JP Morgan partners with AI data startup

Fintech firm will apply analytics to bank's investment banking arm

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

You are now subscribed

Your newsletter sign-up was successful

JP Morgan has signed a multi-year contract with data startup Mosaic Smart Data to aid its entire fixed income trading business globally.

Mosaic Smart Data aims to help banks understand the increasing volume of their trade data and apply new technologies such as predictive analytics and artificial intelligence to it, using its real-time data analytics platform MSX.

The London-based fintech startup is the first graduate of the bank's 'In-Residence' programme, created last year for tech startups that solve problems in financial services. Through the programme, startups are given access to JP Morgan's facilities, systems and expertise for six-month periods.

Matthew Hodgson, Mosaic's CEO and founder, said: "Data analytics and artificial intelligence are changing the face of investment banking. Banks understand that the insights locked away in their transaction and market data are potentially some of their biggest competitive advantages.

"They already have the raw materials, but MSX gives them the tools to aggregate and standardise that data and put it to work intelligently."

The startup claims its technology will help users to anticipate market and client activity and therefore offer a better service and reduce the cost and complexity of compliance.

Troy Rohrbaugh, global head of macro at JP Morgan, stated: "Having a more holistic view of trading data will improve our service delivery for clients. The Mosaic platform integrates securely with our existing technology infrastructure, and enables our teams to quickly make better informed decisions."

Sign up today and you will receive a free copy of our Future Focus 2025 report - the leading guidance on AI, cybersecurity and other IT challenges as per 700+ senior executives

A Barclays ex-CEO's fintech startup raised 34 million in September, aiming to introduce a digital banking platform.

In other fintech news, startup Tandem announced in August that it was buying Harrods Bank. This is the banking arm of the London luxury department store and the sale was reportedly a multi-million pound deal. This will give Tandem access to a variety of financial products as well as a banking license.

Image source: Bigstock

Zach Marzouk is a former ITPro, CloudPro, and ChannelPro staff writer, covering topics like security, privacy, worker rights, and startups, primarily in the Asia Pacific and the US regions. Zach joined ITPro in 2017 where he was introduced to the world of B2B technology as a junior staff writer, before he returned to Argentina in 2018, working in communications and as a copywriter. In 2021, he made his way back to ITPro as a staff writer during the pandemic, before joining the world of freelance in 2022.

-

Google just added a new automated code review feature to Gemini CLI

Google just added a new automated code review feature to Gemini CLINews A new feature in the Gemini CLI extension looks to improve code quality through verification

-

Ransomware protection for all: How consumption-based subscription models can lower the entry point for cyber resilience

Ransomware protection for all: How consumption-based subscription models can lower the entry point for cyber resilienceIndustry Insights Consumption-based immutable backup makes enterprise-grade ransomware resilience affordable to all

-

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?

Is Rishi Sunak’s ‘Unicorn Kingdom’ a reachable goal or a mere pipedream?Analysis Plunging venture capital investment and warnings over high-growth company support raise doubts over the ‘Unicorn Kingdom’ ambition

-

Some Tech Nation programs could continue after Founders Forum acquisition

Some Tech Nation programs could continue after Founders Forum acquisitionNews The acquisition brings to a close a months-long saga over what the future holds for Tech Nation initiatives

-

Podcast transcript: Startup succession: From Tech Nation to Eagle Labs

Podcast transcript: Startup succession: From Tech Nation to Eagle LabsIT Pro Podcast Read the full transcript for this episode of the ITPro Podcast

-

The ITPro Podcast: Startup succession: From Tech Nation to Eagle Labs

The ITPro Podcast: Startup succession: From Tech Nation to Eagle LabsITPro Podcast Some small firms are already lamenting the loss of Tech Nation, but Barclays Eagle Labs has much to offer the sector

-

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never has

Don’t count Barclays Eagle Labs out just yet – it can deliver in ways Tech Nation never hasOpinion Tech Nation has a great track record, but Eagle Labs has the experience, the financial clout, and a clear-cut vision that will deliver positive results for UK tech

-

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditions

UK tech sector could face a ‘unicorn winter’ amid spiralling economic conditionsNews Tech Nation’s final piece of industry research calls for action to support continued ecosystem growth

-

"It's still not great": Industry divided on government's SMB tax relief package

"It's still not great": Industry divided on government's SMB tax relief packageNews The government’s handling of R&D tax credits has left SMBs with a “sense of disbelief”

-

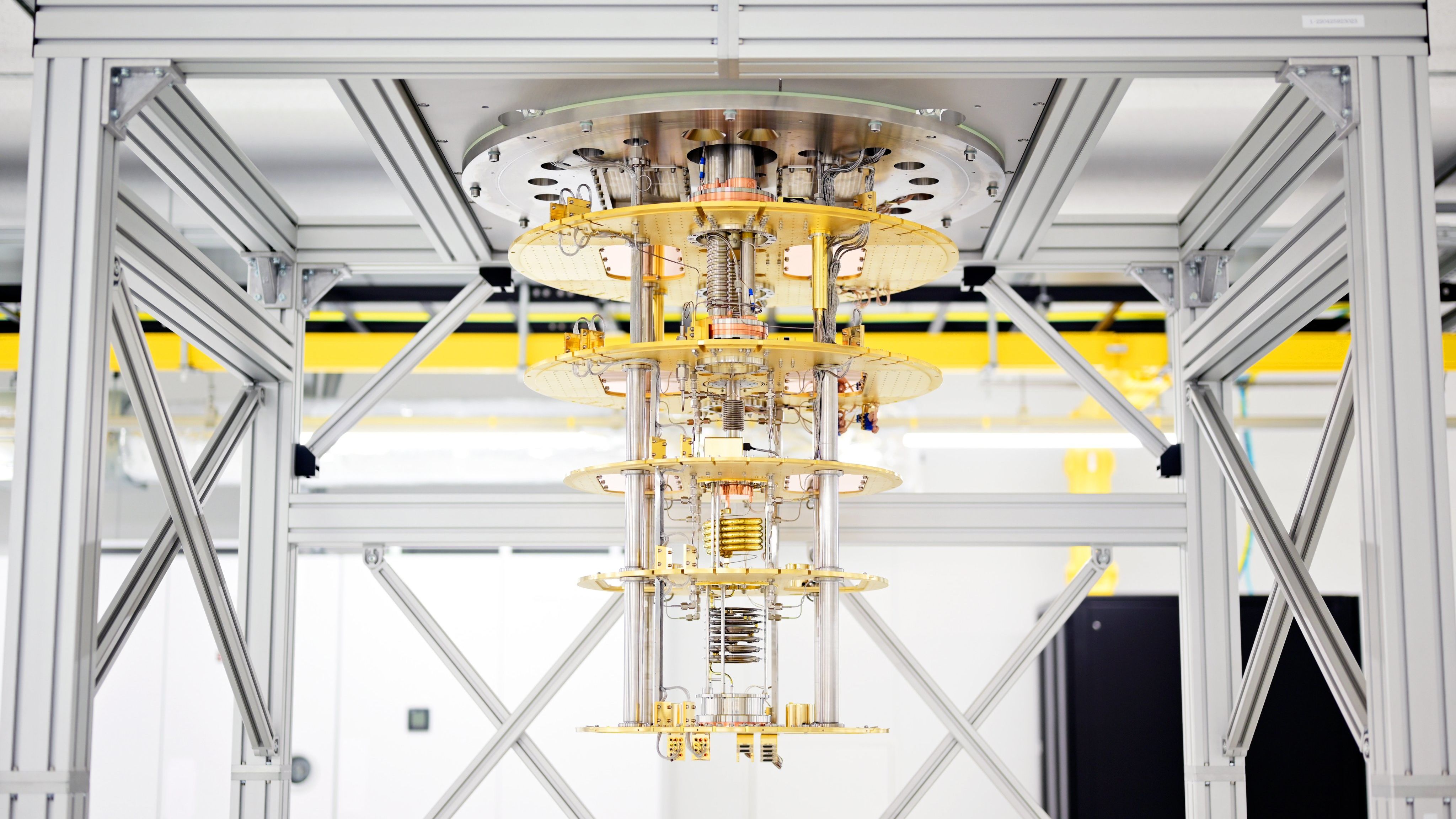

UK startup's Equinix deal marks step towards broad quantum computing access

UK startup's Equinix deal marks step towards broad quantum computing accessNews Businesses around the world will be able to use its quantum computing as a service platform through Equinix