Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

The long-running rivals are teaming up for US-centric x86 architectures

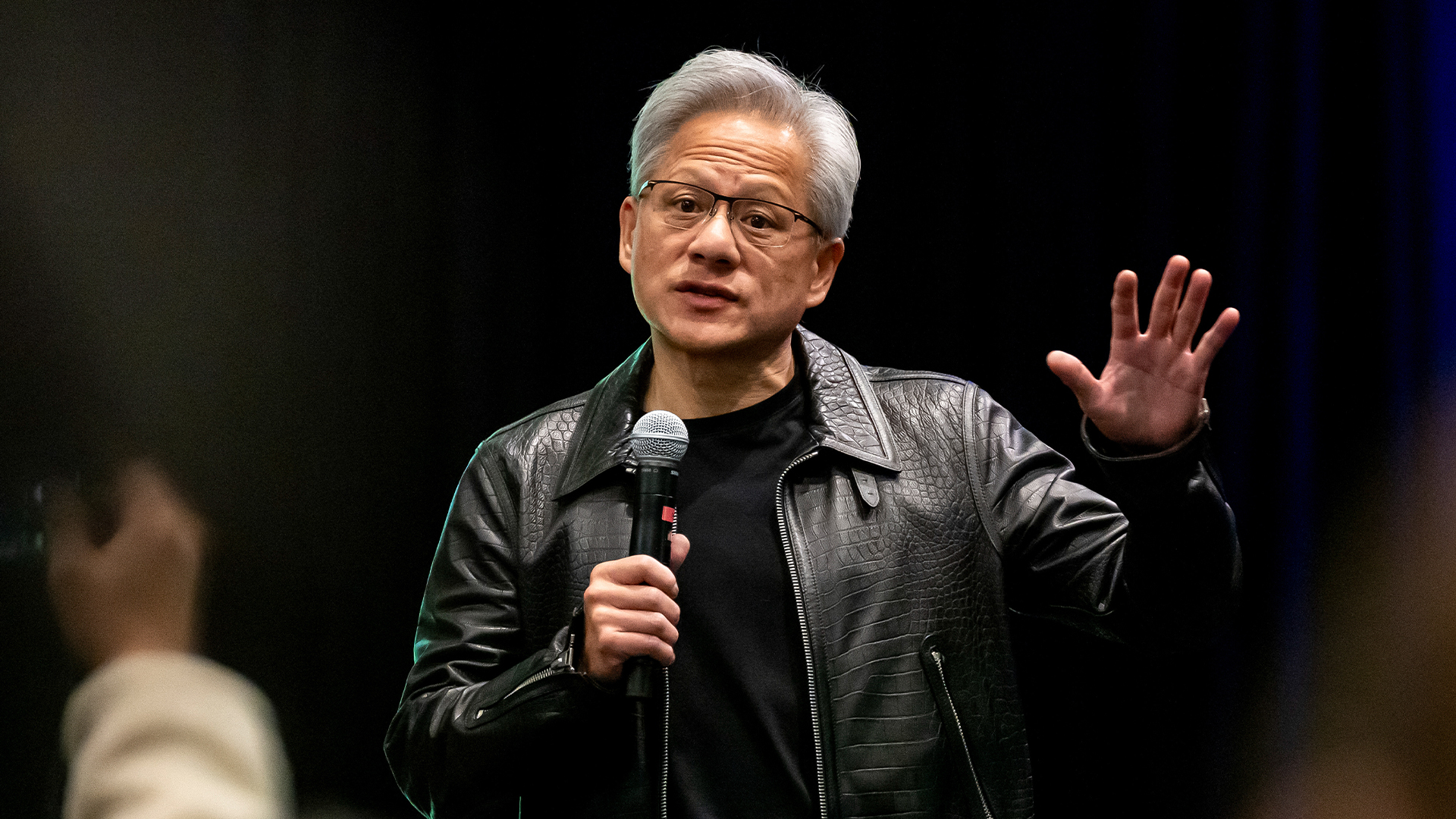

Nvidia plans to invest $5 billion in Intel in a move analysts say will help the chip giant branch out into lucrative new markets.

Announced this week, the partnership will see the two rivals collaborate on data center and PC hardware. The immediate aim is to ensure Intel’s data center architecture – in particular its x86 ecosystem – can connect to Nvidia’s via its proprietary NVLink technology.

In time this will yield Intel-built, custom CPUs for Nvidia that will connect its market-leading GPUs within data centers.

The pair will also collaborate on new hardware in the consumer PC market, with Intel set to build x86 system-on-chips (SoCs) that will complement Nvidia’s RTX range of graphics cards, used for gaming and graphics-intensive applications such as computer assisted design (CAD) software.

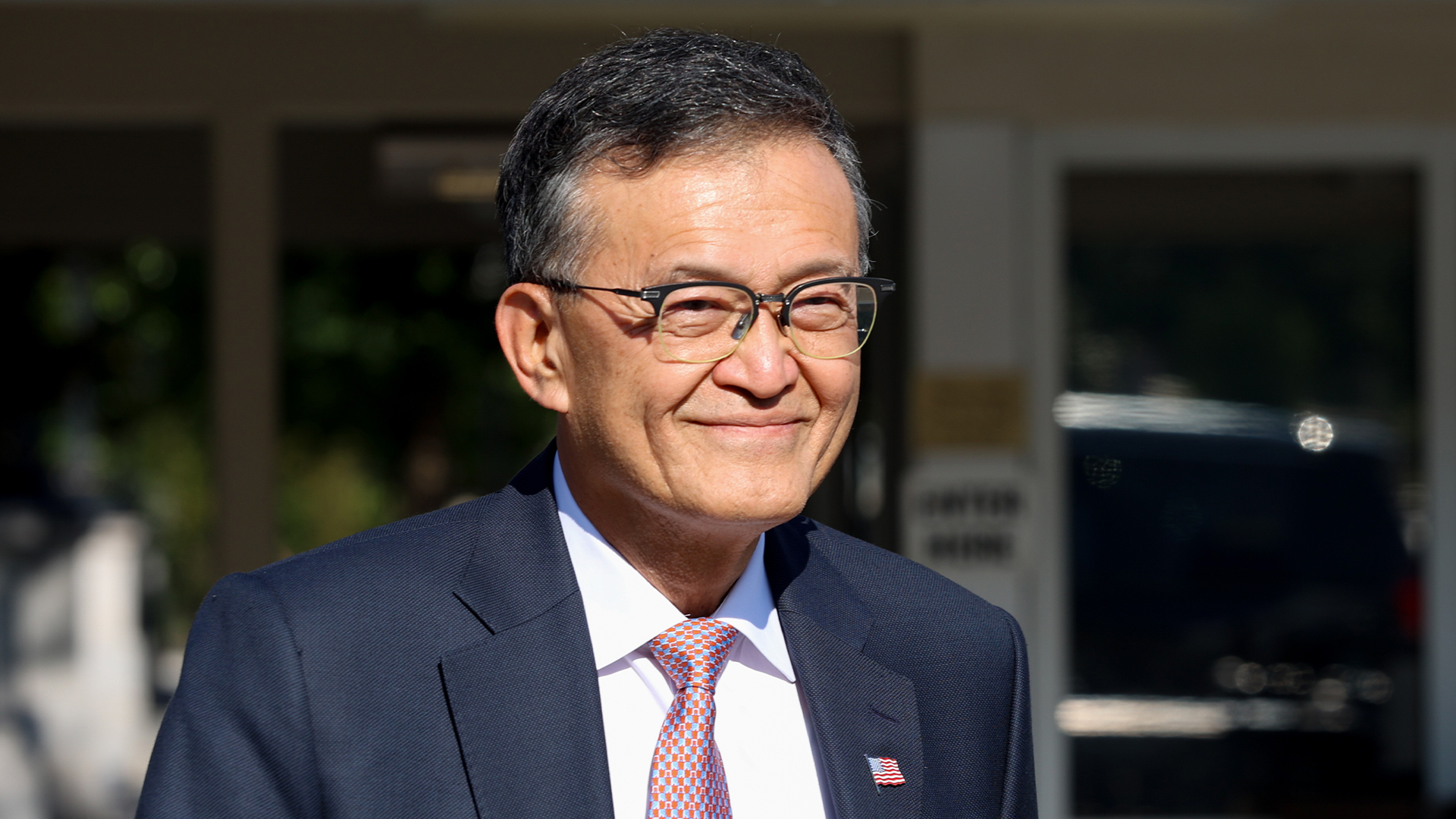

“Intel’s x86 architecture has been foundational to modern computing for decades — and we are innovating across our portfolio to enable the workloads of the future,” said Lip-Bu Tan, CEO of Intel.

“Intel’s leading data center and client computing platforms, combined with our process technology, manufacturing and advanced packaging capabilities, will complement Nvidia's AI and accelerated computing leadership to enable new breakthroughs for the industry,” he added.

“We appreciate the confidence Jensen and the Nvidia team have placed in us with their investment and look forward to the work ahead as we innovate for customers and grow our business.”

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Nvidia is the big winner

Intel has struggled in recent years to curb Nvidia’s meteoric rise to becoming not only the largest chip company, but also the most valuable company in the world.

The former chip titan’s shares fell 60% in 2024, the same year the firm slashed 15,000 roles and missed its own targets for AI hardware dominance.

Tan’s time as leader so far has been marked by a sharp strategic shift and stabilizing financials, though the firm still reported a net loss of $2.9 billion in its Q2 earnings statement.

In this light, the announcement with Nvidia could come as welcome news to Intel shareholders and help the company increase its US spending. Mario Morales, group vice president, Enabling Technologies and Semiconductors at IDC, said the partnership will be seen as a “positive move for both companies”.

Nvidia, however, will likely be the big winner given it now has an opportunity to capitalize on a broader array of markets.

“They are leveraging each other's strengths to deliver products to customers, particularly in the enterprise sector,” he said.

“This collaboration will help Nvidia expand into new markets beyond the data center, focusing on AI inferencing across various endpoints like PCs, smartphones, and autonomous systems that can leverage a collection of compute chiplets and dry the requirements of performance efficiency.”

The partnership comes just weeks after the US government took a 10% stake in Intel for $8.9 billion, amid financial woes, layoffs, and criticism of CEO Lip-Bu Tan by President Trump.

Under the terms of the deal, the purchase will be financed with a remaining grant of $5.7 billion from the US CHIPS Act and $3.2 billion from the Secure Enclave program – both legacies of the Biden administration.

The funding comes with the caveat of all spending needing to be carried out within the US, in alignment with each act’s stated aim of improving the US semiconductor industry and making it more competitive with China.

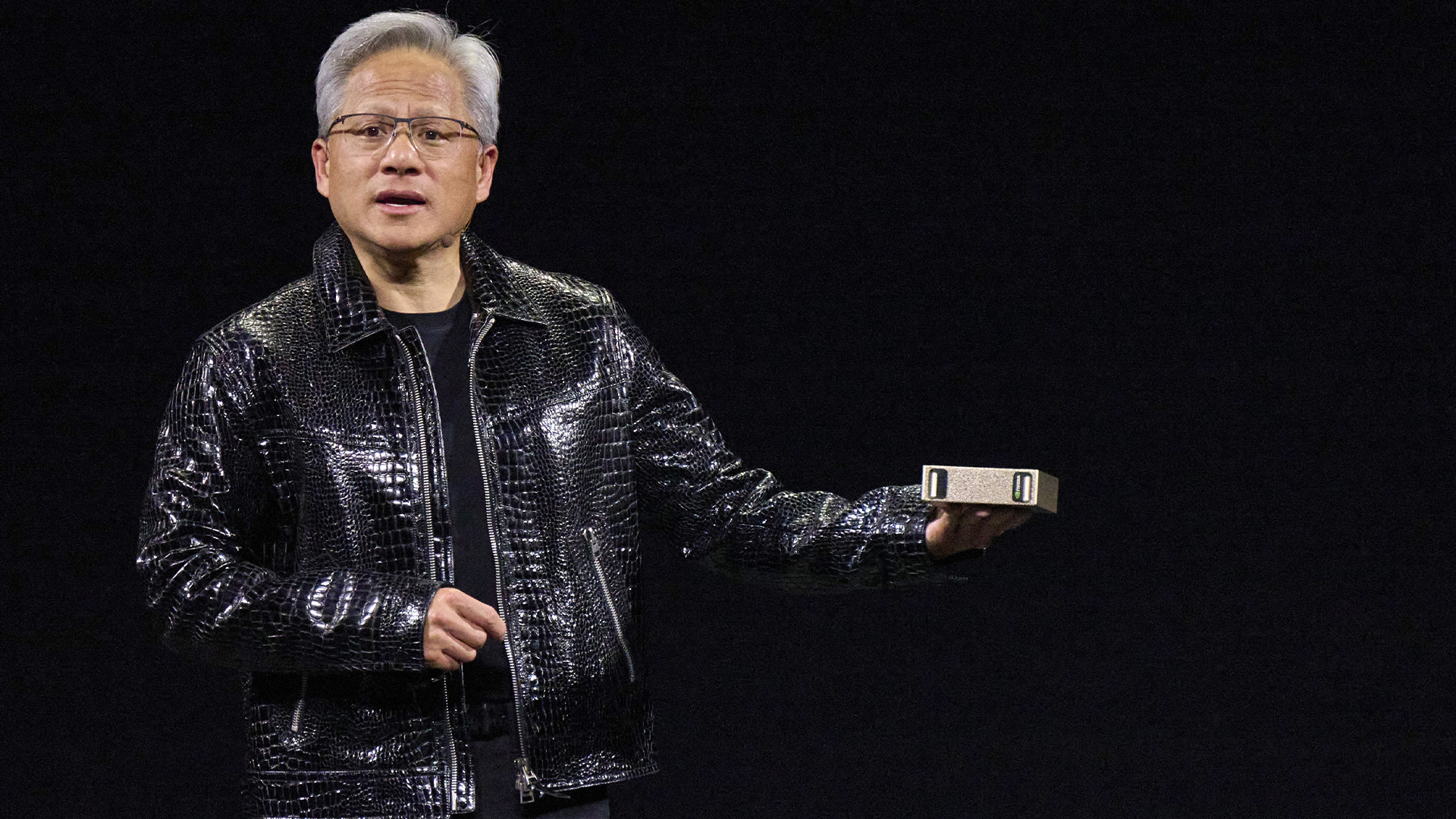

In the wake of tech tariffs and a greater focus by the Trump administration on domestic manufacturing, Nvidia has also been under pressure to reduce its reliance on firms such as Taiwan-based TSMC.

Its partnership with Intel will push it closer to US-centric operations, though the chip giant still heavily depends on TSMC, which produces 90% of the world’s advanced chips.

“The announcement today highlights the ongoing AI race between the US and China,” Morales added.

“While the US currently leads in technology, China is rapidly advancing with its own AI initiatives. The collaboration between Nvidia and Intel is seen as a strategic move to maintain US leadership in AI technology infrastructure and endpoints.”

Make sure to follow ITPro on Google News to keep tabs on all our latest news, analysis, and reviews.

MORE FROM ITPRO

- UK to host largest European GPU cluster under £11 billion Nvidia investment plans

- Jensen Huang says AI will make workers ‘busier in the future’

- Nvidia hails ‘another leap in the frontier of AI computing’ with Rubin GPU launch

Rory Bathgate is Features and Multimedia Editor at ITPro, overseeing all in-depth content and case studies. He can also be found co-hosting the ITPro Podcast with Jane McCallion, swapping a keyboard for a microphone to discuss the latest learnings with thought leaders from across the tech sector.

In his free time, Rory enjoys photography, video editing, and good science fiction. After graduating from the University of Kent with a BA in English and American Literature, Rory undertook an MA in Eighteenth-Century Studies at King’s College London. He joined ITPro in 2022 as a graduate, following four years in student journalism. You can contact Rory at rory.bathgate@futurenet.com or on LinkedIn.

-

The modern workplace: Standardizing collaboration for the enterprise IT leader

The modern workplace: Standardizing collaboration for the enterprise IT leaderHow Barco ClickShare Hub is redefining the meeting room

-

Interim CISA chief uploaded sensitive documents to a public version of ChatGPT

Interim CISA chief uploaded sensitive documents to a public version of ChatGPTNews The incident at CISA raises yet more concerns about the rise of ‘shadow AI’ and data protection risks

-

The Asus Ascent GX10 is a MiniPC with supercomputer ambitions for AI developers – but it's not cheap

The Asus Ascent GX10 is a MiniPC with supercomputer ambitions for AI developers – but it's not cheapReviews The Ubuntu-on-ARM operating system could limit its appeal, but for both serious and neophyte AI developers, it's a great desktop box

-

Nvidia hails ‘another leap in the frontier of AI computing’ with Rubin GPU launch

Nvidia hails ‘another leap in the frontier of AI computing’ with Rubin GPU launchNews Set for general release in 2026, Rubin is here to solve the challenge of AI inference at scale

-

The US government's Intel deal explained

The US government's Intel deal explainedNews The US government has taken a 10% stake in Intel – but what exactly does the deal mean for the ailing chipmaker?

-

US government could take stake in Intel as chip giant's woes continue

US government could take stake in Intel as chip giant's woes continueNews The move would see increased support for Intel’s manufacturing operations

-

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlight

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlightNews The shift to Windows 11 means IT leaders can ditch old tech and get their hands on AI PCs

-

Nvidia braces for a $5.5 billion hit as tariffs reach the semiconductor industry

Nvidia braces for a $5.5 billion hit as tariffs reach the semiconductor industryNews The chipmaker says its H20 chips need a special license as its share price plummets

-

The gloves are off at Intel as new CEO plots major strategy shift

The gloves are off at Intel as new CEO plots major strategy shiftNews Intel’s incoming CEO has some big plans for the firm’s business strategy, sources familiar with the matter have told Reuters, with more job cuts looming on the horizon.

-

“The Grace Blackwell Superchip comes to millions of developers”: Nvidia's new 'Project Digits' mini PC is an AI developer's dream – but it'll set you back $3,000 a piece to get your hands on one

“The Grace Blackwell Superchip comes to millions of developers”: Nvidia's new 'Project Digits' mini PC is an AI developer's dream – but it'll set you back $3,000 a piece to get your hands on oneNews Nvidia unveiled the launch of a new mini PC, dubbed 'Project Digits', aimed specifically at AI developers during CES 2025.