FreshBooks review: Slick, but shallow

Cloud accounting designed for freelancers and service-based small enterprises

FreshBooks packs in plenty of features, but although it supports Making Tax Digital, it lacks support for other UK tax filings and its cheapest tier places harsh restrictions on client numbers.

-

+

Excellent user interface

-

-

No support for UK self-assessment or PAYE; No manual bank statement uploads

FreshBooks is a Canadian cloud accounting suite that dedicates itself to serving freelancers, sole traders, microbusinesses and growing small businesses. It's designed to be easy to use, without the clutter of features that are only needed by larger enterprises.

Instead, it focuses on capabilities commonly used by small businesses, from standard invoicing and expenses to time tracking and project management. There are three set subscription tiers, plus a top-end custom priced tier for businesses with more than 500 clients.

Priced at $15 USD per month - 11.47 - the Lite tier gives you five billable clients, unlimited invoices and expenses, time tracking, reports and estimates, among other features. Be aware though, that it lacks user-accessible double-entry accounting reports.

For those, you'll need the $25 (19.11) per month Plus tier, which also includes detailed customer proposal templates, recurring invoices and late fee handling. It supports up to 50 billable clients and is the best tier for most freelance service providers.

If your customer base grows beyond that, the Premium tier supports up to 500 clients and costs $50 (38.22) per month. Extra team members can be added to any account for $10 (7.64) per person and all tiers allow you to give your accountant access to your books free of charge.

Unfortunately, none of the tiers include support for submitting UK self-assessment tax returns or PAYE for your employees.

FreshBooks review: Getting started

Whatever tier you subscribe to, you'll be given the option of using FreshBooks or legacy FreshBooks Classic. While the latter is more comfortable for long-time users, its focus is primarily on invoicing and it lacks features such as a proper double-entry ledger and accessible Chart Of Accounts. Our review looks exclusively at the current edition of the service.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

During a short guided setup process, you're prompted to add your company's details, customise the appearance of your invoices and test the service's email-based invoicing system. Invoices are made available online to clients, who can print them to paper or PDF or - if you've added a payment provider - pay directly online.

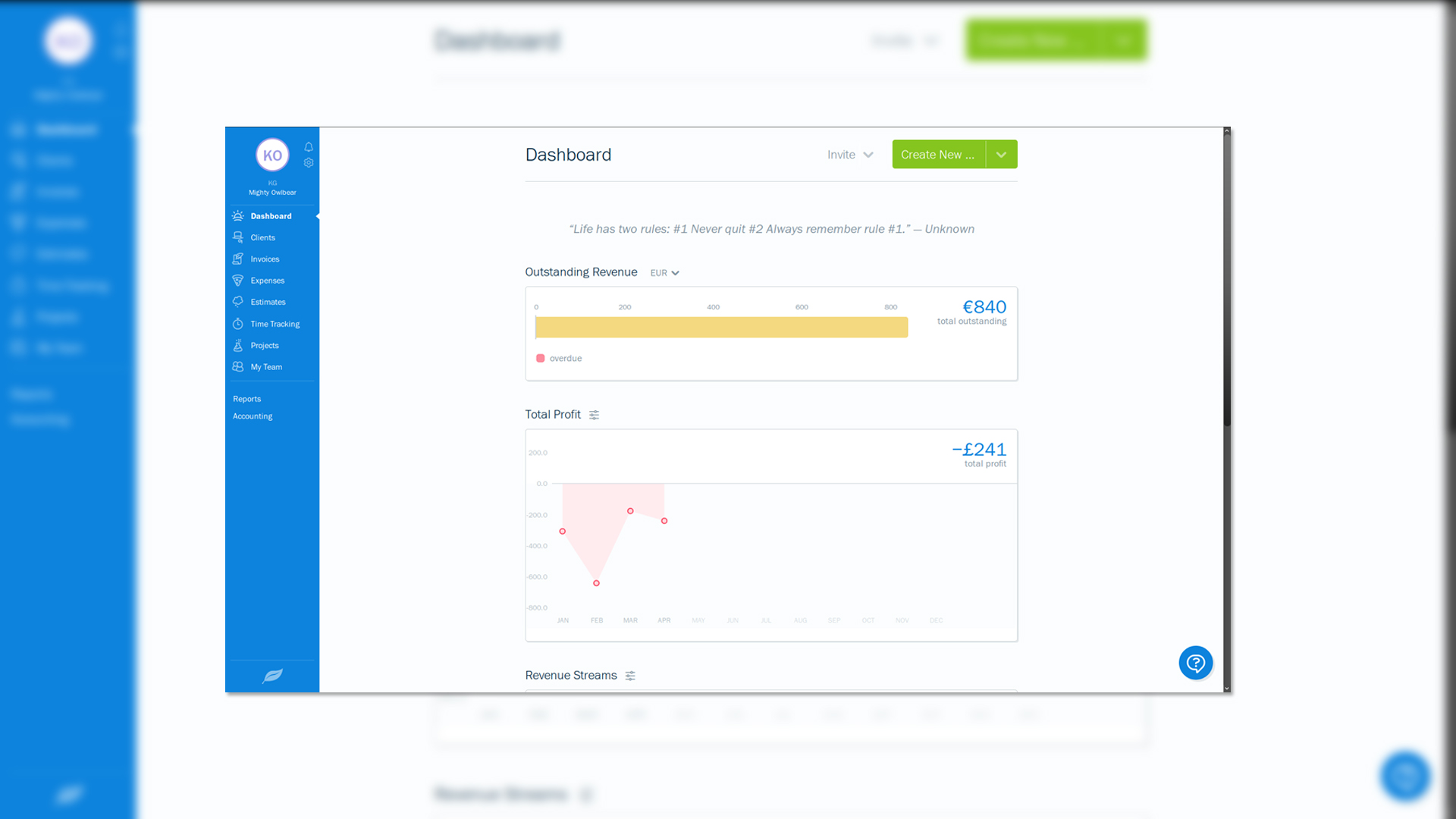

With that done, you're left with your dashboard page, capable of providing an overview of revenue, spending, profit and time. But you'll need to create some invoices before it has anything to show you.

FreshBooks review: Clients, invoicing, estimates and expenses

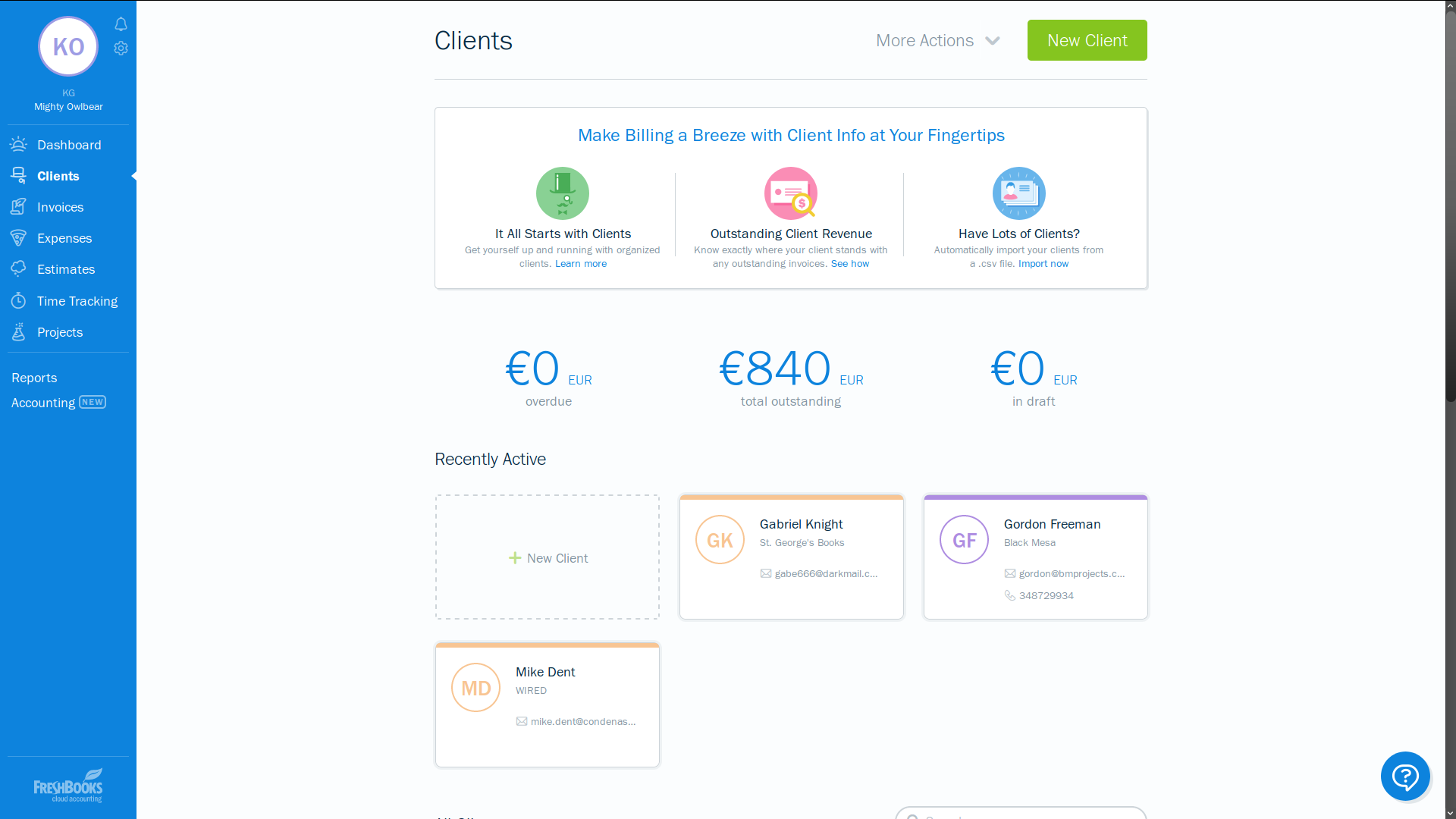

It's generally very obvious where to find everything in FreshBooks, but we'd have nonetheless appreciated more of a guided setup process, particularly for users with existing data to import. You can bulk import clients from contact data files in CSV format. Address handling is a little odd, in that only a single street address line is shown in your client records. However, pasted carriage returns within addresses are recognised and accurately reproduced on invoices.

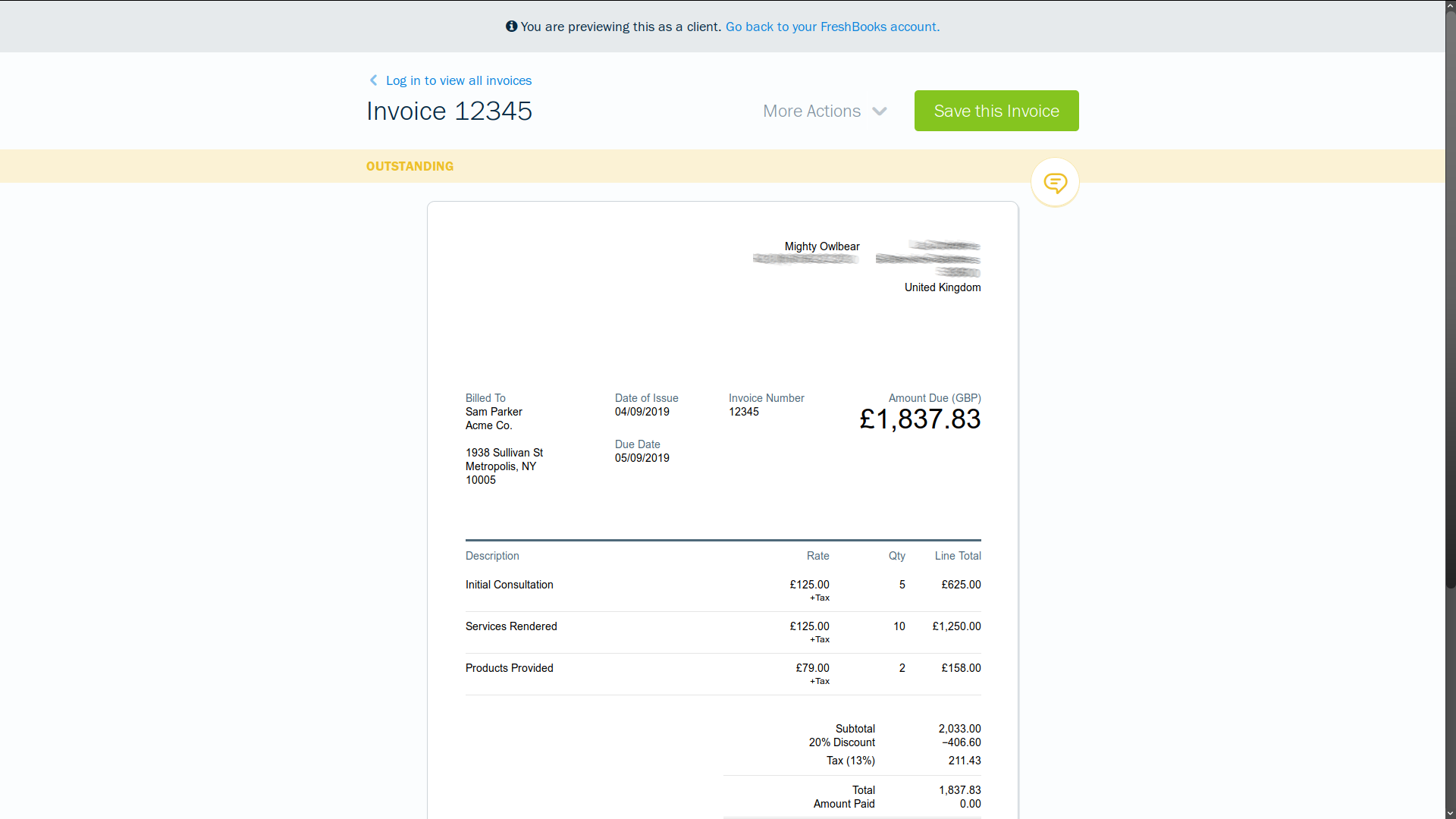

You can also add clients directly from the invoice creation interface, where you can also customise invoice numbers - future invoices automatically increment on any numbering pattern. You can also invoice in foreign currencies, create recurring invoices, specify taxes, request deposits and add discounts.

Clicking into the due date field allows you to set the invoice as due on receipt or on net 30, net 15 or custom terms. These will be inherited by any future invoices you create.

As well as sending them via email or shareable link, invoices can be printed, downloaded and marked as sent, for customers who prefer to receive physical paperwork. You can also mark them as paid when you receive payment.

FreshBooks automatically keeps track of your balances in any currency you start working in, in addition to the base currency defined in your company profile. You can also choose which currency to see in the summary graphs on your Dashboard screen.

When you select the Invoices pane, an Other Income tab will become visible below its navigation bar entry on the right. This allows you to enter income in a number of different categories above and beyond direct invoicing. Note that you must provide customers with invoices and bills in compliance with the legal status of your company, even for cash transactions, and you must retain relevant documentation relating to cash sales, royalties, advertising income and online sales carried out on your behalf by third parties.

As well as invoices, FreshBooks can create estimates and - at its higher subscription tiers - detailed proposals describing the exact nature of the services or project plan you're offering to a client. Once created, these can easily be converted into invoices if your client accepts the estimates, and proposals have digital signature support, to create a permanent record showing that your client has approved the suggested plan.

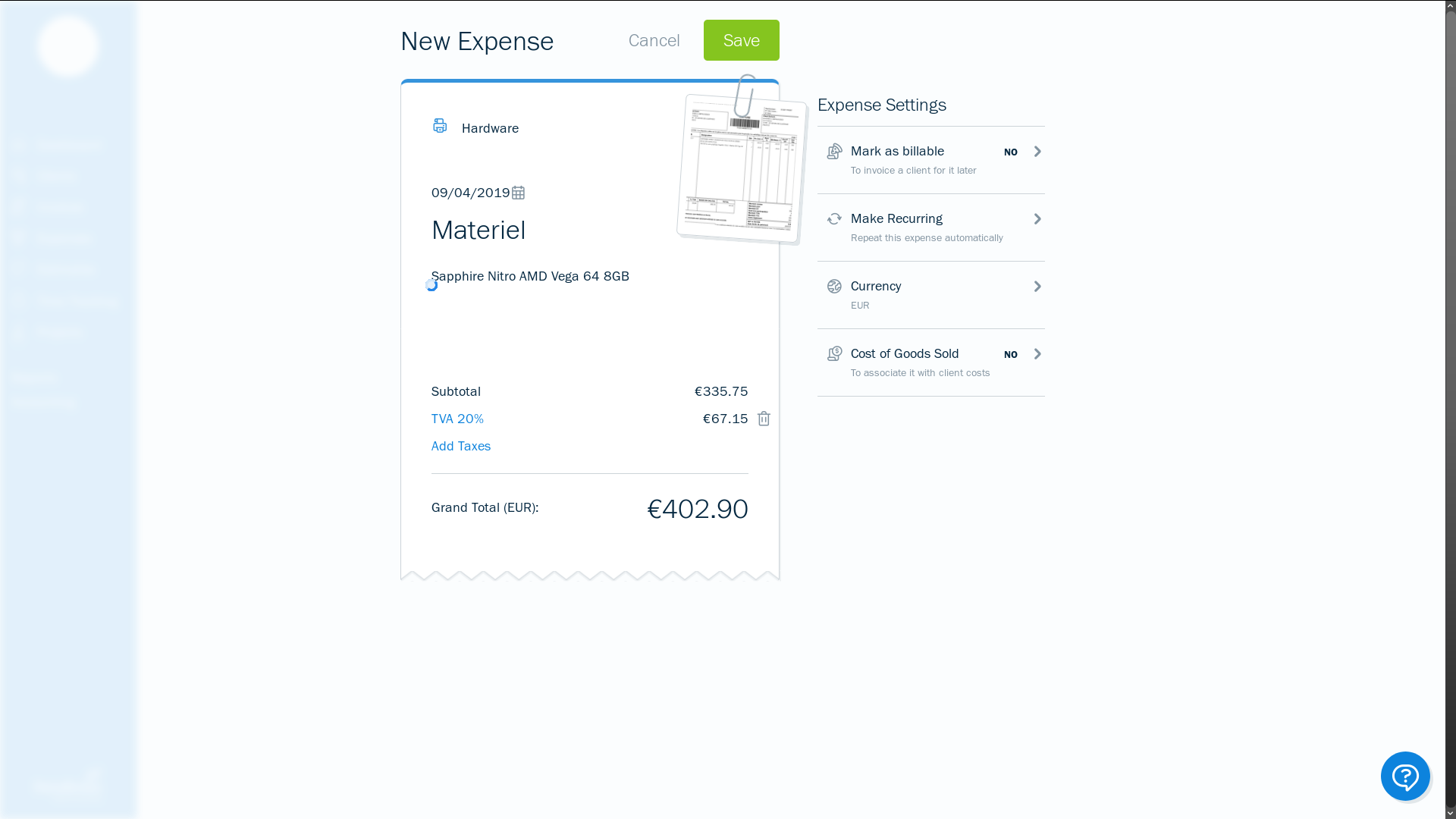

Expenses can be added one-by-one, or in bulk via a CSV template. You can add an image of a receipt to go with each expense entry, although we'd have liked PDF support here, as well. Once again, you can work in any currency you like and mark it expenses as recurring - helpful for subscriptions and instalment purchases.

You can also tag the expense as Cost of Goods Sold to for more accurate profit and loss tracking, or directly assign it to a client - with or without a markup - if it's something you've purchased to sell directly or include in the costs of a larger project.

FreshBooks review: Banking and accounting

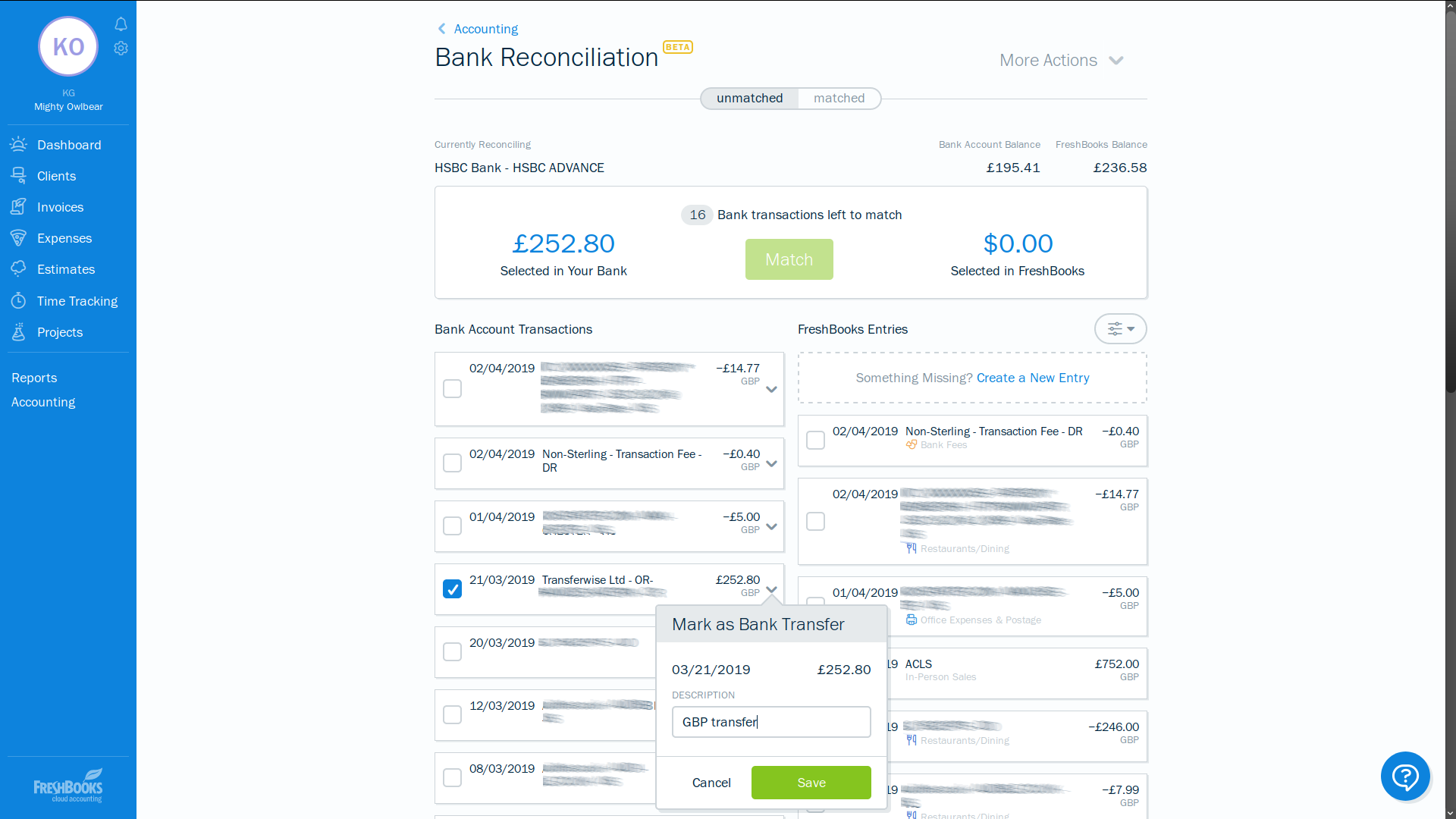

Expenses can also be added from imported bank statements and linked bank accounts. Direct bank account linking is a relatively new feature for FreshBooks, as is bank account reconciliation in general.

To access the bank connection beta, go to the Accounting pane and click the Connect My Bank button. All the major UK high street banks are supported, alongside many foreign banks and some digital-only services, such as Revolut, although as with most accounting software, Starling, Monzo, TransferWise and Shine are all conspicuous by their absence.

Unfortunately, if your bank isn't supported, then there's no way to manually add it or upload statements. FreshBooks plans to implement this in the future but doesn't currently have a concrete date for the feature's introduction.

The reconciliation tool - available to Plus and Premium customers - will attempt to automatically match bank activity to your invoices and expenses, and appropriately classify other transactions by category. There were a few misses when it came to automatic transaction identification, but it's easy to reclassify items and create new COA categories on the fly.

The Accounting section also gives you access to your Chart Of Accounts, balance sheet, profit and loss reports and other tools to help you ensure the accuracy of your accounts. The Reports tab provides further helpful summaries of invoices, expenses and more.

FreshBooks review: Projects, time and tax

Project management and time tracking tools are built into FreshBooks. When you create a project, you're prompted to select whether it's to be billed at a flat rate or by the hour.

You can categorise different tasks that will be involved in your projects, or create new ones when you enter work time. Time can be logged for either kind of project, allowing you to see how many working hours go into flat rate projects to help assess their efficiency and profitability. You can also generate invoices directly from the time tracking page for projects that are billed hourly.

FreshBooks is compliant with HMRC's Making Tax Digital scheme, via a bridging application created by 1 Click Accounts. Although the UK VAT return option is a little buried in the Reports section of the web interface, the bridging tool is neatly embedded into FreshBooks, with consistent branding and a clear guide to using it. As well as your FreshBooks and HMRC logins, you'll also need to create an account for the bridging tool. Once set up and linked, however, the process is a matter of just a few clicks.

FreshBooks has no payroll support, which in turn means no support for PAYE, pensions or other employee benefits. Gusto, the only payroll suite currently supported as a FreshBooks integration, is only available for US customers, while another supported external option, Payroll Evolution, is restricted to Canada. You can simply create appropriate COA classifications for staff wages and contributions, but you'll have to manage them using entirely separate software.

FreshBooks review: Mobile apps & integrations

A wide range of integrations are available, from e-commerce platforms such as Shopify to CRM including SalesForce and Capsule, integrations with G-Suite for contact syncing, and payment services like Stripe.

FreshBooks apps are available for Android and iOS, providing a streamlined mobile experience for invoicing, quote generation and expense tracking on the move. You can also get an overview of your account, track time and create full proposals using the app. A separate app is available for legacy FreshBooks Classic users.

FreshBooks review: Verdict

FreshBooks provides a genuinely easy-to-use accounting experience for small businesses, and is particularly well designed for businesses and individuals who provide services.

FreshBooks support HMRC's Making Tax Digital scheme, but UK businesses with employees will have to look elsewhere for payroll and PAYE, as payroll integrations are only available for the US and Canada. Additionally, if you use a bank that isn't supported by the service's linking tool, there's also no way of manually adding it or uploading statements.

If you have only a handful of clients, FreshBooks' Lite tier is competitively priced. However, it's ultimately less flexible and less suitable for freelancers and growing small businesses than key rival FreeAgent.

Verdict

FreshBooks packs in plenty of features, but although it supports Making Tax Digital, it lacks support for other UK tax filings and its cheapest tier places harsh restrictions on client numbers.

K.G. is a journalist, technical writer, developer and software preservationist. Alongside the accumulated experience of over 20 years spent working with Linux and other free/libre/open source software, their areas of special interest include IT security, anti-malware and antivirus, VPNs, identity and password management, SaaS infrastructure and its alternatives.

You can get in touch with K.G. via email at reviews@kgorphanides.com.

-

Snowflake and OpenAI are teaming up to help enterprises capitalize on their "most valuable asset"

Snowflake and OpenAI are teaming up to help enterprises capitalize on their "most valuable asset"News OpenAI models and tools will now be embedded within the Snowflake Intelligence and Cortex platforms

By Ross Kelly Published

-

What security teams need to know about the NSA's new zero trust guidelines

What security teams need to know about the NSA's new zero trust guidelinesNews The new guidelines aim to move an organization from discovery to target-level implementation of zero trust practices

By Emma Woollacott Published

-

Amazon’s rumored OpenAI investment points to a “lack of confidence” in Nova model range

Amazon’s rumored OpenAI investment points to a “lack of confidence” in Nova model rangeNews The hyperscaler is among a number of firms targeting investment in the company

By Ross Kelly Published