Western Digital in merger talks with former Toshiba chip subsidiary Kioxia

Deal to join Kioxia could create a manufacturing giant in the NAND flash storage market

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

US manufacturer Western Digital is reportedly in advanced talks for a $20 billion stock merger with Japanese chipmaker Kioxia.

If initial reports are correct, it could create a new chip manufacturer to rival the likes of Samsung, according to details revealed by Reuters, which cited a person familiar with the matter.

It's thought that the companies could reach an agreement by the middle of September, with Western Digital CEO, David Geockeler, taking charge of the combined entity.

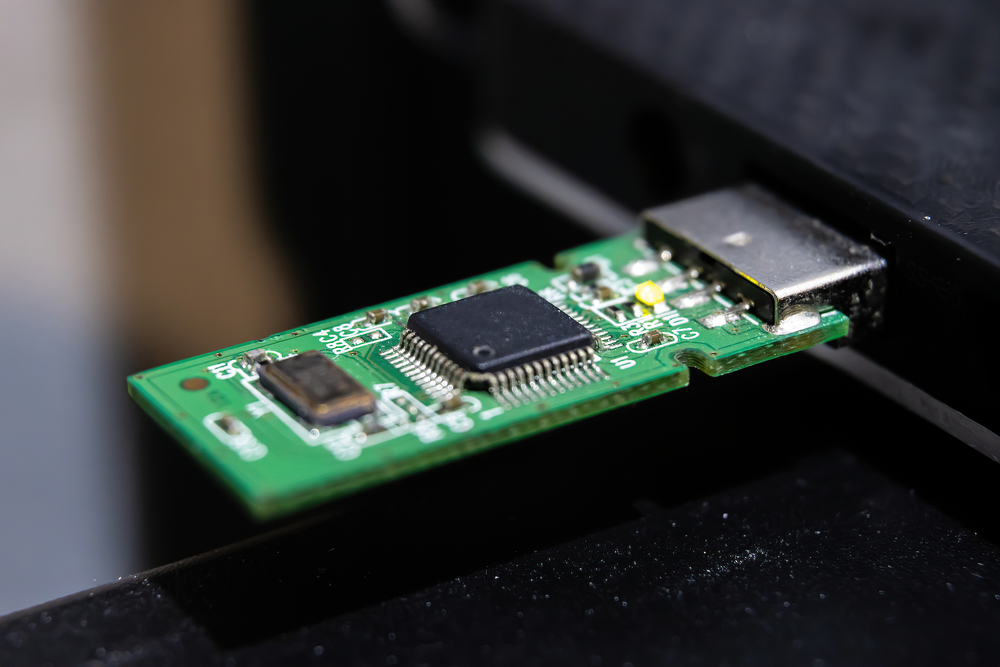

Kioxia, a Tokyo-based computer memory manufacturer, came to exist in its current form after Toshiba spun off its majority stake in the firm in June 2020. The founders of the company were credited with inventing flash memory in the 1980s, while it was still a part of Toshiba, and by 2018 it was estimated to have 19% of the global revenue share for non-volatile storage technology (NAND) flash solid-state drives.

By combining with Western Digital designs, which manufactures and sells storage hardware, the two companies could become a dominant force in the market for memory chips. Samsung currently has over a third of the NAND market, according to estimates by research firm TrendForce, whereas Kioxia and Western Digital have 19% and 15%, respectively.

The potential effect of the merger on the market is likely to draw attention from antitrust regulators in the US, China, and a number of other territories. Trade conflicts between the US and China have squashed deals before, such as Qualcomm's proposed $44 billion acquisition of NXP Semiconductors, which failed to secure Chinese approval in 2018.

RELATED RESOURCE

IBM FlashSystem 5000 and 5200 for mid-market enterprises

Manage rapid data growth within limited IT budgets

Similar issues are currently undermining Nvidia's $40 billion takeover of UK chip giant Arm, with the UK's Competition and Markets Authority concerned it will hamper other chip manufacturers and allow Nvidia to restrict access to Arm products.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"We're concerned that Nvidia controlling Arm could create real problems for Nvidia's rivals by limiting their access to key technologies, and ultimately stifling innovation across a number of important and growing markets," said CMA chief executive, Andrea Coscelli.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

IDC: The business value of IBM Maximo

IDC: The business value of IBM MaximoWhitepaper Integral to the transformation of asset management

-

UK firms are pouring money into AI, but they won’t see a return on investment unless they address these key issues

UK firms are pouring money into AI, but they won’t see a return on investment unless they address these key issuesNews An SAP report projects increased AI investment, but cautions that too many organizations are taking a fragmented approach

-

Intel makes high-level hires while factory workers are warned of layoffs

Intel makes high-level hires while factory workers are warned of layoffsNews The company is appointing four senior executives as part of efforts to refocus on engineering and customer relationships

-

UiPath names Simon Pettit as new AVP for UK and Ireland

UiPath names Simon Pettit as new AVP for UK and IrelandNews The seasoned leader will spearhead region-specific transformation projects as UiPath looks to drive operational growth and customer engagement

-

How to empower employees to accelerate emissions reduction

How to empower employees to accelerate emissions reductionin depth With ICT accounting for as much as 3% of global carbon emissions, the same as aviation, the industry needs to increase emissions reduction

-

Worldwide IT spending to grow 4.3% in 2023, with no significant AI impact

Worldwide IT spending to grow 4.3% in 2023, with no significant AI impactNews Spending patterns have changed as companies take an inward focus

-

Report: Female tech workers disproportionately affected by industry layoffs

Report: Female tech workers disproportionately affected by industry layoffsNews Layoffs continue to strike companies throughout the tech industry, with data showing females in both the UK and US are bearing the brunt of them more so than males

-

How can small businesses cope with inflation?

How can small businesses cope with inflation?Tutorial With high inflation increasing the cost of doing business, how can small businesses weather the storm?