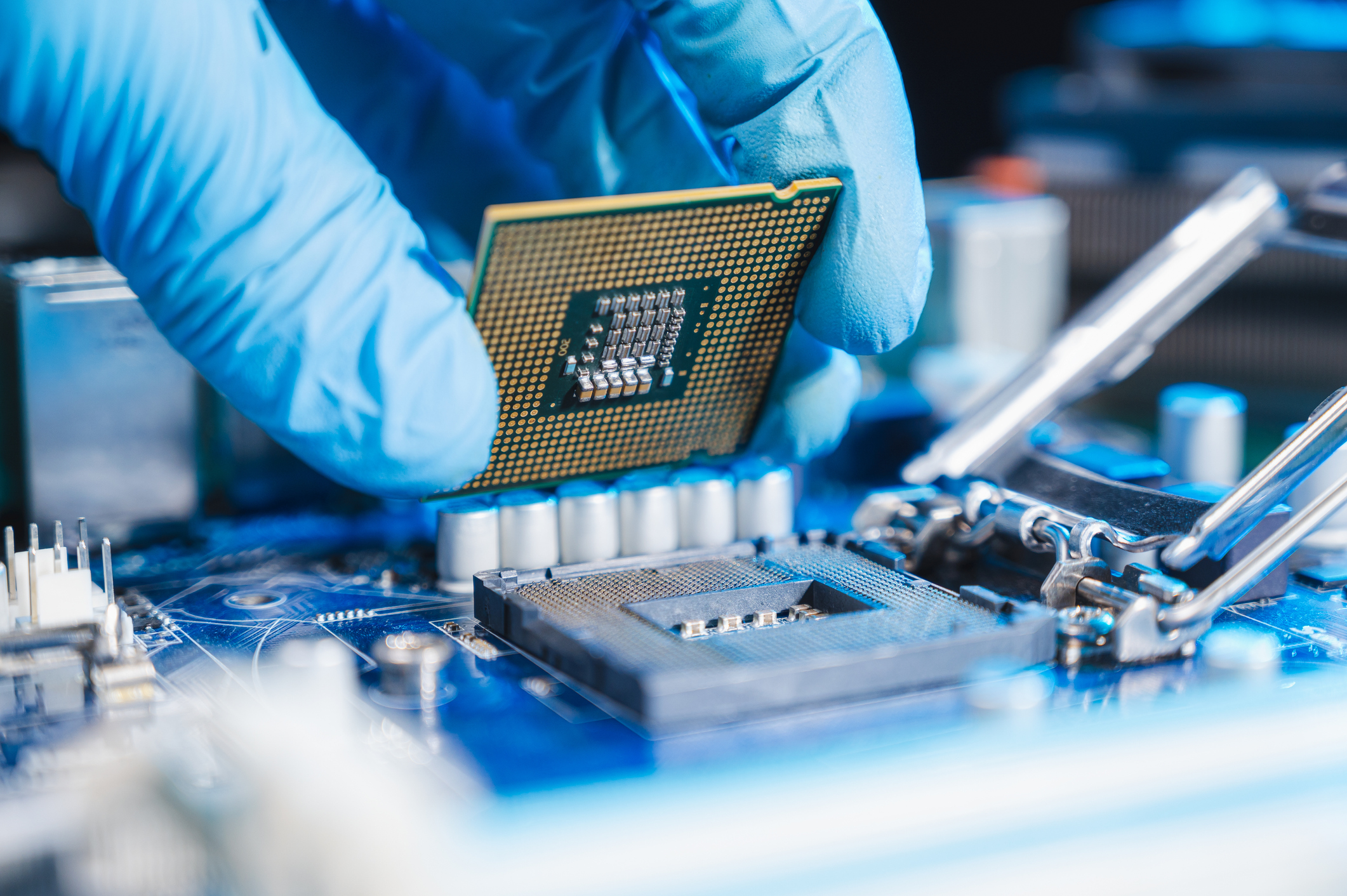

Intel to acquire Tower Semiconductor for $5.4 billion

The chipmaker says the deal will unlock new opportunities in an era of "unprecedented demand" for semiconductors

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Intel has announced that it has entered into an agreement to acquire Tower Semiconductor for $5.4 billion (£3.98 billion).

Founded in 1993, Tower Semiconductor is an Israeli public company that manufactures chips for the mobile, automotive, and power industries. With factories based in Japan, Texas, and Italy, the locations have been deemed “geographically complementary” to Intel.

The deal, which is part of Intel’s “integrated device manufacturing (IDM) 2.0 vision”, will see the chipmaker pay $53 (£39) per Tower share in cash, with a total enterprise value of around $5.4 billion (£3.98 billion).

Announced in March 2021, IDM 2.0 is a $20 billion (approximately £14.5 billion) initiative that aims to expand Intel’s own manufacturing plans, alongside manufacturing custom chips for other tech firms, in an effort to revitalise Intel’s business after a difficult 2020.

This includes the construction of new chip factories in Arizona and Ohio as it bids to serve foundry customers around the globe.

Commenting on the announcement, Intel CEO Pat Gelsinger said that the deal will enable Intel to offer a "compelling breadth of leading-edge nodes and differentiated speciality technologies on mature nodes”.

This, in turn, is expected to unlock “new opportunities for existing and future customers in an era of unprecedented demand for semiconductors”.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“Tower’s speciality technology portfolio, geographic reach, deep customer relationships and services-first operations will help scale Intel’s foundry services and advance our goal of becoming a major provider of foundry capacity globally,” he added.

RELATED RESOURCE

Tower CEO Russell Ellwanger said that he “could not be prouder of the company and of [Tower’s] talented and dedicated employees”. However, he did not provide details on whether the acquisition will see Tower retain its estimated 5,500 staff.

“Together with Intel, we will drive new and meaningful growth opportunities and offer even greater value to our customers through a full suite of technology solutions and nodes and a greatly expanded global manufacturing footprint. We look forward to being an integral part of Intel’s foundry offering,” he added.

Forrester VP research director Glenn O’Donnell said that the acquisition comes as "no surprise":

"Intel has demonstrated it is serious about rebuilding its manufacturing capabilities and the Tower deal fills an important void," he told IT Pro.

News of Intel's acquisition of Tower comes just hours after AMD announced that it had completed its takeover of FPGA heavyweight Xilinx.

Having only graduated from City University in 2019, Sabina has already demonstrated her abilities as a keen writer and effective journalist. Currently a content writer for Drapers, Sabina spent a number of years writing for ITPro, specialising in networking and telecommunications, as well as charting the efforts of technology companies to improve their inclusion and diversity strategies, a topic close to her heart.

Sabina has also held a number of editorial roles at Harper's Bazaar, Cube Collective, and HighClouds.

-

Sumo Logic expands European footprint with AWS Sovereign Cloud deal

Sumo Logic expands European footprint with AWS Sovereign Cloud dealNews The vendor is extending its AI-powered security platform to the AWS European Sovereign Cloud and Swiss Data Center

-

Going all-in on digital sovereignty

Going all-in on digital sovereigntyITPro Podcast Geopolitical uncertainty is intensifying public and private sector focus on true sovereign workloads

-

MSG giant Ajinomoto's chipmaking foray helps break financial records

MSG giant Ajinomoto's chipmaking foray helps break financial recordsNews In addition to umami seasoning, the company produces a microfilm insulation used by the semiconductor industry which was repurposed from its amino acid technology

-

IBM unveils its 'most powerful' 433-qubit quantum processor

IBM unveils its 'most powerful' 433-qubit quantum processorNews The Osprey is three times more powerful than IBM's 127-qubit Eagle processor the company launched a year ago

-

Blackberry revenue falls by 4% as cyber security division takes hit

Blackberry revenue falls by 4% as cyber security division takes hitNews Despite this, the company’s Internet of Things (IoT) division increased its revenue by 28% as it attracted new customers from the automotive sector

-

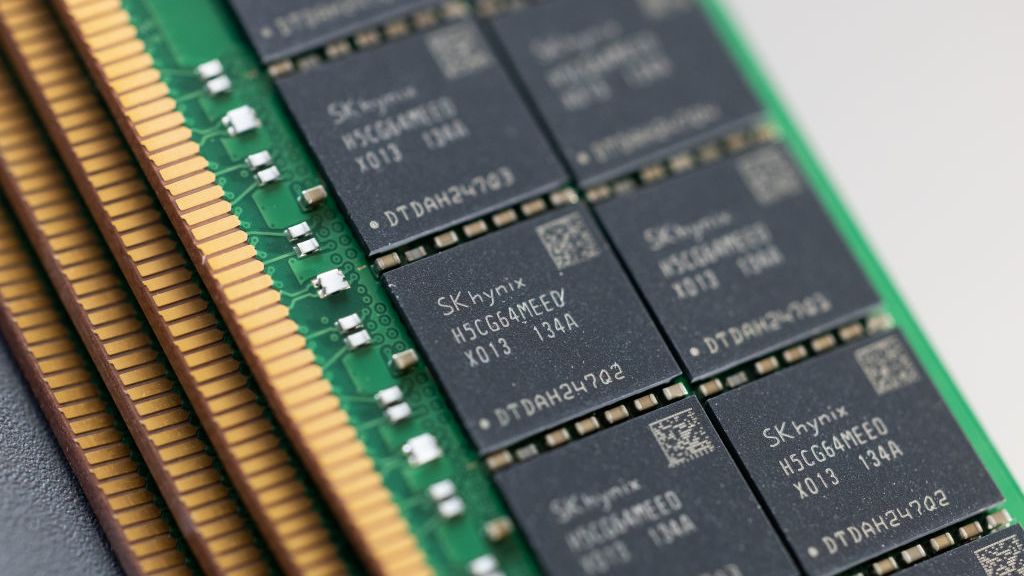

SK Hynix splashes out $11 billion on new semiconductor plant

SK Hynix splashes out $11 billion on new semiconductor plantNews The company will produce memory chips, but will reportedly decided closer to the time whether they will be DRAM or NAND flash chips depending on market conditions

-

Intel strikes $30 billion private equity partnership to fund Arizona plant expansion

Intel strikes $30 billion private equity partnership to fund Arizona plant expansionNews Brookfield Infrastructure Partners will invest around $15 billion into the expansion of the chipmaker’s Ocotillo campus

-

The best 3D printer tools and accessories for your business

The best 3D printer tools and accessories for your businessIn-depth Every business using 3D printers should be aware of these essential extras to raise its output to the next level

-

LED vs laser printers: What should your business choose?

LED vs laser printers: What should your business choose?In-depth Laser and LED printer technology is similar, but each come with their own unique benefits that could make them best for your company

-

Intel to produce chips for Taiwanese manufacturer MediaTek

Intel to produce chips for Taiwanese manufacturer MediaTekNews The agreement comes after the US chip company managed to secure deals with Amazon and Qualcomm last year