GV invests £20m in UK startup Currencycloud

The deal will reassure UK startups after a turbulent year following the Brexit vote

GV, the venture capital arm of technology giant and Google parent Alphabet, has invested 20 million into a UK technology startup, providing a means for businesses to offer cross-border payment services to their customers.

Currencycloud, a UK based payments service that has just set up shop in the US, has already received investment from firms including Notion Capital, Sapphire Ventures and Japanese technology company Rakuten.

This is certainly good news for the UK technology startup scene, as overall investment recently fell to its lowest point in five years, blamed largely on the turbulence created as a result of the Brexit vote last year.

According to a report by Beauhurst, UK startups received 3.6 billion in investments in 2016, down 12% on 2015 figures, with the total number of annual deals also falling by 18%.

Google's stake brings total investment in Currencycloud to 44 million, which will be used to support its global expansion, which already counts Klarna, Travelex, Standard Bank and Azimo among its customers. The company revealed $25 billion in payments had so far been sent through its infrastructure in over 200 countries.

CEO Mike Laven said: "Currencycloud provides a set of multi-currency payment and conversion tools that are helping hundreds of companies globalise fast. We are seeing massive and increasing demand for these services, with volumes growing over 150% last year."

Initially launched in 2012, Currencycloud provides a platform for business wanting to offer international payment services without the need for complex and expensive infrastructure. It also provides a means for companies to build apps and services using its currency APIs.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

"We believe in empowering developers by making it easier for them to add scalable services to their products, ideally with simply APIs," said GV general partner Tom Hulme. "Currencycloud is the leader in providing cross-border payment services in this manner, a real need as companies globalise."

Despite acknowledging a dip in sales as a result of the vote to leave the European Union, Laven remained optimistic that business would continue to thrive, and is preparing to seek a licence to operate within the EU if it becomes necessary after Brexit negotiations.

Dale Walker is a contributor specializing in cybersecurity, data protection, and IT regulations. He was the former managing editor at ITPro, as well as its sibling sites CloudPro and ChannelPro. He spent a number of years reporting for ITPro from numerous domestic and international events, including IBM, Red Hat, Google, and has been a regular reporter for Microsoft's various yearly showcases, including Ignite.

-

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and Google

Microsoft unveils Maia 200 accelerator, claiming better performance per dollar than Amazon and GoogleNews The launch of Microsoft’s second-generation silicon solidifies its mission to scale AI workloads and directly control more of its infrastructure

-

Infosys expands Swiss footprint with new Zurich office

Infosys expands Swiss footprint with new Zurich officeNews The firm has relocated its Swiss headquarters to support partners delivering AI-led digital transformation

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

-

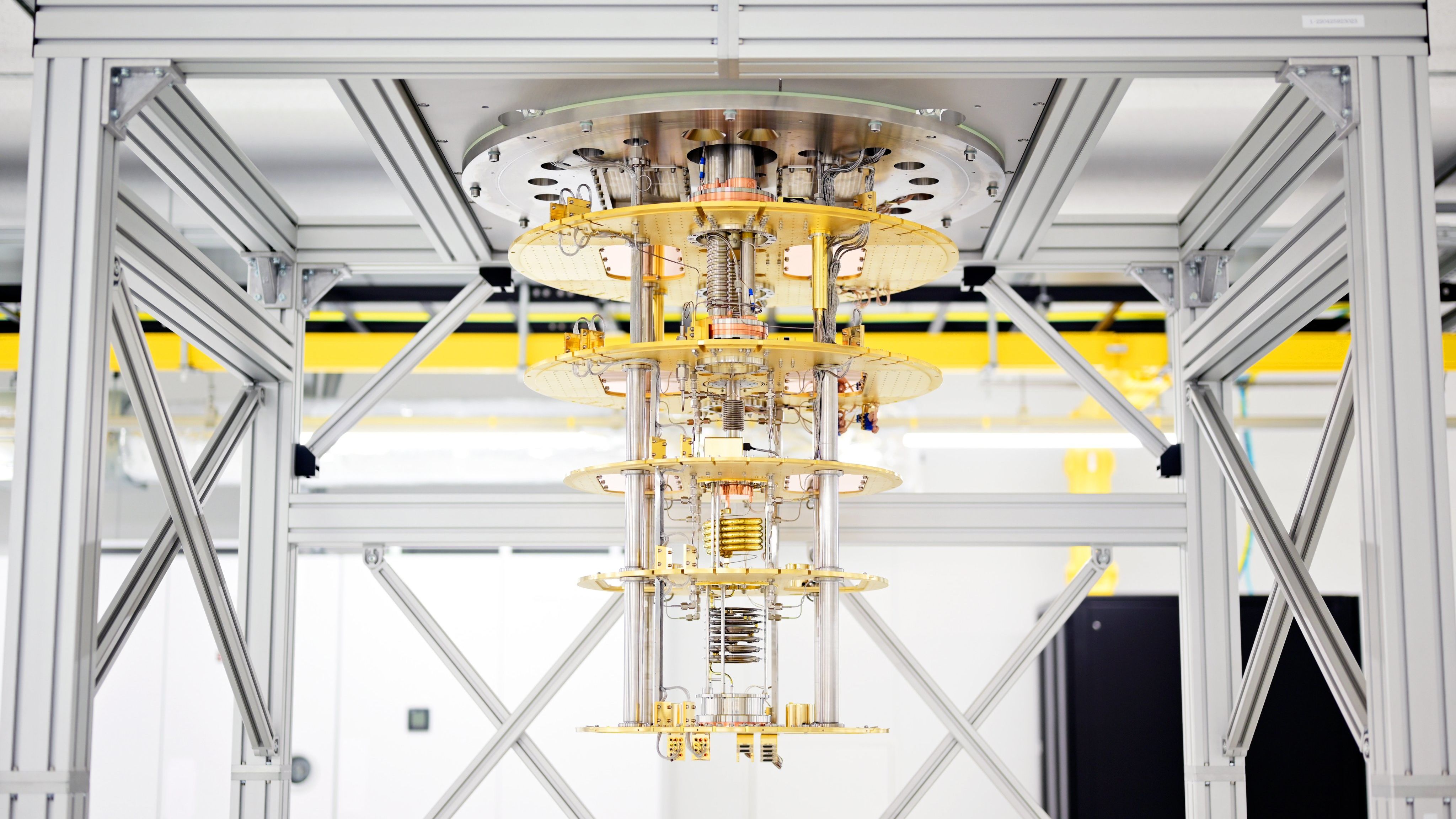

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix