Why the Raspberry Pi IPO is a major seal of approval for the British tech scene

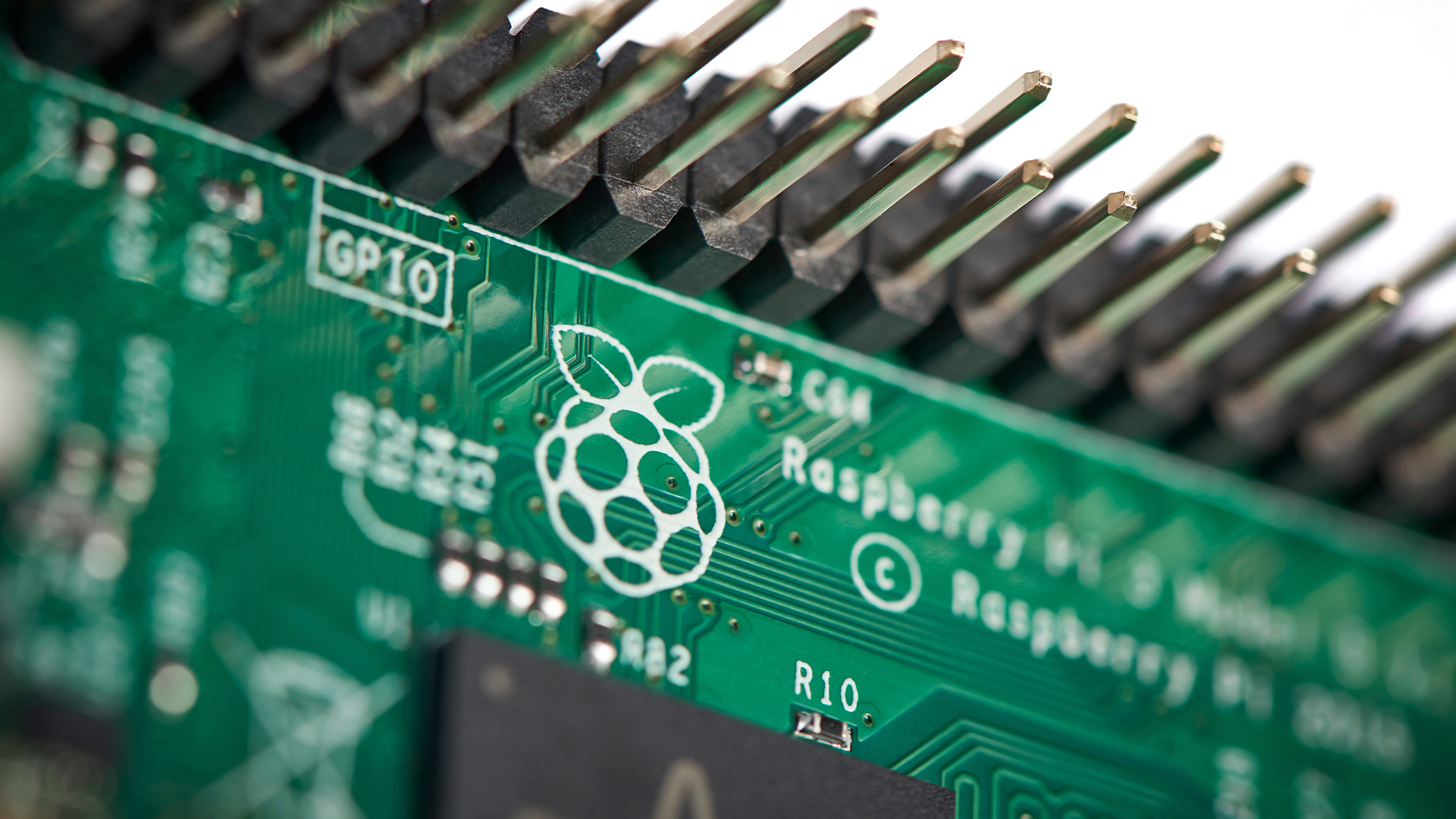

Raspberry Pi has surged in popularity since first launching in 2012, and has plans to further boost its appeal globally

Raspberry Pi’s decision to list on the London Stock Exchange (LSE) has been hailed as a major seal of approval for both the UK’s tech sector.

Russ Shaw CBE, founder of Tech London Advocates & Global Tech Advocates, believes the move is a prime example of “homegrown tech success” and will continue to position the country as a leading tech economy.

“Raspberry Pi choosing London as its listing destination is a major vote of confidence in the LSE,” Shaw said.

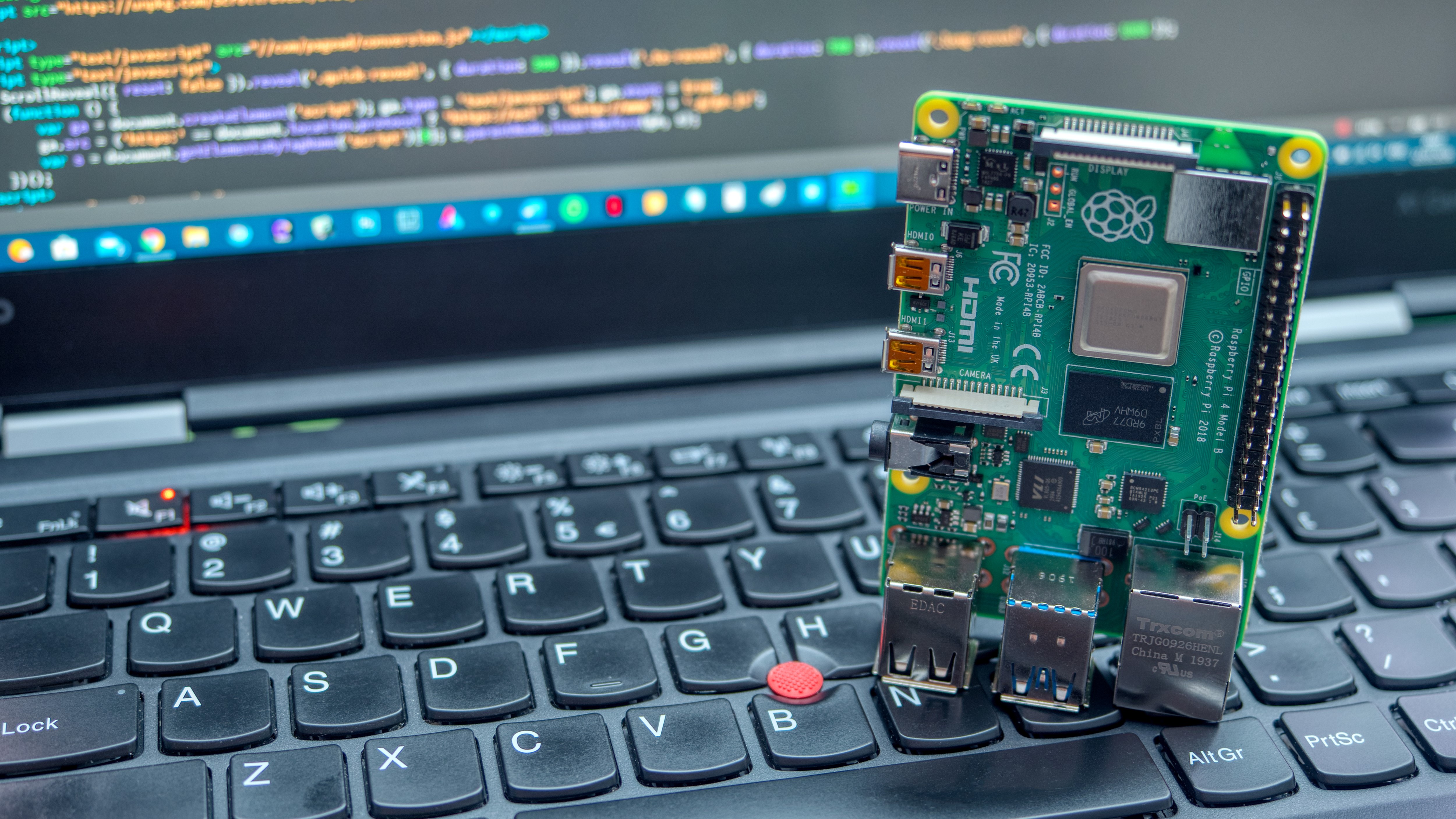

Raspberry Pi confirmed the move on 15 May, and estimates its total addressable market is around £17 billion (around $21.2 billion), representing a “substantial opportunity” to capitalize on and sustain its “strong growth trajectory”.

The firm cited its strong track record of revenue growth and profitability, with the CEO of Raspberry Pi Eben Upton drawing attention to the potential this IPO creates in generating further innovation.

“This IPO brings the opportunity to double down on their outstanding work to enable young people to realize their potential through the power of computing,” Upton said.

“In an ever more connected world, the market for Raspberry Pi's high-performance, low-cost computing platforms continues to expand. We have the technology roadmap to play an increasingly significant role, and we are excited to embark on the next stage of our growth," he added.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Raspberry Pi is looking for a valuation of £500 million according to reports, which will form the basis of a range of investments and forward-looking growth plans in the business.

It plans to grow unit profit by introducing more product variants designed to “better serve” the needs of its customers, as well as focus on in-house semiconductor design.

Raspberry Pi has also set its sights set on bringing products into a wider range of education settings, “further penetrating” the design consultancy sector while building out its original equipment manufacturer (OEM) credentials.

As Shaw mentioned, Raspberry Pi’s IPO could play a critical role in keeping the UK’s tech industry relevant.

RELATED WHITEPAPER

“To retain the capital’s crown as one of the world’s leading tech ecosystems, it is vital that our home-grown tech success stories choose to scale and grow here too,” Shaw said.

“Raspberry Pi has rightly been a mainstay on the British tech scene for many years, encouraging children and young people to engage with the boundless potential of programming from the comfort of their own homes,” he added.

Raspberry Pi is a hallmark of British tech

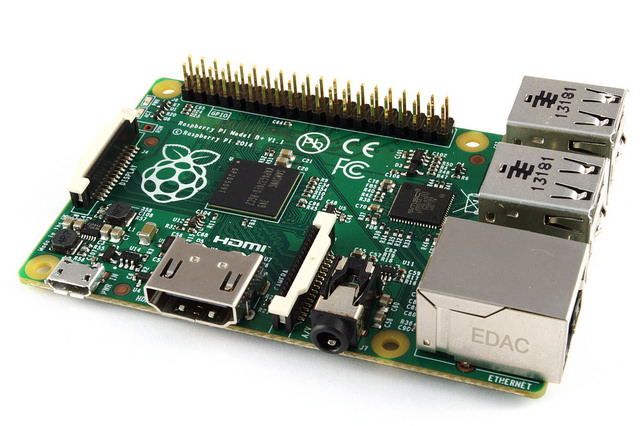

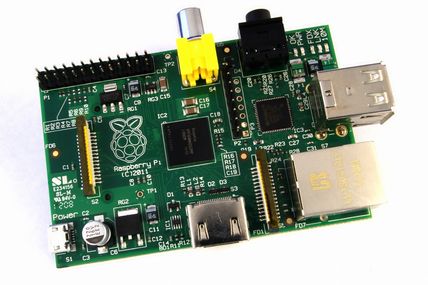

After first hitting the market in 2012, Raspberry Pi has maintained its position in the tech landscape primarily as an educational tool designed with the intention of helping young people learn to code.

Raspberry Pi has gained a lot of popularity in emulation by allowing users to replicate older computers and machines, and its popularity has only grown - since it began trading, it has sold over 60 million products, with 7.4 million sold in 2023 according to the firms ‘Intention to Float’ document.

The firm released its most recent iteration of the product last year, Raspberry Pi 5, which is between two and three-times more powerful than previous versions.

Prior to this recent decision to go public, Raspberry Pi had a minority stake acquired by Arm in a move aimed at garnering the firm a better position in the Internet of Things (IoT) market.

George Fitzmaurice is a former Staff Writer at ITPro and ChannelPro, with a particular interest in AI regulation, data legislation, and market development. After graduating from the University of Oxford with a degree in English Language and Literature, he undertook an internship at the New Statesman before starting at ITPro. Outside of the office, George is both an aspiring musician and an avid reader.

-

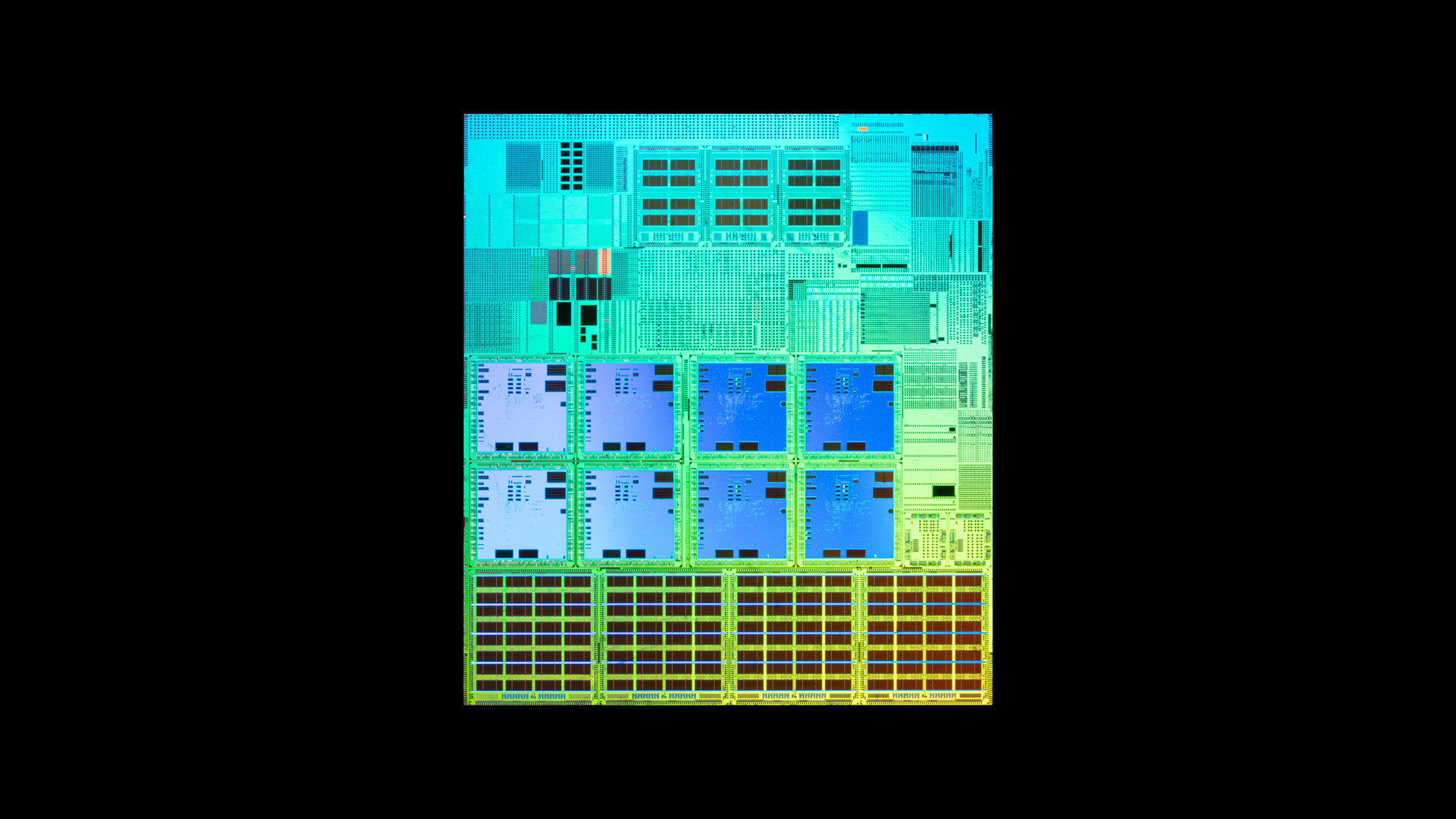

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Raspberry Pi expands support for industrial customers

Raspberry Pi expands support for industrial customersNews Businesses will now be matched with design partners to help with industrial deployments

-

Upton Funk: what’s next for the man behind the Pi?

Upton Funk: what’s next for the man behind the Pi?In-depth Raspberry Pi founder Eben Upton on charity, chips, and the changing face of tech

-

Oracle and Raspberry Pi Foundation launch kids learning project

Oracle and Raspberry Pi Foundation launch kids learning projectNews The two companies are inviting children to build their own weatherstation to gain programming skills

-

University of Cambridge offers free Raspberry Pi course

University of Cambridge offers free Raspberry Pi courseNews Twelve step course will teach students how to build an operating system for £29 computer.

-

Firms demanding more from next-gen workers

Firms demanding more from next-gen workersNews The skills you need to be attractive to modern day employers have drastically changed - and the pressure is on the education sector to help equip students for the workplace.