SK Hynix-backed consortium mulls Arm acquisition

The company’s CEO doesn’t think the British chipmaker can be bought by one company or organisation

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

SK Hynix, the world’s second largest memory chip maker based in South Korea, is reportedly reviewing plans to acquire the semiconductor company Arm.

The idea of potentially acquiring Arm is said to be at a very early stage, according to Yonhap News Agency.

Park Jung-ho, vice chairman and CEO of the company, said yesterday that SK Hynix is considering forming a consortium, along with strategic partners, to jointly acquire the British chipmaker. He underlined that he doesn’t think Arm is a company that can be bought by one organisation.

"I want to buy Arm, if not entirely. It doesn't have to be buying a majority of its shares to be able to control the company," he said during SK Square's annual shareholders meeting, a company he is also CEO of and is the investment spin off of SK Telecom, a leading South Korea telecoms company.

This came after SK Hynix’s acquisition of local chipmaker Key Foundry was approved by South Korea’s antitrust regulator. The deal is worth 575.8 billion won ($474.85 million), with SK Hynix hoping to boost its presence in the non-memory sector, according to The Star. The non-memory sector includes communications chipsets, display driver chips, smart card chips, and image sensors.

Park also revealed the company will build an R&D centre in Silicon Valley, to function as a key base to enhance its partnerships with big tech companies and improve competitiveness.

RELATED RESOURCE

Delivering on demand: Momentum builds toward flexible IT

A modern digital workplace strategy

Nvidia’s deal to acquire the British chipmaker collapsed in February, with the company citing significant regulatory challenges as the reason for the collapse. Instead, SoftBank, Arm’s owner, said it is looking to float the company on the stock market by 2023, although it didn’t clarify which stock market.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

The collapse of the deal saw CEO Simaon Segars step down and replaced by industry veteran Rene Haas, who will now lead the company through its IPO. Arm has previously gone to market, making its initial debut in 1998, but was purchased by SoftBank in 2016.

It is thought the investment group sold Arm so that it could shore up its finances after spending money on other investments, like WeWork and Uber.

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

CISOs are keen on agentic AI, but they’re not going all-in yet

CISOs are keen on agentic AI, but they’re not going all-in yetNews Many security leaders face acute talent shortages and are looking to upskill workers

-

Why Amazon’s ‘go build it’ AI strategy aligns with OpenAI’s big enterprise push

Why Amazon’s ‘go build it’ AI strategy aligns with OpenAI’s big enterprise pushNews OpenAI and Amazon are both vying to offer customers DIY-style AI development services

-

Boomi snaps up former MuleSoft executive as APJ channel lead

Boomi snaps up former MuleSoft executive as APJ channel leadNews Global software veteran Jim Fisher will work to expand the company’s channel operations across the region

-

Why Microsoft Teams has only just launched in China

Why Microsoft Teams has only just launched in ChinaNews The tech giant has officially launched Teams via its local partner in China, after it was launched globally in 2017

-

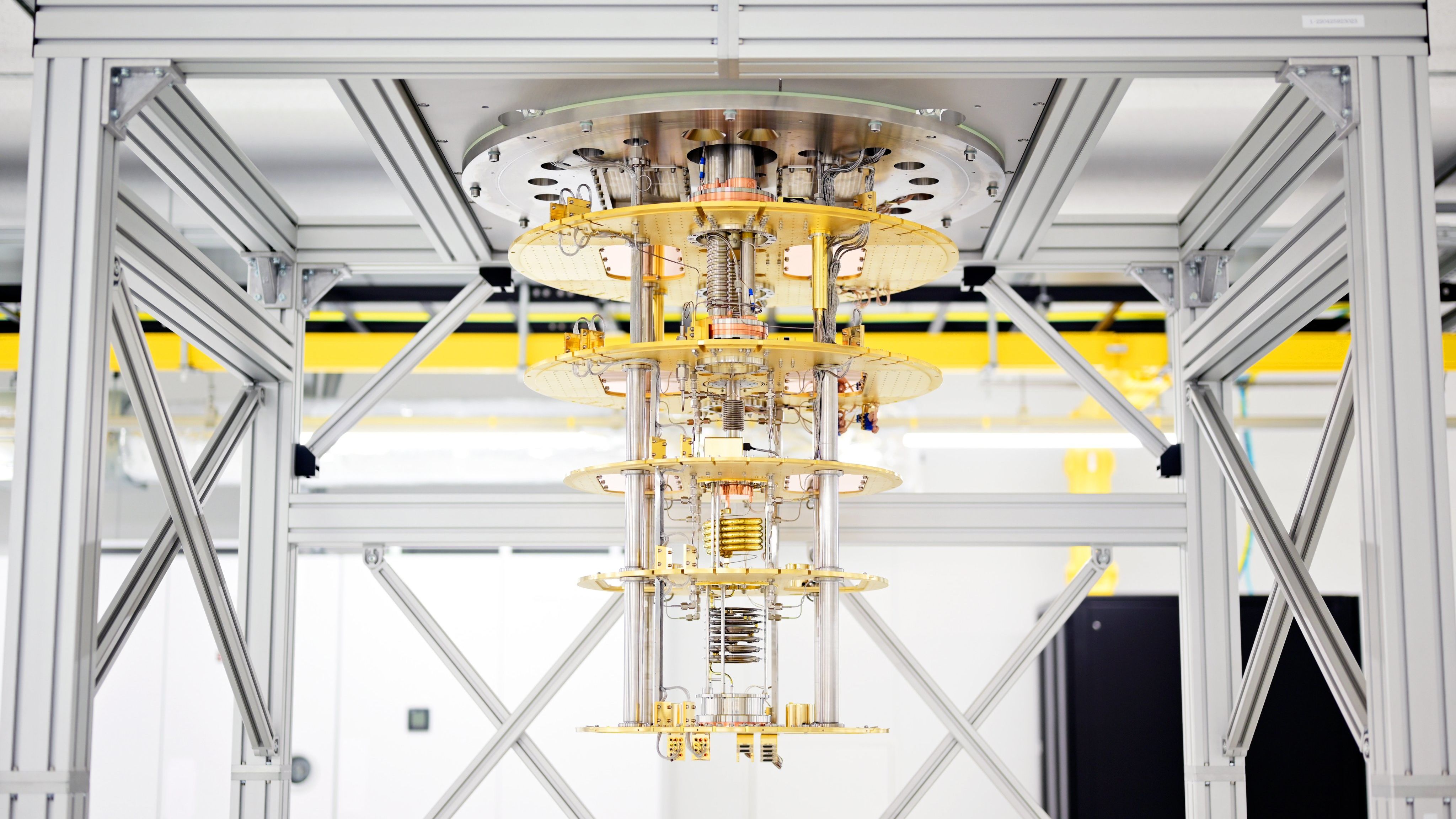

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix

-

MI5 to establish new security agency to counter Chinese hacking, espionage

MI5 to establish new security agency to counter Chinese hacking, espionageNews The new organisation has been compared to GCHQ’s NCSC, and will provide companies advice on how to deal with Chinese companies or carry out business in China

-

UK set to appoint second-ever tech envoy to Indo-Pacific region

UK set to appoint second-ever tech envoy to Indo-Pacific regionNews The role will focus on India after Joe White was made the first technology envoy, a role focused on the US, in 2020

-

Wipro faces criticism after cutting graduate salaries by nearly 50%

Wipro faces criticism after cutting graduate salaries by nearly 50%News Graduates were given days to decide whether they would accept greatly reduced pay offers, prompting union action

-

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEA

Freshworks appoints Sandie Overtveld as new SVP of APJ and MEANews The digital transformation veteran brings years of regional expertise to lead Freshworks’ growth strategy

-

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024

Suncorp signs three-year Azure deal to complete multi-cloud migration by 2024News The financial services firm seeks to wind down its on-prem data centres and wants 90% of its workloads in the cloud by the end of the year