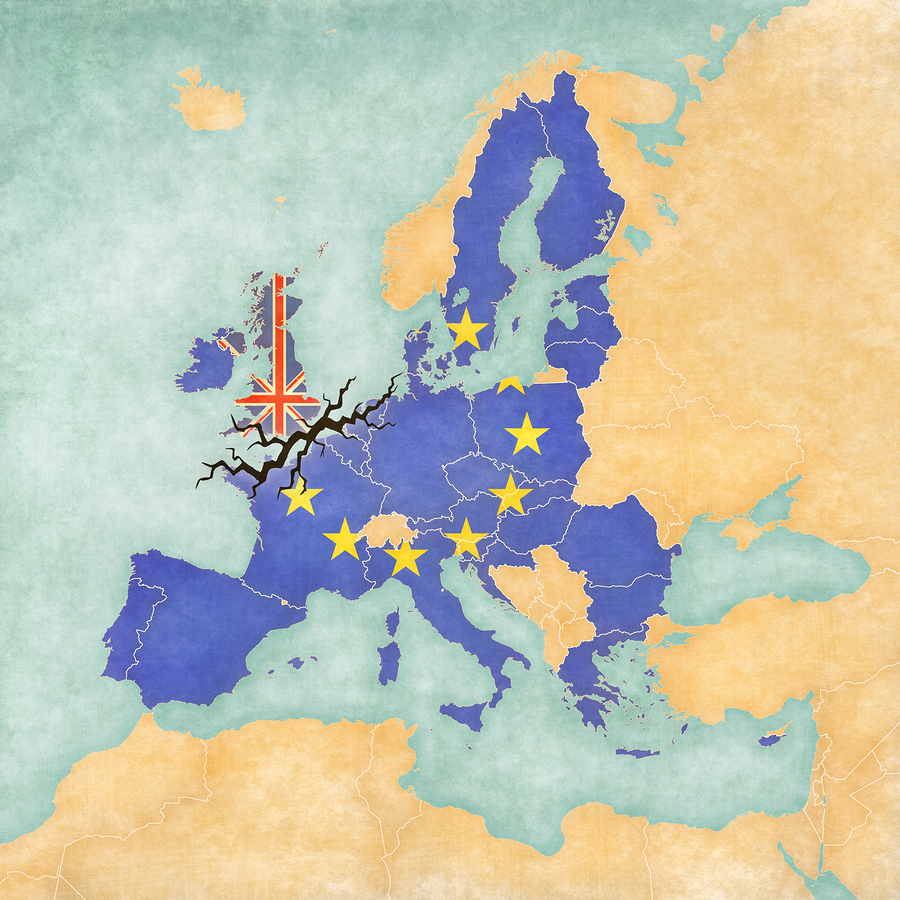

IT contractors earn more despite Brexit vote

Survey: More IT contractors are better off after the vote to leave the EU

IT contractors' daily rates are growing even as Britain heads towards a hard Brexit, according to new research.

One in five contractors' rates are increasing, according to accountancy firm Nixon Williams' survey of 600 contractors that compared the first half of 2016 to the second half, after 23 June's vote to leave the EU.

Nixon Williams found that more rates are increasing than decreasing, with 20.5% seeing their rates rise compared to 16.6% whose rates fell post-June.

The 20.5% whose rates increased after the Brexit vote beats the 19.4% whose rates grew before it. The percentage of respondents whose rates fell after Brexit - 16.6% - was lower than before the referendum too, when it stood at 18.6%.

Derek Kelly, CEO of Nixon Williams, said: "The fear was that the EU referendum result would send the jobs market into a tailspin, and that contractors would be first to feel the pain. Even though IT is often regarded as a discretionary spend, technology is key to increasing worker productivity. In that respect, IT contractors are likely to find that demand for their skills holds up well this year."

The survey also found that just 30% of IT contractors were downbeat about the UK's prospects outside of the EU, with the vast majority optimistic or neutral about it.

Contractors seem to be faring better than full-time staff, with the UK's average engineering salary falling from 55,709 to 45,964 last October, according to figures from Balderton Capital.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"Employers are likely to be reticent to commit to permanent hires, and any business transformation projects related to Brexit will be of limited duration and require highly specialised skills, making them ideal for contractors," said Kelly.

The figures also come as public sector bodies prepare to crack down on those who will be affected by the HMRC's IR35 legislation, which seeks to tax contractors as full-time staff.

Public bodies will be responsible for enforcing IR35 among their contractors from next month, and it will target contractors who pay themselves through dividends via their own companies, thereby avoiding National Insurance payments. IR35 will tax them as regular employees, meaning they could lose up to 25% of their earnings.

But those with in-demand skills, like cybersecurity, can charge more to make up for the shortfall in earnings. Kelly added: "Skills shortages in this key area are predicted to worsen this year, which means that cybersecurity professionals are likely to see more frequent multiple contract offers and bidding wars for their skills."

-

Hackers are using LLMs to generate malicious JavaScript in real time

Hackers are using LLMs to generate malicious JavaScript in real timeNews Defenders advised to use runtime behavioral analysis to detect and block malicious activity at the point of execution, directly within the browser

-

Developers in India are "catching up fast" on AI-generated coding

Developers in India are "catching up fast" on AI-generated codingNews Developers in the United States are leading the world in AI coding practices, at least for now

-

IT Pro Panel: Tackling technical recruitment

IT Pro Panel: Tackling technical recruitmentIT Pro Panel With the recruitment market shifting, how can businesses both retain their best staff and fill gaping talent shortages?

-

Podcast transcript: Why techies shouldn’t become managers

Podcast transcript: Why techies shouldn’t become managersIT Pro Podcast Read the full transcript for this episode of the IT Pro Podcast

-

The IT Pro Podcast: Why techies shouldn’t become managers

The IT Pro Podcast: Why techies shouldn’t become managersIT Pro Podcast Managing people is a completely different skillset to managing technology - so why do we keep pushing people from one to the other?

-

Podcast transcript: How umbrella companies exploit IT contractors

Podcast transcript: How umbrella companies exploit IT contractorsIT Pro Podcast Read the full transcript for this episode of the IT Pro Podcast

-

The IT Pro Podcast: How umbrella companies exploit IT contractors

The IT Pro Podcast: How umbrella companies exploit IT contractorsIT Pro Podcast Is tighter regulation needed to stop workers from being cheated out of earnings?

-

Federation of small businesses says tech vouchers needed to survive Brexit transition

Federation of small businesses says tech vouchers needed to survive Brexit transitionNews SMBs need financial support to help them with expertise, new technology, and training, group argues

-

The IT Pro Podcast: Cyber security post-Brexit

The IT Pro Podcast: Cyber security post-BrexitIT Pro Podcast Changes are on the way - but how will they affect IT security?

-

UK tech investment jumps 44%, despite Brexit uncertainty

UK tech investment jumps 44%, despite Brexit uncertaintyNews The country has sprouted eight unicorns in the past year – more than any other European nation