HPE to pay $1 billion for Nimble Storage to boost flash

Tech giant hopes to bolster hybrid IT position

Hewlett Packard Enterprise (HPE) has announced a definitive agreement to acquire flash storage specialist Nimble Storage for a whopping $1 billion.

The agreement comes a mere seven weeks after the company announced plans to buy hyperconverged infrastructure firm SimpliVity. Prior to that, it bought high-performance computing (HPC) firm SGI.

This is by far the biggest deal the firm has signed since it separated from its printer and laptop business (now called HP Inc) in 2015. While SimpliVity and SGI cost $650 million and $275 million cash respectively, Nimble will set HPE back $1 billion plus roughly $200 million to assume or pay out the storage company's unvested equity awards.

In a blog post, Antonio Neri, EVP and GM of HPE's enterprise group, said: "We believe that Nimble's entry to midrange predictive flash storage solutions, coupled with InfoSight, its leading predictive analytics technology, will strengthen HPE's flash storage portfolio by expanding market reach and enabling a transformed, analytics-based customer experience.

"Together, we'll be able to bring flash optimised data services, which provide the right balance of price, performance, and agility, to customers across SMB, Enterprise and Service Provider segments."

"Nimble Storage's portfolio complements and strengthens our current 3PAR products in the high-growth flash storage market and will help us deliver on our vision of making hybrid IT simple for our customers," added Meg Whitman, HPE's CEO, in a statement.

"This acquisition is exactly aligned with the strategy and capital allocation approach we've laid out. We remain focused on high-growth and higher-margin segments of the market," she said.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Industry reaction

Reaction to the news on social media has been largely one of surprise, with industry watchers across the globe saying it is an unexpected move on the part of HPE.

However, Bola Rotibi, research director of Creative Intellect Consulting told IT Pro it isn't that surprising if you consider HPE's overall strategy.

"Last year the company underwent what it rather euphemistically termed a split merge model which saw the company hive off both its software and enterprise services divisions to Micro focus and CSC respectively. What was left is a company that has once again might I add infrastructure at its core. Some might even go further and say was always thus and that software was the usurper that never sat right with the company.

"You don't have to look too hard to see the other recent acquisitions that the company has made and the big push and drive that it has with Synergy that infrastructure and delivering the best type of infrastructure that will enable, support and manage the hybrid estate for digital economy. Storage is a key component of that infrastructure story as is high performing compute. Therefore from this perspective the acquisition of Nimble makes sense."

Not everyone is sold on the matter, however and some on social media have expressed concern.

Speaking to IT Pro, Clive Longbottom, founder of analyst house Quocirca, said: "Just how many storage companies does HPE have to acquire before it believes in its own storage story? Paying over $1 billion for a company still making a loss with a revenue run rate of under $500m is ... paying over the odds."

"HPE now has to figure out rapidly what it has done - where does this fit with the old HP storage portfolio? How does it work with the Simplivity acquisition? And so on. I won't be holding my breath for an excellent outcome."

The deal is expected to close April 2017.

Jane McCallion is Managing Editor of ITPro and ChannelPro, specializing in data centers, enterprise IT infrastructure, and cybersecurity. Before becoming Managing Editor, she held the role of Deputy Editor and, prior to that, Features Editor, managing a pool of freelance and internal writers, while continuing to specialize in enterprise IT infrastructure, and business strategy.

Prior to joining ITPro, Jane was a freelance business journalist writing as both Jane McCallion and Jane Bordenave for titles such as European CEO, World Finance, and Business Excellence Magazine.

-

HPE says unified channel strategy won't force Juniper partners to generalize

HPE says unified channel strategy won't force Juniper partners to generalizeNews Does the company embrace specialists or want a full portfolio push? The answer, it seems, is both

-

Three things I expect to see at HPE Discover Barcelona 2025 (and two I don’t)

Three things I expect to see at HPE Discover Barcelona 2025 (and two I don’t)Analysis With the conference kicking off at the Fira Barcelona next week, here are some things to look forward to

-

HPE launches first phase of new-look Partner Ready Vantage program

HPE launches first phase of new-look Partner Ready Vantage programNews The IT giant’s freshly unified channel initiative combines its legacy programs into a single framework

-

HPE names Phil Mottram as new global sales chief

HPE names Phil Mottram as new global sales chiefNews Mottram succeeds HPE veteran Heiko Meyer who is retiring after 38 years with the tech giant

-

Who is Fidelma Russo?

Who is Fidelma Russo?Learn more about HPE's CTO and leader of GreenLake's success

-

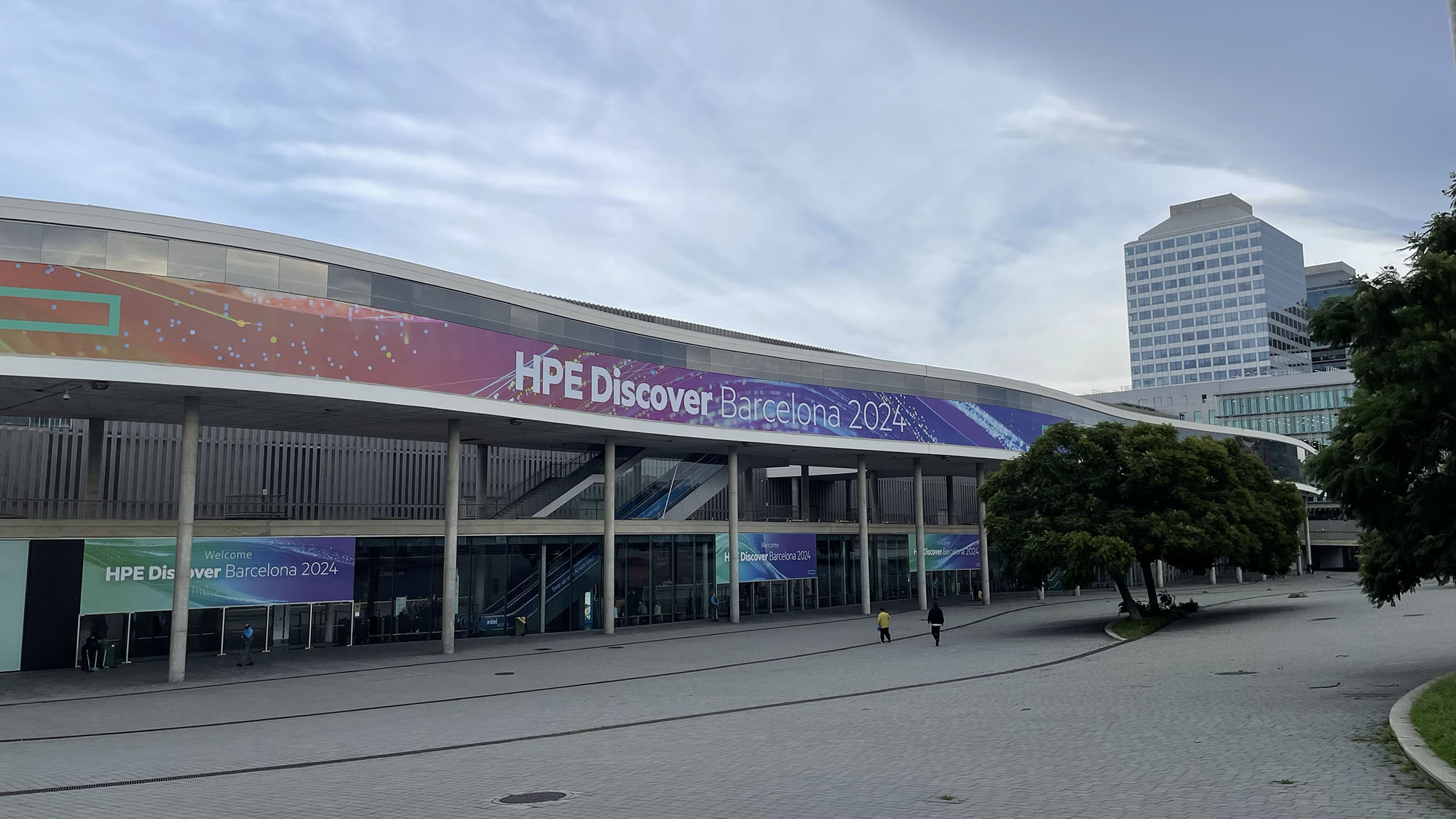

Steady progress and partner potential at HPE Discover Barcelona 2024

Steady progress and partner potential at HPE Discover Barcelona 2024Analysis With few product announcements, HPE's annual Europe event instead laid the groundwork for 2025

-

HPE launches exclusive sovereign cloud offering for the channel

HPE launches exclusive sovereign cloud offering for the channelPartners will need HPE Sovereignty competency before they can start selling

-

HPE Discover Barcelona 2024: All the news and updates live

HPE Discover Barcelona 2024: All the news and updates liveLive coverage of the keynote at HPE Discover Barcelona