Banco Sabadell signs up to 10-year IBM deal

The Spanish bank will migrate its IT systems to a Red Hat-developed hybrid cloud infrastructure

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Spain's Banco Sabadell has agreed on a €1 billion (£852.5 million) digital transformation deal with IBM to overhaul its IT systems over the next ten years.

The bank will migrate to a hybrid cloud infrastructure, developed by IBM's Red Hat unit, which it acquired in 2019.

The deal is an extension of an existing partnership between the two companies that will see IBM transform Banco Sabadell's technological infrastructure into an advanced platform, able to integrate all its data and applications and facilitate a centralised single customer view.

Banco Sabadell is aiming to upgrade its computer systems to be more efficient as it handles more data and transactions from customers. The bank has also prioritised security and a readiness to adapt to regulatory changes as digitisation sweeps through the industry.

"As the financial sector develops its digitalisation process in a highly regulated environment, banks need to combine a huge capacity for customer-focused innovation with a technological environment that offers maximum levels of solidity, resilience and security," said Marta Martinez, president of IBM Spain, Portugal, Greece and Israel.

RELATED RESOURCE

Benefits of the consistent hybrid cloud

A total cost of ownership analysis of the Dell Technologies Cloud

"An open hybrid cloud platform, created and managed with in-depth knowledge of the financial sector, is the best possible foundation for confronting these challenges."

According to Banco Sabadell's CEO, Jamie Guardiola Romojaro, the deal will not only increase its resilience, security and scalability but also help the bank adopt key elements of the new technologies and processes such as cloud, intensive use of data and artificial intelligence.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

In November, IBM announced a deal with Bank of America to develop "the world's first financial services-ready public cloud". Like the Banco Sabadell deal, the public cloud platform was said to be built using services acquired through its Red Hat deal.

The deal also extends to UK bank TSB, which is a subsidiary of Banco Sabadell and has previously worked with IBM during its 2018 meltdown nightmare. A report from IBM suggested that the bank didn't carry out rigorous enough testing of its new systems.

Bobby Hellard is ITPro's Reviews Editor and has worked on CloudPro and ChannelPro since 2018. In his time at ITPro, Bobby has covered stories for all the major technology companies, such as Apple, Microsoft, Amazon and Facebook, and regularly attends industry-leading events such as AWS Re:Invent and Google Cloud Next.

Bobby mainly covers hardware reviews, but you will also recognize him as the face of many of our video reviews of laptops and smartphones.

-

Building AI readiness through clear workflows

Building AI readiness through clear workflowsWithout clear systems and shared context, even the smartest AI can’t unlock value. People remain central to making automation effective

-

Pure Storage snaps up 1touch in data management pivot

Pure Storage snaps up 1touch in data management pivotNews The all-flash storage company is turning its focus to data management with a new acquisition and new name

-

FinOps: A new approach to cloud financial management

FinOps: A new approach to cloud financial managementWhitepaper Best practices and culture to increase an organization’s ability to understand cloud financial management

-

Accelerating FinOps & sustainable IT

Accelerating FinOps & sustainable ITWhitepaper With IBM's Turbonomic® Application Resource Management

-

What bank CIOs must know when considering bank-specific cloud solutions

What bank CIOs must know when considering bank-specific cloud solutionsWhitepaper Giving banks a way to evaluate industry-specific clouds' value propositions

-

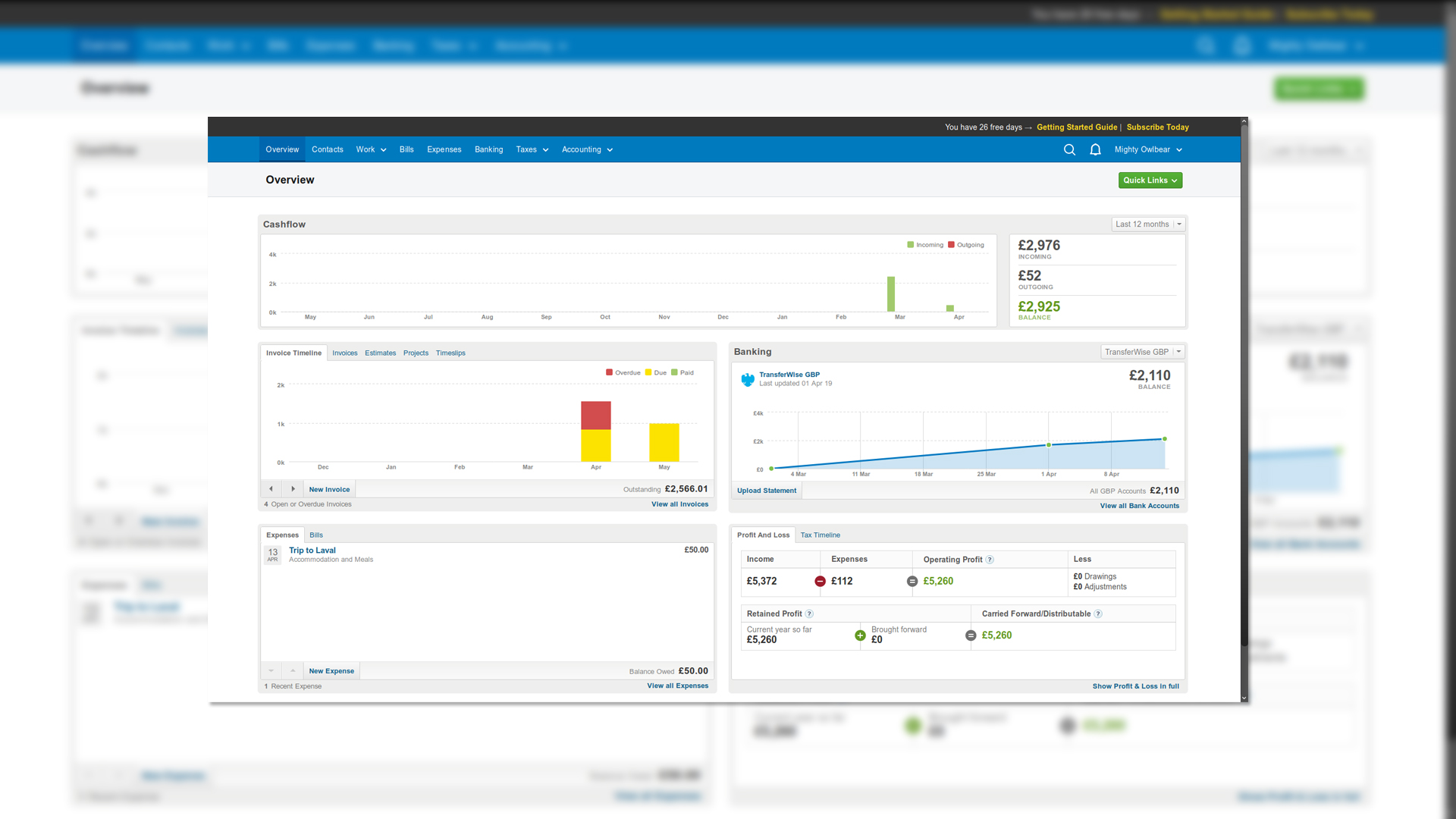

FreshBooks review: Slick, but shallow

FreshBooks review: Slick, but shallowReviews Cloud accounting designed for freelancers and service-based small enterprises

-

FreeAgent review: Financial software you can count on

FreeAgent review: Financial software you can count onReviews A hugely feature-packed small business cloud accounting suite, based in the UK