Microsoft beats Q1 expectations as AI anticipation buoys Azure revenues

Increased AI spend could flatten the curve on Azure revenues for FY24, but the firm's success on customer investment is undeniable

Microsoft has announced better-than-expected results for Q1 2024, with revenue growth of 13% that it credited in large part to its extensive investments in AI and burgeoning generative AI product range.

READ MORE

The firm's overall revenue across the period was $56.5 billion (£46.61 billion), with revenue across Intelligent Cloud rising to $24.3 billion, as it rode into the year on a high note buoyed by customer and investor interest in its infrastructure and AI products.

Revenue for Azure and cloud services rose 29% year-on-year. The Azure cloud platform forms the basis for Microsoft's AI operations, with vast infrastructure and cloud services alongside the dedicated Azure AI portfolio including support for enterprise generative AI. Reuters reported that analysts had predicted a lower revenue of $54.52 billion across the quarter, per LSEG.

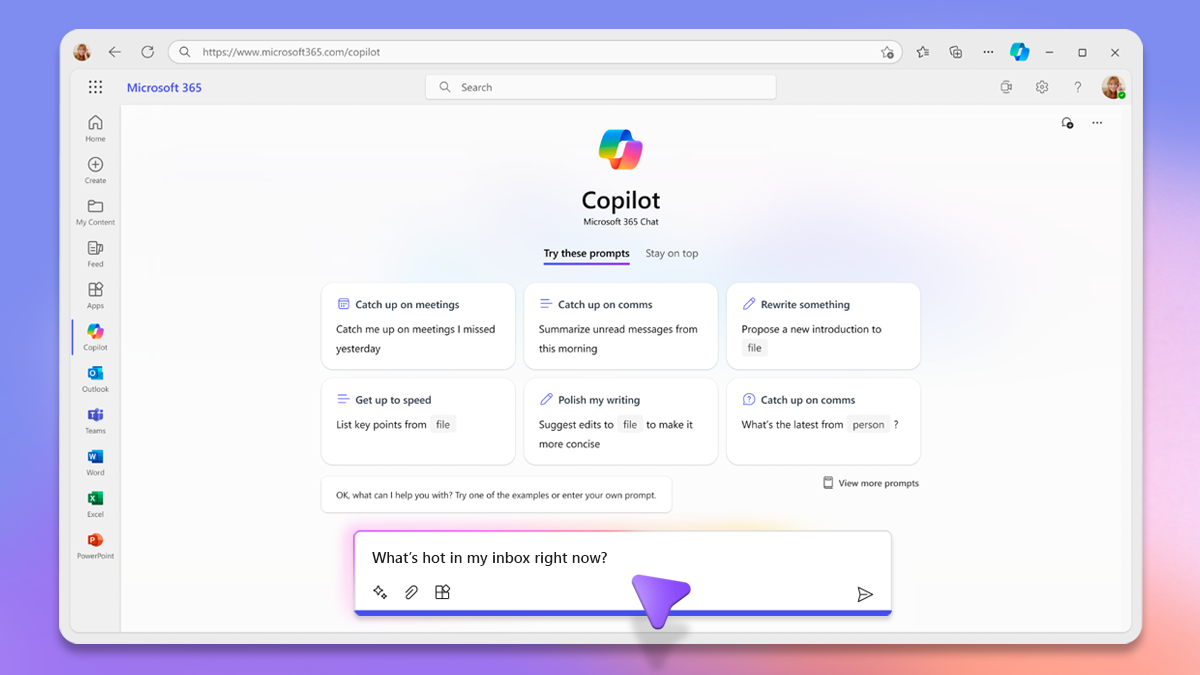

In 2023, Microsoft rapidly expanded its generative AI product offerings under the 'Copilot' banner to include the productivity assistant 365 Copilot, as well as Security Copilot and Bing Chat. Its efforts have in large part been driven by its collaboration with OpenAI, the headline-grabbing firm behind ChatGPT into which Microsoft has invested billions of dollars.

"With copilots, we are making the age of AI real for people and businesses everywhere," said Satya Nadella, chairman and chief executive officer of Microsoft. "We are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers."

Microsoft said that GitHub Copilot, its pair programmer tool, has more than a million users and that its new GitHub Copilot Chat is already being used at an enterprise level by software developers at firms such as Maersk and PwC.

In Microsoft's earnings call Amy Good, the company's CFO, stated that in Q2 AI would show up in cost of goods sold (COGS) but that the firm's heavy investment in the technology would continue to be reflected in revenue and deliver healthy margins.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"[O]n operating expenses, there's been a good focus on continuing even within that segment to make sure we're focusing that work on leading in the AI transition with Azure," Hood said.

For Q2, Microsoft has projected continued revenue growth in Intelligent Cloud of between 17-18% with Azure still deciding the direction of travel across the segment. Azure revenue alone is expected to grow 26-27% in constant currency across Q2.

RELATED RESOURCE

The Ultimate Guide to the Best Legacy POS Systems for Restaurants

Cut through the noise and make shopping for a new POS less painful

DOWNLOAD NOW

"Our per-user business should continue to benefit from Microsoft 365 suite momentum, though we expect continued moderation in seat growth rates given the size of the installed base," said Hood.

"For H2, assuming the optimization and new workload trends continue and with the growing contribution from AI, we expect Azure revenue growth in constant currency to remain roughly stable compared to Q2.

Responding to a question from Karl Keirstead, stock analyst at UBS, on why Microsoft couldn't project continued acceleration in its Azure AI revenue, Amy Hood indicated that investment in new workloads would be necessary to ground the service but that margins would remain healthy.

"[A]t the scale we're talking about, being able to have stability in our Azure business does mean that we will have a lot of new workload starts," said Hood. "And primarily, we're expecting those to come from AI workloads, but AI workloads don't just use our AI services. They use data services, and they use other things."

Bola Rotibi, chief of enterprise research at CCS Insight, told ITPro that Microsoft's successful report is in line with its track record over the past few quarters, as well as its vocal advocacy for AI.

"Everybody has some kind of generative AI capability now, whether you're generating new text or code, or summarizing documents," said Rotibi. "The use of AI, algorithms, and models is not new but we are in a generative AI moment - and Microsoft is certainly making very good on that moment."

"Obviously it's early days, and while Microsoft has put a price tag on some of its Copilot use, this will shake out and whenever you look at numbers such as customer acquisition this has gone up. Over the quarter, Microsoft also talked about some of its products exceeding $1 billion in revenue, and this shows clear market interest."

Rotibi said that Microsoft has demonstrated clear success with GitHub Copilot and that going forward Microsoft was in a good position to shout about its end-to-end analytics.

"Since the acquisition, Microsoft has driven 4x developer usage and Microsoft says developer productivity is up 55%. Microsoft's role as a major supporter of the developer ecosystem remains, and Copilot will enhance that, especially as it drives productivity," Rotibi added.

READ MORE

"One of the things we'll start to see is Microsoft Fabric taking a much more front-and-center role in much of their operations because data is the generator, good clean unbiased data is a pre-requisite for generative AI."

Microsoft's aim to integrate AI throughout its existing product base, and to improve rather than overly expand its current range, fits with Gartner's expectations that organizations will implement AI using existing software budgets rather than allocating new funds.

It will also have to match user excitement with reassurances that the technology is safe for business use, amidst growing measures to mitigate the faults of AI at the enterprise level. Nadella outlined steps to fix AI's issues in his annual LinkedIn letter, but the firm still faces uncertainty when it comes to risk and AI legislation.

An AI boost for Office 365

Alongside surging revenue in its Intelligent Cloud segment, Microsoft also announced double-digit growth in Productivity and Business Processes of 13%. While all businesses within the segment saw increased revenue, Dynamics 365 and Office 365 Commercial saw revenue growth of 28% and 18% respectively. Microsoft pinned some of this on customer expectations ahead of the 365 Copilot's general release on 1 November and indicated that it expects revenue related to the offering to grow over time.

Nadella said that Microsoft was very happy for 365 Copilot to already have garnered this level of use and excitement. Microsoft expects much of the growth in this market to be driven by small and midsize businesses, what it has labeled "the frontline worker opportunity".

This is expected to be reflected in a 16% growth in Office 365 revenue growth across Q2, versus 11-12% growth across Productivity and Business Processes to $18.8-19.2 billion.

Rory Bathgate is Features and Multimedia Editor at ITPro, overseeing all in-depth content and case studies. He can also be found co-hosting the ITPro Podcast with Jane McCallion, swapping a keyboard for a microphone to discuss the latest learnings with thought leaders from across the tech sector.

In his free time, Rory enjoys photography, video editing, and good science fiction. After graduating from the University of Kent with a BA in English and American Literature, Rory undertook an MA in Eighteenth-Century Studies at King’s College London. He joined ITPro in 2022 as a graduate, following four years in student journalism. You can contact Rory at rory.bathgate@futurenet.com or on LinkedIn.

-

Mitigating bad bots

Mitigating bad botsSponsored Podcast Web crawlers pose an immediate business risk, necessitating immediate action from IT leaders

-

Thousands of Microsoft Teams users are being targeted in a new phishing campaign

Thousands of Microsoft Teams users are being targeted in a new phishing campaignNews Microsoft Teams users should be on the alert, according to researchers at Check Point

-

Microsoft sharpens agentic AI focus with new ‘CoreAI’ division

Microsoft sharpens agentic AI focus with new ‘CoreAI’ divisionThe new department will bring together teams from across engineering and AI

-

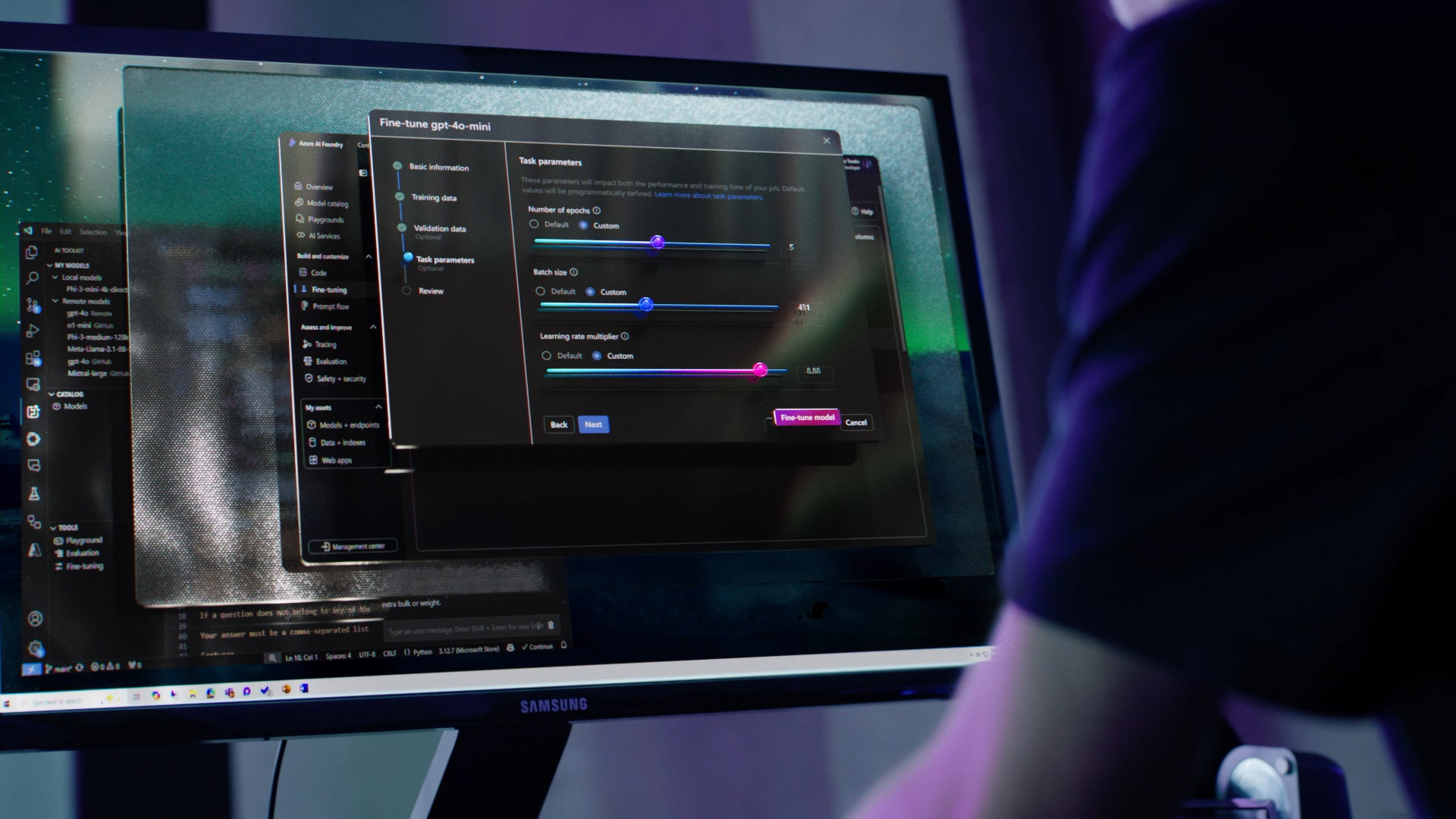

Microsoft unveils Azure AI Foundry to help businesses consolidate AI across their tech stack

Microsoft unveils Azure AI Foundry to help businesses consolidate AI across their tech stackNews The new AI application creation and management platform will integrate Azure AI Studio, and plug into popular IDEs such as Visual Studio to help developers and IT professionals drive AI adoption

-

Hyperscaler AI spending is getting out of control — and Microsoft says it could take 15 years for it to make good on investments

Hyperscaler AI spending is getting out of control — and Microsoft says it could take 15 years for it to make good on investmentsNews Tech giants' results show billions being poured into AI infrastructure, but big leaps in revenue remain elusive

-

Microsoft’s Mistral AI partnership has EU regulators concerned - here’s why

Microsoft’s Mistral AI partnership has EU regulators concerned - here’s whyNews Microsoft has found its European champion in Mistral AI, but regulators worry the deal raises questions over the scope of control and influence the tech giant will have over the French startup

-

Generative AI has been the secret sauce for Microsoft as its market cap surpasses Apple

Generative AI has been the secret sauce for Microsoft as its market cap surpasses AppleAnalysis Microsoft has ramped up generative AI investment over the last year and its surging share price has been a reflection of its sharpened focus on the emerging technology

-

OpenAI could fast become a money pit for investors

OpenAI could fast become a money pit for investorsAnalysis OpenAI will soon have to compete on a more level footing with others in the space, after its year-long head start

-

Microsoft’s latest AI move will see it open up Azure AI Infrastructure for startups training LLMs

Microsoft’s latest AI move will see it open up Azure AI Infrastructure for startups training LLMsAnalysis Opening up Azure AI Infrastructure will lower industry entry barriers for high-growth startups

-

Big tech quarterly earnings buoyed by generative AI interest

Big tech quarterly earnings buoyed by generative AI interestNews Surging interest in generative AI appears to be underpinning recent earnings results