Can regulation shape cryptocurrencies into useful business assets?

Although the likes of Bitcoin may never stabilise, legitimising the crypto market could, in turn, pave the way for more widespread blockchain adoption

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

One of the more complex corners of the technology industry businesses often refrain from touching is the cryptocurrency market. Built on a principle of a decentralised market, away from the prying eyes of central bodies or governments, and utilising blockchain technology to provide a clear and concise record of all transactions, cryptocurrencies have proved to be eminently investable.

Bitcoin has almost become synonymous with cryptocurrencies, and for good reason, after seeing its valuation grow to $48,000 in the wake of the pandemic. As has always been the case, however, its value plummeted again in what’s only the latest twist in a series of rises and falls. The crypto market, at the time, underwent something of an implosion given the raft of negative headlines and incidents revolving around fraud and bankruptcy.

One of the biggest stories that continue to affect the market is the demise of FTX, an exchange that seems to have defrauded its 1.2 million users to the tune of $8 billion. It’s no wonder, therefore, that the UK government has decided to join the US and EU in kicking off legislative proceedings with a view to regulating the cryptocurrency and blockchain world.

Regulation will force crypto to ‘grow up’

For those already invested in crypto assets, regulation could be seen as a dirty word. After all, one of the reasons investors are attracted to these tokens is its decentralised nature. Gabriella Kusz, CEO of the Global Digital Asset and CryptoCurrency Association, however, is quick to temper expectations, saying “this is still an emerging space”.

“Although governments that are balancing innovation with protecting consumers and market integrity, the decentralised nature of crypto is still one of the key components that drive value,” says Kusz. “I think, as we've seen with FTX, there are risks and challenges that centralised digital assets firms need to address in order to ensure protection and advancement of a high-quality digital asset ecosystem.”

RELATED RESOURCE

Even without those protections, there are great swathes of people who believe in the crypto revolution. Countries like El Salvador and the Central African Republic have adopted Bitcoin as legal tender, and Latin Americans alone accounted for $562 billion of received value from crypto last year. On top of this, the Venezuelan government also attempted to introduce its own oil-backed stablecoin called Petro the nation’s official cryptocurrency.

This relatively mainstream adoption doesn’t make the world of crypto a stable environment, though. Despite these moves – which are sure to send positive signals – over the course of the last 12 months, thousands of dollars have been wiped off the value of Bitcoin.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

This volatility is one of the key reasons why cryptocurrencies need a set of governable rules, according to Bittrex Global CEO and general counsel, Oliver Linch. “I think regulation is necessary for crypto to grow up,” he says. “The analogy I really like is looking at the internet in 1995, it was an absolute cesspit. But amongst all the awfulness were things that became Google, Amazon, and eBay.

“Crypto is a bit like that,” he continues. “We need to have a bit of a clearout, get rid of some of the scams, but the way to do that in financial services is through regulation. The individuals who want to get involved in crypto want to do that in an environment where they’re not going to be left to fend for themselves. I wouldn't put my money in an unregulated bank, so why would I put my money in an unregulated exchange?”

What about existing regulations?

The analogy to the early days of the internet is one that Andreas Veneris, professor of computer science at the University of Toronto, also draws. He adds, however, that the crypto market isn’t completely unregulated.

In order to handle money, crypto exchanges have to comply with financial conduct regulations in all major countries to maintain a licence to provide financial services. “Of course, this regulation is more critical than in the early days of the internet, because cryptocurrencies can risk financial stability,” explains Veneris.

“But it's wrong to say there's no regulation. In order to own a crypto share or a token, you have to deposit money into a centralised exchange, which takes your money out into a decentralised exchange. Those money service providers need a money remittance licence, otherwise, they cannot operate.”

It’s clear, though, these regulations aren’t doing enough, and Veneris himself says as much. Yet, headlines of fraud, scams and bad actors also undermine the philosophy behind the crypto movement, which is to open up the financial landscape to everyone, no matter of nationality or credit score and away from the dominant central banks of today. Kusz, however, says the industry should hold itself to account more, adding “when talk turns to the right to self-regulate, I always push back and talk about the responsibility they have to self-regulate.”

Protecting users and customers

The fact is that the window of opportunity for the crypto industry to self-regulate has passed, and governments across the world are looking to establish a regulatory framework to protect users and create a safer environment in which to participate. The UK is seeking to introduce stablecoins, while the Financial Conduct Authority (FCA) has also set out its stall on regulation. This is in addition to the US Treasury calling for stablecoin legislation.

RELATED RESOURCE

Participation is well underway, according to Kusz, who says we're already starting to see consumer outlets offering payments in Bitcoin. “But the biggest implications of regulation will be for the broader digital assets, and tokenisation in general; NFTs but also stablecoins are areas that are strongly affected by regulation.”

As a result of this regulation, Veneris says cryptocurrencies like Bitcoin “will present an asset that has characteristics like gold”, in which entities can invest and check every six months to see if the value increases.

For Linch, though, the real benefits that cryptocurrency regulation will bring will be linked with the legitimisation of blockchain, given the core technology powering the likes of Bitcoin has often been unfairly tarred with the same brush. Indeed, the ledger technology would allow any nefarious activity to be picked up on and traced to the original offender.

“With blockchain monitoring, banks will be able to carry out anti-money laundering, know your customer (KYC) checks, and combat terrorist financing,” he says. “The transparency of the blockchain means banks can trace Bitcoins all the way back to exactly who mined them in the very first place.

“If we use this technology, we will end up having much cleaner markets, fairer trading environments, and more transparency than we ever could in the traditional markets. In fact, there are some areas where the crypto industry has not only caught up with the big banks – but have exceeded them.”

Elliot Mulley-Goodbarne is a freelance journalist and content writer with six years of experience writing for B2B technology publications, notably Mobile News and Comms Business. He specialises in mobile, business strategy, and cloud technologies, with interests in environmental impacts, innovation, and competition. You can follow Elliot on Twitter and Instagram.

-

HPE ProLiant Compute DL345 Gen12 review

HPE ProLiant Compute DL345 Gen12 reviewReviews The big EPYC core count and massive memory capacity make this affordable single-socket rack server ideal for a wide range of enterprise workloads

-

What is a vector database?

What is a vector database?Explainer Storing data as mathematical values provides critical functionality for ML and AI

-

Three things you need to know about the EU Data Act ahead of this week's big compliance deadline

Three things you need to know about the EU Data Act ahead of this week's big compliance deadlineNews A host of key provisions in the EU Data Act will come into effect on 12 September, and there’s a lot for businesses to unpack.

-

UK financial services firms are scrambling to comply with DORA regulations

UK financial services firms are scrambling to comply with DORA regulationsNews Lack of prioritization and tight implementation schedules mean many aren’t compliant

-

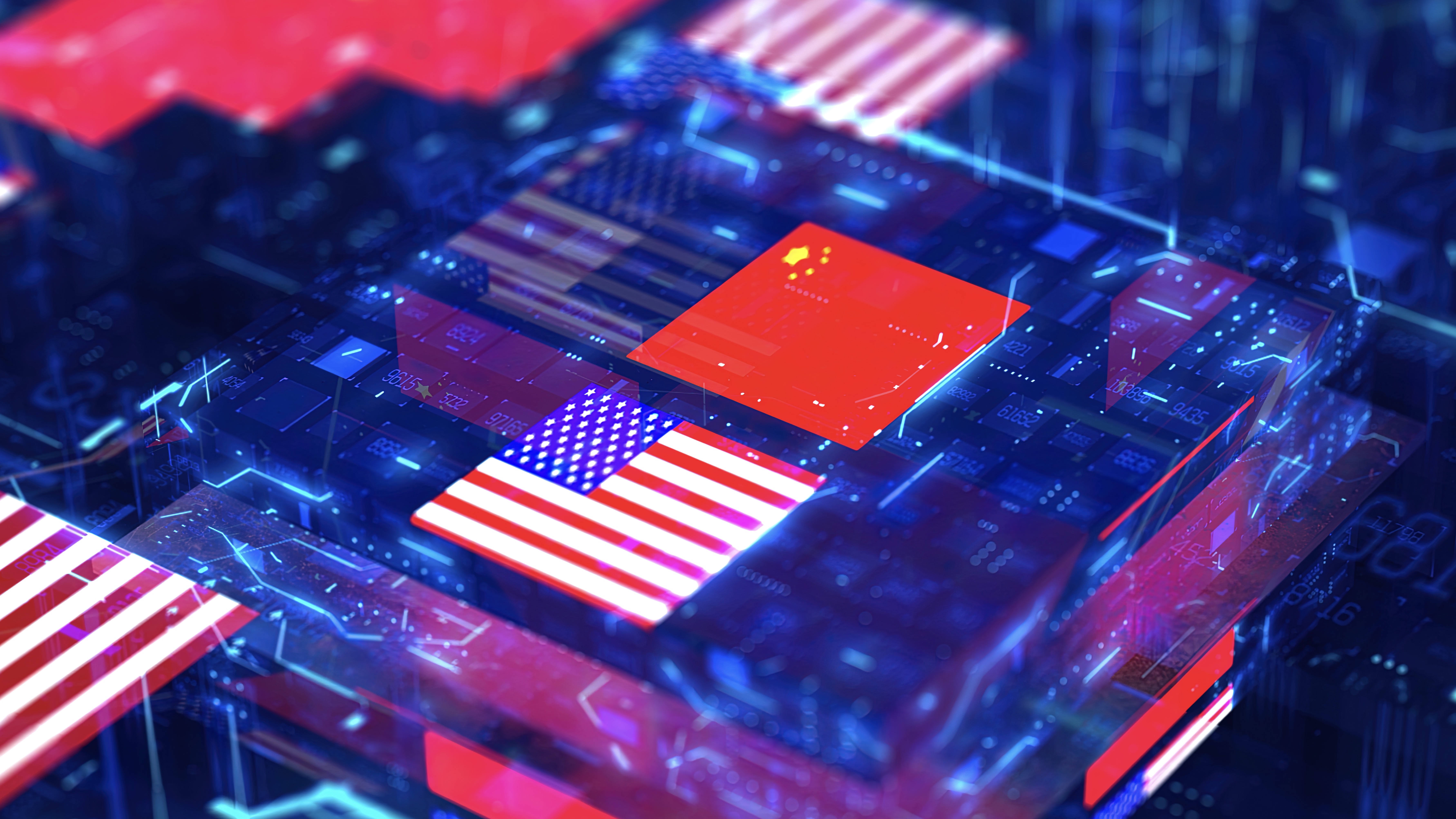

What the US-China chip war means for the tech industry

What the US-China chip war means for the tech industryIn-depth With China and the West at loggerheads over semiconductors, how will this conflict reshape the tech supply chain?

-

Former TSB CIO fined £81,000 for botched IT migration

Former TSB CIO fined £81,000 for botched IT migrationNews It’s the first penalty imposed on an individual involved in the infamous migration project

-

Microsoft, AWS face CMA probe amid competition concerns

Microsoft, AWS face CMA probe amid competition concernsNews UK businesses could face higher fees and limited options due to hyperscaler dominance of the cloud market

-

Online Safety Bill: Why is Ofcom being thrown under the bus?

Online Safety Bill: Why is Ofcom being thrown under the bus?Opinion The UK government has handed Ofcom an impossible mission, with the thinly spread regulator being set up to fail

-

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operators

UK gov urged to ease "tremendous" and 'unfair' costs placed on mobile network operatorsNews Annual licence fees, Huawei removal costs, and social media network usage were all highlighted as detrimental to telco success

-

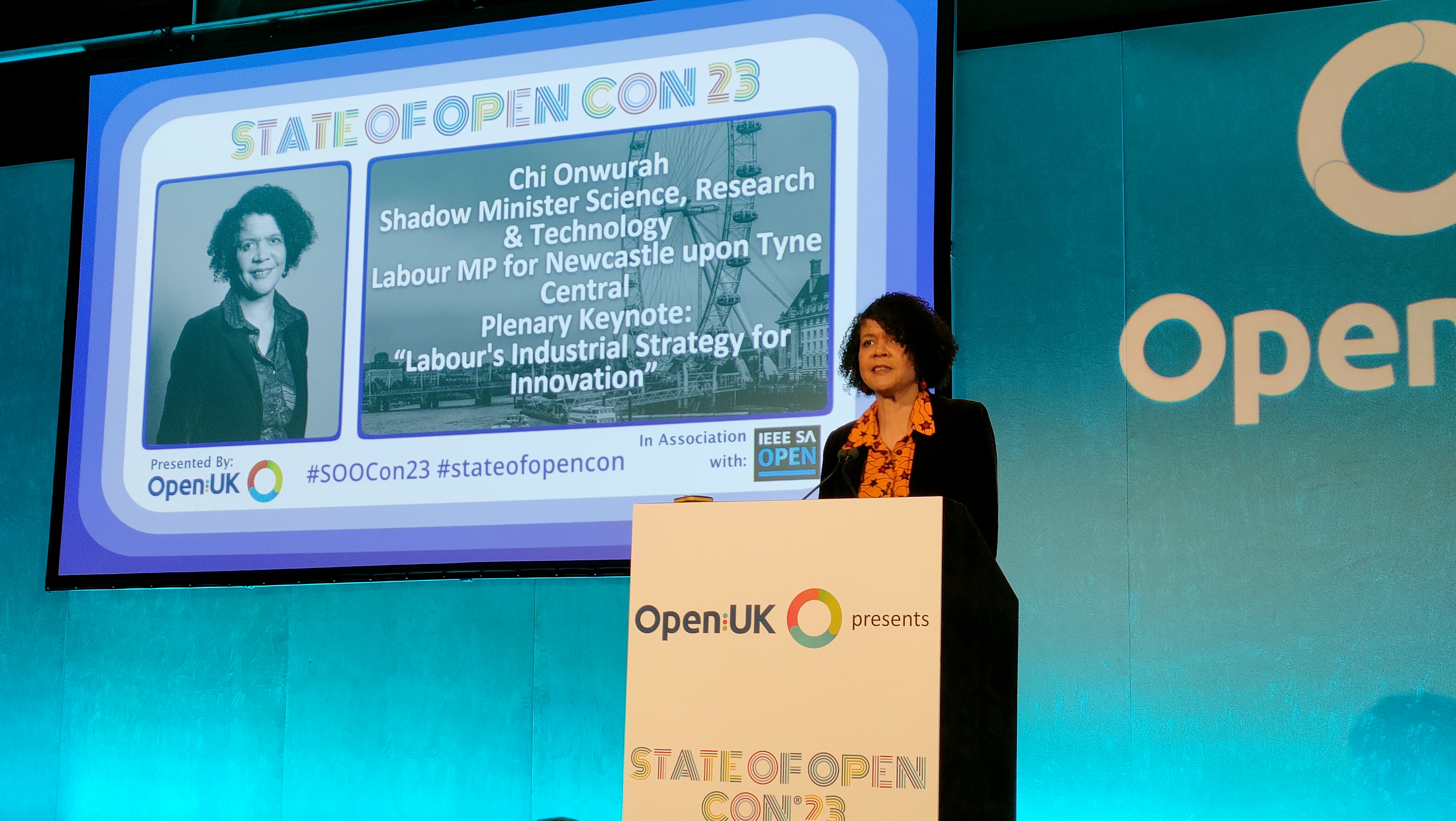

Labour plans overhaul of government's 'anti-innovation' approach to tech regulation

Labour plans overhaul of government's 'anti-innovation' approach to tech regulationNews Labour's shadow innovation minister blasts successive governments' "wholly inadequate" and "wrong-headed" approach to regulation