The AI PC is coming: Here’s what you need to know

Analysts believe a new wave of AI PC’s will spur increased tech spending in 2024

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

After a long period of decline, the PC looks primed to return to growth, thanks to the arrival of new AI PC devices optimized for generative AI.

PCs have seen seven consecutive quarters of declining sales, with inflation and a more conservative approach to tech spending among enterprises prompting a marked dip in shipments.

But that could be about to change, according to analysts, with an improved economic environment leading to a surge in sales over the holiday period and beyond into 2024.

Across next year, shipments could hit 267 million units – marking an 8% increase compared to 2023, according to analysis from Canalys.

While the need to replace aging Windows 10 devices will be a key factor behind this increase, the consultancy said a sharpened focus on the development of new AI PC models by manufacturers will play a pivotal role.

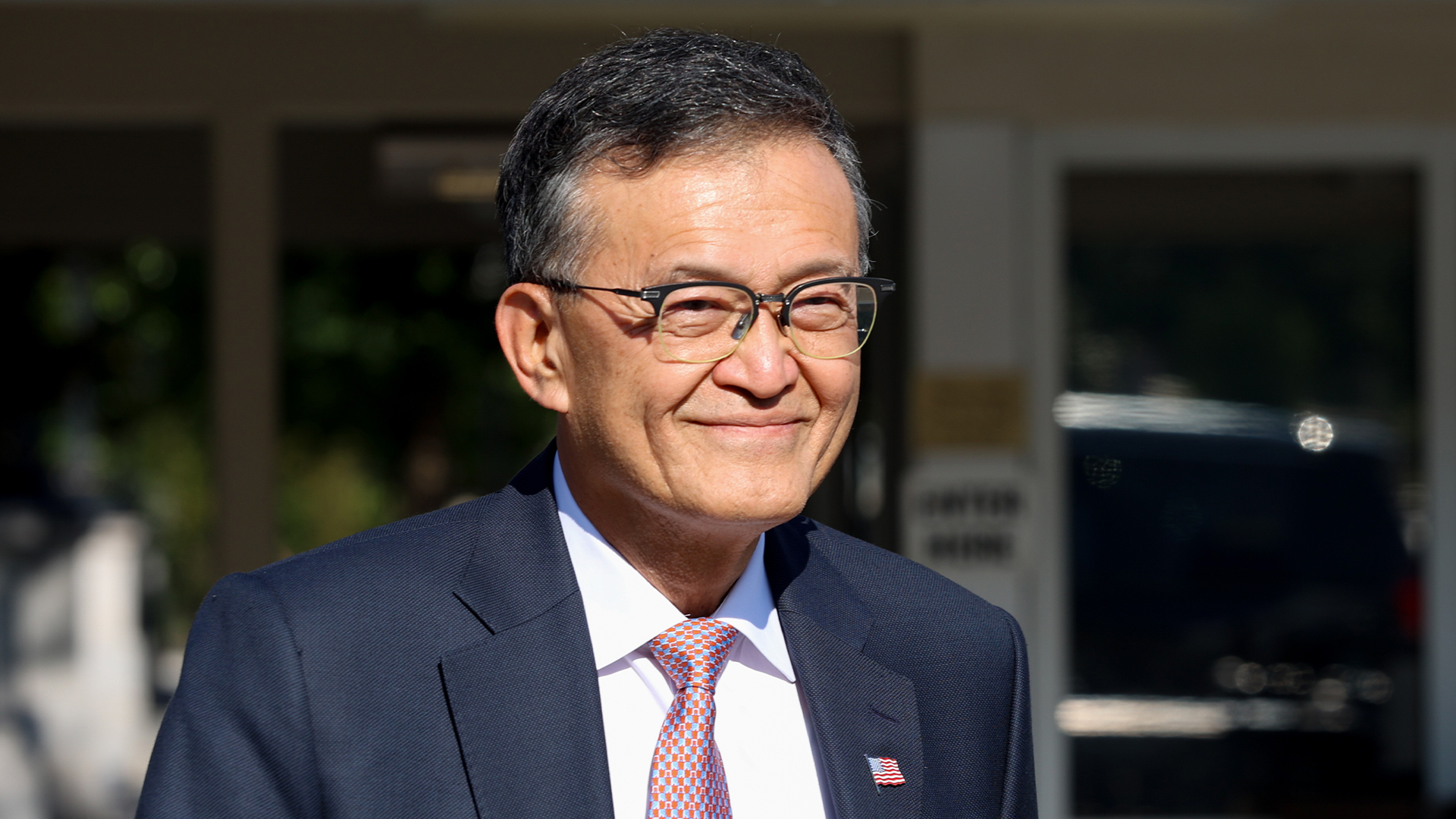

The global PC market is on a recovery path and set to return to 2019 shipment levels by next year, said Canalys analyst Ben Yeh.

"The impact of AI on the PC industry will be profound, with leading players across OEMs, processor manufacturers, and operating system providers focused on delivering new AI-capable models in 2024,” he said.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Canalys predicts that by 2027 over half (60%) of PCs will be ‘AI-capable’. It argues that the boom in generative AI will see PCs undergo a significant transformation in both hardware and software.

Hardware makers are also – unsurprisingly – upbeat about the potential here, with Intel CEO Pat Gelsinger saying earlier this month that the “AI PC will be the star of the show” in 2024.

So, what exactly is an AI PC?

Everything you need to know about the rise of the AI PC

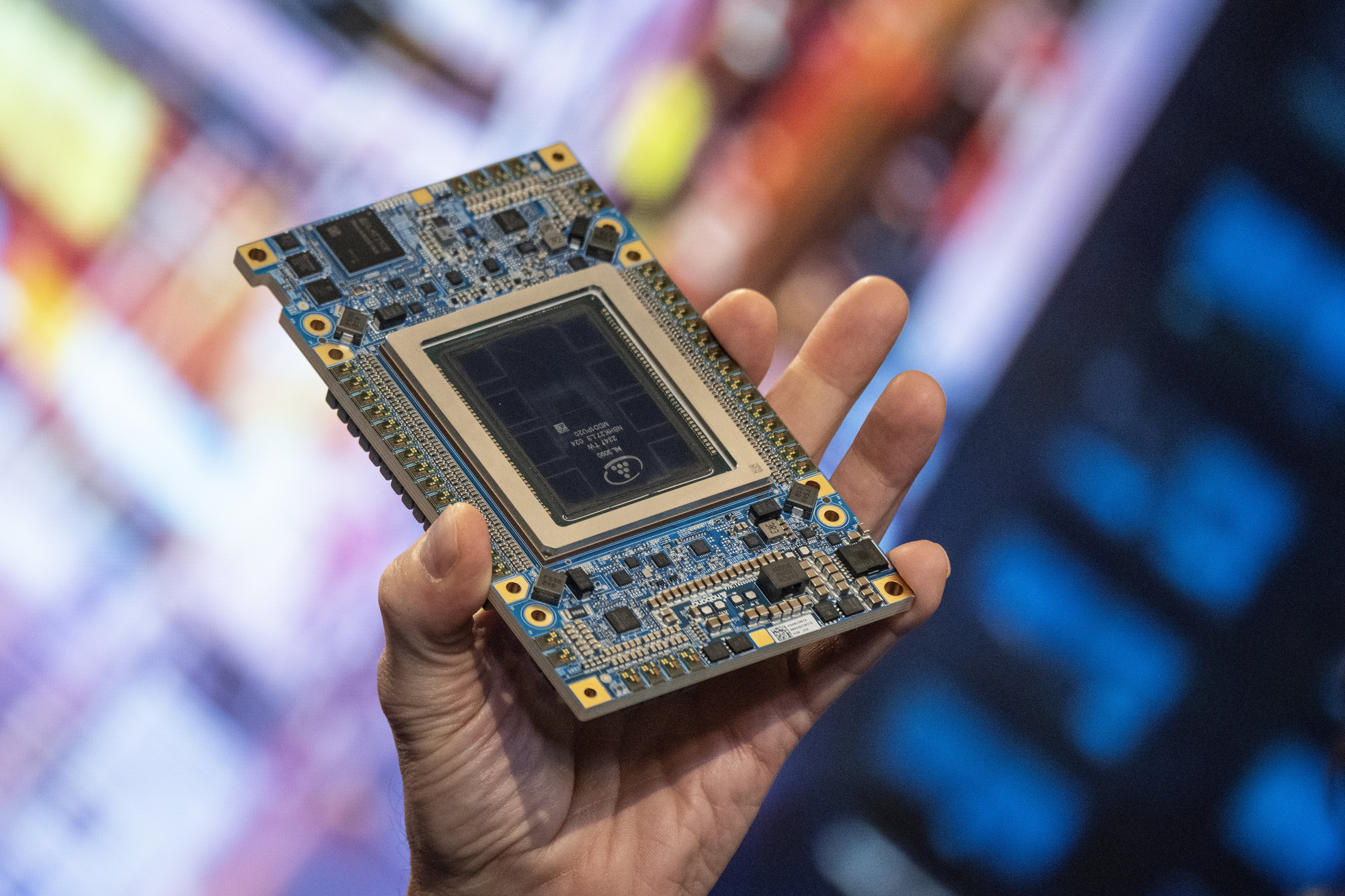

Canalys principal mobility analyst Ishan Dutt said that the AI-capable PC category is still in a nascent stage, but the consultancy defines it as a desktop or notebook possessing a dedicated chipset or block to accelerate AI computing.

Current examples include Qualcomm’s Hexagon Tenser Accelerator, Apple’s Neural Engine, Intel’s Movidius VPU and AMD’s XDNA, he said.

“This definition will evolve over time as these dedicated chipset features become increasingly commonplace in mainstream processors,” he told ITPro.

Dutt said there will be a move towards a nuanced grading scale that takes into consideration specifications about the neural processing unit – such as number of tera operations per second (TOPS) and other hardware requirements around memory and storage.

Apple has been leading the way with AI integration with its M1 Neural Engine way back in 2020, and since then Qualcomm has added to its ARM-based 8cx Gen3 chipset's AI capabilities, with a 2024 upgrade featuring the Nuvia architecture and Windows Copilot integration according to the analyst.

RELATED RESOURCE

The enterprise’s guide for Generative AI

Get an informed overview of what to consider when executing GenAI

DOWNLOAD NOW

In the x86 world, AMD introduced its AI offering with the "Phoenix" Ryzen 7040, while Intel is marking its AI move by embedding the Movidius VPU in its Meteor Lake range. But beyond the processors, AI PCs will need additional memory, storage and GPUs, Canalys said.

“For instance, as optimized large language models (LLMs) become pre-installed on PCs, a combination of increased storage capacity with high-speed interfaces becomes essential. Similarly, running these LLMs will necessitate more memory and a robust GPU,” Canalys noted.

While adding generative AI capabilities to PCs could make everyone more efficient, the early adopters are likely to be workers who need to use LLMs to crunch data but are cautious about putting that data into a cloud service, or those that don’t want to deal with the latency that using cloud services can create.

Fellow tech analyst Gartner also expects the PC market to bounce back in 2024, as the business PC market is ready for the next replacement cycle, driven by the Windows 11 upgrades.

Meanwhile, it believes consumer PC demand should also begin to recover as devices purchased during the pandemic start to be replaced too.

Steve Ranger is an award-winning reporter and editor who writes about technology and business. Previously he was the editorial director at ZDNET and the editor of silicon.com.

-

ITPro Best of Show NAB 2026 awards now open for entries

ITPro Best of Show NAB 2026 awards now open for entriesThe awards are a fantastic opportunity for companies to stand out at one of the industry's most attended shows

-

Mistral CEO Arthur Mensch thinks 50% of SaaS solutions could be supplanted by AI

Mistral CEO Arthur Mensch thinks 50% of SaaS solutions could be supplanted by AINews Mensch’s comments come amidst rising concerns about the impact of AI on traditional software

-

Touchscreen laptops are always a bad idea – MacBook or otherwise

Touchscreen laptops are always a bad idea – MacBook or otherwiseOpinion If the rumors of a touchscreen MacBook prove correct, it will kill my confidence in the brand

-

With the M5 iPad Pro, Apple has finally made a tablet that can replace your laptop

With the M5 iPad Pro, Apple has finally made a tablet that can replace your laptopReviews Still rocking the same design, but inside it's all change – and that is what makes the M5 iPad Pro so good

-

M5 MacBook Pro is a minor spec bump with increased GPU performance – but once again, the immense battery life is the standout feature

M5 MacBook Pro is a minor spec bump with increased GPU performance – but once again, the immense battery life is the standout featureReviews Literally looks the same as the M4 model, and only really a minor upgrade, but it is still a tremendous work machine

-

Global PC shipments surge in Q3 2025, fueled by AI and Windows 10 refresh cycles

Global PC shipments surge in Q3 2025, fueled by AI and Windows 10 refresh cyclesNews The scramble ahead of the Windows 10 end of life date prompted a spike in sales

-

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new markets

Nvidia’s Intel investment just gave it the perfect inroad to lucrative new marketsNews Nvidia looks set to branch out into lucrative new markets following its $5 billion investment in Intel.

-

The US government's Intel deal explained

The US government's Intel deal explainedNews The US government has taken a 10% stake in Intel – but what exactly does the deal mean for the ailing chipmaker?

-

The Apple Mac Mini M4 is an affordable powerhouse that's perfect for any office desk – and it's also utterly adorable

The Apple Mac Mini M4 is an affordable powerhouse that's perfect for any office desk – and it's also utterly adorableReviews A changed design, an M4 chip, and more value for money, this is probably the best mini PC available right now

-

US government could take stake in Intel as chip giant's woes continue

US government could take stake in Intel as chip giant's woes continueNews The move would see increased support for Intel’s manufacturing operations