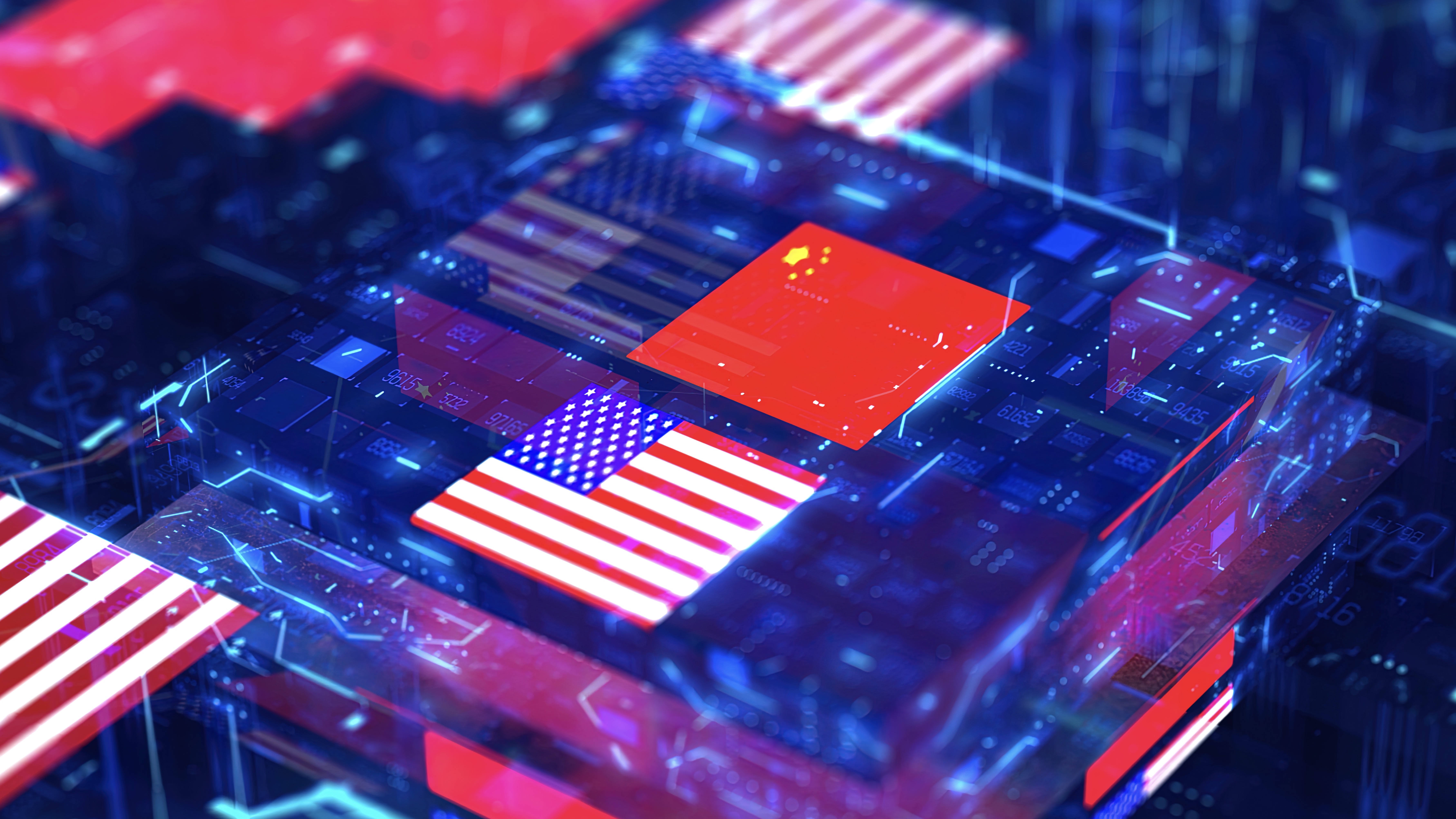

US carries out semiconductor review in light of security concerns

The US semiconductor review will examine the country's reliance on overseas exports and moves to support national production goals

The US is to carry out a review of the semiconductor supply chain amid fears about national security risks from China.

The aim is to survey the industry and identify how US companies are sourcing current-generation and mature-node semiconductors - legacy chips.

Learnings from the review will help bolster the semiconductor supply chain, promote a level playing field for legacy chip production, and make the US less dependent on chips manufactured in China.

"Government alone cannot create and sustain a robust supply chain – we need industry at the table," said secretary of commerce Gina Raimondo. "This survey will empower the department with the data we need to inform our next steps in building strong, diverse, and resilient semiconductor supply chains."

The survey follows the release of a Congressionally-mandated report from the Bureau of Industry and Security (BIS) this week, assessing the capabilities of the US microelectronics industrial base to support US national defense.

This report found that companies headquartered in the US account for around half of global semiconductor revenue, but face intense competition thanks to increasing subsidies from foreign governments. China, it said, has given its semiconductor industry an estimated $150 billion in subsidies in the last decade.

Meanwhile, the cost of manufacturing in the US is significantly higher than abroad, it points out, by as much as 35 to 40%.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The report recommends that the US give more support for domestic fabrication, assembly, test, and package capabilities, along with continued protection of US technology through export controls, and further assessment of the industry.

"Legacy chips are essential to supporting critical US industries, like telecommunications, automotive and the defense industrial base. Addressing non-market actions by foreign governments that threaten the US legacy chip supply chain is a matter of national security," Raimondo said.

"Over the last few years, we’ve seen potential signs of concerning practices from the PRC to expand their firms’ legacy chip production and make it harder for US companies to compete."

The survey will kick off in January, and will coincide with new grants and awards under the US CHIPs Act.

RELATED RESOURCE

This in-depth analysis shares insight into IoT malware trends

DOWNLOAD NOW

This act includes subsidies of $52.7 billion for domestic production and an investment tax credit for chip plants aimed at reducing US reliance on foreign semiconductor production. More than 200 companies have applied so far.

The EU is facing similar concerns over dependence on foreign chip suppliers, and, again, China in particular.

In September, the European Chips Act came into force, aimed at securing the semiconductor supply chain and strengthening manufacturing in the EU. The aim is to double the region's current global market share to 20% by 2030.

€3.3 billion of EU funds will be given to support advanced pilot production lines, develop a cloud-based design platform, and provide debt financing and equity.

In addition, a framework has been created to ensure security of supply by attracting investment and enhancing semiconductor production capacity.

Emma Woollacott is a freelance journalist writing for publications including the BBC, Private Eye, Forbes, Raconteur and specialist technology titles.