Is Nvidia’s takeover of Arm a threat to the UK tech industry?

The spectre of a US chipmaker buying one of Britain's tech crown jewels is causing discontent

In September, American tech firm Nvidia made global headlines when it unveiled plans to acquire British chipmaker Arm for $40 billion. While the deal seems a huge economic win for the UK’s tech industry, many tech experts and companies are worried it could cause more harm than good.

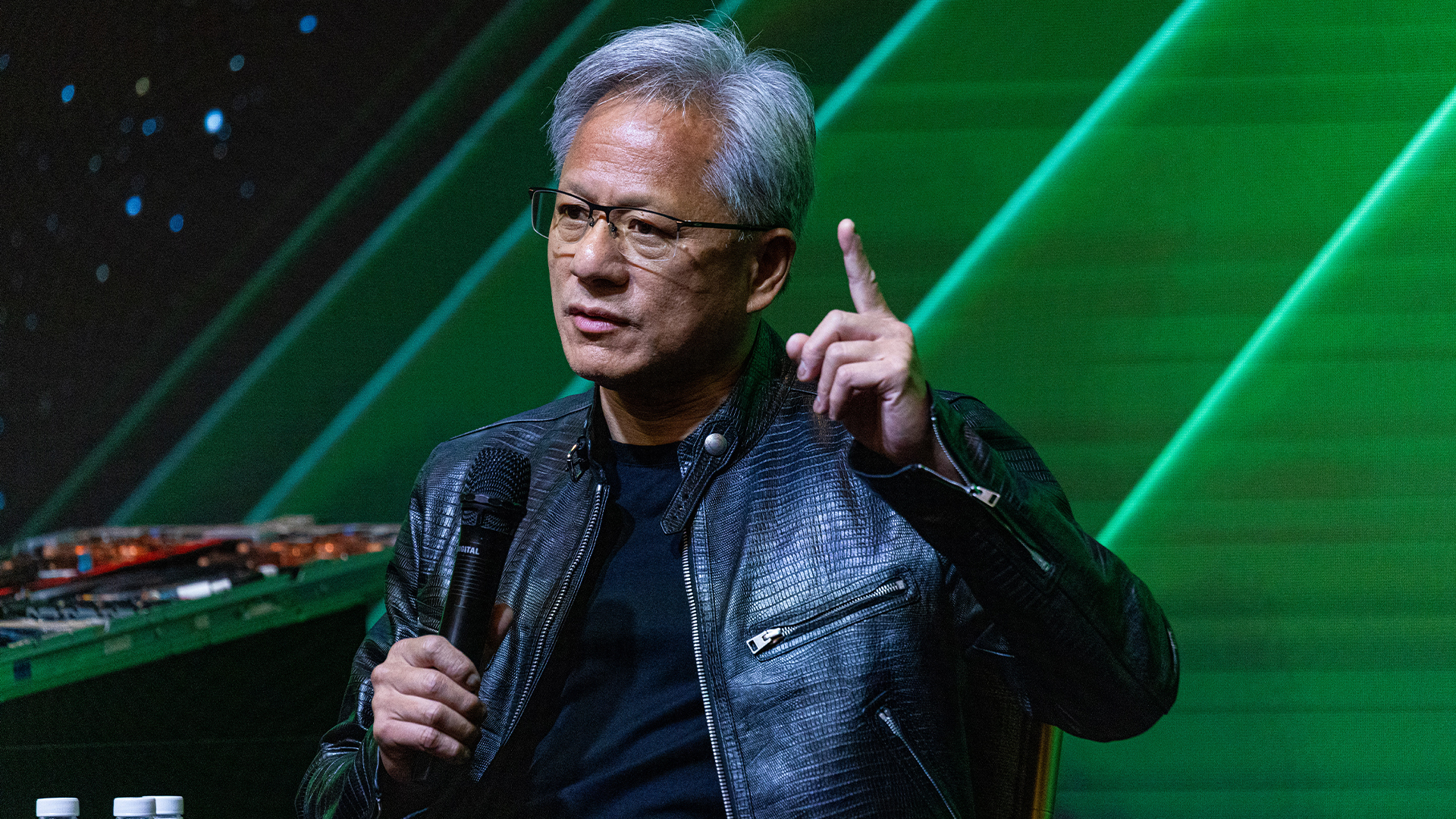

In particular, they’re concerned the acquisition could result in Nvidia transferring jobs and operations at Arm to the other side of the Atlantic. Nvidia has denied this, with CEO Jensen Huang saying it "intends to retain the name and strong brand identity" of Arm. But despite these assurances, there have been calls on the UK government to step in and block the deal.

Hermann Hause, co-founder of Arm, has been one of biggest critics of the deal. He claims that it will be “an absolute disaster for Cambridge, the UK and Europe". Meanwhile, Labour’s Ed Miliband believes that "legally binding assurances" are needed to ensure that UK-based roles aren’t lost. Are these concerns warranted, and does this deal really pose a threat to the UK tech industry?

Losing control

For many experts, the prospect of another country gaining control of Britain’s biggest technology company is a massive concern. Jake Moore, security specialist at ESET, says: “A foreign takeover of Britain’s most successful tech company will always send shivers down the industry’s spine.

“Losing the business to overseas and inevitably placing jobs on the line will always worry the industry. It’s losing yet another piece of armour to foreign soil, surrendering one of the industry’s most famous companies.”

But Moore points out that Nvidia’s acquisition of Arm doesn’t just present economic challenges; he believes there are also security concerns surrounding the deal. “Companies will always be acquired, but the loss of control goes far deeper than just financial reasons. Security threats that we don’t even know are possibly more worrying when ownership is handed over,” he explains.

“The internet is already full of unknowns. But this is increased in company acquisitions, especially when it’s unknown how the company manages its data, which can concern governments. Cyber due diligence is vital, yet rarely a game changer. It does, however, highlight the change for UK tech sovereignty.”

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Paolo Pescatore, tech, media and telco analyst at PP Foresight, agrees that the acquisition could have huge implications. He tells IT Pro: “Deals of this magnitude inevitably lead to significant cost cutting measures. Therefore, there will be huge uncertainty as to whether jobs will be cut, offices closed and operations relocated.

“This could potentially have an impact on the UK tech industry, more so at a time when the UK is looking to reposition itself as a global hub for innovation in technology and connectivity.”

US restrictions

If the deal is approved and goes ahead, some experts are worried that UK-based companies using Arm technologies could suffer in the long-term. Harman Singh, director at cyber security services firm Cyphere, says: “One of the biggest threats is the UK companies that incorporate Arm chip designs in their products may suffer due to this deal. There have been no US export controls exemptions promised so far to UK companies.

“It's Nvidia's bosses who sit across the pond and all decisions will be made there. A lot of UK companies that work in the China market, for example, may face the heat due to US/China relations as well as possible export restrictions.”

He also expresses concern about potential job losses in Cambridge. “There may be hundreds of jobs at risk as there is no formal job assurance (as seen or read so far) by Nvidia. Our country's CMA (Competition and Markets Authority) should perform a review of this deal keeping in mind financial impact on the local market,” says Singh.

Russ Shaw, founder of Tech London Advocates, also warns of potentially devastating consequences if Nvidia starts making changes to Arm’s UK operations. “We could potentially see British tech jobs under threat, as well as crucial expertise and IP moved to the US. With Brexit and COVID-19 already adversely affecting foreign tech talent from remaining in the UK, this would surely act as a further catalyst for a brain drain,” he says.

Shaw says the deal could limit the UK's leverage in tech diplomacy, which could be catastrophic as the country looks to negotiate trade deals globally. He explains: “Should the political and diplomatic relationship with the US sour, the Trump Administration could feasibly place trade restrictions on the UK similar to those currently affecting China, preventing the UK from using its own micro-chips and design capability. More broadly, international tech collaboration could further suffer, as the US government would be able to prevent Chinese companies’ access to a Nvidia-owned Arm in the same way that it has been doing with Huawei.”

Being positive

While many aspects of this takeover are uncertain, some members of the British tech community are more optimistic. Chris Greenwood, general manager of UK&I at NetApp, says: "I believe this acquisition will give local technology entrepreneurs a shot in the arm to help propel the UK out of the recession by inspiring the next generation of UK tech success stories.

“There are reasons to be positive. Firstly, the acquisition proves UK-built technology has global credibility. Secondly, the wider availability of high-performance cloud computing at manageable costs is powering Nvidia’s artificial intelligence (AI) proposition. Our sector and government should be confident that British technological innovation will continue post-Arm."

Dr Andrew Rogoyski, an independent technology advisor, says Nvidia will make an interesting owner of Arm. “It’s a company with grand ambitions who has transformed itself from a leading GPU manufacturer to one of the world’s biggest chip manufacturers. Acquiring Arm could place it at the head of next generation technologies for mobile, AI, low-energy and IoT technologies,” he explains.

“Nvidia has made some very creative investments in AI hardware, repurposing their GPU technologies for deep learning applications and other AI techniques. AI is certainly one of the ‘next big things’ and if the acquisition of Arm is part of this roadmap then we can expect some truly remarkable developments.”

But he expresses concern around changes to Arm’s business model, should the deal go ahead. He explains: “The problem with the sale to Nvidia is that it breaks Arm’s business model, which currently depends on being able to sell its innovations to all the major tech companies. If Nvidia tries to leverage the advantages Arm innovations brings it, favouring certain companies, it may break that model.”

On the face of things, a $40 billion takeover of a British-born and bred technology company appears to be a huge vote of confidence for the UK tech industry during times of economic uncertainty. But it’s clear that the deal is far from perfect and could have huge consequences for the sector not just in its home country but around the world.

Nicholas Fearn is a freelance technology journalist and copywriter from the Welsh valleys. His work has appeared in publications such as the FT, the Independent, the Daily Telegraph, the Next Web, T3, Android Central, Computer Weekly, and many others. He also happens to be a diehard Mariah Carey fan. You can follow Nicholas on Twitter.

-

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Startups get seal of approval from CrowdStrike, AWS, and Nvidia

Startups get seal of approval from CrowdStrike, AWS, and NvidiaNews 35 startups are promised mentorship, technical expertise, go-to-market support, and ecosystem visibility

-

Microsoft and Nvidia are teaming up again to support UK startups

Microsoft and Nvidia are teaming up again to support UK startupsNews Agentic Launchpad will offer participants AI expertise, training and networking, and marketing support

-

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investment

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investmentNews Microsoft CEO Satya Nadella says it's commitment to the UK is "stronger than ever" after the tech giant pledged $30bn to expand AI infrastructure and build a new supercomputer.

-

Europe's first exascale supercomputer, Jupiter, is now live

Europe's first exascale supercomputer, Jupiter, is now liveNews Planned uses for Jupiter include climate research, medical research and the development of multi-language LLMs

-

Why does Nvidia have a no-chip quantum strategy?

Why does Nvidia have a no-chip quantum strategy?As the world’s leading manufacturer of GPUs, Nvidia’s approach to quantum computing has left many experts baffled

-

AMD to cut around 1,000 staff to focus on "growth opportunities"

AMD to cut around 1,000 staff to focus on "growth opportunities"News The AMD layoffs come after rival Intel cut staff on the back of flagging AI returns

-

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South East

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South EastNews Microsoft and Nvidia have teamed up to launch a generative AI accelerator for UK startups.

-

Nvidia promises to give Californians free AI training with new initiative

Nvidia promises to give Californians free AI training with new initiativeNews A new partnership between Nvidia and the state of California promises to help train 100,000 residents in AI skills and give academic institutions better access to hardware