Report: UK’s SME tax-relief schemes exacerbating Golden Triangle growth disparity

A report from the UK Treasury has called for more targeted support for tech SMEs

UK tax relief schemes could require an overhaul to compensate for regional disparities in venture capital investment, according to a new report.

Research from the UK Treasury Select Committee into the state of venture capital investment found that funding is disproportionately concentrated in the country’s ‘Golden Triangle’ - London, Cambridge, and Oxford.

The study noted that London-based SMEs accounted for nearly half (47%) of investment deals in 2020, despite only making up 19% of the total number of SMEs across the country.

While regional disparities in venture capital have long been identified as a key hurdle for firms outside of London, the current tax relief framework could also be exacerbating the issue further, the report suggested.

At present, the UK runs three tax relief schemes aimed at businesses. These include the Enterprise Investment Scheme (EIS), the Seed Enterprise Investment Scheme (SEIS), and Venture Capital Trusts (VCTs).

Specific conditions of tax relief schemes, such as the requirement that companies be aged between seven to ten years, mean that firms outside of London could be placed at a disadvantage.

The report found that this was due to traditional growth challenges experienced by firms operating in other regions of the country.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

RELATED RESOURCE

The board's evolving perceptions of cyber risk

Read what leadership must do to work protected.

Because of this, it means that SMEs in other towns and cities could take so long to reach the same level of business maturity as Golden Triangle-based firms that they no longer fall within the company age limits to receive tax relief, further inhibiting potential growth.

“Given firms elsewhere in the UK can take longer to become established, the maximum company age limits of seven and ten years written into the tax reliefs currently hold back economic growth,” the committee said in a statement yesterday.

The report called for the extension of this age limit to support growth for regional SMEs which takes into account traditional growth-related challenges.

Tax relief evaluations underway

An evaluation of the tax relief schemes by HMRC is currently underway, the report noted.

HMRC told the Treasury that the results of its evaluation of EIS and VCTs will be “published in late summer or early autumn of 2023” and will provide clarity on any future changes.

Will Fraser-Allan, chair of the Venture Capital Trust Association, welcomed the calls for an extension to tax relief age restrictions, adding that the report sheds light on the lingering concerns aired by businesses in recent months.

“We welcome the Treasury Committee’s Report and their recommendations; these very clearly demonstrate the concerns of the VCT community and represent a very positive future vision for continuing growth in the sector, to ensure continued investment in small businesses across the UK.”

“We hope that the Treasury will take on board the recommendations, as the report notes, because as the April 2025 deadline draws closer, the absence of a clear plan from the Treasury could seriously harm investment, which relies on certainty,” he added.

SMEs not sold on tax relief packages

Tax relief support for UK tech firms has been a contentious topic in recent months in the wake of the Spring Statement.

In April, Chancellor Jeremy Hunt’s changes to R&D tax relief credits were met with a mixed reception. The government’s ‘enhanced’ tax relief package for SMEs would enable firms that currently spend 40% or more of their total expenditure on R&D to be able to claim a credit worth £27 on every £100 spent.

Hunt said at the time that the package amounted to more than £1.8 billion in support for SMEs across the UK and would help some 20,000 firms access vital support.

Critics described the move as a “partial climbdown” on previous commitments, with others noting that the package would still leave many SMEs left with a financial shortfall amid challenging economic conditions.

Ross Kelly is ITPro's News & Analysis Editor, responsible for leading the brand's news output and in-depth reporting on the latest stories from across the business technology landscape. Ross was previously a Staff Writer, during which time he developed a keen interest in cyber security, business leadership, and emerging technologies.

He graduated from Edinburgh Napier University in 2016 with a BA (Hons) in Journalism, and joined ITPro in 2022 after four years working in technology conference research.

For news pitches, you can contact Ross at ross.kelly@futurenet.com, or on Twitter and LinkedIn.

-

Implementation and atychiphobia: helping SMEs overcome fear

Implementation and atychiphobia: helping SMEs overcome fearIndustry Insights Fear of failure stalls SME system upgrades, but resellers can calm concerns and build confidence

-

An end-to-end roadmap for SMB cloud migration

An end-to-end roadmap for SMB cloud migrationWhitepaper Future-proofing transformation

-

The total economic impact™ of Datto

The total economic impact™ of DattoWhitepaper Cost savings and business benefits of using Datto Integrated Solutions

-

The most significant challenges facing SMBs post-pandemic

The most significant challenges facing SMBs post-pandemicIn-depth We examine the obstacles small and medium businesses face in a post-pandemic world

-

Help to Grow: Government responds to SMB SOS

Help to Grow: Government responds to SMB SOSWhitepapers Sample our exclusive Business Briefing content

-

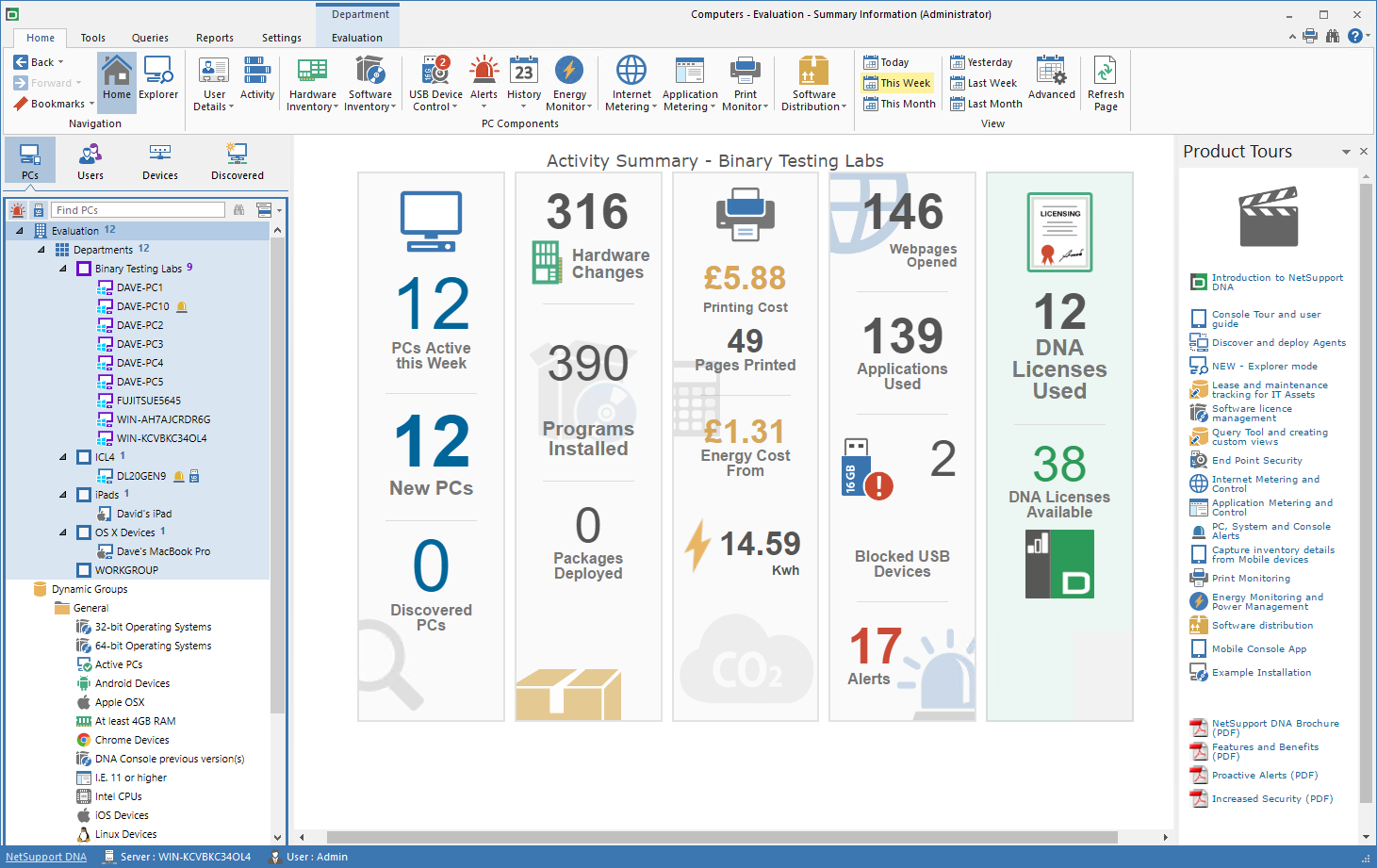

NetSupport DNA 4.5 review

NetSupport DNA 4.5 reviewReviews A prize asset management solution packed with valuable features and priced right for SMBs

-

SMEs to increase digital spending in next six months

SMEs to increase digital spending in next six monthsNews A study has revealed 69 per cent of SMEs want to buy new tech and premises to boost productivity

-

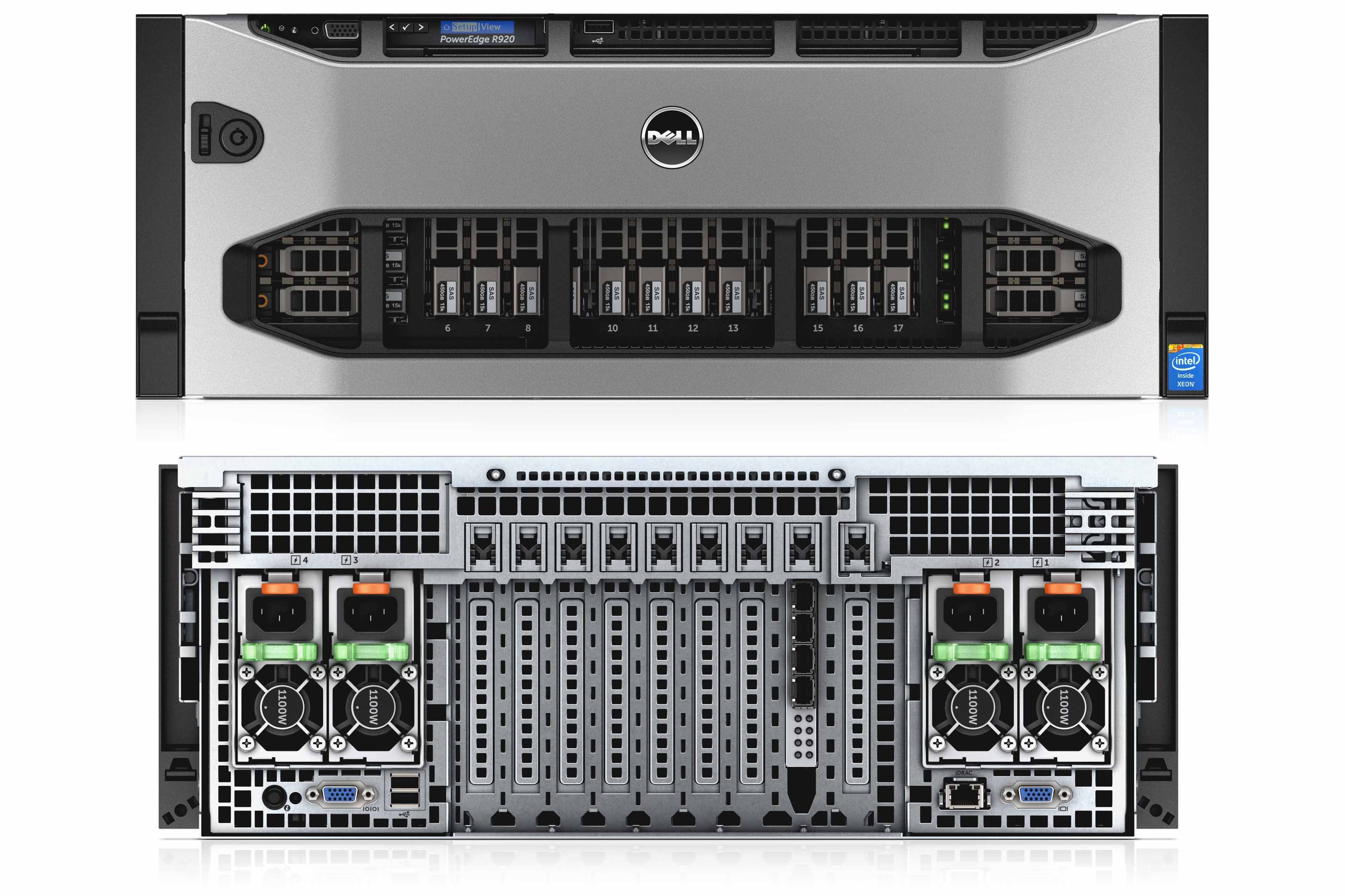

Dell PowerEdge R920 review

Dell PowerEdge R920 reviewReviews Powered by Intel’s latest E7 v2 Xeon processors, the PowerEdge R920 also beats HP alternatives when it comes to storage features