How RBS initiated a virtual desktop revolution

RBS teamed up with Fujitsu to roll out thousands of virtual desktops and it's not even finished yet.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

The bank now runs much of the same hardware it was using three to four years ago. This doesn't just mean a lower cost, it meant RBS stopped using the classic desktop support model.

"What we've done is marginalise the desktop from being an intelligent device into being a kiosk, a dumb terminal," Diamond said.

"By making desktops thin we've effectively reduced support costs and at the same time introduced self-service for both migration and application provisioning."

There are always the luddites and the naysayers who say they don't want to change. They need to change to get the benefit back to the business.

When end users' hardware breaks, it can be simply replaced with a thin client device, meaning workers don't have to pester the IT department.

"What we're doing with that is driving the behavior of staff and changing the operating model for support. There's a huge benefit in that," Diamond said.

Changing the way the bank works

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

As for how RBS brought about the culture shift needed, the bank created a blue print for "Intelligent Working" to empower a new operating model and a new way of working.

"For too long the business had been given far too much power in decision making in technology and not fully embracing the fact they needed to adapt and change at the pace of technology," the IT head said.

"Our challenge was positioning this change so that the business leaders understood that if they got on board early, they would have financial benefits and they could leverage and improve staff engagement. The longer they delayed, the higher their costs would be, and more importantly they would risk getting left behind."

With the programme progressing well, senior executives within the business are now enthusiastically coming forward to adopt desktop virtualisation and acquire the tangible benefits early.

"There are always the luddites and the naysayers who say they don't want to change," he explained. "They need to change to get the benefit back to the business."

The state of play

RBS is still adding virtualised desktops, but there are areas it does not see Citrix virtualisation as appropriate yet. Whilst Deutsche Bank, Citrix Innovation Award winner at the vendor's Synergy 2011 event in Barcelona, decided to virtualise its trading floor, that's not something runner-up RBS is planning right now.

"We already have VDI type technology deployed in our trading room desktops, so expanding this programme to trading floors is not a priority today," Diamond said.

There aren't any plans to virtualise the remaining areas of the business either.

"There's approximately 20 per cent of the business where the cost of virtualising is high, and you just can't easily move users off a fat client," he added. "That's usually due to very bespoke legacy applications where the investment is too significant to move it into virtual. When we start to move away from some of those legacy applications when you move to automation with the evolution of new products then you can start to switch those off too."

In the UK, the bank will have 55,000 virtual desktops users up and running by the end of the first quarter next year. That is approximately half of the UK workforce. Virtualisaiton is effectively being used in every part of the business.

Looking forward, RBS won't have to spend 70 million again when it upgrades to Windows 8. It will be a much smaller figure, potentially less than 20 per cent of that, according to Diamond.

"It could be even cheaper," he added. "We'll be doing less than half a dozen core builds, with a simplified image deployment to our centralised VCS servers, instead of tens of thousands of desktops."

Tom Brewster is currently an associate editor at Forbes and an award-winning journalist who covers cyber security, surveillance, and privacy. Starting his career at ITPro as a staff writer and working up to a senior staff writer role, Tom has been covering the tech industry for more than ten years and is considered one of the leading journalists in his specialism.

He is a proud alum of the University of Sheffield where he secured an undergraduate degree in English Literature before undertaking a certification from General Assembly in web development.

-

Salesforce targets telco gains with new agentic AI tools

Salesforce targets telco gains with new agentic AI toolsNews Telecoms operators can draw on an array of pre-built agents to automate and streamline tasks

-

Four national compute resources launched for cutting-edge science and research

Four national compute resources launched for cutting-edge science and researchNews The new national compute centers will receive a total of £76 million in funding

-

Citrix warns products sold through legacy licensing setup face 'loss of functionality'

Citrix warns products sold through legacy licensing setup face 'loss of functionality'News With Citrix moving to a new cloud-based licensing scheme next year, the company has urged customers to make plans for the transition.

-

Citrix wants to help enterprises dodge pricey hardware costs

Citrix wants to help enterprises dodge pricey hardware costsNews Tariffs could push up hardware costs in the coming months - Citrix wants to ease the pressure

-

Citrix confirms two new NetScaler vulnerabilities as firms urged to patch immediately

Citrix confirms two new NetScaler vulnerabilities as firms urged to patch immediatelyNews Citrix has issued patches for two new vulnerabilities in its NetScaler ADC and Gateway appliances

-

Citrix mulling potential sale after tumultuous 2021

Citrix mulling potential sale after tumultuous 2021News Share prices have tumbled due to consecutive quarters of "mixed" financial results

-

Thales strikes key cloud partnership to support Fujitsu services

Thales strikes key cloud partnership to support Fujitsu servicesNews The security firm’s tech will help Fujitsu launch a new PKI management platform

-

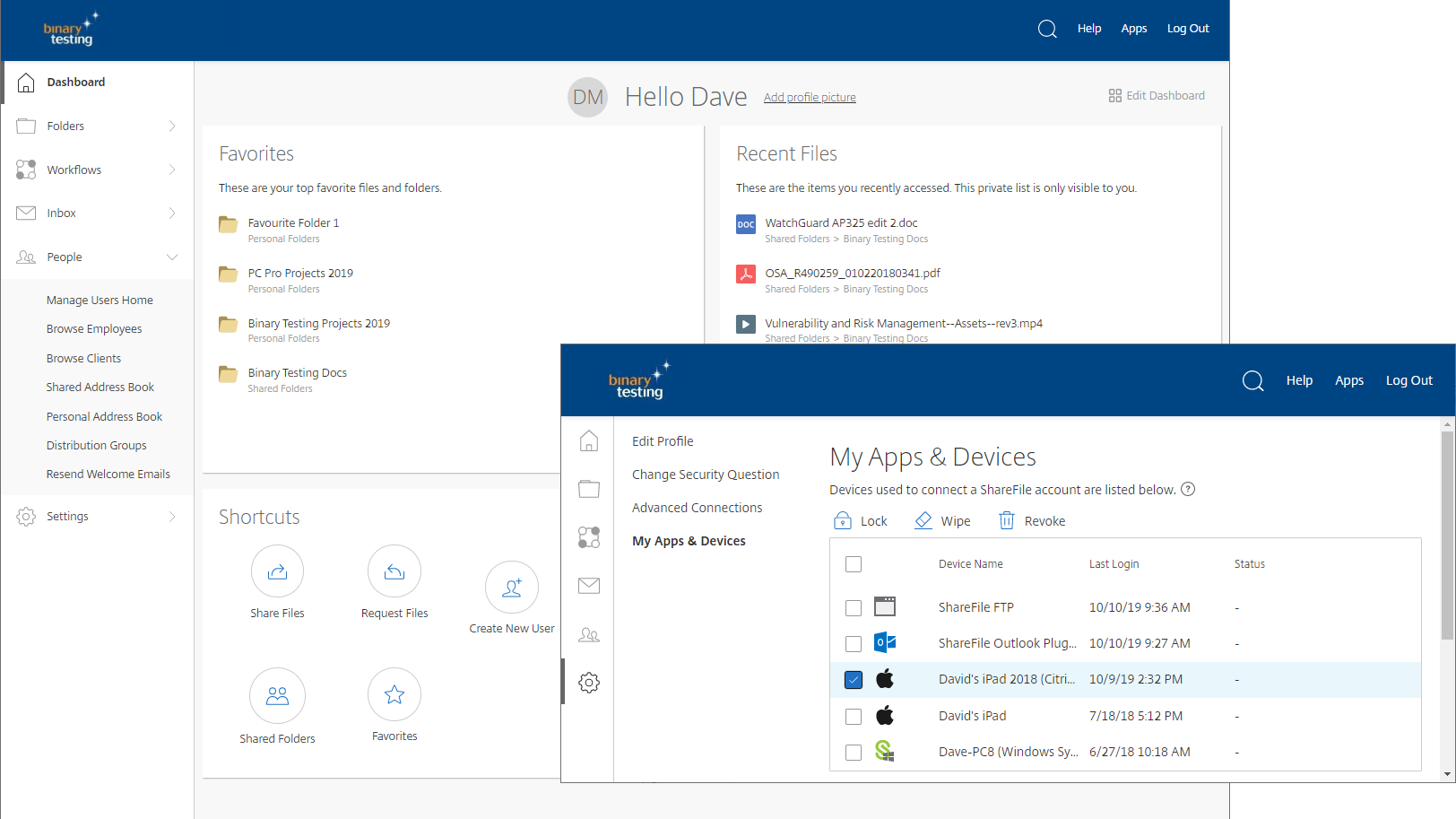

Citrix ShareFile review: Slick collaboration, stonking price

Citrix ShareFile review: Slick collaboration, stonking priceReviews An affordable cloud service that’s easy to manage and perfect for businesses that need to share huge files

-

Server virtualization: What is it and what are the benefits?

Server virtualization: What is it and what are the benefits?In-depth Server virtualization offers a quick and effective way of creating a more efficient IT infrastructure, but how does it work?

-

Everything you need to know about Citrix

Everything you need to know about CitrixIn-depth A comprehensive guide to Citrix, tracing its history from on-premises virtualization to cloud services, highlighting key acquisitions and business mission