The US government's Intel deal explained

Why does the US government want 10% of a struggling chip maker?

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

The US government has taken a 10% stake in Intel, giving the company access to billions in funds to build factories and conduct research – but what exactly does the move mean for the ailing chipmaker?

Under the terms of the long-rumored deal, the Trump administration has bought a 9.9% stake in Intel for $8.9 billion — Reuters noted that works out to $20.47 per share, a discount of about $4 from the company's Friday closing price.

The share purchase will be paid for via two existing grants — agreed but not yet paid — awarded by the previous administration: $5.7bn from the CHIPS act and $3.2bn from the Secure Enclave program.

That doesn't include a $2.2bn tranche of the CHIPS grants that were already paid to Intel. Or, as President Trump said in a post on Truth Social: "The United States paid nothing for these shares, and the shares are now valued at approximately $11 billion dollars."

The nature of those grants requires the funding be spent in the US. Similarly, as part of the deal, the grants are converted into an equity stake, but the terms require the money to be spent inside the US in ways aligned with CHIPS and Secure Enclave.

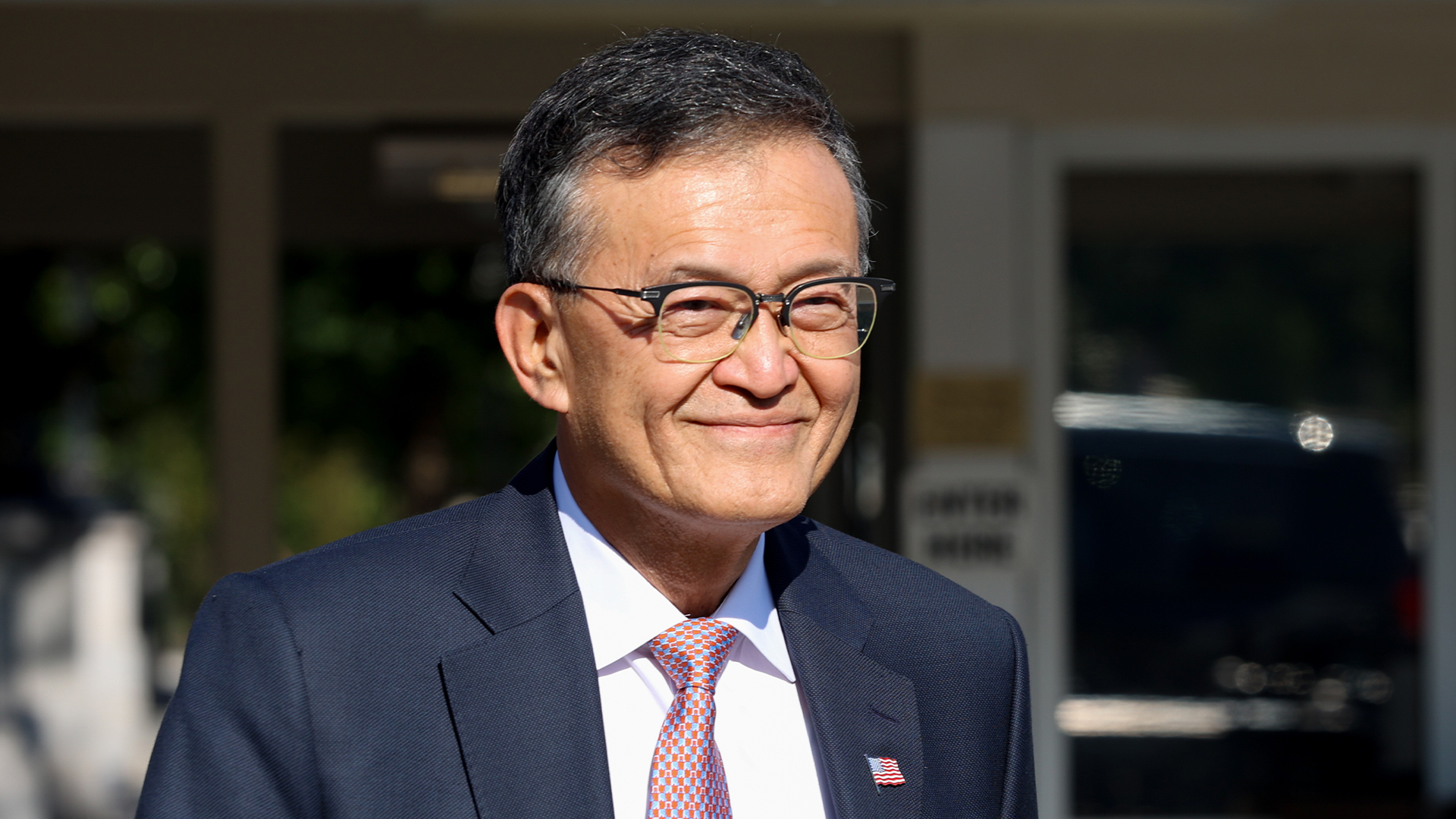

“As the only semiconductor company that does leading-edge logic R&D and manufacturing in the US, Intel is deeply committed to ensuring the world’s most advanced technologies are American made,” said Intel CEO Lip-Bu Tan.

The deal comes amid a backdrop of a tariffs war that has hit the technology industry hard as well as long-running tensions with China.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Intel's woes

Once the dominant force in the chips market, Intel has struggled to keep up with rivals such as AMD and Nvidia, first during the shift to mobile and now with the rise of generative AI.

At the end of 2024, Intel announced billions in losses — the tech giant's first annual losses since 1986 — followed by cuts to 15% of its job force. Former CEO Pat Gelsinger departed the company after decades, with Intel eventually naming Tan as the new CEO.

Tan swiftly unveiled his own turnaround plans. That included restructuring how the company targets AI and widening its manufacturing to include external clients like rival Nvidia — but also another round of job cuts and the cancellation of chip factories planned in Germany and Poland.

Criticism of new CEO

The deal also reduces, if not resolves, Trump's ongoing — though largely one-sided — war of words with Tan.

Trump said earlier this month that Tan should resign over his ties to Chinese companies, which included hundreds of millions of dollars in investments as well as his role as CEO of Cadence Design, which recently pled guilty to selling software illegally to the Chinese military.

In a social media post, Trump wrote: "The CEO of Intel is highly conflicted and must resign, immediately." Tan replied via a note to staff that he'd always "operated within the highest legal and ethical standards," and called the criticism "misinformation."

As it turns out, there was another solution: cutting a deal.

After a meeting with the Intel CEO, Trump reportedly said of Tan: "He walked in wanting to keep his job and he ended up giving us $10 billion for the United States. So we picked up $10 billion."

That references the requirement that the money be spent investing in American manufacturing and R&D. Intel noted it is already investing more than $100bn to expand its US-based manufacturing facilities, but the money from the new deal is believed to be targeted at speeding up development at Intel's delayed Ohio plant.

Response to the deal

Intel naturally welcomed the agreement. "We are grateful for the confidence the President and the Administration have placed in Intel, and we look forward to working to advance U.S. technology and manufacturing leadership," Tan said in a statement.

In a statement provided by Intel, the deal was welcomed by luminaries from the tech industry. Microsoft CEO Satya Nadella said the deal would "benefit the country", while Dell CEO Michael Dell said he fully supports the agreement.

Dell added it was "great to see Intel and the Trump Administration working together to advance US technology and manufacturing leadership."

AWS CEO Matt Garman said: "We applaud the Trump administration’s efforts to usher in a new era of American innovation in partnership with American companies."

But the deal is not without risks for Intel. The company said in a filing there could be "adverse reactions" to the agreement from investors, employees, and even customers or suppliers, noting that 76% of Intel's sales come from outside the US.

"There could be adverse reactions, immediately or over time, from investors, employees, customers, suppliers, other business or commercial partners, foreign governments or competitors," the filing noted.

"There may also be litigation related to the transaction or otherwise and increased public or political scrutiny with respect to the company."

The deal sparked wider criticism, including one pundit claiming that "Intel should have been sold for car parts three years ago," and others calling it "right-wing socialism" and "pretty darn bonkers."

What's next?

Trump suggested similar deals may be in the pipeline. After announcing the Intel agreement, he told reporters: "I hope I'm going to have many more cases like it."

He later added on social media: "I will make deals like that for our country all day long. I will also help those companies that make such lucrative deals with the United States States [sic]."

The Intel deal follows another agreement with Nvidia and AMD, in which the rival chipmakers are allowed to sell some specific chips to China — but only if they give a 15% cut of those sales to the US government.

Make sure to follow ITPro on Google News to keep tabs on all our latest news, analysis, and reviews.

MORE FROM ITPRO

- The gloves are off at Intel as new CEO plots major strategy shift

- Intel needs to “get its story right” to turn things around and capitalize on the AI boom

- Intel makes high-level hires while factory workers are warned of layoffs

Freelance journalist Nicole Kobie first started writing for ITPro in 2007, with bylines in New Scientist, Wired, PC Pro and many more.

Nicole the author of a book about the history of technology, The Long History of the Future.

-

Salesforce targets telco gains with new agentic AI tools

Salesforce targets telco gains with new agentic AI toolsNews Telecoms operators can draw on an array of pre-built agents to automate and streamline tasks

-

Four national compute resources launched for cutting-edge science and research

Four national compute resources launched for cutting-edge science and researchNews The new national compute centers will receive a total of £76 million in funding

-

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new marketsNews Nvidia looks set to branch out into lucrative new markets following its $5 billion investment in Intel.

-

US government could take stake in Intel as chip giant's woes continue

US government could take stake in Intel as chip giant's woes continueNews The move would see increased support for Intel’s manufacturing operations

-

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlight

Dell says Windows 11 migration is a prime opportunity to overhaul ageing PC fleets – and AI devices are in the spotlightNews The shift to Windows 11 means IT leaders can ditch old tech and get their hands on AI PCs

-

The gloves are off at Intel as new CEO plots major strategy shift

The gloves are off at Intel as new CEO plots major strategy shiftNews Intel’s incoming CEO has some big plans for the firm’s business strategy, sources familiar with the matter have told Reuters, with more job cuts looming on the horizon.

-

Intel just won a 15-year legal battle against EU

Intel just won a 15-year legal battle against EUNews Ruled to have engaged in anti-competitive practices back in 2009, Intel has finally succeeded in overturning a record fine

-

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?

AMD and Intel’s new x86 advisory group looks to tackle Arm, but will it succeed?News The pair will look to make x86 CPU architecture more interoperable

-

Why the world is about to be swamped with AI PCs

Why the world is about to be swamped with AI PCsNews With adoption rates set to surge, AI PCs will become far more mainstream in years to come

-

Intel needs to “get its story right” to turn things around and capitalize on the AI boom

Intel needs to “get its story right” to turn things around and capitalize on the AI boomAnalysis Intel has entered a period of uncertainty after announcing restructuring plans and a huge round of layoffs