SUSE leaves unanswered questions as it confirms return to private ownership

Delisting puts Linux vendor “less at the whim of shareholders”, experts have said

Veteran Linux distribution developer SUSE is once again going private as its majority shareholder announced plans to delist the company from the Frankfurt stock exchange.

According to the company, the deal “will allow SUSE to focus fully on its operational priorities and execution of its long-term strategy”.

SUSE’s majority shareholder, Marcel LUX III SARL, currently holds 79% of the company’s shares.

The offer price per SUSE share to be paid by Marcel has been set at €16.00, less the gross amount per share of an interim dividend due to all shareholders. €16.00 represents a premium of just over two-thirds (67%) on the XETRA closing share price of €9.605 on 17 August 2023.

The company’s stock was nearer €20.00 earlier this year.

An acceptance period of at least four weeks is expected for the offer, and settlement of the offer - if accepted - is expected in the first half of October 2023. An extraordinary general meeting of SUSE will then be held and result in SUSE’s delisting from the Frankfurt stock exchange.

Why take SUSE private?

Other than a desire to focus on its operational priorities and the execution of its long-term strategy, SUSE has given little detail regarding its motivations.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

Nader Henein, VP analyst at Gartner, told ITPro the move would enable SUSE to place a greater focus on development revenue.

By going private, Henein said: “You’re less exposed to market fluctuations, you’re less at the whim of shareholders”.

“A lot of organizations go private to be able to grow, rather than have to deal with quarter on quarter - being successful, making money,” he added.

According to the analyst, a public company would likely see its stock price suffer if it were to announce a significant increase in development, for example, while a private company was not so beholden to market pricing and was not required to make its plans public.

The company has also waded into the Red Hat Enterprise Linux (RHEL) furor, first with plans to invest over $10 million into a fork of RHEL and, most recently, by forming the Open Enterprise Linux Association (OpenELA) with Oracle and CIQ.

RELATED RESOURCE

Three steps to transforming security operations

See how to optimize and automate processes, save thousands of hours for your IT security staff, and stay ahead of the latest cyberthreats.

The timing of SUSE’s move is therefore interesting, although unlikely to be directly caused by the events of the last few months.

However, Henein noted that “if anything, the timing of the Red Hat announcement probably accelerated the process”.

That said, the timescales involved in both setting up the OpenELA and planning to take SUSE private were likely in parallel and therefore involved a fair amount of coincidence.

“Nobody just wakes up in the morning and says, ‘I’m going to take this company private,’” Henein said.

The analyst also noted that having two flavors of Enterprise Linux - SUSE maintains the SLES distribution - could result in one moving to end-of-life in the coming years as customers transition to the new platform.

“You do not maintain two Enterprise Linux distributions unless they serve two very different purposes,” he said.

A spokesperson for SUSE told ITPro: "SUSE remains committed to SLES".

SUSE is no stranger to going in and out of private ownership. It was sold by Micro Focus in a deal worth $2.5 billion, which closed in 2019. It was acquired by Novell in 2004.

The company has also had an active few months. In May, it appointed a new CEO, Dirk-Peter van Leeuwen, named Ian Halifax as its CFO, and Frank Feldmann was hired as CSO in August. Feldmann had also served more than 15 years in various senior roles at Red Hat.

While SUSE did not immediately respond to a request for comment regarding its future, one possibility is another public offering after it has had time to regroup and restructure. The advent of OpenELA and the agreement with Oracle could mean a refocus in the near future.

Richard Speed is an expert in databases, DevOps and IT regulations and governance. He was previously a Staff Writer for ITPro, CloudPro and ChannelPro, before going freelance. He first joined Future in 2023 having worked as a reporter for The Register. He has also attended numerous domestic and international events, including Microsoft's Build and Ignite conferences and both US and EU KubeCons.

Prior to joining The Register, he spent a number of years working in IT in the pharmaceutical and financial sectors.

-

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses

-

Report reveals the one characteristic that every tech recruiter is looking for in new candidates

Report reveals the one characteristic that every tech recruiter is looking for in new candidatesNews Only one third of respondents described University degrees as being important for the roles they manage, despite many adverts still listing them under required experience

-

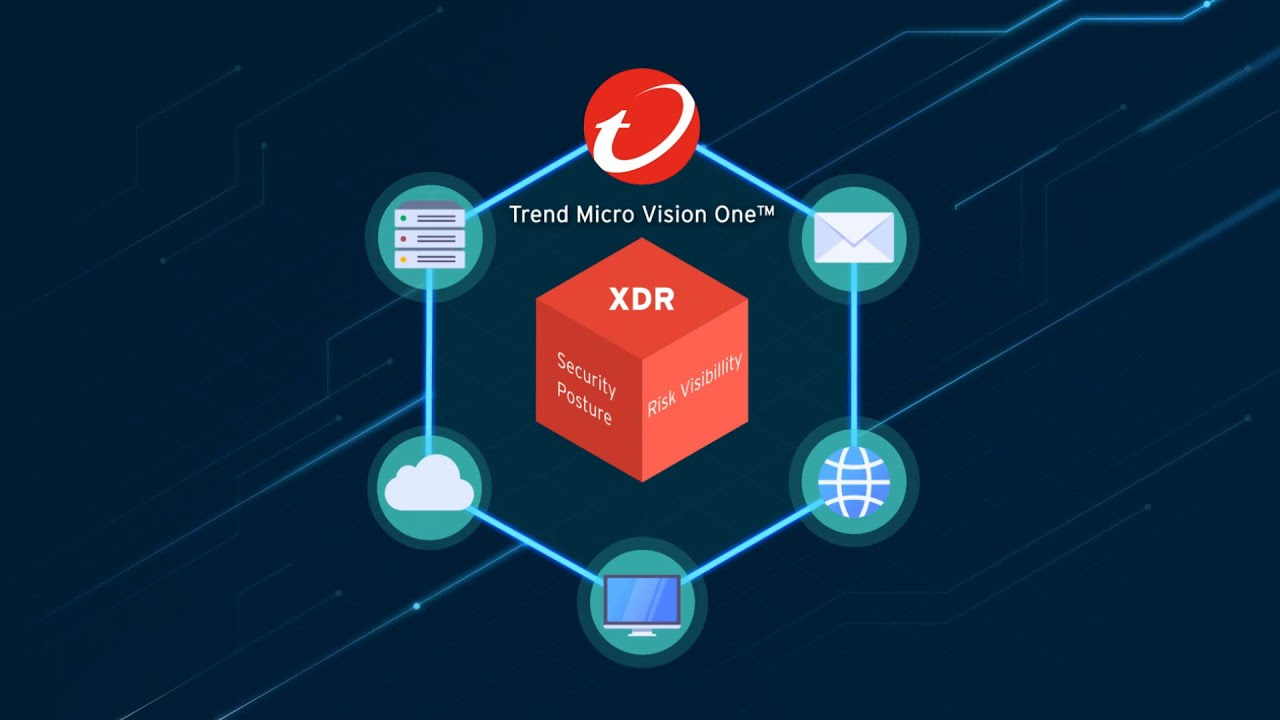

Analyzing the economic benefits of Trend Micro Vision One

Analyzing the economic benefits of Trend Micro Vision OneWhitepaper Trend Micro Vision One as a solution to cyber risks