UK tech sector attracting greater investment than EU leaders combined

The UK tech sector reached a valuation of $1 trillion this year, becoming the third country to do so alongside China and the US

UK tech companies have raised more than double the venture capital investment than French and German firms combined, according to new research.

Figures published by Dealroom on behalf of the UK government showed that domestic tech firms have continued to raise near-record levels of investment this year despite challenging economic conditions.

Across 2022, firms raised a total of £24 billion, more than second and third-ranked France (£11.8 billion) and Germany (£9.1 billion) combined, bringing the total raised over the past five years to £97 billion.

This strong performance propelled the UK tech industry to surpass $1 trillion in value earlier this year, making it the third country to reach this valuation alongside the US and China.

Digital minister Paul Scully said the Dealroom figures highlight the impressive performance of the UK tech sector across 2022 and showcase the ecosystem as an attractive proposition for businesses.

“UK tech has remained resilient in the face of global challenges and we have ended the year as one of the world’s leading destinations for digital businesses,” he said.

“This is good news and reflects our pro-innovation approach to tech regulation, continuing support for startups and ambition to boost people’s digital skills.”

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Pulling away from the European pack

This latest research shows that the UK tech industry is continuing to steam ahead of European peers. At present, the sector is worth more than double Germany’s, which has a valuation of $476.2 billion.

The overall value of the UK tech sector also eclipses that of France, which currently stands at a valuation of $307.5 billion.

Similarly, Dealroom also revealed that the UK still retains a strong lead with regard to overall funding, unicorns and the number of startups.

The UK is currently home to 144 unicorn businesses and 237 ‘futurecorns’ - fast-growing companies which are expected to be the most valuable businesses in the next few years.

This marks an increase compared to 2021 figures, which revealed there were 116 unicorns and 204 futurecorns operating in the UK.

Eight cities are now home to two unicorn companies or more, including Bristol, Cambridge, Edinburgh, Leeds, London, Manchester, Nottingham, and Oxford.

According to the government, this continued growth demonstrates the “strong pipeline of global tech leaders being created up and down the UK”.

Digital skills focus

A key factor underpinning current tech sector growth is the strong focus on digital skills development.

Upskilling and reskilling have become a “key part of the UK’s dominance” in tech, the government said.

Nearly 3,000 edtech startups have raised a combined £1.7 billion in funding over the past five years, figures show. Many of these companies are focused on enabling people to re-train or develop key skills required in the tech industry.

Figures from job search engine Adzuna showed that UK companies are increasingly hiring for entry-level tech roles, up from 6,596 in November 2021 to over 15,000 this year.

According to the government, part of the UK’s strength in creating a “wide-ranging and expansive tech ecosystem” can be attributed to its continued focus on regulatory reform.

Earlier this year, the UK unveiled a new approach to regulating artificial intelligence based on core principles such as safety, transparency and fairness.

This move will see the UK take a “less centralised” approach to regulating AI innovation compared to EU standards.

Chancellor Jeremy Hunt also revealed that the government will develop legal powers for the Digital Markets Unit to create a more competitive industry marketplace for challenger tech firms.

The ‘next Silicon Valley’

The research from Dealroom follows a recent announcement that the government plans to appoint five ‘industry-leading experts’ to support its plans to turn the UK into the world’s ‘next Silicon Valley’.

Chancellor Hunt outlined the government’s ambition to support the UK tech sector in the Autumn Statement and launched a review to identify key barriers to innovation and economic growth.

The five-person advisory team will support national technology advisor Sir Patrick Valance in curating the report and highlight key areas in which the government can bolster support for the industry.

Antony Walker, techUK Deputy CEO, said the Dealroom research is a strong indication of the UK tech industry's potential, but warned that government must continue its support for businesses.

“Over the last couple of years the technology sector has gone from strength to strength, weathering the disruptions caused by the pandemic lockdowns. However, recent economic headwinds, rising energy costs and skills shortages are shaking our usually resilient sector," he said.

“The government said they intend to turn the UK into the next Silicon Valley - but to do that, we need a long-term plan that gives tech businesses the confidence they need to keep investing in the UK," Walker added.

"In particular, regulatory stability, R&D incentives and investment in skills are top priorities for tech businesses. If these issues are addressed, the tech sector could help the UK economy by bringing an additional £41.5 billion according to the government’s own estimates.”

Ross Kelly is ITPro's News & Analysis Editor, responsible for leading the brand's news output and in-depth reporting on the latest stories from across the business technology landscape. Ross was previously a Staff Writer, during which time he developed a keen interest in cyber security, business leadership, and emerging technologies.

He graduated from Edinburgh Napier University in 2016 with a BA (Hons) in Journalism, and joined ITPro in 2022 after four years working in technology conference research.

For news pitches, you can contact Ross at ross.kelly@futurenet.com, or on Twitter and LinkedIn.

-

Hackers are using LLMs to generate malicious JavaScript in real time

Hackers are using LLMs to generate malicious JavaScript in real timeNews Defenders advised to use runtime behavioral analysis to detect and block malicious activity at the point of execution, directly within the browser

-

Developers in India are "catching up fast" on AI-generated coding

Developers in India are "catching up fast" on AI-generated codingNews Developers in the United States are leading the world in AI coding practices, at least for now

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

-

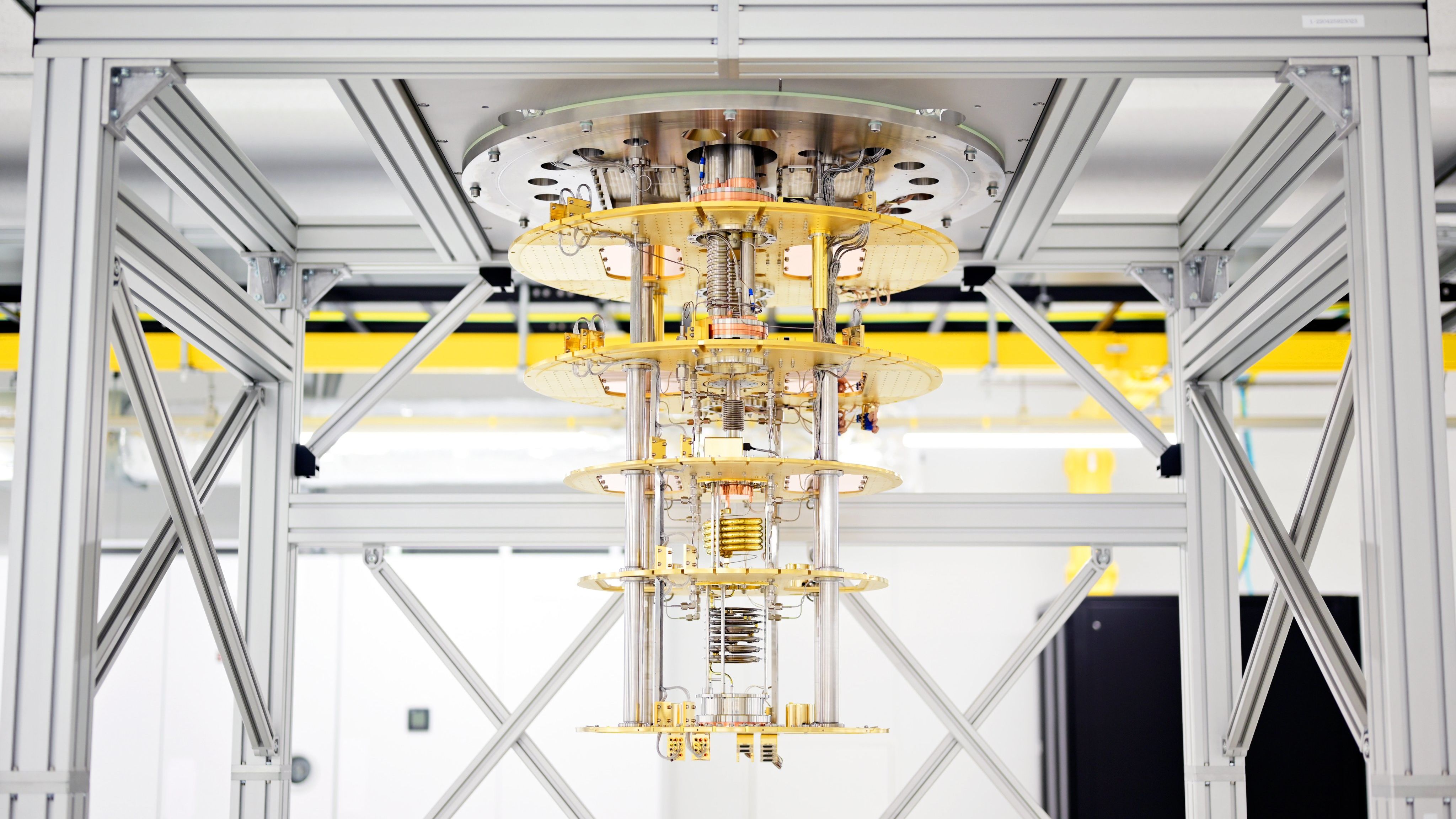

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix