Toshiba receives £14.5 billion takeover bid

The offer comes from CVC Capital Partners, which has an office in London and its official headquarters in Luxembourg

Toshiba has confirmed that it has received a proposal to be acquired by CVC Capital Partners, a Luxembourg-based private equity firm.

In a note published on its website, the company said: “Toshiba received an initial proposal yesterday, and will ask for further clarification and give it careful consideration. The company will make a further announcement in due course.”

The offer, which is for a reported $20 billion (£14.5 billion), came from private equity firm CVC Capital Partners, which has an office in London and its official headquarters in Luxembourg.

Toshiba has had a rocky few years which saw it hit by scandals and forced to sell parts of its business. Over a period of seven years, the Japanese tech giant claimed its profits were $1.3bn higher than they really were, which became known as the Toshiba accounting scandal in 2015. Japan’s Securities and Exchange Surveillance Commission recommended a $60 million penalty to the firm following the accounting fraud.

Toshiba’s president and vice-president left the company as an independent panel found it had overstated its profits.

RELATED RESOURCE

IT Pro 20/20: Meet the companies leaving the office for good

The 15th issue of IT Pro 20/20 looks at the nature of operating a business in 2021

In 2017, the company was facing up to $5 billion in losses and attempted to sell its memory chip business in an attempt to raise money. It experienced difficulty as its joint-venture partner, Western Digital, was concerned the sale might violate the companies’ contract. The two companies fell out, particularly as one of Western Digital’s rivals tried to participate in a bidding consortium for the business. Ultimately, Toshiba sold its flash memory unit for $18 billion to a group led by Bain capital.

Furthermore, the company was looking to offload its memory chip unit in 2020 by selling a 40.2% stake in flash memory chip manufacturer Kioxia Holdings. It reportedly wanted to escape the volatility of the semiconductor market.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

A few months later, Toshiba officially exited the laptop business after a 35-year run. It sold its remaining 19.9% stake in the Dynabook laptop brand to Sharp. The sale came two years after Sharp bought an 80.1% stake of Toshiba’s PC business for $36 million (£27 million).

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

OpenAI sets February retirement date for popular GPT-4o model

OpenAI sets February retirement date for popular GPT-4o modelNews OpenAI has confirmed plans to retire its popular GPT-4o model in February, citing increased uptake of its newer GPT-5 model range.

-

ITPro Podcast: Amazon layoffs and the return of XPS

ITPro Podcast: Amazon layoffs and the return of XPSITPro Podcast This year's tech layoffs have just begun, as Amazon sheds 16,000 workers in one go

-

Boomi snaps up former MuleSoft executive as APJ channel lead

Boomi snaps up former MuleSoft executive as APJ channel leadNews Global software veteran Jim Fisher will work to expand the company’s channel operations across the region

-

Why Microsoft Teams has only just launched in China

Why Microsoft Teams has only just launched in ChinaNews The tech giant has officially launched Teams via its local partner in China, after it was launched globally in 2017

-

What the UK can learn from the rest of the world when it comes to the shift to IP

What the UK can learn from the rest of the world when it comes to the shift to IPSponsored From the Netherlands to Singapore, UK organisations can learn lessons from forward-thinking countries and make the PSTN switchover as seamless as possible

-

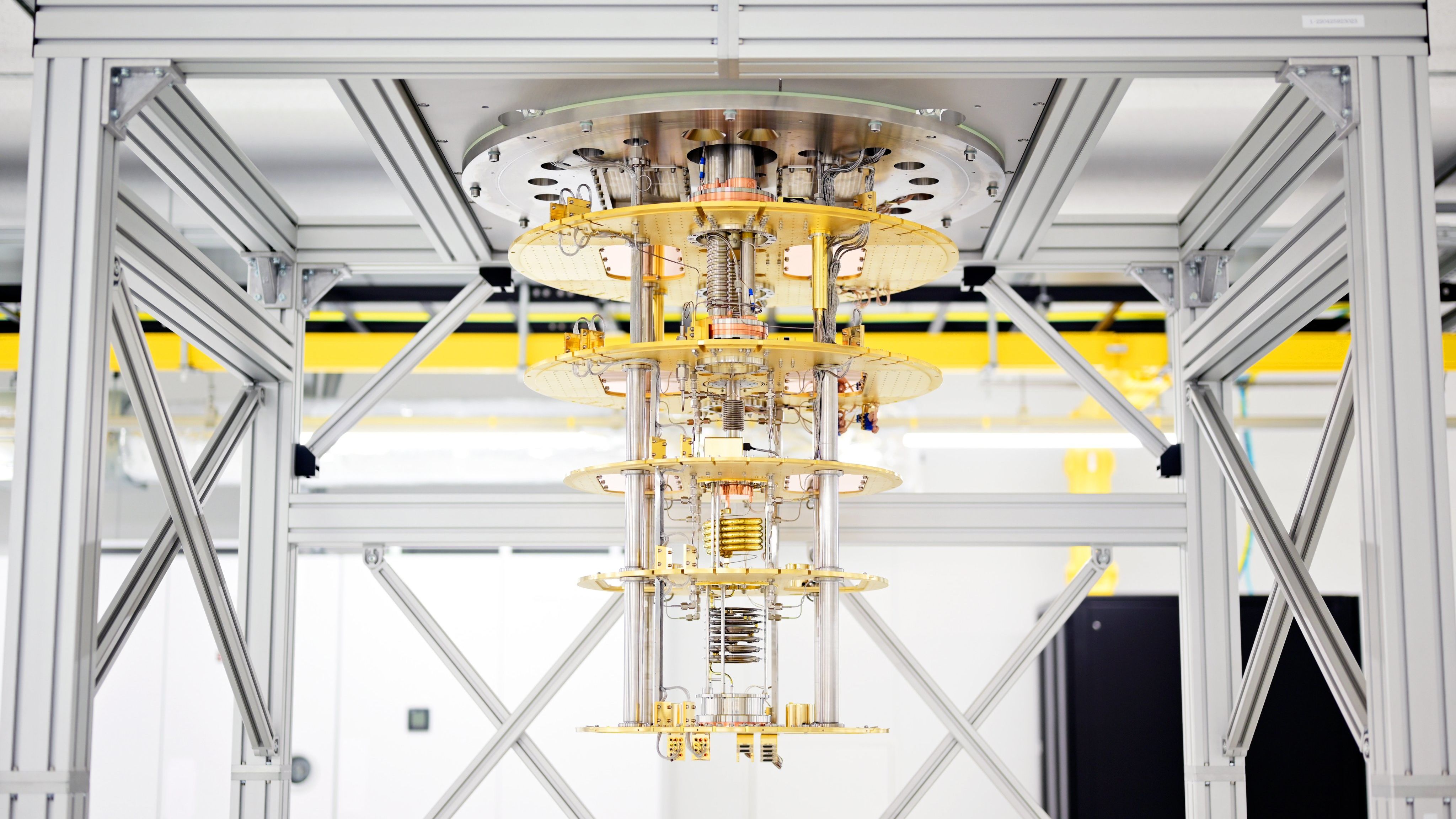

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

-

The big PSTN switch off: What’s happening between now and 2025?

The big PSTN switch off: What’s happening between now and 2025?Sponsored The challenges of adopting IP telephony can be overcome, but you don't have long to act

-

MI5 to establish new security agency to counter Chinese hacking, espionage

MI5 to establish new security agency to counter Chinese hacking, espionageNews The new organisation has been compared to GCHQ’s NCSC, and will provide companies advice on how to deal with Chinese companies or carry out business in China

-

UK set to appoint second-ever tech envoy to Indo-Pacific region

UK set to appoint second-ever tech envoy to Indo-Pacific regionNews The role will focus on India after Joe White was made the first technology envoy, a role focused on the US, in 2020

-

Wipro faces criticism after cutting graduate salaries by nearly 50%

Wipro faces criticism after cutting graduate salaries by nearly 50%News Graduates were given days to decide whether they would accept greatly reduced pay offers, prompting union action