mac range of computers to Intel processors.

This had numerous, well-noted benefits, including cost savings to Apple, and putting faster and more flexible CPUs at the heart of its machines.

Furthermore, it also meant that it could piggyback the innovations Intel itself was making, and it in conjunction with the evolution of OS X, it's given its Mac range a welcome shot in the arm.

One offshoot has been though that there have been grumblings from other manufacturers. Apple, runs the argument, is getting first dibs at the Intel product line, and simply fulfilling the orders for new Macs is putting Intel's supply line under pressure.

It's good times for Apple, though, as the announcement of its quarterly revenues earlier this week more than proved. Staggeringly, Apple has brought in a 90 per cent increase in profits to $3.07 billion for the first three months of the year.

It sold lots more Macs, it sold lots more iPhones, and only the sales of iPods have very slightly declined. Given that the next quarter's results will include the iPad, it would be fair to conclude that Apple is one of the few very cash rich businesses in the market.

This, then, has inevitably led to speculation over where it's going to spend its wealth, and its the aforementioned processor market that originally attracted speculation. Apple, however, has also been linked to a major chip maker too, and there appears to be a general feeling in the air that a big deal may very well be in the offing.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

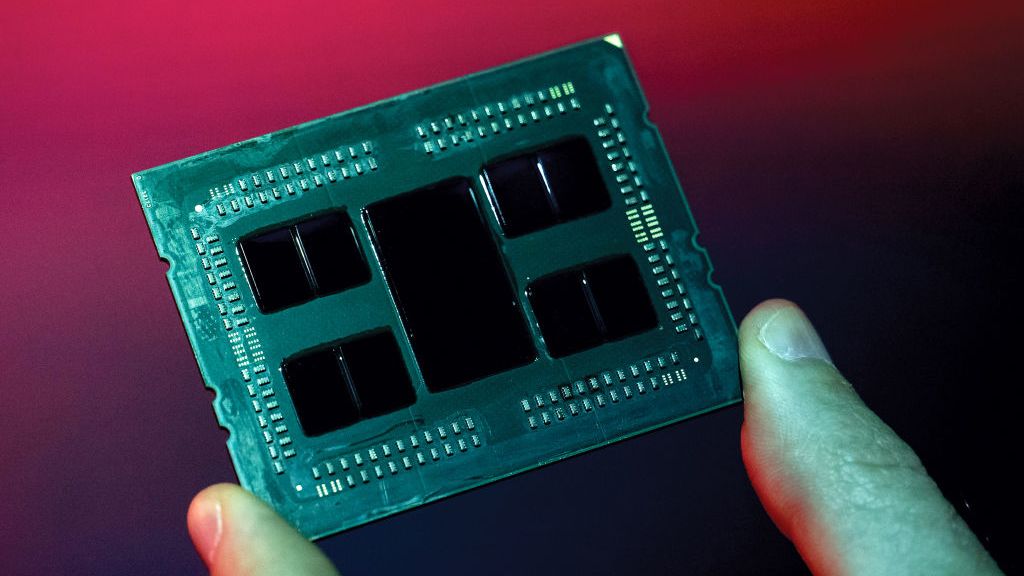

AMD attraction

Firstly then, there was the news that Apple was considering switching its Mac line to AMD processors.

There'd be an obvious logic to such a move. AMD chips are cheaper for Apple to buy, and AMD is negotiating from a position of some weakness, as it continues to try and reseize some initiative back from Intel.

The fact that AMD chips outperform their Intel equivalents would be made moot by the fact that Apple's machines rarely require cutting edge grunt to do their work.

However, the rumour was then fuelled by suggestions that Apple wasn't just interested in using AMD's processors, but it was considering buying the company outright.

This would be a bold and risky move for Apple, although one with an obvious benefit. Having a company to design and manufacture the processors at the heart of Mac computers would give it a cost advantage and flexibility that it doesn't currently have.

Furthermore, you get AMD, you also take buoyant graphics technology firm ATI, and you also get a solid integrated business too.

That said, it's a plan with a couple of problems. AMD has been making sizeable losses over the past few years, and technologically, Intel has held the upper hand in the processor sector since the launch of Core 2 back in 2006.

This has meant that AMD has had little choice but to compete on price, and yet it's doing that against a cash-rich opponent that can bring down what it charges on a whim should it choose. AMD also doesn't have the fabrication plants that Intel has at its disposal.

Furthermore, where AMD chips suffer the most is in their portable incarnations, where there's some distance between the performance of its CPUs and Apples. It's a market that AMD has really struggled to convincingly break into.

Some suggest that Apple's hand here is being forced by the ongoing legal battles between Intel and NVidia. Intel has put a stop on NVidia creating chipsets for the Core i5 and i7 processor platforms. This means that Apple has to use Intel's chipsets rather than the NVidia ones it's rumoured to prefer. There's also no doubt interest in AMD's work on Fusion, which will bring together the CPU and GPU in one product.

Still, all this could all be a negotiation smokescreen of course, designed to get a better deal out of Intel. But there does seem to be a modicum of logic at the heart of it all.

ARM

However, it's not just AMD that's come under the speculative microscope, for Apple is also being strongly linked with a move for ARM.

ARM is the Cambridge-based chip designer who is responsible for nine-tenths of the chips sat inside the world's smartphones.

Specifically, it's also the chip designer that Apple uses to help power its own A4 processor, which is the beast that sits at the heart of the iPhone.

Apple is currently the biggest customer on ARM's books, and again, there's some basic logic to the move. Even before you get to the cost advantage of having the chip technology in-house, Apple would also be able to restrict its competitors making use of ARM chips.

Granted, that's something that regulators are bound to have something to say about, but just the mere mention that Apple may be considering an ARM deal is no doubt enough to cause some urgent meetings in the boardrooms of its rivals.

ARM is not going to be a cheap business to buy though, with the starting price likely to be around the $3 billion mark. To actually buy ARM? That may take up to $8 billion, depending on who you talk to. And while, with iPhone sales rocketing, ARM is enjoying good times of its own, there are many who are questioning whether Apple would be making the right move here.

What next?

Apple has, as always, made no formal comment on either potential acquisition, but that hasn't stopped an abundance of analysts from having their say.

The ARM buy-out in particular, which ARM itself doesn't seem too keen on, is raising questions of Apple's power and influence in the martketplace.

And it might just be that a quick chat with US regulators may nix any chance of it happening.

Apple, however, is unlikely to be dissuaded from investigating a major hardware purchase such as AMD and ARM, and is likely to be keen to strike while the proverbial iron is hot. And, more to the point, while the bank balance is full.

There's an obvious longer term benefit to making the Apple business as vertically integrated as possible, especially for a firm as protective of its platforms as Apple. There's also the argument that the bigger the acquisition, the more that can go wrong.

Apple, however, even though it's keeping mum is sure to be tempted. And with little sign of its sales or profits falling in the months ahead, it's one of the few companies in the sector with the power to pull off such a major deal. Watch this space

-

How the rise of the AI ‘agent boss’ is reshaping accountability in IT

How the rise of the AI ‘agent boss’ is reshaping accountability in ITIn-depth As IT companies deploy more autonomous AI tools and agents, the task of managing them is becoming more concentrated and throwing role responsibilities into doubt

-

Hackers are pouncing on enterprise weak spots as AI expands attack surfaces

Hackers are pouncing on enterprise weak spots as AI expands attack surfacesNews Potent new malware strains, faster attack times, and the rise of shadow AI are causing havoc

-

AMD and DoiT partner to help Google Cloud customers maximise performance

AMD and DoiT partner to help Google Cloud customers maximise performanceNews The collaboration also aims to reduce costs and improve the security of cloud workloads running on Epyc

-

AMD and Microsoft fix Ryzen performance in Windows 11

AMD and Microsoft fix Ryzen performance in Windows 11News Both companies shipped software updates to address two performance issues

-

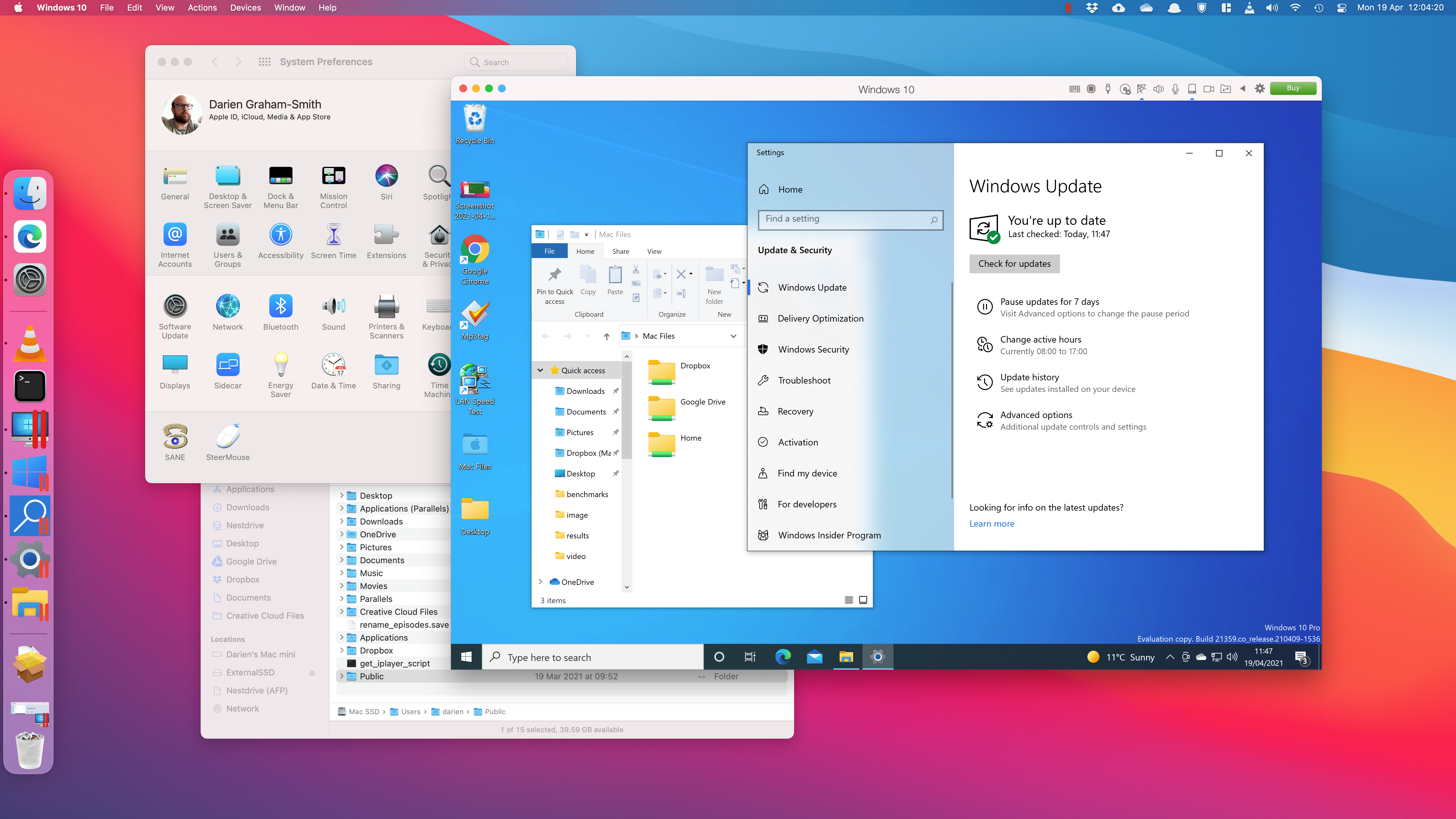

Parallels Desktop 16.5 review: Windows comes to Apple Silicon (sort of)

Parallels Desktop 16.5 review: Windows comes to Apple Silicon (sort of)Reviews The best way to run Windows apps on an M1 Mac – but it’s not yet a fully stable proposition

-

Apple discontinues the iMac Pro

Apple discontinues the iMac ProNews Desktop product shake-up paves the way for new Apple Silicon-powered machines

-

M1 Mac mini users suffering Bluetooth connectivity problems

M1 Mac mini users suffering Bluetooth connectivity problemsNews It’s unknown if the issue is in the new Apple silicon or the Big Sur OS

-

Apple starts accepting Mac trade-ins at retail stores

Apple starts accepting Mac trade-ins at retail storesNews Up until now, you could only trade in a used Mac online, which was unwieldy and time-consuming

-

Apple launches surprise desktop iMac and iMac Pro upgrades

Apple launches surprise desktop iMac and iMac Pro upgradesNews New iMac models have up to 9th-gen Core i9 processors and Vega Pro graphics

-

Apple unveils next-generation Mac mini

Apple unveils next-generation Mac miniNews Space grey device with five times the performance has been unveiled at special October event