Why does Nvidia have a no-chip quantum strategy?

As the world’s leading manufacturer of GPUs, Nvidia’s approach to quantum computing has left many experts baffled

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

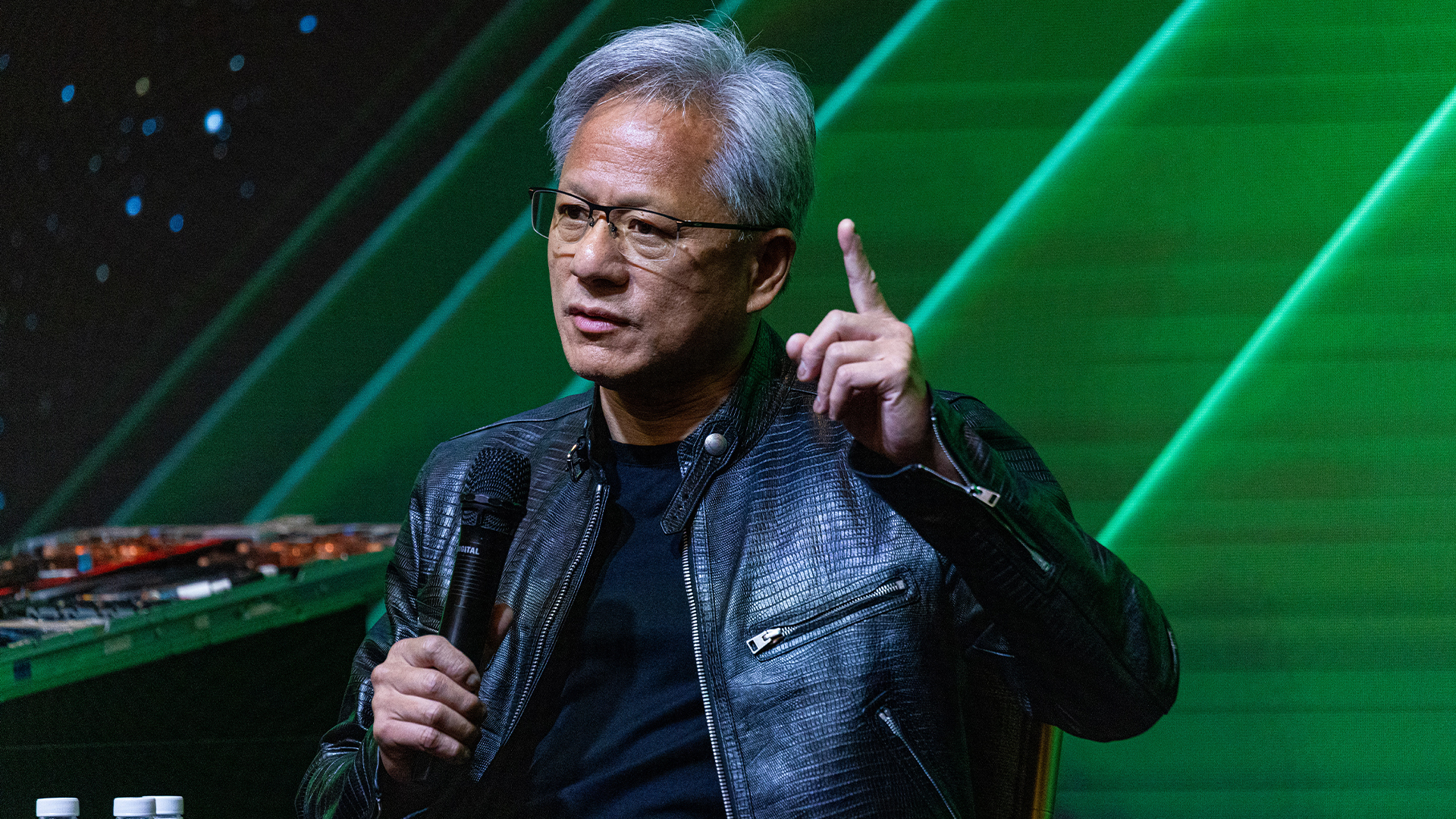

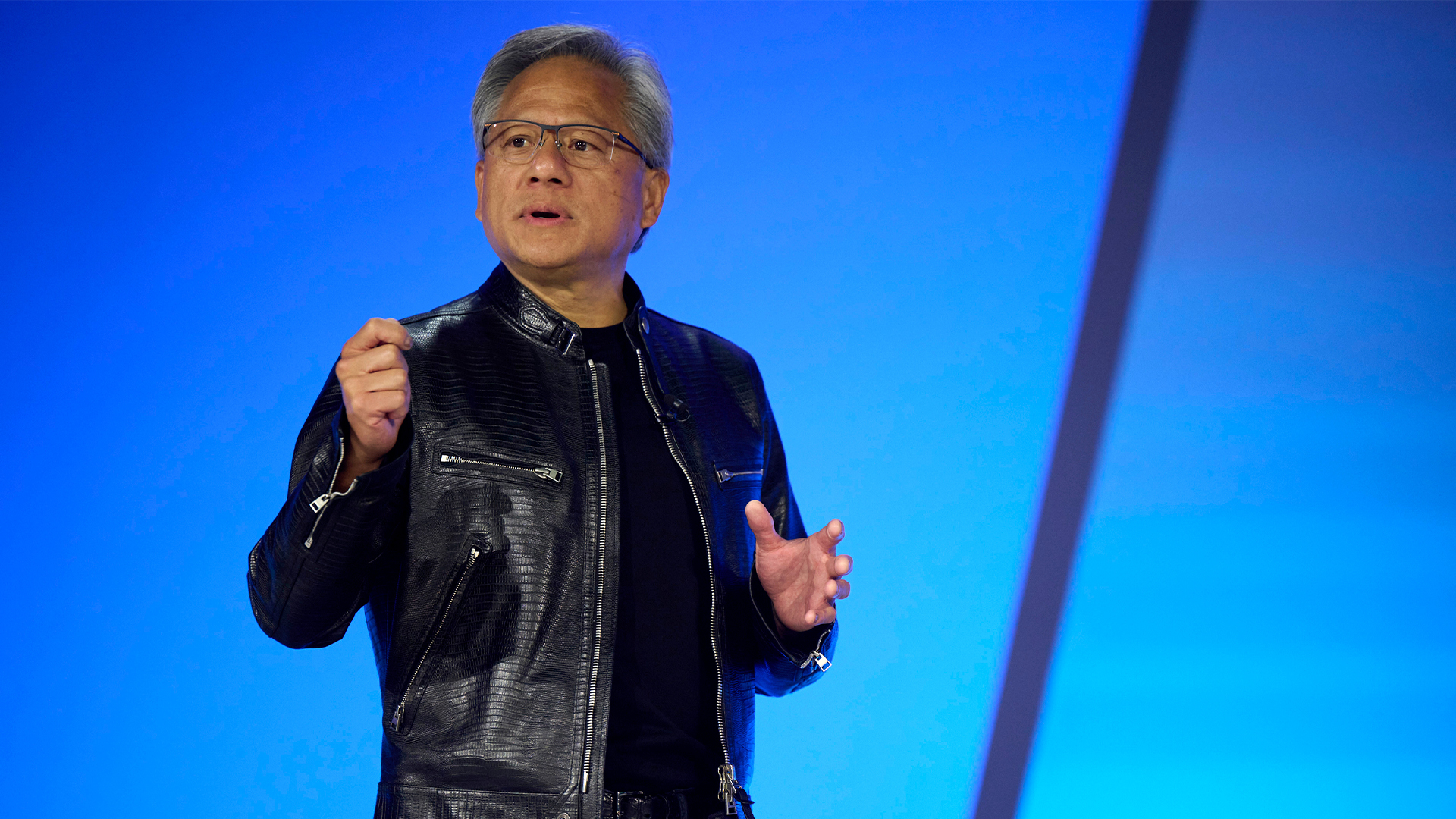

At the start of 2025, Nvidia CEO Jensen Huang caused the stock valuations of leading quantum computing companies to plummet by up to 40% (including Nvidia partners such as IonQ and Rigetti) when he claimed that a “very useful quantum computer” was at least two decades away.

“If you kind of said 15 years for very useful quantum computers, that'd probably be on the early side,” Huang said, during Nvidia's financial analyst day at the Consumer Electronics Show. “If you said 30, it’s probably on the late side. But if you picked 20, I think a whole bunch of us would believe it."

In the following weeks, there was a significant response from the quantum computing industry and quantum stocks tumbled. It was at Nvidia’s GTC event in March, during a panel where a number of affected quantum computing companies were in attendance, that Huang delivered a mea culpa of sorts and explained what was behind his comments.

“Building Nvidia and CUDA, and turning it into the computing platform it is today, has taken us over 20 years. So, the idea of time horizons of five, ten, 15, 20 years is really nothing to me. And of course quantum computing has the potential and the hope, all of our hopes, that it will deliver extraordinary impact,” Huang said.

“But the technology is insanely complicated, so the idea that it would take years to achieve was something that one: I would expect. Two: because of the complexity of it and the grand impact it would have, is something that we should expect.”

The panel provided a fascinating glimpse into the world of quantum computing. But it also posed a number of questions, notably around Nvidia’s own quantum strategy.

“We’re not trying to build qubits”

With Nvidia being world’s largest supplier of graphics processing units (GPUs), and one of the world’s most valuable companies, ranking second for global market cap at the time of publishing, Huang’s statements served as a stark reminder that the company isn’t planning to produce its own quantum processing unit (QPU).

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“Nvidia is not trying to build quantum hardware,” explained Nicholas Harrigan, product marketing manager for quantum at Nvidia, in a promotional video. “We're not trying to build qubits, we're not trying to build a quantum processor. But we are trying to build a device that will turn those qubits into a useful quantum computer, and we call that device an accelerated quantum supercomputer.”

On the face of it, this may seem like an odd decision, especially when you consider the strategy of Nvidia’s peers. For example, Intel made its Tunnel Falls quantum processor available to developers and researchers in 2023. At the end of 2024, Google announced that it was creating its own quantum chip, Willow (using the same underlying tech as IBM). And, at the start of 2025, Microsoft announced its Majorana 1 quantum chip.

However, when you dig a little deeper, the decision makes more sense. Intel’s chip is created using silicon-spin qubits. Google (like IBM) uses superconducting qubits. Microsoft has opted for topological qubits. And there are other qubit technologies in the mix, too, such as trapped ions, neutral atoms, quantum annealing, and photonics.

"We can understand the strategy – staying chip-agnostic seems to be the strategically right call for now," says Arit Kumar Bishwas, director at PwC Innovation Hub.

"Nvidia is monetizing quantum today through software and hybrid systems while letting startups absorb the hardware risk. The strategy maximizes leverage from its GPU dominance, buys time for the physics to shake out, and preserves the option to dive into chips later, either via acquisition or joint ventures.

“They might be monitoring ecosystem wins and latency metrics; the day a hardware winner becomes obvious, maybe the expectation is to move swiftly (and capital-intensively) down-stack.”

Building on CUDA-Q

Rather than create its own quantum processing unit, Nvidia’s strategy is to take an ecumenical approach to quantum qubit technology. It is concentrating on the provision of AI factories, using software platforms that take advantage of Nvidia’s expertise in GPU-acceleration.

“The world is racing to build state-of-the-art large scale AI factories,” Huang said. “In a fab [semiconductor fabrication plant], there's the factory that manufactures the wafers, and then there's the factory that manufactures the information to manufacture the wafers. Every industry that has factories will have two factories in the future: the factory for what they build, and the factory for the AI.”

At the heart of Nvidia’s strategy is software called CUDA-Q, which is an open source quantum development platform that can run useful, large-scale quantum computing applications.

“We don't build quantum computers, but we are deeply integrated into the quantum computing industry, and we create libraries,” said Harrigan. “Software is just as important as hardware, and that's why we've built CUDA-Q, our software platform that allows users to seamlessly both access and control large scale accelerated quantum supercomputers.”

The Nvidia Accelerated Quantum Research Center

To help researchers and quantum hardware companies develop on its platform, Nvidia will be opening a new research center in Boston, which it says will be operational by the end of 2025. The NVIDIA Accelerated Quantum Research Center (NVAQC) will integrate leading quantum hardware with AI supercomputers, enabling what Nvidia refers to as ‘accelerated quantum supercomputing’.

“The Nvidia Accelerated Quantum Research Center will provide EQuS group researchers with unprecedented access to technologies and expertise needed to solve the challenges of useful quantum computing,” said William Oliver, director of the MIT Center for Quantum Engineering, in the announcement’s press release.

“We anticipate the future will also include other members of the Center for Quantum Engineering at MIT. Integrating the Nvidia accelerated computing platform with qubits will help tackle core challenges like quantum error correction, hybrid application development, and quantum device characterization.”

The Center will work with companies and research groups including Quantinuum, Quantum Machines, QuEra Computing, Harvard Quantum Initiative in Science and Engineering (HQI), and the Engineering Quantum Systems (EQuS) group at the Massachusetts Institute of Technology (MIT).

“One key part of quantum computing is developing software. And people always talk about a million qubits. But writing software for a million qubits is not easy,” said Avinash Palaniswamy, chief commercial officer at Quantinuum, in the same promotional video as Harrigan. “Where Nvidia is really useful is they also provide libraries, which run on GPUs. So in the software development flow, as long as we need to develop software for quantum computers, you will have to have the Nvidia technology there to develop those scaled qubits.”

The question of whether removing itself from the race for qubit development is a good decision could take decades to answer, especially if we follow Huang’s January timeline for the development of a “very useful” quantum computer. But, in doing so, Nvidia can continue to focus its hardware efforts on the present, which is dominated by AI infrastructure.

Dan Oliver is a writer and B2B content marketing specialist with years of experience in the field. In addition to his work for ITPro, he has written for brands including TechRadar, T3 magazine, and The Sunday Times.

-

CISOs are keen on agentic AI, but they’re not going all-in yet

CISOs are keen on agentic AI, but they’re not going all-in yetNews Many security leaders face acute talent shortages and are looking to upskill workers

-

Why Amazon’s ‘go build it’ AI strategy aligns with OpenAI’s big enterprise push

Why Amazon’s ‘go build it’ AI strategy aligns with OpenAI’s big enterprise pushNews OpenAI and Amazon are both vying to offer customers DIY-style AI development services

-

Startups get seal of approval from CrowdStrike, AWS, and Nvidia

Startups get seal of approval from CrowdStrike, AWS, and NvidiaNews 35 startups are promised mentorship, technical expertise, go-to-market support, and ecosystem visibility

-

Microsoft and Nvidia are teaming up again to support UK startups

Microsoft and Nvidia are teaming up again to support UK startupsNews Agentic Launchpad will offer participants AI expertise, training and networking, and marketing support

-

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investment

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investmentNews Microsoft CEO Satya Nadella says it's commitment to the UK is "stronger than ever" after the tech giant pledged $30bn to expand AI infrastructure and build a new supercomputer.

-

Europe's first exascale supercomputer, Jupiter, is now live

Europe's first exascale supercomputer, Jupiter, is now liveNews Planned uses for Jupiter include climate research, medical research and the development of multi-language LLMs

-

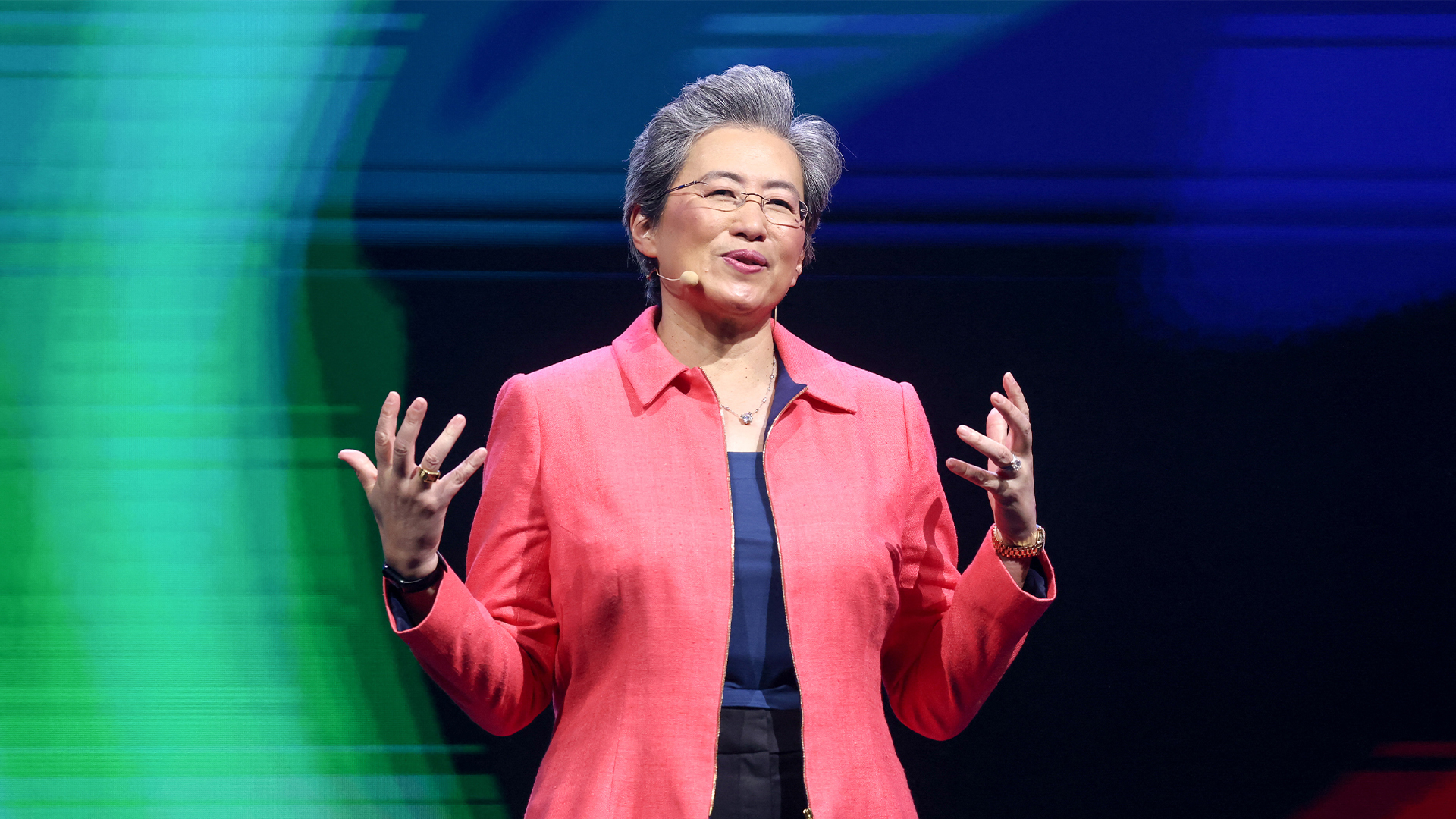

AMD to cut around 1,000 staff to focus on "growth opportunities"

AMD to cut around 1,000 staff to focus on "growth opportunities"News The AMD layoffs come after rival Intel cut staff on the back of flagging AI returns

-

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South East

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South EastNews Microsoft and Nvidia have teamed up to launch a generative AI accelerator for UK startups.

-

Nvidia promises to give Californians free AI training with new initiative

Nvidia promises to give Californians free AI training with new initiativeNews A new partnership between Nvidia and the state of California promises to help train 100,000 residents in AI skills and give academic institutions better access to hardware

-

Jensen Huang has taken Nvidia to the top – but he says the 'suffering' wasn't really worth it

Jensen Huang has taken Nvidia to the top – but he says the 'suffering' wasn't really worth itNews Nvidia’s Jensen Huang waxed lyrical about the trials and tribulations of turning a startup into a trillion-dollar company