Apple turns to Chinese suppliers for next iPhone

The tech giant bolsters its supply chain amid tensions between the US and China

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Apple has chosen new Chinese suppliers to make key parts of its next iPhone, as the US continues to maintain trade restrictions against the country.

Luxshare Precision Industry will build up to 3% of the upcoming iPhone 13 series, taking business away from its Taiwanese rivals Foxconn and Pegatron, according to Nikkei Asia. Luxshare will reportedly begin building Apple's next flagship device, the iPhone 13 Pro, this month, work that is traditionally reserved for tried and tested suppliers.

South Korean camera module maker Cowell and metal frame maker Casetek of Taiwan, which were acquired by Luxshare last year, will also reportedly supply key components for this year’s new iPhone.

China’s biggest maker of smartphone camera lenses, Sunny Optical Technology, also reportedly entered the iPhone supply chain for the first time this year, supplying the tech giant with rear camera lenses.

"Although Luxshare only makes a small percentage of iPhones this year, we can't let our guard down," a senior executive at a rival iPhone supplier told Nikkei Asia. "If we don't strengthen our competitiveness, sooner or later they will be the major source."

A number of other Chinese companies appeared on Apple’s supplier list for the first time last year, such as display maker Tianma Micro-Electronics, memory chip maker GigaDevice Semiconductor, and Nexperia, owned by China’s biggest smartphone assembler, Wingtech. Nexperia acquired a Welsh semiconductor manufacturer last month, which immediately fell under review by prime minister Boris Johnson's national security advisor.

RELATED RESOURCE

Top obstacles and business strategies for digital sellers

This survey reveals both challenges and emerging opportunities in 2021

Apple's supplier deals come at a time of increased tensions between the US and China, as the former seeks to make it easier for domestic companies to compete internationally.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

In June, the US Senate passed legislation that was intended to boost the country’s ability to compete with Chinese technology. The measures included $190 billion to strengthen US technology and research and $54 billion for semiconductor and telecommunications equipment research.

In response to the legislation, China’s parliament expressed “strong indignation and resolute opposition” to the bill, saying it showed “paranoid delusion of wanting to be the only winner”. There were other provisions in the bill related to China too, such as banning TikTok from government devices, blocking the purchase of drones from the country’s government, and creating broad sanctions on Chinese entities engaged in US cyber attacks.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Palo Alto Networks CEO hails ‘the end of identity silos’ as firm closes CyberArk acquisition

Palo Alto Networks CEO hails ‘the end of identity silos’ as firm closes CyberArk acquisitionNews Palo Alto Networks' CEO Nikesh Arora says the $25bn CyberArk acquisition heralds "the end of identity silos" for customers, enabling them to supercharge privileged access management.

-

Google says hacker groups are using Gemini to augment attacks

Google says hacker groups are using Gemini to augment attacksNews Google Threat Intelligence Group has shut down repeated attempts to misuse the Gemini model family

-

Boomi snaps up former MuleSoft executive as APJ channel lead

Boomi snaps up former MuleSoft executive as APJ channel leadNews Global software veteran Jim Fisher will work to expand the company’s channel operations across the region

-

What the US-China chip war means for the tech industry

What the US-China chip war means for the tech industryIn-depth With China and the West at loggerheads over semiconductors, how will this conflict reshape the tech supply chain?

-

Why Microsoft Teams has only just launched in China

Why Microsoft Teams has only just launched in ChinaNews The tech giant has officially launched Teams via its local partner in China, after it was launched globally in 2017

-

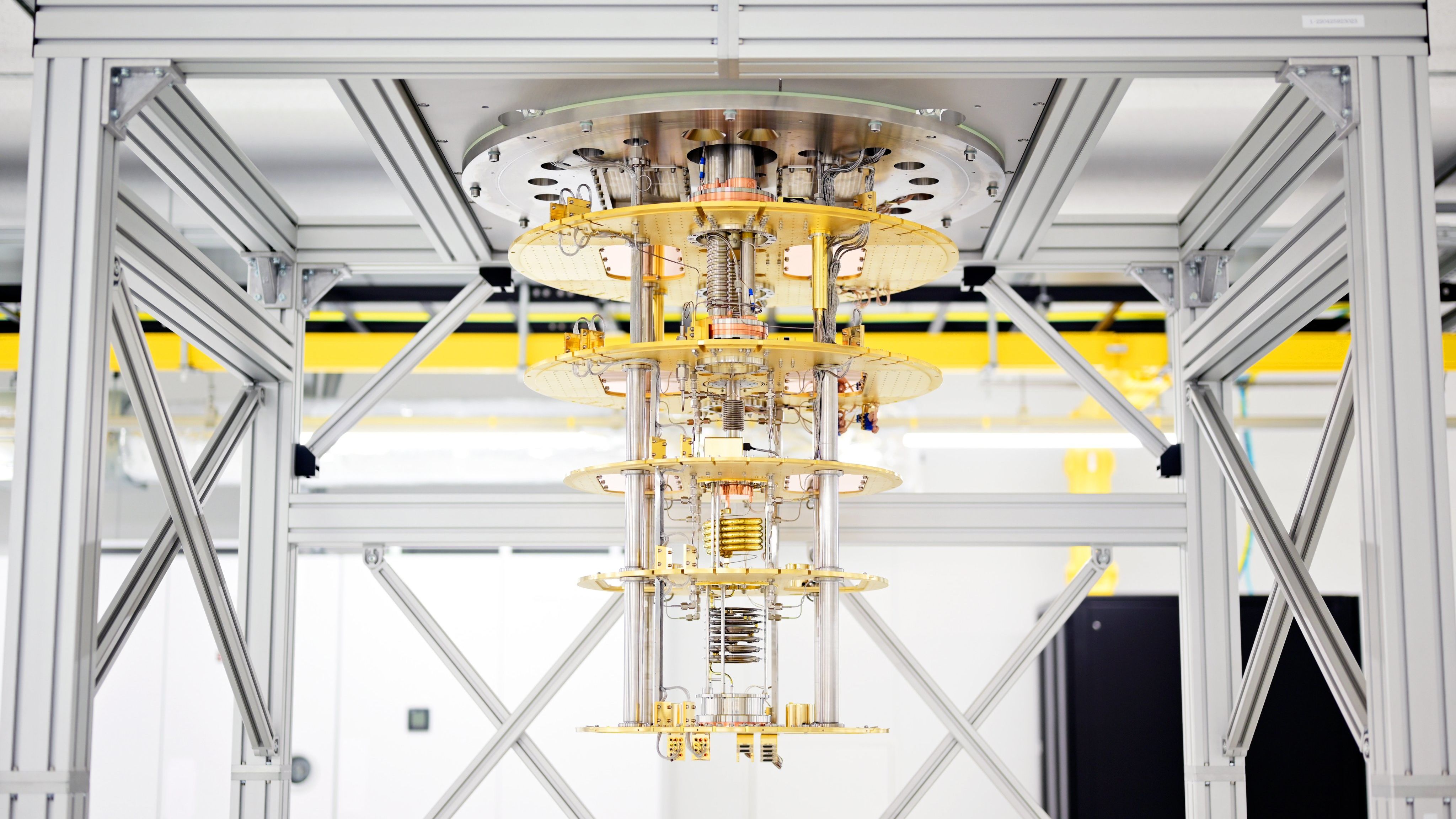

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

-

MI5 to establish new security agency to counter Chinese hacking, espionage

MI5 to establish new security agency to counter Chinese hacking, espionageNews The new organisation has been compared to GCHQ’s NCSC, and will provide companies advice on how to deal with Chinese companies or carry out business in China

-

UK set to appoint second-ever tech envoy to Indo-Pacific region

UK set to appoint second-ever tech envoy to Indo-Pacific regionNews The role will focus on India after Joe White was made the first technology envoy, a role focused on the US, in 2020

-

Wipro faces criticism after cutting graduate salaries by nearly 50%

Wipro faces criticism after cutting graduate salaries by nearly 50%News Graduates were given days to decide whether they would accept greatly reduced pay offers, prompting union action

-

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEA

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEANews The digital transformation veteran brings years of regional expertise to lead Freshworks’ growth strategy