Double-digit decline for servers

The economy has hit server shipments around the world, sending them down 12 per cent and hitting revenue for the quarter, too.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Following a trend set in the PC and mobile markets, server makers are also being hit hard by the struggling global economy, according to statistics from Gartner.

A double-digit falloff in the fourth quarter hit shipments and revenue, with global shipments slipping 11.7 per cent and revenue diving 15.1 per cent in the fourth quarter. Strong results at the beginning of the year helped keep shipments for the year positive, at 2.6 per cent growth, but full-year revenue still fell 4.1 per cent.

The worst revenue decline was seen in Europe, the Middle East and Africa (EMEA), at 20.6 per cent, while North America marked falls of 14.6 per cent.

"The outlook for 2009 is a very challenging one, with the pattern of the fourth quarter more indicative for the level of demand in 2009 than that seen in 2008 as a whole," Kota said.

"The continued weak economic environment will cause users to be extremely cautious with levels of expenditure which will make for a particularly challenging environment for vendors," Kota added. "The server market already has high levels of vendor consolidation but the conditions expected during 2009 will increase the threat of further consolidation."

Despite the declines, blade servers saw revenue and shipment growth of 30 per cent, boosting the leaders in those systems, HP and IBM. "Blade servers were one of the few segments to achieve any growth at all in this challenging environment," said Kota. "Unix servers on the other hand fell for the fourth quarter at 10.5 per cent in shipments and 13.7 per cent in revenue for the year."

For the fourth quarter, despite diving 17.4 per cent, IBM held on to top place by revenue with 34.4 per cent of the market, followed by HP at 28.8 per cent and Dell at 10.2 per cent. By shipments, HP fell just 1.6 per cent to hold the market lead at 29 per cent, followed by Dell at 20.6 per cent and IBM with just 15.4 per cent, after its shipments fell 22.3 per.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

NEC, Lenovo and Dawning were the only top ten server makers which did not see any decline in shipments.

Freelance journalist Nicole Kobie first started writing for ITPro in 2007, with bylines in New Scientist, Wired, PC Pro and many more.

Nicole the author of a book about the history of technology, The Long History of the Future.

-

ITPro Best of Show NAB 2026 awards now open for entries

ITPro Best of Show NAB 2026 awards now open for entriesThe awards are a fantastic opportunity for companies to stand out at one of the industry's most attended shows

-

Mistral CEO Arthur Mensch thinks 50% of SaaS solutions could be supplanted by AI

Mistral CEO Arthur Mensch thinks 50% of SaaS solutions could be supplanted by AINews Mensch’s comments come amidst rising concerns about the impact of AI on traditional software

-

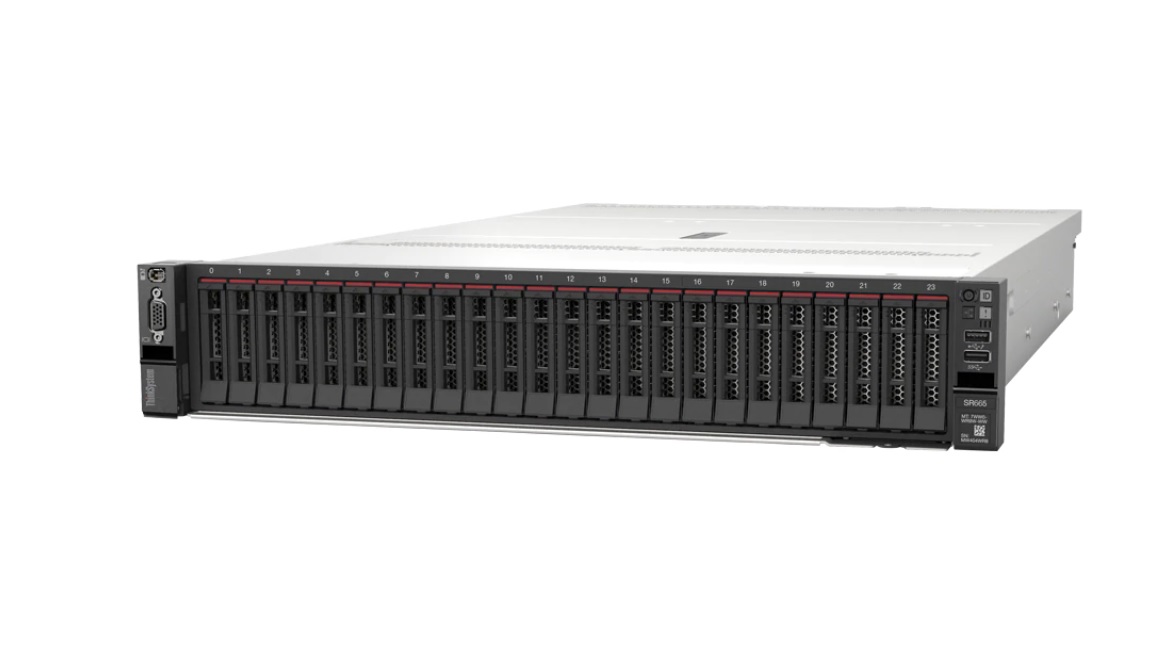

Lenovo introduces ThinkSystem SR645 and SR665 two-socket servers

Lenovo introduces ThinkSystem SR645 and SR665 two-socket serversNews Lenovo joins the dual-socket AMD EPYC game with two new servers

-

HP packs 64-bit ARM chips into Moonshot servers

HP packs 64-bit ARM chips into Moonshot serversNews ARM coming to a mainstream datacentre near you soon

-

Enterprise Blade Servers

Reviews Using blade servers can help you improve both data centre resource utilisation and effectiveness, and IT PRO has exclusively reviewed and tested four of the latest blade server products.

-

Fujitsu Primergy BX400 S1 review

Fujitsu Primergy BX400 S1 reviewReviews Fujitsu's new Primergy BX400 S1 blade server is a complete data centre on wheels for SMBs. However, HP sells a very similar system, the c3000 Shorty. Is the new Primergy a match for the Shorty? Dave Mitchell finds out in our exclusive review.

-

HP refreshes rack and blade server lines

HP refreshes rack and blade server linesNews At its Tech Forum event in Las Vegas, HP calls it latest server refresh the biggest in at least four years.

-

Fujitsu Primergy BX900S1 Dynamic Cube - blade server review

Fujitsu Primergy BX900S1 Dynamic Cube - blade server reviewReviews Fujitsu ups the ante in the blade server market with its new Dynamic Cube. Is resistance futile?

-

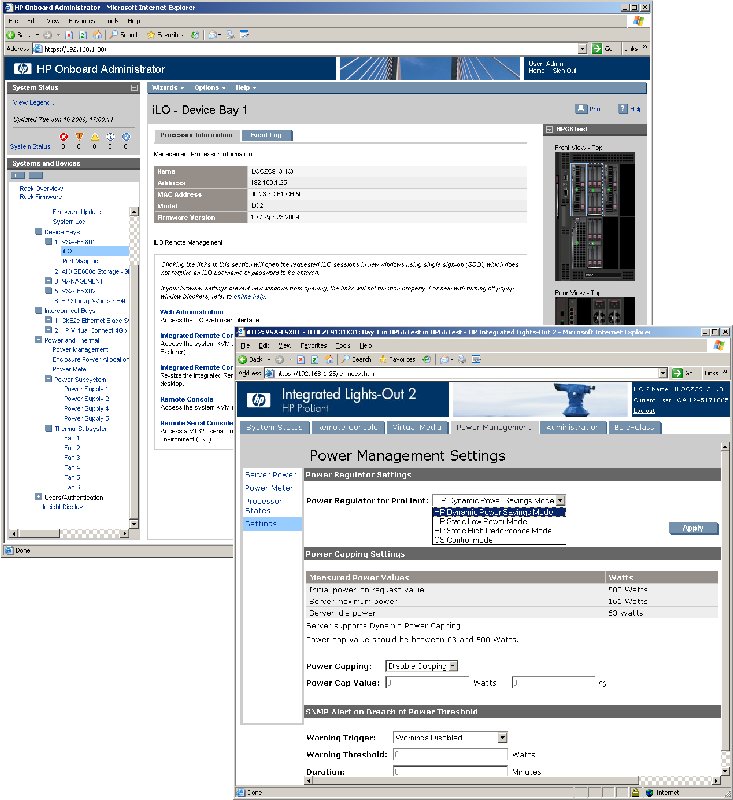

HP BladeSystem c3000 review: blade server

HP BladeSystem c3000 review: blade serverReviews Built like a tank and not weighing much less, this floor-standing ‘data-centre in a box’ from HP comes on wheels, much to Dave Mitchell's relief.

-

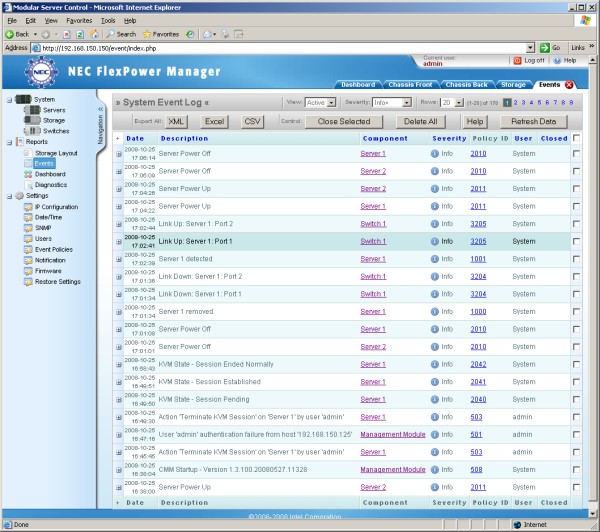

EXCLUSIVE - NEC FlexPower Server

EXCLUSIVE - NEC FlexPower ServerReviews NEC delivers a blade server solution to SMBs and shows that this technology doesn’t need an enterprise price tag.