US government could take stake in Intel as chip giant's woes continue

The move would see increased support for Intel’s manufacturing operations

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

The US government is reportedly weighing up plans to take a stake in Intel as the chip giant’s troubles continue.

According to reports from Bloomberg, the proposed deal aims to support the company's efforts to expand manufacturing operations across the US.

A key focus here would reportedly be ramping up development of its delayed Ohio manufacturing facility. While initially touted to open this year, the company has repeatedly pushed back the launch date.

While first delayed until late 2026, in February this year Intel admitted the site wouldn’t become operational until 2030-2031.

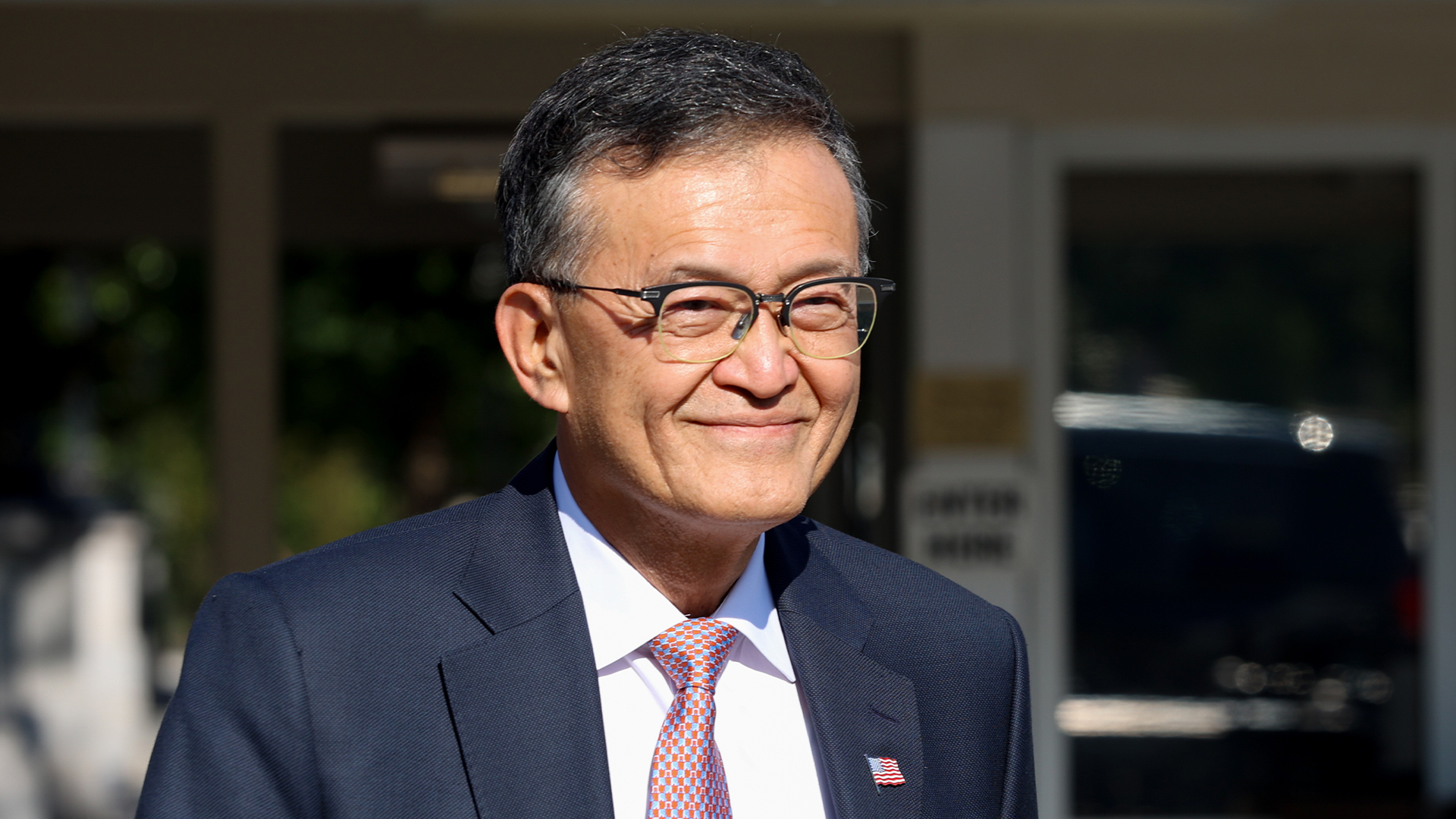

The reports from Bloomberg come in the wake of sharp criticism from the US administration. Last week, President Donald Trump suggested CEO Lip-Bu Tan resign amid claims over alleged ties to China.

Subsequent talks between Tan and the administration appear to have been productive, with President Trump later hailing the meeting in a post on Truth Social.

"His success and rise is an amazing story," he wrote.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

ITPro has approached Intel for comment, but received no response by time of publication.

In a statement given to Bloomberg, a spokesperson for Intel said the company is “deeply committed to supporting President Trump’s efforts to strengthen US technology and manufacturing leadership”.

“We look forward to continuing our work with the Trump Administration to advance these shared priorities, but we are not going to comment on rumors or speculation,” the spokesperson added.

Intel’s long-running woes

Intel has experienced significant troubles in recent years, falling behind competitors such as AMD and, notably, Nvidia, since the advent of the generative AI race. Intel's market value, for example, has halved since 2020.

The company has gone through repeated rounds of layoffs and a restructuring effort. Last month, the company announced plans to cut its global workforce by 15% and cancelled plans to develop new chip factories in Poland and Germany.

Tan’s appointment as CEO earlier this year was viewed at the time as an effort to steady the ship following Pat Gelsinger’s retirement. In the wake of the appointment, reports from Reuters detailed plans for an overhaul of the company’s chip and AI strategies in a bid to breathe new life into the company and reverse sluggish revenue growth.

Any involvement from the Trump administration could represent a lifeline for the semiconductor giant, and the White House has made clear its plans to ramp up domestic manufacturing and support for fellow chip giants in recent months.

Earlier this week, Nvidia and AMD announced an agreement with the administration to pay 15% of revenues from Chinese chip sales.

Make sure to follow ITPro on Google News to keep tabs on all our latest news, analysis, and reviews.

MORE FROM ITPRO

- Intel makes high-level hires while factory workers are warned of layoffs

- Intel layoffs confirmed as CEO eyes 'sustainable growth'

- Intel needs to “get its story right” to turn things around and capitalize on the AI boom

Ross Kelly is ITPro's News & Analysis Editor, responsible for leading the brand's news output and in-depth reporting on the latest stories from across the business technology landscape. Ross was previously a Staff Writer, during which time he developed a keen interest in cyber security, business leadership, and emerging technologies.

He graduated from Edinburgh Napier University in 2016 with a BA (Hons) in Journalism, and joined ITPro in 2022 after four years working in technology conference research.

For news pitches, you can contact Ross at ross.kelly@futurenet.com, or on Twitter and LinkedIn.

-

How the rise of the AI ‘agent boss’ is reshaping accountability in IT

How the rise of the AI ‘agent boss’ is reshaping accountability in ITIn-depth As IT companies deploy more autonomous AI tools and agents, the task of managing them is becoming more concentrated and throwing role responsibilities into doubt

-

Hackers are pouncing on enterprise weak spots as AI expands attack surfaces

Hackers are pouncing on enterprise weak spots as AI expands attack surfacesNews Potent new malware strains, faster attack times, and the rise of shadow AI are causing havoc

-

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new marketsNews Nvidia looks set to branch out into lucrative new markets following its $5 billion investment in Intel.

-

The US government's Intel deal explained

The US government's Intel deal explainedNews The US government has taken a 10% stake in Intel – but what exactly does the deal mean for the ailing chipmaker?

-

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlight

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlightNews The shift to Windows 11 means IT leaders can ditch old tech and get their hands on AI PCs

-

The gloves are off at Intel as new CEO plots major strategy shift

The gloves are off at Intel as new CEO plots major strategy shiftNews Intel’s incoming CEO has some big plans for the firm’s business strategy, sources familiar with the matter have told Reuters, with more job cuts looming on the horizon.

-

Intel just won a 15-year legal battle against EU

Intel just won a 15-year legal battle against EUNews Ruled to have engaged in anti-competitive practices back in 2009, Intel has finally succeeded in overturning a record fine

-

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?News The pair will look to make x86 CPU architecture more interoperable

-

Why the world is about to be swamped with AI PCs

Why the world is about to be swamped with AI PCsNews With adoption rates set to surge, AI PCs will become far more mainstream in years to come

-

Intel needs to “get its story right” to turn things around and capitalize on the AI boom

Intel needs to “get its story right” to turn things around and capitalize on the AI boomAnalysis Intel has entered a period of uncertainty after announcing restructuring plans and a huge round of layoffs