Nvidia warns rivals are exploiting uncertainty surrounding Arm’s future

The company claims Intel and AMD have been getting ahead due to the drawn-out regulatory process

Nvidia has warned that Arm’s competitors are getting ahead as a result of the company having to grapple with regulatory hurdles surrounding its acquisition of the British chipmaker.

The government ordered the CMA to carry out a “phase two” investigation in November last year to further scrutinise the proposed acquisition. During this part of the investigation, the CMA would consider whether the acquisition of Arm by the US chip giant is a threat to competition and national security.

In Nvidia and Arm’s initial Phase 2 submission, the companies have published their response and warned that while they are engaging with regulators, Arm’s competition has been exploiting the delay and moving fast. Nvidia, SoftBank, and Arm underlined they have been working with regulators at the CMA and worldwide for over a year, while Intel, Qualcomm, and Arm’s other competition continue to expand their offerings and exploit the uncertainty surrounding Arm’s future.

An example of this is in March 2021, several months after Nvidia and Softbank announced the acquisition, when Intel announced it will license its dominant x86 CPU IP to chip designers as part of its foundry services (IFS), according to the submission. Intel called IFS a “meaningful shift in how people think about Arm versus x86.”

Nvidia and Arm said that Intel is already competing head-to-head with Arm to supply CPU IP for important customers, targeting cloud service providers. They added that IFS is a strong challenge to Arm’s efforts in the data centre and PC markets.

“Customization was Arm’s greatest selling point in the data centre, as Arm does not have the mature ecosystem or massive R&D resources that Intel can bring to bear,” they stated. “Now Arm’s handful of data centre customers can create custom x86 CPUs that will benefit from the massive x86 code base.”

The companies went on to emphasise that SoftBank’s investment phase has concluded, and one way or another, it intends to exit Arm. They said that regulators worldwide have considered two different outcomes for the company, to either be acquired by Nvidia, subject to legally binding commitments to expand its R&D and license Arm IP to all without bias or discrimination, or to become a profit-maximising IP licensing firm, with no other profit generators or specific legal restrictions on its licensing practices. Most importantly, there would be no binding or enforceable assurance that Arm will invest in any market or product.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

When it comes to whether Arm should have undergone an IPO, the companies said SoftBank rejected this idea in 2019 and again in 2020 as the markets would not give SoftBank the necessary return on investment.

“We contemplated an IPO but determined that the pressure to deliver short-term revenue growth and profitability would suffocate our ability to invest, expand, move fast and innovate,” said Arm’s CEO Simon Segars.

The companies added that Arm does not have the systems building expertise, the software engineering scale, or the R&D resources of x86 vendors like Intel and AMD. Even under the most optimistic projections, Arm wouldn’t be able to generate the revenue necessary to invest and compete with the entrenched x86 incumbents, said the companies.

Nvidia said it was particularly concerned that Arm would be forced to deprioritise data centre and PC and instead focus on its core mobile and growing IoT business, which would result in a concentrated CPU market largely controlled by Intel and AMD, with the remainder controlled by powerful and far more profitable Arm architectural licensees.

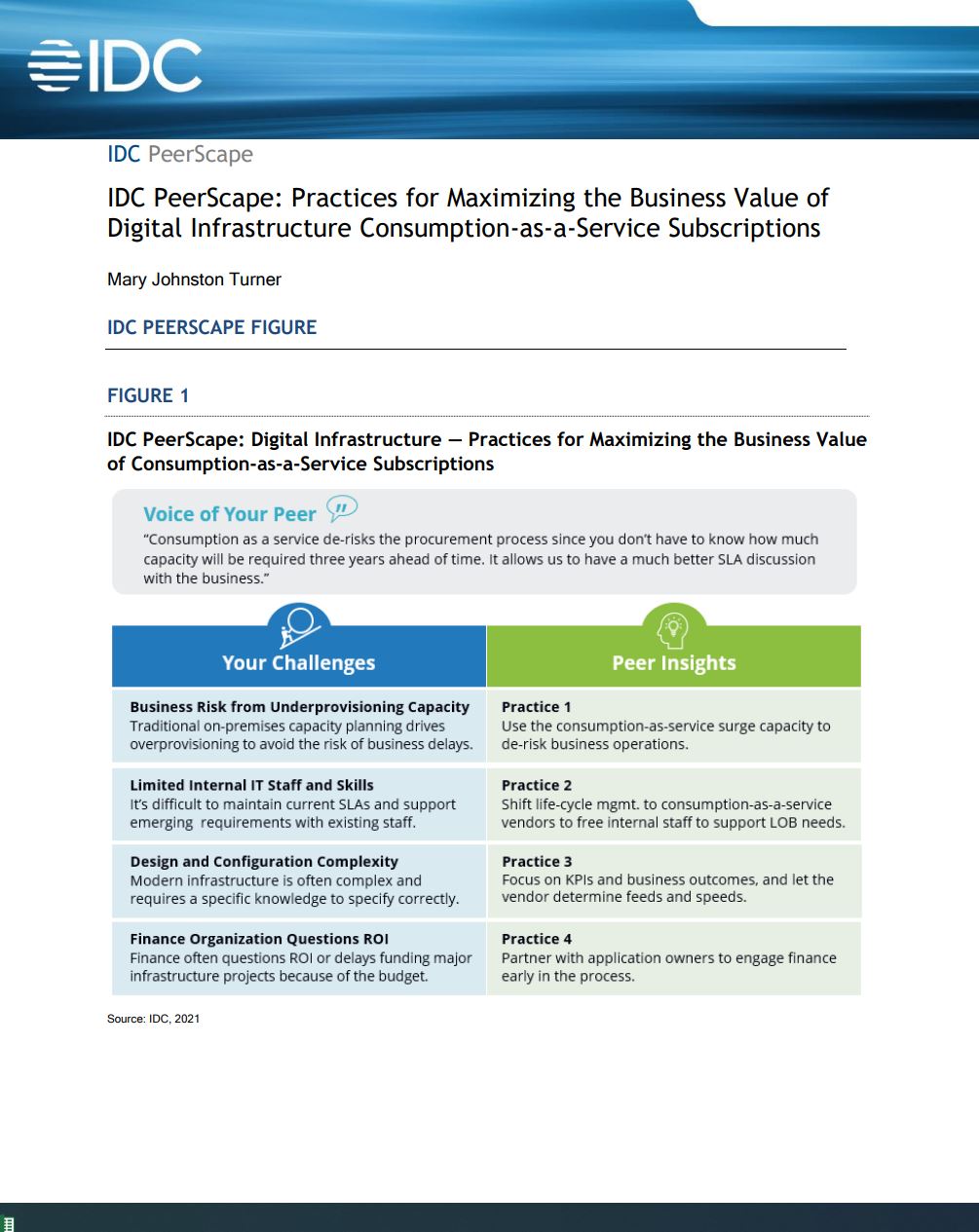

RELATED RESOURCE

Practices for maximising the business value of digital infrastructure Consumption-as- a-Service subscriptions

IDC PeerScape

Nvidia emphasised it has offered comprehensive guarantees, which Arm does not provide today and would not provide if it went through an IPO. This includes implementing an open license programme, expanding Arm’s R&D in the UK and supporting its product roadmaps, promoting interoperability and allowing customers to determine it as they see fit, and protecting any confidential Arm customer information.

“If Arm alone could vanquish x86 in data centre and PC, its market share would not be mired in the low single digits, and tomorrow’s technologies—such as Omniverse—would be developed on Arm, not x86,” the submission concludes.

The companies argued that if the acquisition was not allowed to go ahead, it would prevent Arm from bringing competition into areas that have long been dominated by x86. The alternative, urged by deal opponents, would be a standalone, profit maximising business without any guarantees on licensing policy or investments. The companies finished by saying this would result in less investment in the UK, less resources for Arm, and less competition worldwide.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Asus Zenbook DUO (2026) review

Asus Zenbook DUO (2026) reviewReviews With a next-gen processor and some key design improvements, this is the best dual-screen laptop yet

-

Pegasystems wants to help you modernize outdated Lotus Notes applications

Pegasystems wants to help you modernize outdated Lotus Notes applicationsNews The Notes to Blueprint tool lets enterprises understand their Lotus Notes estates and get rid of broken workflows

-

The Asus Ascent GX10 is a MiniPC with supercomputer ambitions for AI developers – but it's not cheap

The Asus Ascent GX10 is a MiniPC with supercomputer ambitions for AI developers – but it's not cheapReviews The Ubuntu-on-ARM operating system could limit its appeal, but for both serious and neophyte AI developers, it's a great desktop box

-

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new marketsNews Nvidia looks set to branch out into lucrative new markets following its $5 billion investment in Intel.

-

Nvidia hails ‘another leap in the frontier of AI computing’ with Rubin GPU launch

Nvidia hails ‘another leap in the frontier of AI computing’ with Rubin GPU launchNews Set for general release in 2026, Rubin is here to solve the challenge of AI inference at scale

-

Nvidia braces for a $5.5 billion hit as tariffs reach the semiconductor industry

Nvidia braces for a $5.5 billion hit as tariffs reach the semiconductor industryNews The chipmaker says its H20 chips need a special license as its share price plummets

-

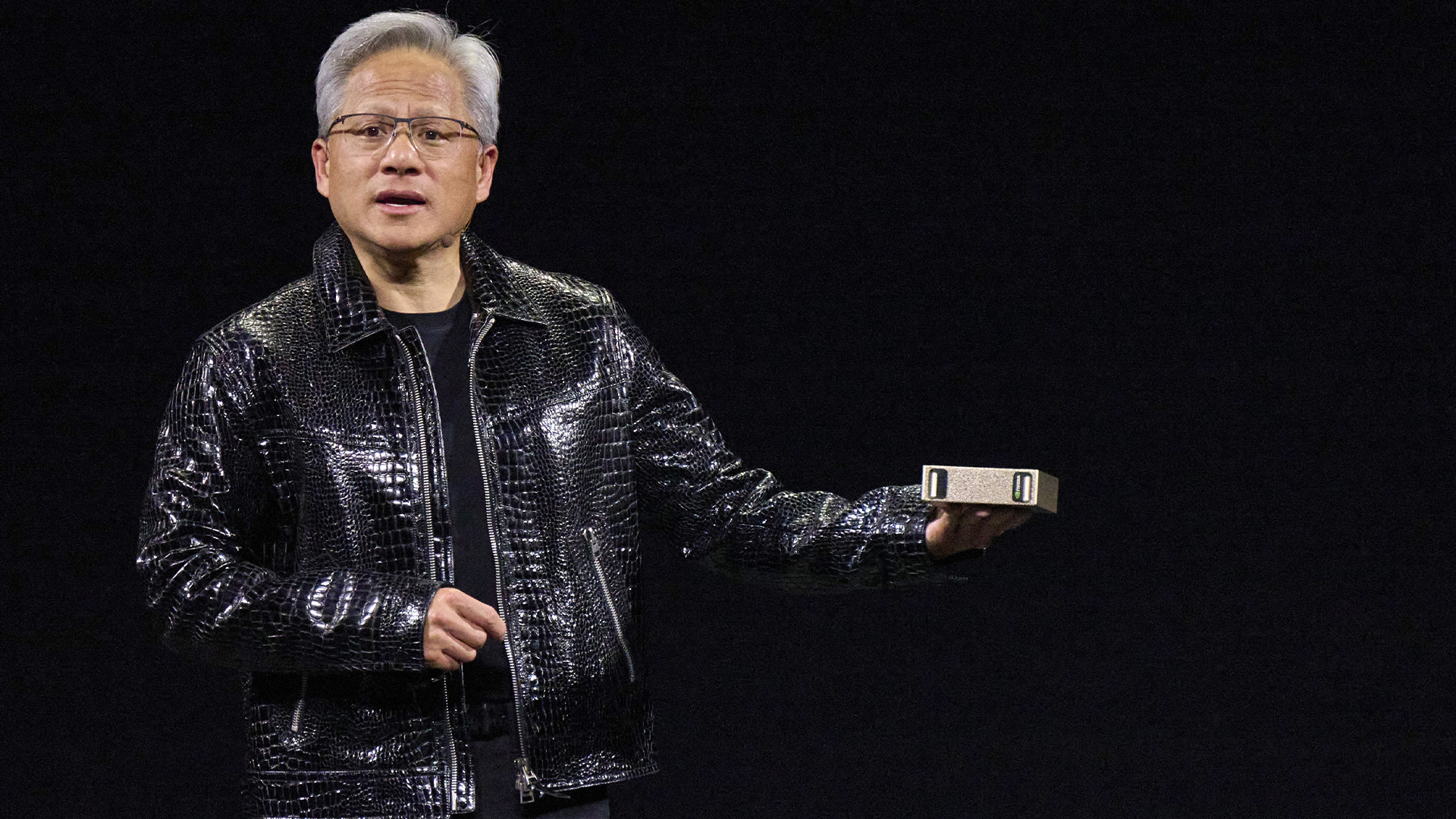

“The Grace Blackwell Superchip comes to millions of developers”: Nvidia's new 'Project Digits' mini PC is an AI developer's dream – but it'll set you back $3,000 a piece to get your hands on one

“The Grace Blackwell Superchip comes to millions of developers”: Nvidia's new 'Project Digits' mini PC is an AI developer's dream – but it'll set you back $3,000 a piece to get your hands on oneNews Nvidia unveiled the launch of a new mini PC, dubbed 'Project Digits', aimed specifically at AI developers during CES 2025.

-

Intel just won a 15-year legal battle against EU

Intel just won a 15-year legal battle against EUNews Ruled to have engaged in anti-competitive practices back in 2009, Intel has finally succeeded in overturning a record fine

-

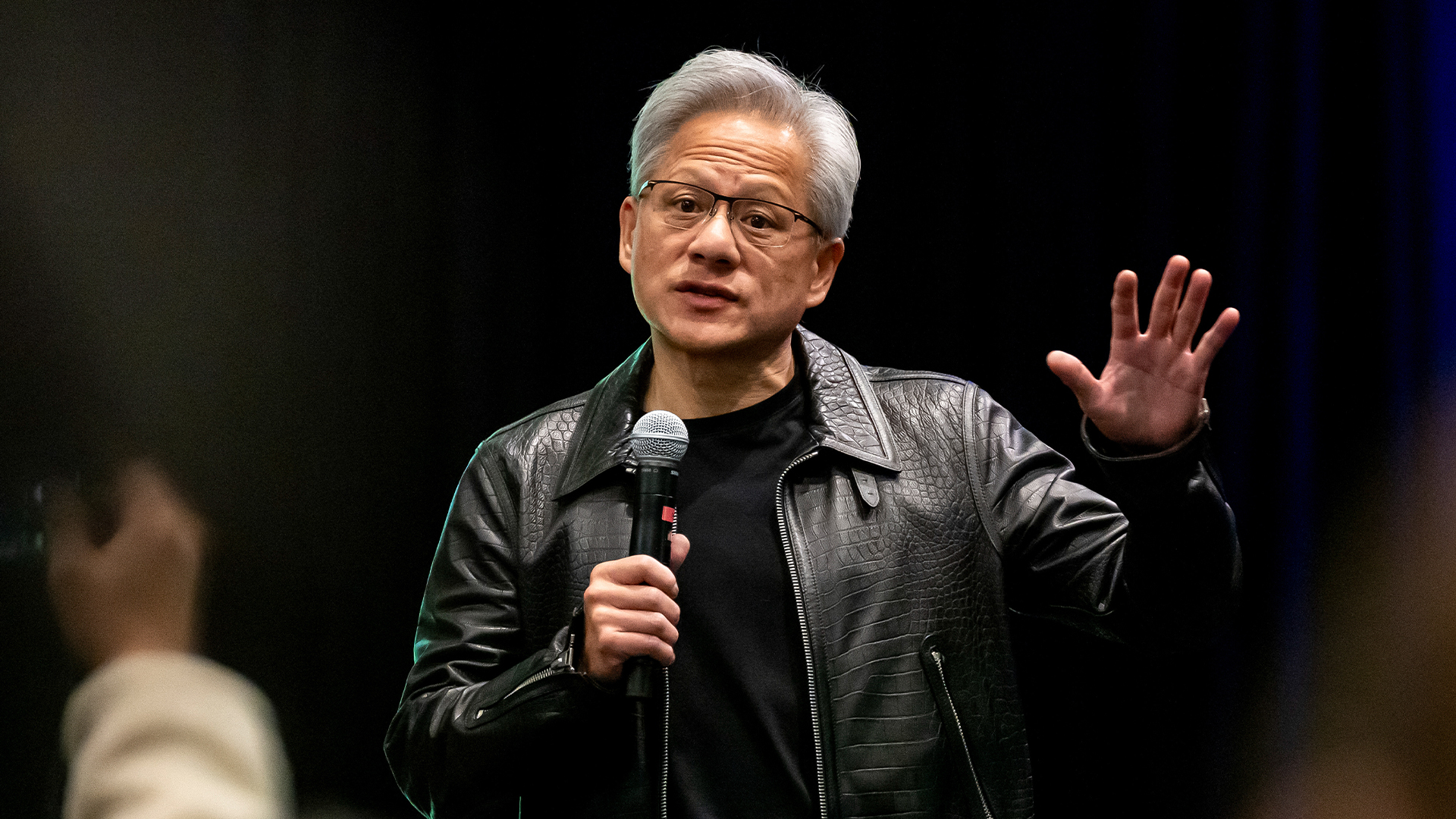

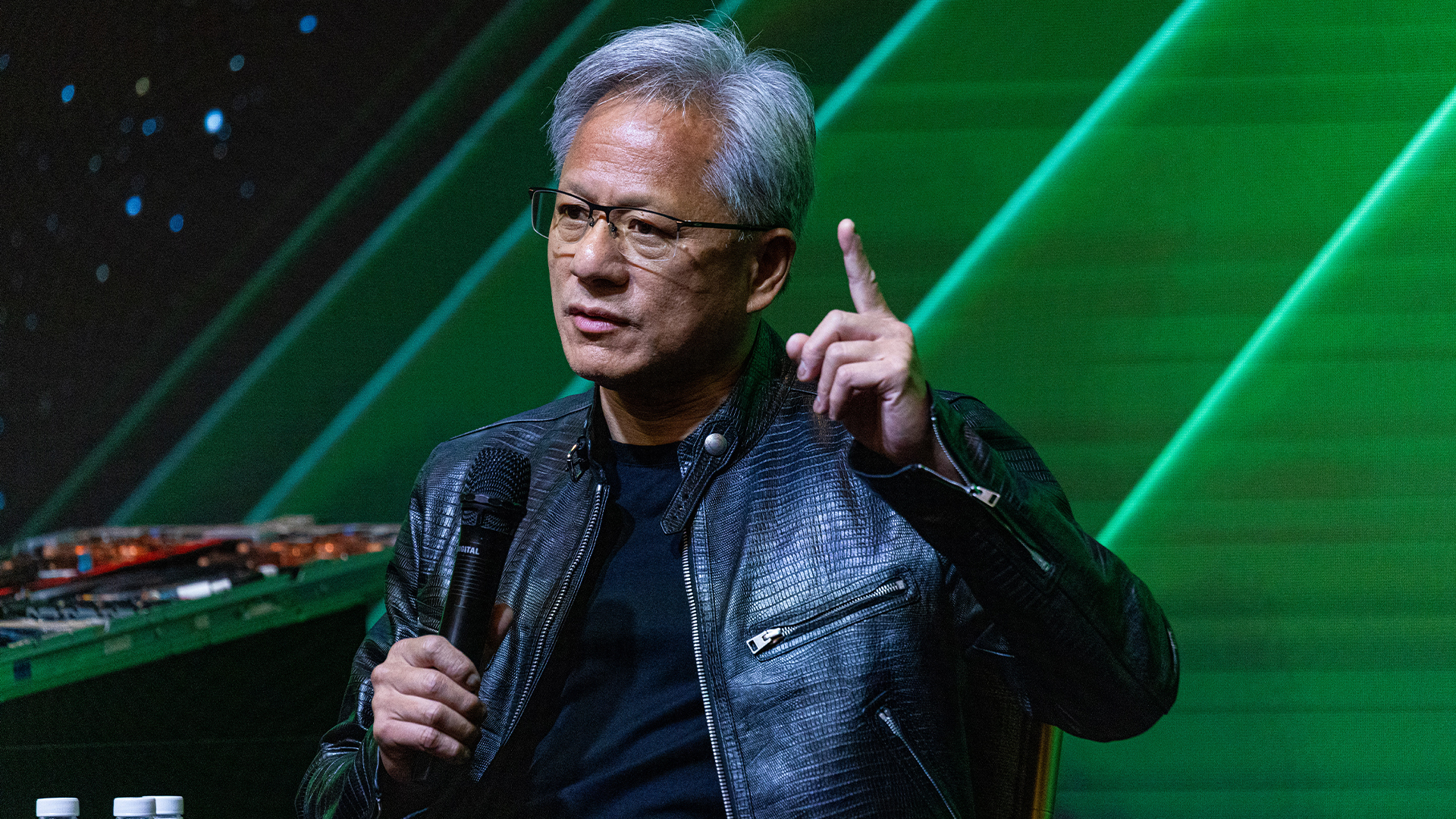

Jensen Huang just issued a big update on Nvidia's Blackwell chip flaws

Jensen Huang just issued a big update on Nvidia's Blackwell chip flawsNews Nvidia CEO Jensen Huang has confirmed that a design flaw that was impacting the expected yields from its Blackwell AI GPUs has been addressed.

-

How Nvidia took the world by storm

How Nvidia took the world by stormAnalysis Riding the AI wave has turned Nvidia into a technology industry behemoth