Hong Kong considers own centralised digital currency

The plans form part of the “Fintech 2025” strategy to drive the development of fintech in the region

The Hong Kong Monetary Authority (HKMA) is exploring whether to launch a centralised digital currency as part of the country's "Fintech 2025" strategy".

The HKMA will soon begin a comprehensive study on e-HKD to understand its use cases, benefits, and related risks, chief executive Eddie Yue revealed at a seminar this week.

"This is to increase our technical readiness so that we are prepared for all kinds of circumstances in the future, including the potential for Hong Kong to issue e-HKD," he added.

"We have already established an internal cross-departmental working group within the HKMA to study the relevant technical, policy and legal issues, and we hope to offer our initial thought[s] on this complex matter in 12 months' time."

The HKMA also stated it will continue to work with the People's Bank of China in supporting the technical testing of e-CNY, China's digital yuan, in Hong Kong with the aim to provide a convenient means of cross-boundary payments for both domestic and mainland residents.

This comes as part of the country's new fintech strategy, "Fintech 2025", which aims to encourage comprehensive technology adoption across its financial sector by 2025 and promote the provision of fair and efficient financial services for the benefit of Hong Kong citizens and the economy.

RELATED RESOURCE

Medium business IT survey highlights

An online study to understand the state of medium businesses in Europe and South Africa

As part of this, the HKMA will promote the all-round adoption of fintech by Hong Kong banks and fully encourage them to digitalise their operations, "from front-end to back-end". To support this, it will roll out a "Tech Baseline Assessment" to take stock of banks' current and planned adoption of fintech and identify areas that would benefit from HKMA support.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The authority also hopes to take the lead in enhancing the city's existing data infrastructure and build new ones. Additionally, it wants to increase the supply of fintech talent by introducing initiatives such as a fintech training programme and qualifications, as well as promoting joint projects between industry and academia.

The HKMA said that the full details of the strategy will be unveiled at a later date.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

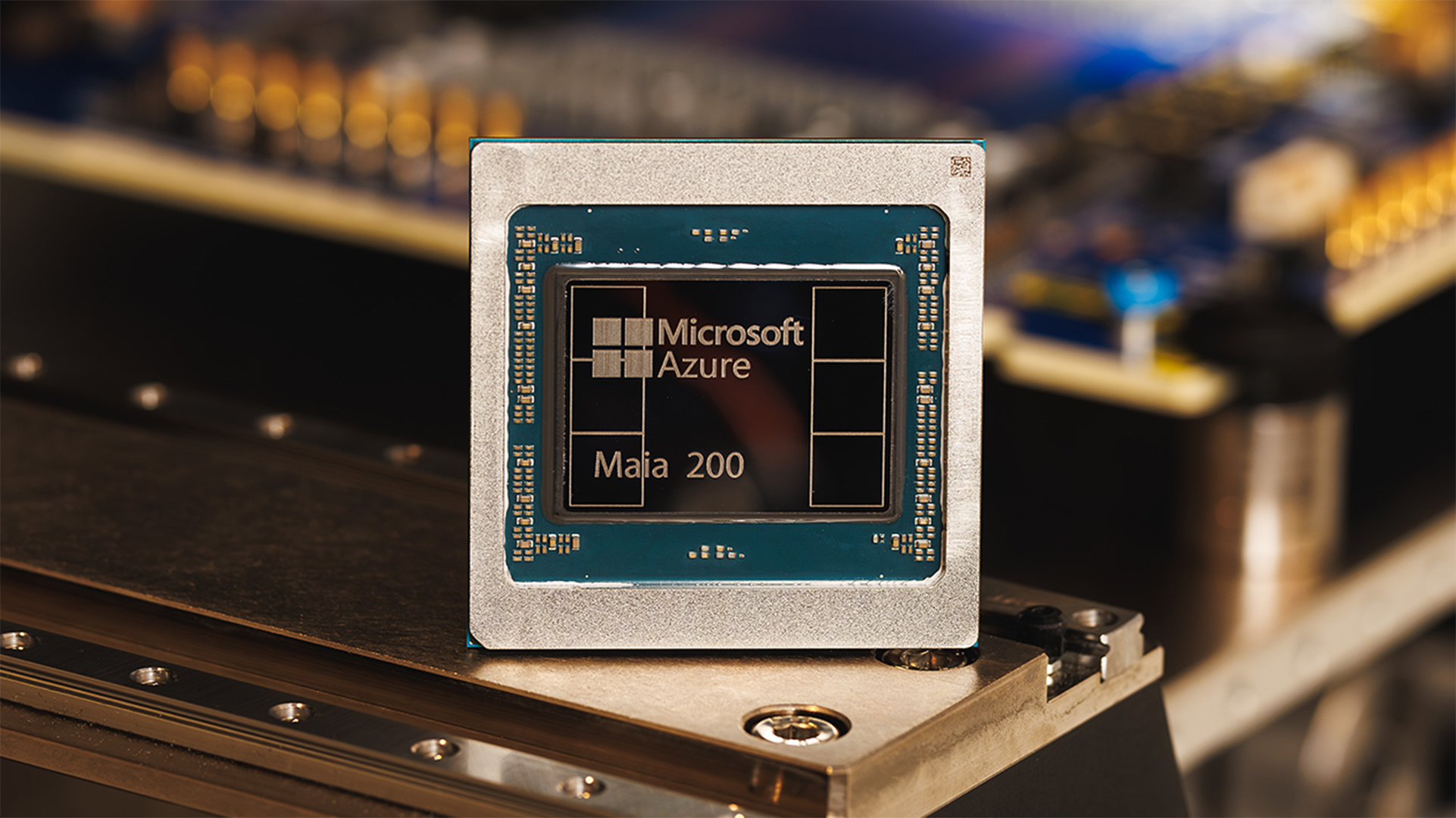

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Infosys expands Swiss footprint with new Zurich office

Infosys expands Swiss footprint with new Zurich officeNews The firm has relocated its Swiss headquarters to support partners delivering AI-led digital transformation

-

Accenture bolsters industrial AI services with Flutura acquisition

Accenture bolsters industrial AI services with Flutura acquisitionNews Bangalore-based AI specialist will help “power industrial AI-led transformation” for Accenture’s global clients

-

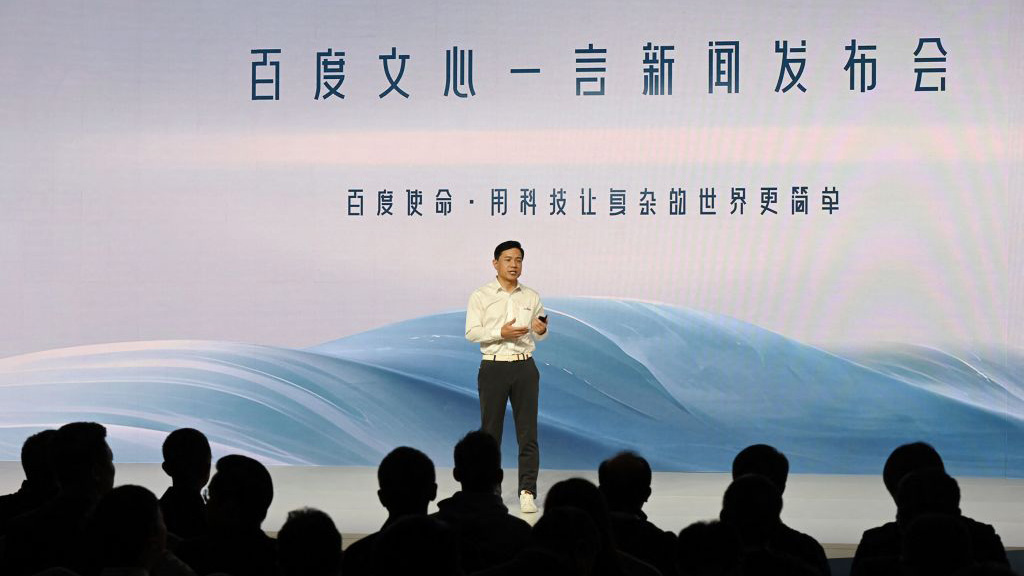

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?

Baidu unveils 'Ernie' AI, but can it compete with Western AI rivals?News Technical shortcomings failed to persuade investors, but the company's local dominance could carry it through the AI race

-

HPE Cray supercomputer to boost Singapore’s met office weather forecasting

HPE Cray supercomputer to boost Singapore’s met office weather forecastingNews The new system provides twice the speed of its predecessor and has a peak performance of 401.4 teraflops

-

National banks build blockchain CBDC platform for faster international payments

National banks build blockchain CBDC platform for faster international paymentsNews The banks ran a pilot test where 164 payment and foreign exchange transactions were completed, totalling over $22 million over the six weeks

-

Fujitsu and Keio University partner on automated internet 'trust layer'

Fujitsu and Keio University partner on automated internet 'trust layer'News The pair want to create an interface that draws information from different sources, like experts or physical tools like sensors, to verify the authenticity of data posted on the internet

-

Mapping an entire country: Meet Singapore’s digital twin

Mapping an entire country: Meet Singapore’s digital twinIn-depth Digital twins are the future of urban planning – disclosing insights we could have once only dreamed of

-

Toshiba smashes AI engineer recruitment targets

Toshiba smashes AI engineer recruitment targetsNews The company has also outlined seven principles to help train human resources to research, develop, and use AI

-

Fujitsu taps India’s AI talent with new research centre in Bengaluru

Fujitsu taps India’s AI talent with new research centre in BengaluruNews The company aims to boost the number of its researchers in the country to 50 by 2024