Radware grows market share following Nortel fire sale purchase

$18m acquisition close to recoup after 18 months, Nortel products add 500 customers but existing partners snub Alteon line

Application delivery specialist Radware (RDWR) has significantly grown its Nortel business unit and retained five key UK partners and both former distributors of the Alteon line it acquired for the bargain basement price of $18m in 2009.

The vendor has also made good its pledge to fix some of the gnawing bugs and support issues it inherited from Nortel who had failed to update its Alteon line as the firm ran into financial difficulties before its eventual breakup last year.

Justification

“In terms of revenue, we pretty much justified the purchase,” comments Ilan Kinreich, COO for Radware. “It is very close to paying for itself in such a short time.” Kinreich claims Radware has added a further 400 to 500 customers over the last year and, in his view, is the only major web application delivery specialist to have grown market share this year. “The Alteon customers were very loyal… and we have had almost zero drop off,” he adds.

After 18 months redeveloping the Alteon range, Kinreich believes that the product now justifies the loyalty shown by the customer base. The focus now will be on “potential for up sell” to these loyalists, as well as ultimately developing a next generation device which combines features of the current Radware line and some of the technologies it acquired from Nortel.

Although Radware is proud of the upgrade to the Nortel line, few Radware partners have adopted the Nortel portfolio, which Kinreich admits is lacking in certain core features that Radware already had in existing products.

Radware has retained Maxima, Global Secure Systems, Satisnet, Proximity and NSC Global from the forma Nortel Alteon partners base as well as distributors Westcon, Sphinx and C-MI Labs Plc.

Stay up to date with the latest Channel industry news and analysis with our twice-weekly newsletter

Irrelevant

Although its “mid teens” market share trails Cisco and F5 Networks, Kinreich believes that few other rivals can successfully enter the marketplace and dismisses the software-only challengers as irrelevant.

Part of this view is fuelled by the growth of SaaS and virtualisation, two areas that need higher throughput devices to deliver the kind of services that cost effectively support high volumes of users. Particularly in the carrier space, “You can’t just rely on virtual machines, you still need hardware [to optimise application delivery] and we are now looking at devices with 100GB to 200GB of throughput,” he adds.

-

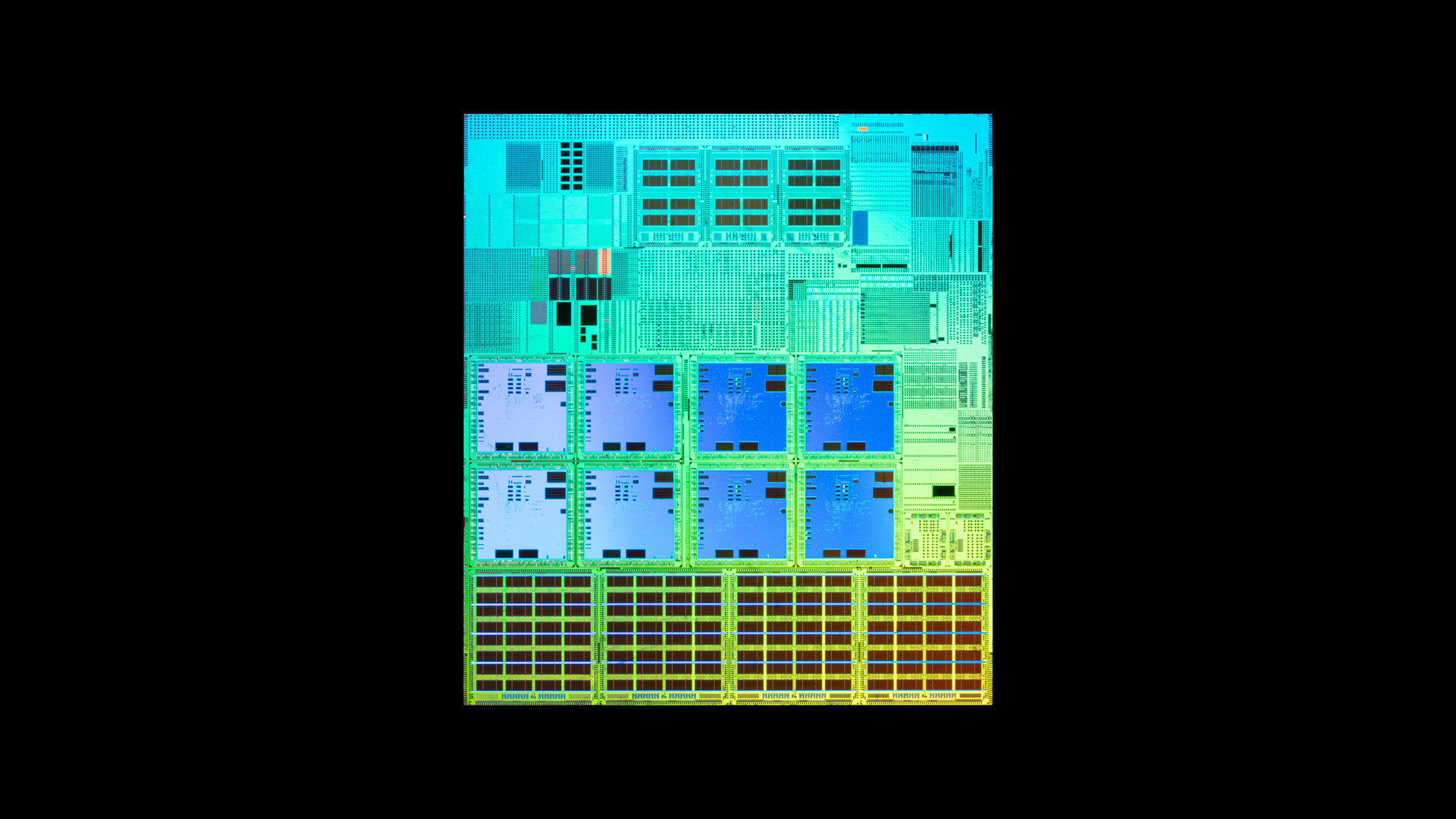

What is Microsoft Maia?

What is Microsoft Maia?Explainer Microsoft's in-house chip is planned to a core aspect of Microsoft Copilot and future Azure AI offerings

-

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using it

If Satya Nadella wants us to take AI seriously, let’s forget about mass adoption and start with a return on investment for those already using itOpinion If Satya Nadella wants us to take AI seriously, let's start with ROI for businesses