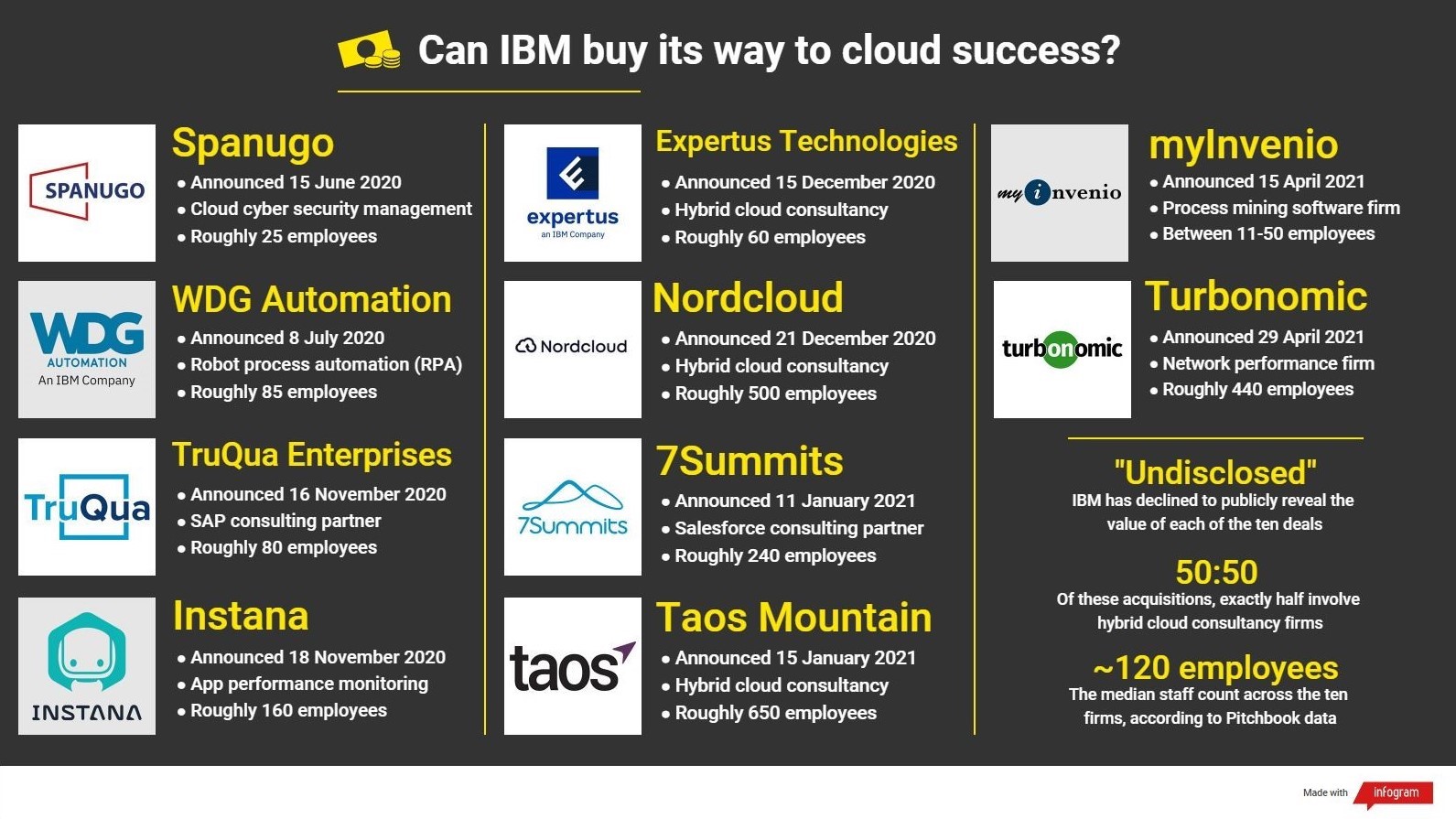

Can IBM buy its way to cloud success?

From spinning off its infrastructure business to making high-profile acquisitions, the industry giant is on a journey to reinvent itself

IBM has been a fixture of the computing industry almost since its inception, defining various eras with products such as the Model 5150 or Watson, the AI-powered suite of business services. One of the secrets to its longevity has been a powerful ability to reinvent itself when market shifts threaten the viability of its business model. As a result, the company is just as relevant today as it was when founded in 1911.

While we may not readily associate IBM with cloud computing, this is where the company sees its future, alongside the twin pillars of AI and quantum computing. As such, the firm has launched itself into a radical shift in pursuit of a revenue model reliant on expanding its hybrid cloud business. This is a strategy that’s seen IBM plot to cleave off its managed services business as well as make ten acquisitions within the space of a year, comprising one of the computing giant’s most comprehensive reinventions yet. It’s a process, however, that its executives feel is essential to IBM’s long-term survival.

The ‘$1 trillion hybrid cloud opportunity’

IBM’s leadership has often referenced the “$1 trillion hybrid cloud opportunity” as a key driver for the strategy, and for good reason. The market has shown a long-term move towards cloud services, Gartner VP analyst Craig Lowery tells IT Pro, with many businesses changing their strategies to help their clients achieve their cloud objectives. “Customers have been making their requirements known for many years,” Lowery says. IBM has, like many other companies, eventually had to respond to that, he adds, saying that its leadership “has taken the appropriate actions, as they see it, to align with customer needs”.

This explosive cloud growth coincides with the continued success of businesses such as AWS, Google Cloud and Alibaba, with a wave of digital transformation projects triggering an acceleration in cloud adoption. “Overall, these trends have maintained growth in cloud spending,” says Blake Murray, research analyst at Canalys. “However, increased spending is now happening across almost all industries, with the need for digitalisation, app modernisation, content streaming, collaboration software, online learning and gaming. This is likely to continue, as an increasingly digital world becomes a ‘new normal’.”

State of decline

Just as the fortunes of major cloud giants have surged, the financial power of IBM as a wider entity has dwindled over the previous decade.

Delving into specific business units, we can see that performance declined on all fronts between 2011 and 2016, but especially the Systems and Technology segment. Like for like comparisons beyond this point are difficult, as IBM underwent two internal restructures, once in 2015 then again in 2018, but these moves failed to stem the long-term trend, and revenues continued to decline. At the same time, IBM’s cloud operations – spread across all divisions – began to spark into life, mirroring wider industry trends.

Today, cloud computing is one of IBM’s most important revenue streams and will continue to grow in significance. The rising value of the firm’s cloud business is clear, and a key reason why its leadership sees cloud computing as a future moneymaker.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Sparking an internal revolution

In October, IBM announced it would carve away its managed services business into a separate entity by the end of 2021. This is a key part of the overall strategy, the company’s vice president for Hybrid Cloud EMEA, Agnieszka Bruyère, tells IT Pro, with its AI, quantum computing and cloud operations being recast as the three main pillars of IBM’s operations.

The origins of this strategy stretch back two or three years, she adds, when the company first pinpointed the key role cloud computing would play in its clients’ digital transformation journeys. At that stage, however, 80% of its customers’ workloads were still residing in the data centre. This is partially why IBM is pursuing hybrid cloud. The firm, Bruyère explains, doesn’t consider the public cloud alone to be a viable long-term solution for helping its customers modernise. “It cannot be only a purely public cloud transformation,” she says. “It does not meet the companies’ reality in terms of security, compliance, business model, whatever, and really the best way to respond to companies’ challenges is a hybrid cloud strategy.”

RELATED RESOURCE

The total economic impact of optimising and managing your hybrid multi-cloud

Cost savings and business benefits of accelerating the cloud journey

The foundational step on this path was IBM’s record $34 billion acquisition of Red Hat, with the open source giant brought in to bolster the company’s technology portfolio. Playing a key role in driving this deal forward was Arvind Krishna, who at the time was VP for hybrid cloud but was named CEO in April 2020. His promotion coincided with the recruitment of Bank of America veteran Howard Boville as his replacement. Since then, Bruyère tells IT Pro, IBM has adopted much-needed “clarity” on its hybrid cloud strategy, with the business taking more aggressive steps since.

The pair have played a key role in making a set of strategic acquisitions while paving the way for the divestiture of its entire managed services business. This follows a long history of divestments, Krishna recently commented, with IBM divesting networking in the 90s, PCs back in the 2000s and semiconductors about five years ago.

“We want to make sure we are focusing our investment in this space, and we really want to do it only in this space – hybrid cloud and AI,” Bruyère says. “Another new aspect is about the industrial offerings with the new management, and this is really important because it’s not only about building technical capabilities, but also bringing the regulation layer; the specifics for every industry.”

The key difference since the leadership reshuffle is a strategic focus on the logistics around hybrid cloud, rather than the technology. The company has made efforts to apply its technology to the needs and requirements of particular industries, taking into account unique security, data protection and regulatory requirements, among other considerations. This was signalled with the launch of IBM Cloud for Financial Services, with specific sector-based services set to follow.

IBM’s cloud computing ‘shopping spree’

The changed approach has also been expressed in the nature of IBM’s ten acquisitions since the Red Hat deal closed in 2019, one of the most recent being Taos Mountain, a cloud consultancy firm. IBM is hoping the services of each business, largely small enterprises, can give its wider cloud offering an added edge.

Reflecting Bruyère’s assessment of IBM’s new strategic direction, Lowery highlights the importance of professional services in making cloud adoption work as the reason the company has focused on acquiring consultancies. Of course, of the ten, five are involved in consultancy. “The expertise about how to build in the cloud, how to build across clouds, how to build from cloud to your on-premises data centre – which is hybrid – most of that requires skills and expertise that are not readily available for hire, except through a professional services company,” he says.

Red Hat, meanwhile, fits into the equation perfectly thanks to its technology for containers and container orchestration, as well as its OpenShift family of software products. “That technology is well-suited to building hybrid and multi-cloud solutions where you have one standard way for building applications,” Lowery adds. “It’s not the only way to solve hybrid and multi-cloud scenarios, but it is a valid way, and Red Hat brings IBM the technology to solve that particular set of problems in that way.”

The rocky road to cloud success

Although the opportunity for IBM is undeniable, so too is the need for urgency. While the size of the cloud market has certainly grown in recent years, the grip of the biggest cloud companies has also tightened; as time passes it becomes increasingly difficult for a challenger to make serious inroads.

Looking at how prospective customers plan to spend in the coming year, we can also see that IBM faces more of an uphill struggle for business than any other player in this space.

Turning the tide commercially will be IBM’s most pressing challenge, although we can start to see these efforts pay off with a turnaround in IBM’s financial results for the first quarter of 2021. As far as Murray is concerned, the company is certainly on the right track with the actions it’s taking, especially the decision to spin off its managed services business into an entity named Kyndryl.

“It allows IBM to become much more nimble and responsive,” he explains, “increasing its relevance in a multi-cloud, hybrid world, and reducing competition with the largest systems integrators that will be critical partners for its hybrid cloud and AI offerings. The most important move it has made recently is establishing a new, simplified global sales structure and go-to-market model, giving partners ownership of all but its largest enterprise customers and removing compensation for IBM sales selling into any other accounts.”

Success will very much depend on IBM’s commitment to its new ecosystem and channel model, with a need to reduce complexity and refresh its rules of engagement, he adds. “In the past, IBM has made similar promises but failed to follow through. It now has an opportunity to establish itself as a vendor of partner choice.”

For Gartner’s Craig Lowery, the first thing he’ll be looking for as signs of green shoots would be when his clients begin showing more interest.“We know when a company is making an impact,” he explains, “when Gartner clients start asking about them and are getting the message in the market that the company has made a significant change and that the change has some substance to it.”

Given the long-term nature of this transition, Lowery advises IBM’s executives to remain consistent in their approach, but also not to shy away from the need to make tweaks as and when required. The fact IBM is making these structural changes, he notes, shows its executives understand the shift that’s required to stay relevant in the future. “It’s clear to me that IBM knows these changes are necessary and that it is willing to do the hard work to make it happen.”

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

The modern workplace: Standardizing collaboration for the enterprise IT leader

The modern workplace: Standardizing collaboration for the enterprise IT leaderHow Barco ClickShare Hub is redefining the meeting room

-

Interim CISA chief uploaded sensitive documents to a public version of ChatGPT

Interim CISA chief uploaded sensitive documents to a public version of ChatGPTNews The incident at CISA raises yet more concerns about the rise of ‘shadow AI’ and data protection risks