Stripe raises another $600m in funding

This latest round of investment brings Stripe’s valuation to $95 billion

Fintech firm Stripe has raised $600m in a funding round that places its value at $95 billion.

The move will fuel further expansion in Europe for the fast-growing company, which is increasingly targeting large enterprise customers.

The money came primarily from insurance companies Allianz and Axa, with other backers, including Baillie Gifford, Fidelity Management and Research Company, Sequoia Capital, and the Irish National Treasury Management Agency (NTMA).

The company has committed much of the funding to expand its European operations, where it already operates in 31 countries. Stripe launched support for companies in the Czech Republic, Romania, Bulgaria, Cyprus, and Malta, in May 2020. Ireland, where it has one of its dual headquarters, will be a focal point, according to its president and co-founder John Collison.

Outside Europe, Stripe will also expand operations in Brazil, India, Indonesia, Thailand, and the UAE.

Stripe will expand its Global Payments and Treasury Network (GPTN), the foundation for a range of services it’s been launching to capture greater parts of the payment chain. These include accepting and making payments and storing and managing them.

The company began focusing on smaller, startup-stage companies, providing them with a way to integrate payments easily into their applications. Over time, it’s expanded to court larger companies with a range of additional enterprise features.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

In 2018, it added a set of anti-fraud tools called Radar. It also launched a platform for companies to issue Mastercard and Visa credit cards during the same year. In late 2020, it announced Stripe Treasury, a banking-as-a-service API2 that provides its clients' banking services. Initial partners for the service included Goldman Sachs and Evolve Bank in the US.

This latest fundraising follows a $250 million Series G funding round that Stripe started in September 2019 that put its value at $35 billion. It extended that round and included General Catalyst, Sequoia, and Andreesen Horowitz to raise another $600 million in April 2020.

Danny Bradbury has been a print journalist specialising in technology since 1989 and a freelance writer since 1994. He has written for national publications on both sides of the Atlantic and has won awards for his investigative cybersecurity journalism work and his arts and culture writing.

Danny writes about many different technology issues for audiences ranging from consumers through to software developers and CIOs. He also ghostwrites articles for many C-suite business executives in the technology sector and has worked as a presenter for multiple webinars and podcasts.

-

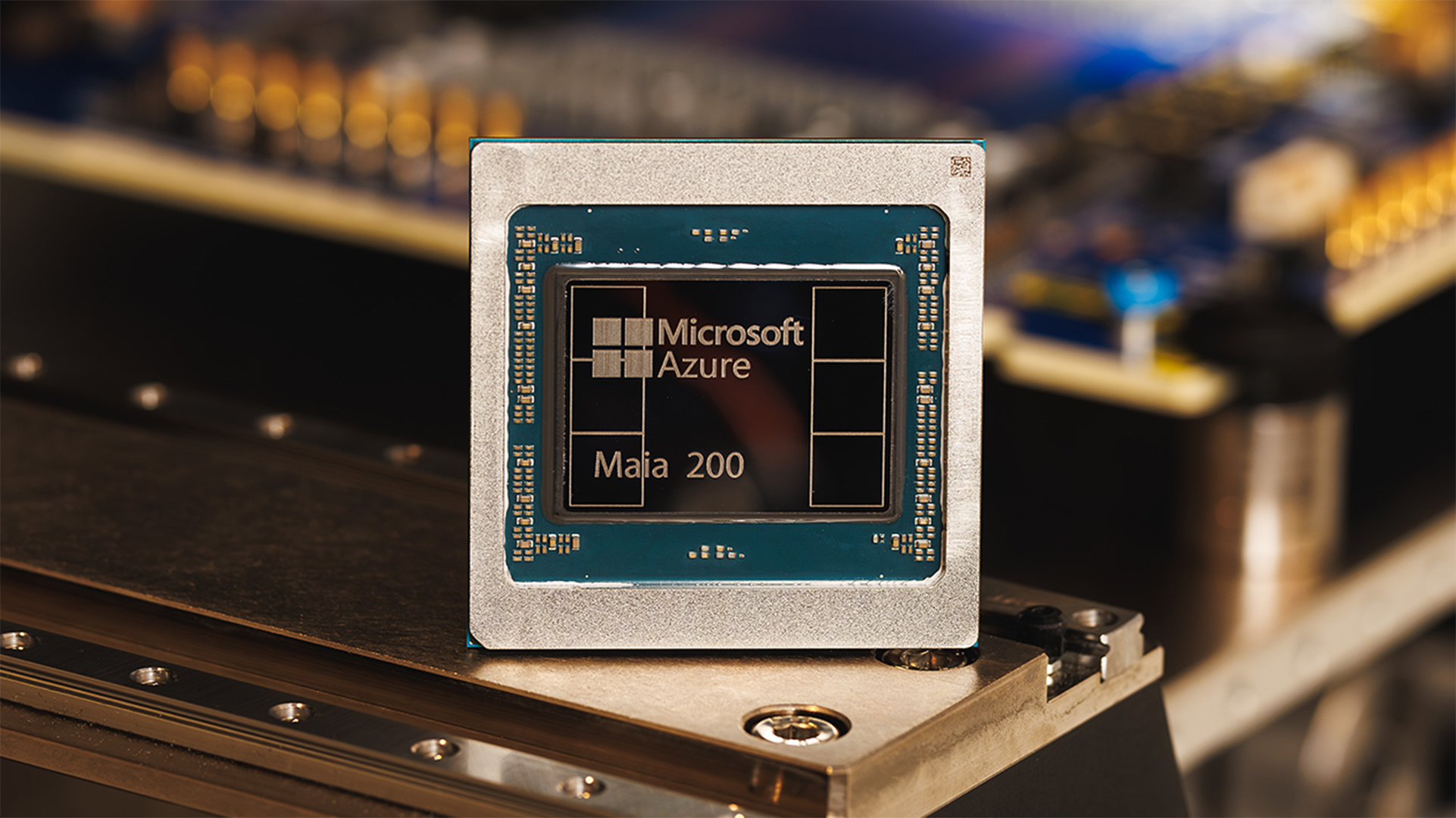

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Infosys expands Swiss footprint with new Zurich office

Infosys expands Swiss footprint with new Zurich officeNews The firm has relocated its Swiss headquarters to support partners delivering AI-led digital transformation

-

The customer knows best: How to ensure you’re delivering an effective digital payments experience

The customer knows best: How to ensure you’re delivering an effective digital payments experienceSponsored Tap into shifting customer trends with account information services that will give your business a competitive edge

-

How AI is accelerating digital transformation in the banking industry

How AI is accelerating digital transformation in the banking industrySupported Content Gen AI, fraud detection, and chatbots are all transforming the financial industry, but the cloud is the foundation for it all

-

What open banking means for the future of online transactions

What open banking means for the future of online transactionsOpen banking offers a faster, more automated future for transactions – but it has a rigid legal road to traverse

-

Put AI to work for talent management

Put AI to work for talent managementWhitepaper Change the way we define jobs and the skills required to support business and employee needs

-

Building an outstanding digital experience

Building an outstanding digital experiencewhitepaper Insight into how banks and financial services organizations can deliver the digital experiences customers and employees expect

-

More than a number: Your risk score explained

More than a number: Your risk score explainedWhitepaper Understanding risk score calculations

-

Why digital wallets could be your secret weapon in Southeast Asia

Why digital wallets could be your secret weapon in Southeast AsiaSponsored Digital wallets represent a step change in supporting the unbanked across the region

-

The top trends in money remittance

The top trends in money remittanceWhitepaper Tackling the key issues shaping the money remittance industry