Verizon buys Tracfone for over $6 billion

Tracfone’s free Lifeline service will continue offering free phones and service to select users

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Verizon has announced it’s purchased the largest reseller of wireless service in the US, Tracfone, for over $6 billion in cash, stock and future considerations.

The deal includes $3.125 billion in cash, $3.125 billion in Verizon common stock at closing. Additionally, Verizon will pay up to another $650 million in future considerations based on Tracfone’s performance and other commercial arrangements.

Tracfone has a massive network of 21 million subscribers, but it doesn’t have a cellular network of its own. Instead, it pays established cellular companies, including Verizon, to use their networks. It then resells access to these networks to retail customers through over 90,000 retail locations.

Tracfone is viewed as a budget cellular offering, catering to buyers on a limited income and who prefer to pay as they go rather than receiving a monthly bill. Also, with it being a prepaid cellular offering, there’s no credit check, making it even more attractive to budget-minded customers. The Tracfone purchase gives Verizon an immediate foothold in this important segment.

Tracfone customers will get access to Verizon’s 4G LTE and 5G networks. Verizon also plans to develop Tracfone’s distribution channels and expands its market opportunities to include residential broadband and international calling.

To help further support low-income users, Verizon plans to allow Tracfone to continue offering its Lifeline service. This service provides low-income families in select states free cellphones and free monthly minutes.

“This transaction is aligned with what we do best: providing reliable wireless service alongside a best-in-class customer experience,” said Hans Vestberg, chairman and CEO of Verizon.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“We are excited about the opportunity to bring Tracfone and its brands into the Verizon family where we can put the full support of Verizon behind this business and provide exciting and compelling products into this attractive segment of the market. We are pursuing this important strategic acquisition from a position of strength given our very strong and prudent financial profile.”

-

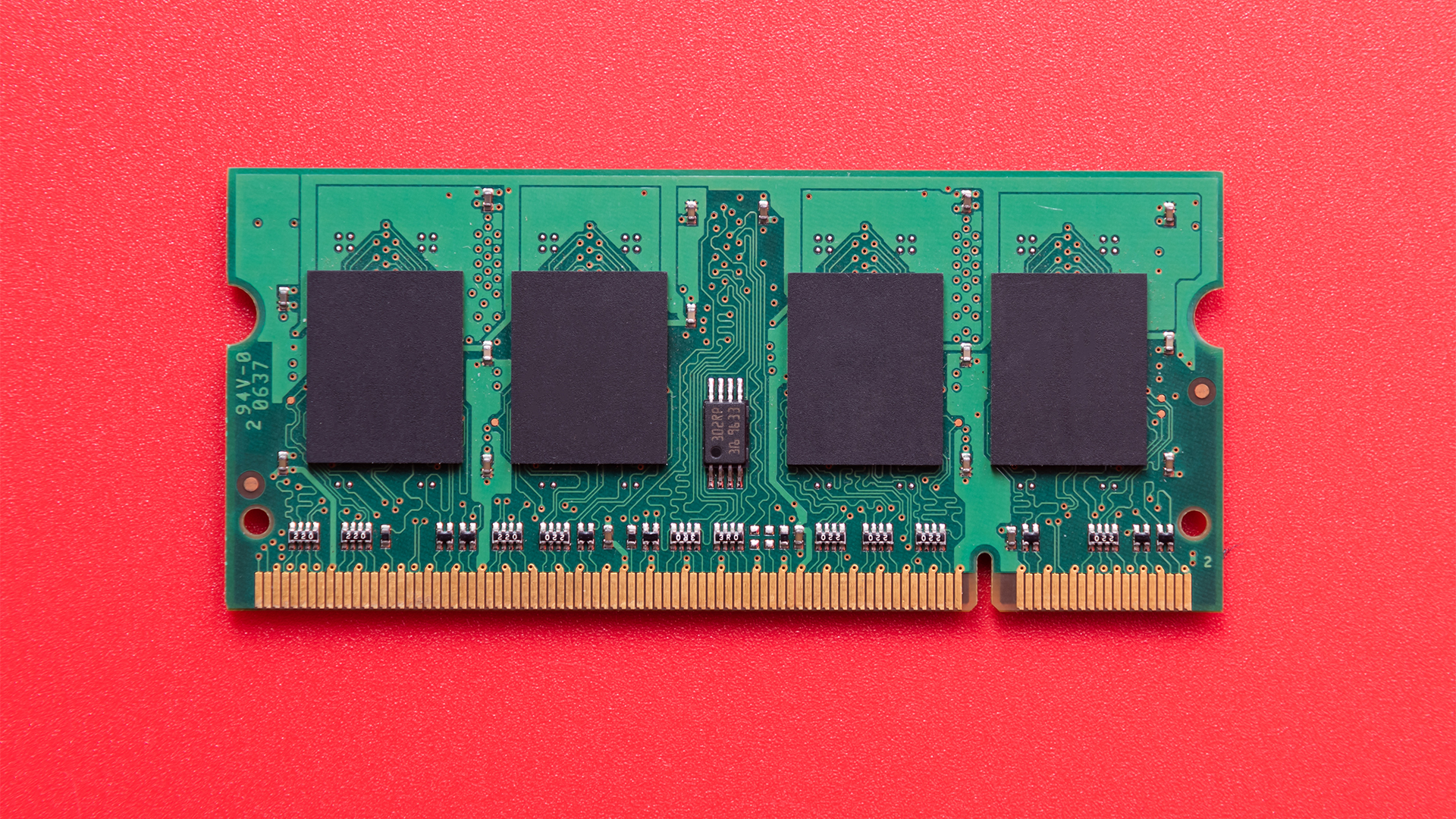

Scalper bots are running riot as memory shortages continue

Scalper bots are running riot as memory shortages continueNews DataDome says bots are driving up the price of DRAM even further thanks to AI demand

-

Xiaomi Pad 8 Pro review

Xiaomi Pad 8 Pro reviewReviews Xiaomi's newest entry offers strong performance, a vibrant 11-inch screen and a blockbuster battery life to maximize productivity