Eight arrested over Royal Mail ‘smishing’ scam

The arrests come weeks after researchers found a 645% increase in Royal Mail-related phishing scams

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

Police officers from the Dedicated Card and Payment Crime Unit (DCPCU) have arrested eight people in relation to a Royal Mail text phishing, or 'smishing', scam.

The eight arrested individuals are suspected of attempting to commit financial fraud and impersonating the Royal Mail by sending out fraudulent texts and emails which link to phishing websites.

The arrests come weeks after researchers from Check Point Software reported a 645% increase in Royal Mail-related phishing scams, with March being the biggest month for attacks on record.

The DCPCU, which is a specialist unit of the City of London and Metropolitan Police, conducted a series of early morning operations across London, Coventry, Birmingham and Colchester, resulting in eight male suspects being arrested. Seven have since been released under investigation, with one suspect charged and remanded into custody ahead of their court appearance.

The DCPCU, which is funded by the banking and cards industry, also managed to recover numerous customers' financial details, enabling these bank accounts to be protected.

Commenting on the arrests, DCI Gary Robinson, who leads the DCPCU, said that the "ongoing investigations are now underway" and that the unit and the Royal Mail "will continue to work together to bring those committing smishing scams to justice".

"The success of these operations shows how through our close collaboration with Royal Mail, the financial services sector, and mobile phone networks, we are cracking down on the criminals ruthlessly targeting the public," he added.

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

RELATED RESOURCE

Prevent fraud and phishing attacks with DMARC

How to use domain-based message authentication, reporting, and conformance for email security

Meanwhile, Stephen Ritter, CTO at digital identity verification provider Mitek, called for organisations within the technology and finance sector to "step up to the challenge" in fighting scammers.

"All too often, industry experts are quick to blame consumers for "falling" for scams – but this blame game needs to stop," he said. "To fight misinformation, Twitter and Facebook started flagging posts that weren't backed up by fact, and the problem has improved significantly. Why can't we do the same for fraudulent activities on our phones?"

According to Ritter, digital service providers such as "messaging apps, mobile manufacturers, email providers, or mobile networks" should use artificial intelligence to warn users "when a suspicious link or message is shared".

"Often, you might not notice a dubious link, or the unknown number it's sent from – but your phone, messaging service, or network could. A simple flag ('This link could be fraudulent') would go a long way to protecting consumers. And all it takes is AI and machine learning algorithms that are trained to spot scams before they reach the consumer," he said.

Having only graduated from City University in 2019, Sabina has already demonstrated her abilities as a keen writer and effective journalist. Currently a content writer for Drapers, Sabina spent a number of years writing for ITPro, specialising in networking and telecommunications, as well as charting the efforts of technology companies to improve their inclusion and diversity strategies, a topic close to her heart.

Sabina has also held a number of editorial roles at Harper's Bazaar, Cube Collective, and HighClouds.

-

AWS CEO Matt Garman isn’t convinced AI spells the end of the software industry

AWS CEO Matt Garman isn’t convinced AI spells the end of the software industryNews Software stocks have taken a beating in recent weeks, but AWS CEO Matt Garman has joined Nvidia's Jensen Huang and Databricks CEO Ali Ghodsi in pouring cold water on the AI-fueled hysteria.

-

Deepfake business risks are growing

Deepfake business risks are growingIn-depth As the risk of being targeted by deepfakes increases, what should businesses be looking out for?

-

C-suites consider quantum a serious threat and "amazing" deepfake attacks are just 'months away'

C-suites consider quantum a serious threat and "amazing" deepfake attacks are just 'months away'News Deepfake technology has matured at a rapid rate, and video scams are likely to be a on par with the more convincing voice-only campaigns very soon, one expert says

-

Shiseido reportedly suffers data breach

Shiseido reportedly suffers data breachNews The Japanese cosmetics company has been accused of failing to notify affected staff of the leak

-

Almost a quarter of all spam emails were sent from Russia in 2021

Almost a quarter of all spam emails were sent from Russia in 2021News Last year's spam emails mostly centred around money and investment, Bond and Spider-Man movie premieres, and the pandemic

-

HMRC issues scam warning ahead of Self Assessment deadline

HMRC issues scam warning ahead of Self Assessment deadlineNews The department stated that 2021 has already seen 797,010 tax-related scams reported

-

Ofcom report reveals alarming uptick in smishing attacks

Ofcom report reveals alarming uptick in smishing attacksNews Text-based scams now more common than phone calls among young adults

-

Smishing attacks increased 700% in first six months of 2021

Smishing attacks increased 700% in first six months of 2021News Which? has urged businesses to play their part to protect people from text message scams

-

Delivery scams become most common form of smishing

Delivery scams become most common form of smishingNews Cyber security provider Proofpoint finds a major increase in the number of threat actors impersonating postal services

-

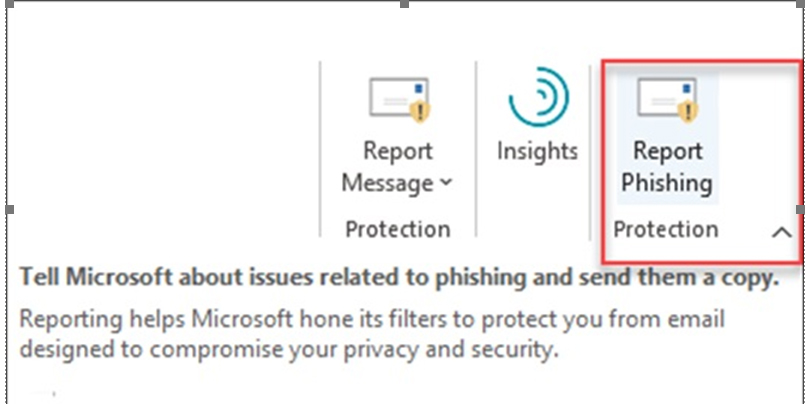

NCSC simplifies Outlook scam-reporting tool

NCSC simplifies Outlook scam-reporting toolNews Users are now able to report phishing emails with just one click