How to pick the best cloud accounting software

There are myriad cloud accounting software products on the market, but which one is best for you?

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Regular readers will understand the power of the cloud to streamline and simplify their business processes, and accounting department work is one of the many areas that stand to benefit from the technology. Businesses both big and small can benefit from the various cloud accounting software solutions available, which allow accounts to be processed without the need to repeatedly buy expensive licenses for on-premises packages that require frequent patching and updating.

RELATED RESOURCE

And it almost goes without saying at this point that cloud-based software that can be used and maintained remotely and on a variety of devices will help your accounting department to better work and collaborate with the minimum of disruption during this time when most of us are working remotely and on-prem solutions are becoming increasingly difficult for dispersed workforces to manage.

There are many different services to choose from, and it can be challenging to identify which cloud accounting software will be the best for your business. To help you make the right choice, we have broken down some of the key things to consider – including how cloud software can assist with the Making Tax Digital initiative – and some of the best options that are available.

How much does cloud accounting software cost?

For microbusinesses and SMBs, cloud accounting software is a blessing. Most providers have tiered offerings with prices based on criteria such as the number of users or the amount of data you process.

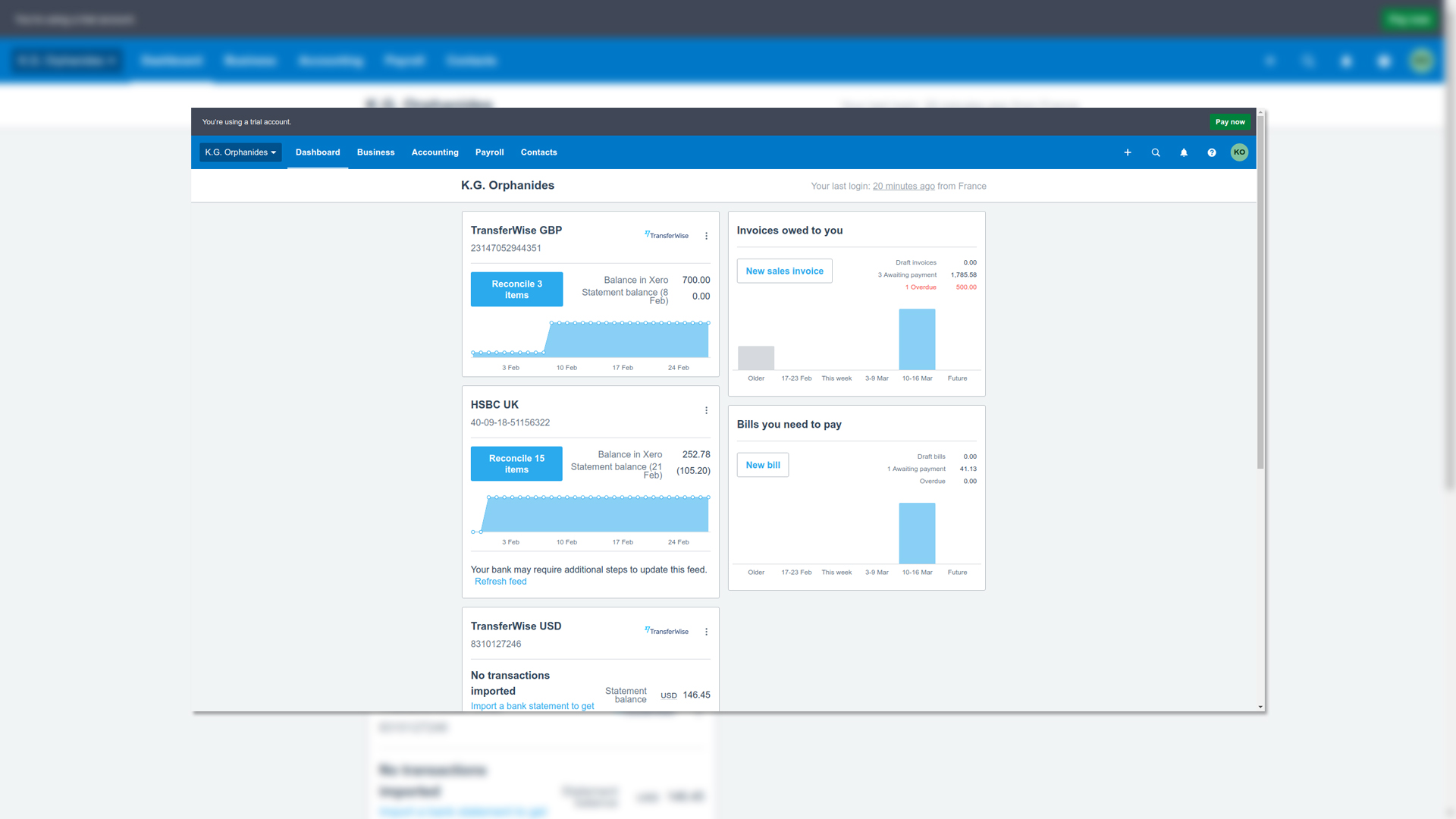

For example, Xero's base level plan is 10 per month, allowing you to send five invoices and quotes, enter five bills and reconcile 20 bank transactions each month.

Zoho Books, meanwhile, has an entry-level tier that costs 6 per month, allows two users, five automated workflows and 50 contacts, as well as Bank reconciliation, custom invoices, expense tracking, projects and timesheets, recurring transactions and sales approval.

Most providers also offer a free trial period, which may help you make up your mind as to which service to choose - just don't forget to cancel before the time's up if you decide it's not for you!

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Does cloud accounting software replace normal accounting software?

Yes. Cloud accounting software is a standalone product and doesn't require you to keep any software you have already.

There are several advantages to this type of software versus normal buy-once products too. First, you can scale up or down to fit the needs of your business - as you grow, you can move up tiers depending on your needs. Or, should you need to scale back, you can move back down tiers too.

Second, you don't need to create independent backups of your data. The beauty of the cloud is that everything is stored off site with redundancy built-in. So if all your computers suffer from a ransomware infection, for example, or the building you work from floods and your IT hardware is destroyed, at least your accounts will be safely held off-site.

Third, if you decide the service you've chosen isn't right for you then you can move over to a different one without the burden of knowing you've sunk a lot of money into your initial purchase and will have to do so again, as is the case with traditional software.

Does cloud accounting software replace my accountant?

No. Cloud accounting software helps you manage your accounting workflow and keep track of transactions. A professional accountant helps you make sense of all this information and make sure it's all in order before you submit it to the tax authorities or take it to your bank if you're seeking a business loan, for example. So it's best for you to retain the services of the person who deals with your accounts now, as you would with any other accounting software.

Is cloud accounting software good for larger businesses?

That largely depends on how large your business is and how many users you would like to add. Some offerings cap out at around a dozen users even on the most expensive plan, which might not be enough for a large business, or even organisations sitting at the top end of medium-sized.

Other products, however, offer unlimited users, although they may have other limitations that make them unsuitable for your needs. Whatever size business you are, it pays to shop around, but this is especially the case for bigger organisations.

Will cloud accounting software help with Making Tax Digital?

It can do. Making Tax Digital (MTD) is the government's initiative to modernise the way businesses submit their tax records. It wants to move all tax filing - including VAT, Corporation Tax and Self-Assessment - to electronic systems by early 2020. This means that whatever the size of your business, from micro through to enterprise, MTD is something you will need to get to grips with sooner rather than later.

Some services pitch themselves as being "MTD-ready", especially at the top tier, but it's worth familiarising yourself with the requirements of Making Tax Digital, if you aren't already. Take into account what each product offers, how comfortable you are with the needs of MTD and how helpful (or convenient) something that's MTD-ready will be for you.

More information on Making Tax Digital can be found in our guide to MTD preparation, but it's worth speaking to your accountant to work out what's best for your individual business needs.

Which is the best cloud accounting software for me?

As alluded to above, this will largely depend on your situation. Consider your needs - not only things like the number of users you have or the number of contacts you can add, but also what you can really afford. Remember, as your business grows you can always move up a tier to unlock those extra bells and whistles that were a nice-to-have but are now more necessary to your operations.

To help you make your decision, check out IT Pro's reviews of some of the major cloud accounting software offerings, including details on pricing, features and configuration.

Jane McCallion is Managing Editor of ITPro and ChannelPro, specializing in data centers, enterprise IT infrastructure, and cybersecurity. Before becoming Managing Editor, she held the role of Deputy Editor and, prior to that, Features Editor, managing a pool of freelance and internal writers, while continuing to specialize in enterprise IT infrastructure, and business strategy.

Prior to joining ITPro, Jane was a freelance business journalist writing as both Jane McCallion and Jane Bordenave for titles such as European CEO, World Finance, and Business Excellence Magazine.

-

AWS CEO Matt Garman isn’t convinced AI spells the end of the software industry

AWS CEO Matt Garman isn’t convinced AI spells the end of the software industryNews Software stocks have taken a beating in recent weeks, but AWS CEO Matt Garman has joined Nvidia's Jensen Huang and Databricks CEO Ali Ghodsi in pouring cold water on the AI-fueled hysteria.

-

Deepfake business risks are growing

Deepfake business risks are growingIn-depth As the risk of being targeted by deepfakes increases, what should businesses be looking out for?

-

Xero to acquire cloud invoicing specialist Waddle

Xero to acquire cloud invoicing specialist WaddleNews The deal will enable Xero to better assist small firms when it comes to accessing capital

-

Xero review: Xero to (almost) hero

Xero review: Xero to (almost) heroReviews Comprehensive cloud accounting that's particularly well suited to sales-based businesses

-

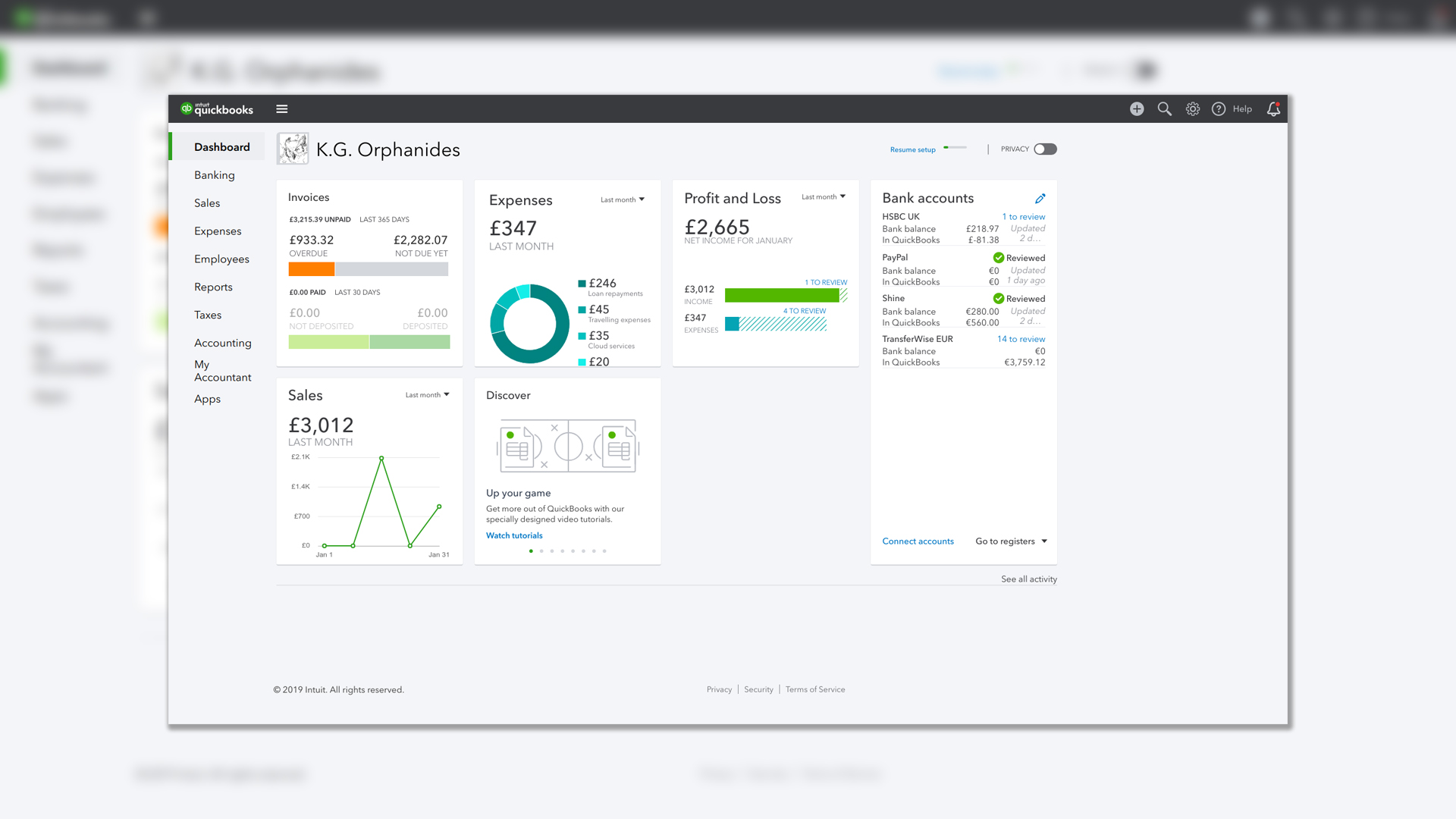

Intuit QuickBooks review: Quick to impress

Intuit QuickBooks review: Quick to impressReviews QuickBooks provides polished, well documented and very easy to use cloud-based business accounting suite