Intel warns global chip shortage could last until 2023

Warnings of an acute supply problem in the next quarter come as Intel reports flat revenues for Q2 2021

Intel has warned that the industry’s prolonged semiconductor shortage is likely to continue until at least 2023 and lead to revenue losses for itself and rival chipmakers.

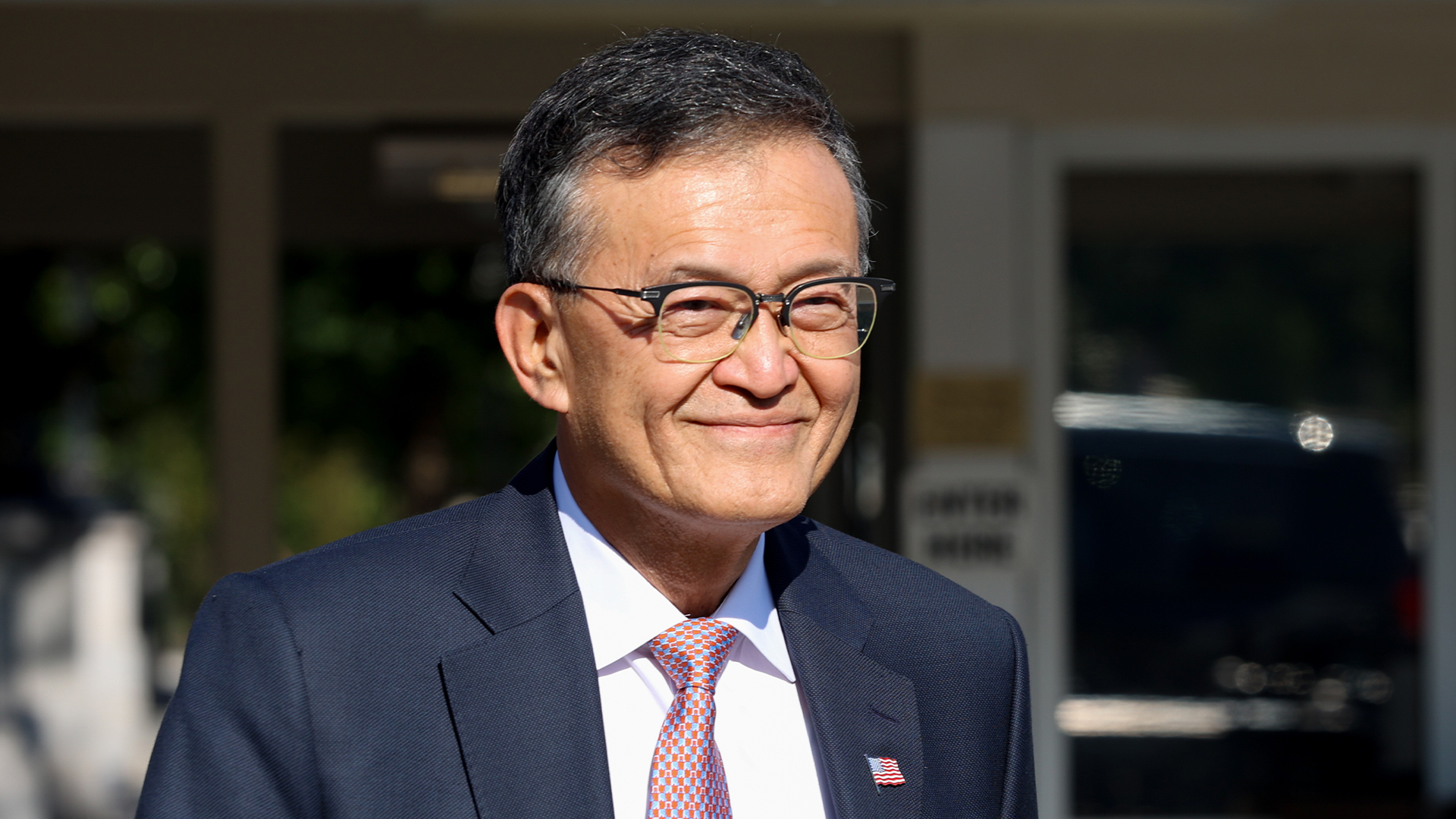

Although the ecosystem is back to shipping over a million PCs a day, strong and sustained demand for devices continues to stress the supply chain, Intel’s CEO Pat Gelsinger said during the firm’s Q2 earnings call.

The company reported a slight 2% year-on-year revenue rise for the second quarter of the year, from $18.2 billion to $18.5 billion. It forecasts a 5.4% revenue increase for Q3, as well as a modest full-year growth of 1% to $73.5 billion.

“While I expect the shortages to bottom out in the second half, it will take another one to two years before the industry is able to completely catch up with demand,” Gelsinger said, according to a transcript of the call published by Seeking Alpha.

He added that the firm’s recently embarked upon IDM 2.0 strategy combines internal manufacturing capacity with the use of third-party foundries, which positions the firm to weather the challenges and build a more resilient supply chain. This is a strategy that Intel announced in March following a tumultuous 2020.

The company’s positive Q2 revenue was mostly fueled by a 6% growth in the client computing group (CCG), the company’s largest division, to $10.1 billion.

RELATED RESOURCE

This was offset by a 9% reduction in revenues for the firm’s data centre division to $6.5 billion. The fastest-growing division was Mobileeye, within Internet of Things, which surged 124% to $327 million for the quarter.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“We remain in a highly constrained environment where we are unable to fully supply customer demand,” Intel’s CEO George Davis said in the company’s earnings call, echoing Gelsinger’s sentiments.

“In CCG, we continue to see very strong demand for our client products and expect TAM [total addressable market] growth to continue. However, persistent industry-wide component in substrate shortages are expected to lower CCG revenues sequentially.

“We expect supply shortages to continue for several quarters, but appear to be particularly acute for clients in Q3. In data centre, we expect enterprise and government, and Cloud to show further recovery in Q3.”

Gelsinger’s and Davis’ remarks echo those made by several major executives in the industry, including most recently the CFO of Taiwanese manufacturing giant TSMC, Wendell Huang. He said he expects the ongoing chip shortage to continue to cripple the tech and automotive industries until at least next year.

In May, both Cisco’s CFO Scott Herren and Dell’s CEO Michael Dell said they expect the crisis to continue until at least the end of 2021, and for “a few years”, respectively.

Cisco’s CEO, Chuck Robbins, by contrast, said in April this year that he would expect the industry to need at least another six months to get through the short term of the crisis, and that the wider crisis is unlikely to be resolved until 2022.

Keumars Afifi-Sabet is a writer and editor that specialises in public sector, cyber security, and cloud computing. He first joined ITPro as a staff writer in April 2018 and eventually became its Features Editor. Although a regular contributor to other tech sites in the past, these days you will find Keumars on LiveScience, where he runs its Technology section.

-

The modern workplace: Standardizing collaboration for the enterprise IT leader

The modern workplace: Standardizing collaboration for the enterprise IT leaderHow Barco ClickShare Hub is redefining the meeting room

-

Interim CISA chief uploaded sensitive documents to a public version of ChatGPT

Interim CISA chief uploaded sensitive documents to a public version of ChatGPTNews The incident at CISA raises yet more concerns about the rise of ‘shadow AI’ and data protection risks

-

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new marketsNews Nvidia looks set to branch out into lucrative new markets following its $5 billion investment in Intel.

-

The US government's Intel deal explained

The US government's Intel deal explainedNews The US government has taken a 10% stake in Intel – but what exactly does the deal mean for the ailing chipmaker?

-

US government could take stake in Intel as chip giant's woes continue

US government could take stake in Intel as chip giant's woes continueNews The move would see increased support for Intel’s manufacturing operations

-

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlight

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlightNews The shift to Windows 11 means IT leaders can ditch old tech and get their hands on AI PCs

-

The gloves are off at Intel as new CEO plots major strategy shift

The gloves are off at Intel as new CEO plots major strategy shiftNews Intel’s incoming CEO has some big plans for the firm’s business strategy, sources familiar with the matter have told Reuters, with more job cuts looming on the horizon.

-

Intel just won a 15-year legal battle against EU

Intel just won a 15-year legal battle against EUNews Ruled to have engaged in anti-competitive practices back in 2009, Intel has finally succeeded in overturning a record fine

-

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?News The pair will look to make x86 CPU architecture more interoperable

-

Why the world is about to be swamped with AI PCs

Why the world is about to be swamped with AI PCsNews With adoption rates set to surge, AI PCs will become far more mainstream in years to come