Should we stop selling the crown jewels of tech?

After a string of high-profile sales, the tech world is starting to ask if it's time to protect the UK’s technology assets

The UK has a rich history in tech, but many of Britain’s biggest tech firms are sold to overseas investors, with assets and know-how heading overseas.

Britain runs a free-market model, but many believe that there’s value in greater intervention. “In the modern world, all the national returns are in the profit and the share of income and assets,” said Dan Ciuriak, a trade consultant and senior fellow at Canada’s Centre of International Governance Innovation.

“This is where new national wealth is being generated – it’s no longer labour income [through taxes] that’s generating the money. If your economic strategy remains in the industrial era, you will see a shrinking as a percentage of global wealth.”

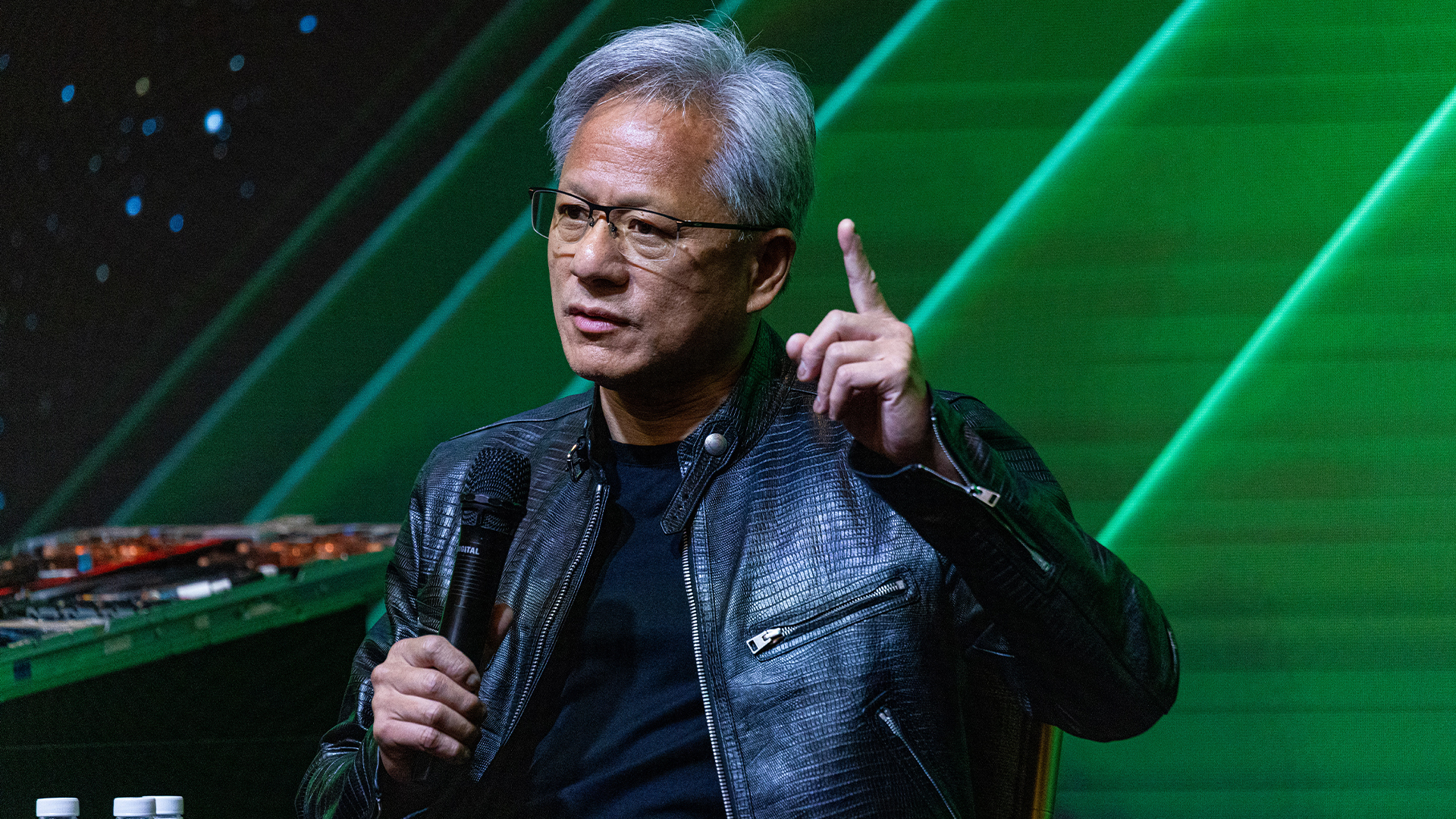

Is Nvidia’s takeover of Arm a threat to the UK tech industry? HP-Autonomy: Industry weighs up where the blame lies Whatever happened to the 1980s coding heroes?

No matter how much money a company such as Facebook makes in the UK, or how much formerly UK-owned chip design giant Arm makes globally, the UK’s benefit is negligible. “The question for a government is do we intervene or not? What matters is who owns these assets and do they reside on your territory,” said Ciuriak.

The UK has waved goodbye to several leading tech companies in recent years as venture capital companies and multinational giants shop for bargains. Logica, CRM, Autonomy, Arm and Sophos have all vanished from the UK stock market in the past eight years, along with a host of others that had potential to be big players.

Senior figures in UK tech believe authorities have been too relaxed about the sale of such assets, allowing valuable or strategic companies to be lost overseas. Not only does this damage tax revenue, it reduces the country’s influence and sees talent, knowledge and intellectual property leave.

Take Sir Hossein Yassaie, former CEO of Imagination Technologies, which still resides in the UK but is largely owned by Chinese capital and has been under scrutiny over who is really running the firm. In May this year, addressing a House of Commons committee exploring how to stop foreign asset stripping of UK companies, Yassaie said that some UK assets were too important to lose, and that current policy left too much to chance.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

“Essentially, if we want to sell some businesses it would not matter, because they are not unique and many people around the world could do those things,” he told the committee. “But if the technologies are powerful and unique and could be used in an unfriendly manner, I think a control mechanism and governance needs to be around them to make sure the right thing happens.”

Asked by the committee whether control mechanisms in the UK were sufficient, Yassaie said: “What we have is lax. I think it is very important that there is sufficient control around ownership and definitely governance.”

Protect and serve

In contrast, the US is more robust due to the Committee on Foreign Investment in the United States (CFIUS), which was set up to review national security implications of acquisitions by foreign investors of US companies.

In recent years, for example, CFIUS has ordered Chinese gaming company Beijing Kunlun to sell Grindr due to worries over security, while foreign acquisitions of semiconductor makers Lattice and Qualcomm have also been blocked. At the time of writing, TikTok’s US operations are up in the air, despite Oracle taking over some of its operations in the country.

Whether that sale of TikTok is actually a security question or merely US protectionism is debatable. “If you look at TikTok, it had gathered a lot of data and was only starting on how to monetise it – but the market valuation was soaring, not because of what it had, but because of the future and it was on a track to be the next Facebook with a trillion-dollar market cap,” said Ciuriak.

“Governments are looking at this and thinking: do we want a Chinese company capturing this future prospect of a one-trillion dollar market cap and the US said ‘no’ – they want to capture that in the US.”

Arm is the best example of a British asset being sold off. The Cambridge-based company has been designing chips since the 1980s. With Arm-designed processors powering 95% of the world’s smartphones, it was the jewel in the crown of UK technology until it was bought by Japanese company SoftBank in 2016 for $32 billion.

It’s now up for sale again, and there are fears that it could face a bleak future depending on who buys it. “The one saving grace about SoftBank was that it wasn’t a chip company, and retained Arm’s neutrality,” Arm co-founder, Hermann Hauser told the BBC recently. “If it becomes part of Nvidia, most of the licensees are competitors of Nvidia, and will of course then look for an alternative to Arm. It will become one of the Nvidia divisions, and all the decisions will be made in America, no longer in Cambridge.”

According to Hauser, the fact that SoftBank is hungry for a deal means a UK buyback would make perfect sense. He argues that if the UK could afford £500 billion to bail out banks, why not invest a few billion in a profitable, strategically important technology player? “The great opportunity that the cash needs of SoftBank presents is to bring Arm back home and take it public, with the support of the British government,” he said. “It’s not about the money, it’s the industrial strategy statements that the government can make.”

Leave it be

Despite the calls for greater government intervention, there are concerns it could deter investors and startups from locating in the UK. Given the goal of many startups is to reach, say, a million users and sell, experts say too much intervention might force them to look elsewhere when founding a business. “With DeepMind [bought by Google] it was a genuine acquisition – it’s not like they didn’t have a choice about selling it,” said Palitha Konara, senior lecturer in international business at the University of Sussex.

“If the government was going to intervene to that extent it might well be counterproductive, because a lot of the good acquisitions would not take place and that could stop people setting up in the UK.”

There are also fears that the UK doesn’t have the economic clout to keep tech companies on our shores. We spoke with one former industry-government liaison professional who didn’t want to be named. “The UK keeps making interesting innovative tech companies of a decent size, good talent and growth and they get the attention of other people and become strategically valuable businesses to acquire – that’s a good thing,” he said.

“We can grow to a certain scale, but there are limitations,” he added. “There are large players in the platform markets who have the money and capacity to buy people out. That’s a global competition question that hasn’t been solved. The reality is that this is always going to happen to an economy the size of the UK that keeps making innovative things.”

There are also questions over whether the government is really capable of working out when and where to invest. “Would you trust them to be the ones saying we can predict what Arm’s business plan should be in ten years’ time?” said one of our commentators, who asked for the comment to be unattributed.

-

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Startups get seal of approval from CrowdStrike, AWS, and Nvidia

Startups get seal of approval from CrowdStrike, AWS, and NvidiaNews 35 startups are promised mentorship, technical expertise, go-to-market support, and ecosystem visibility

-

Microsoft and Nvidia are teaming up again to support UK startups

Microsoft and Nvidia are teaming up again to support UK startupsNews Agentic Launchpad will offer participants AI expertise, training and networking, and marketing support

-

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investment

Microsoft CEO Satya Nadella says UK ties are 'stronger than ever' as tech giant pledges $30bn investmentNews Microsoft CEO Satya Nadella says it's commitment to the UK is "stronger than ever" after the tech giant pledged $30bn to expand AI infrastructure and build a new supercomputer.

-

Europe's first exascale supercomputer, Jupiter, is now live

Europe's first exascale supercomputer, Jupiter, is now liveNews Planned uses for Jupiter include climate research, medical research and the development of multi-language LLMs

-

Why does Nvidia have a no-chip quantum strategy?

Why does Nvidia have a no-chip quantum strategy?As the world’s leading manufacturer of GPUs, Nvidia’s approach to quantum computing has left many experts baffled

-

AMD to cut around 1,000 staff to focus on "growth opportunities"

AMD to cut around 1,000 staff to focus on "growth opportunities"News The AMD layoffs come after rival Intel cut staff on the back of flagging AI returns

-

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South East

Microsoft and Nvidia are teaming up to support UK AI startups – and they want to attract firms outside of London and the South EastNews Microsoft and Nvidia have teamed up to launch a generative AI accelerator for UK startups.

-

Nvidia promises to give Californians free AI training with new initiative

Nvidia promises to give Californians free AI training with new initiativeNews A new partnership between Nvidia and the state of California promises to help train 100,000 residents in AI skills and give academic institutions better access to hardware